Texas

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Mar 24, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

Helpful Things to Know About Your Auto Insurance Policy

The Lone Star State offers Texas drivers lots of ways to save on car insurance. Texas has an unusual system of insuring drivers that sometimes is described as a “sorta-no-fault” approach. Like no-fault car insurance states, Texas decrees that auto insurance pays the owner of the policy when damage is down to the policy holder’s car. Like tort states, Texas also has a rule that the driver of the other car is free to sue you for damages not covered by his or her policy. (For more information, read our “Are no-fault states better for auto insurance?“).

In Texas, it’s easier to get compensated for damage to your own car, but you have to be especially careful to maintain enough liability coverage to defend yourself against claims from other drivers. Any accident for which you are deemed responsible will have to come out of your own pocket if damages to a third parties exceed the liability amounts of your Texas auto insurance policy. This could be financially devastating, as those suffering losses would likely sue you for any costs over and above what your policy covers.

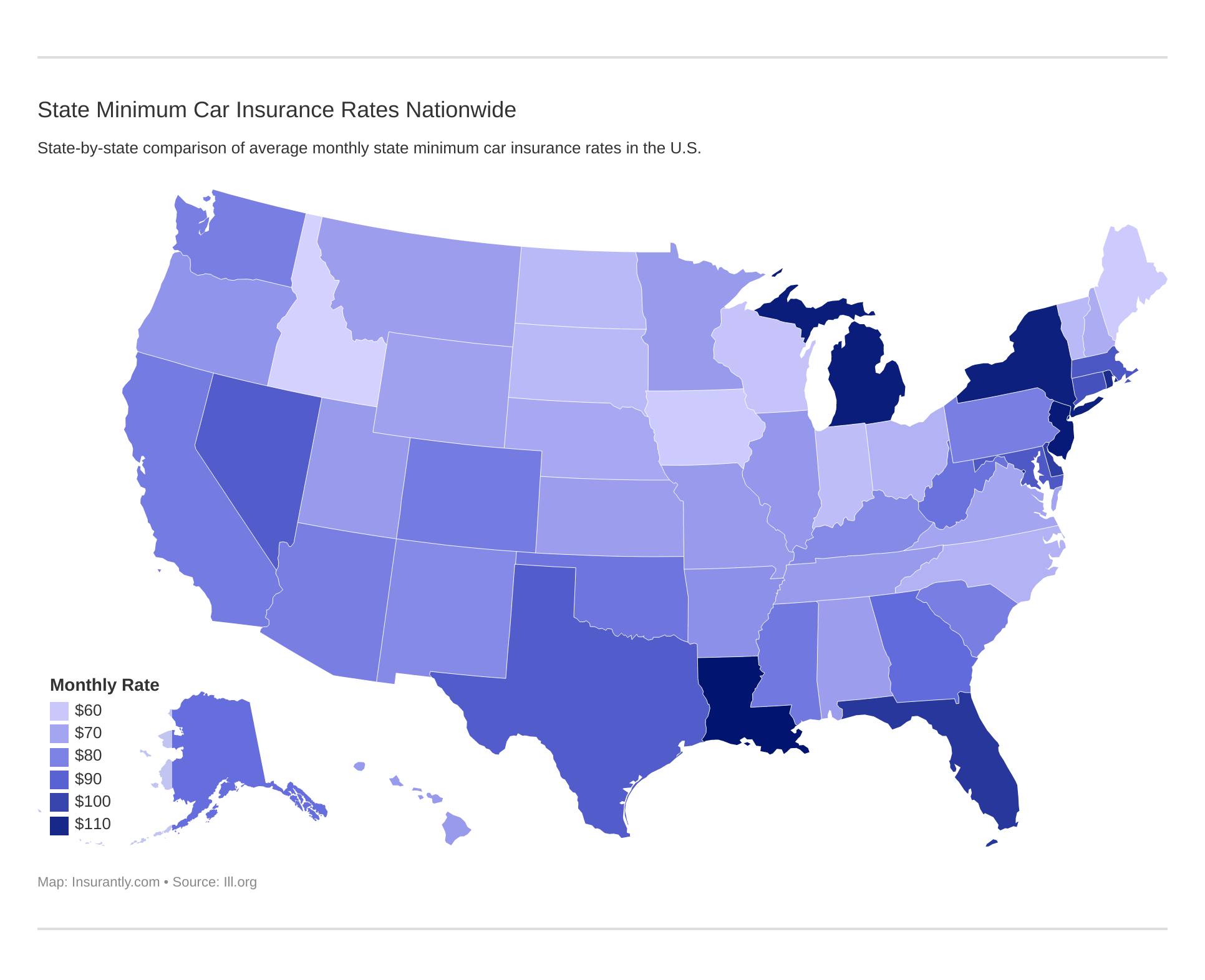

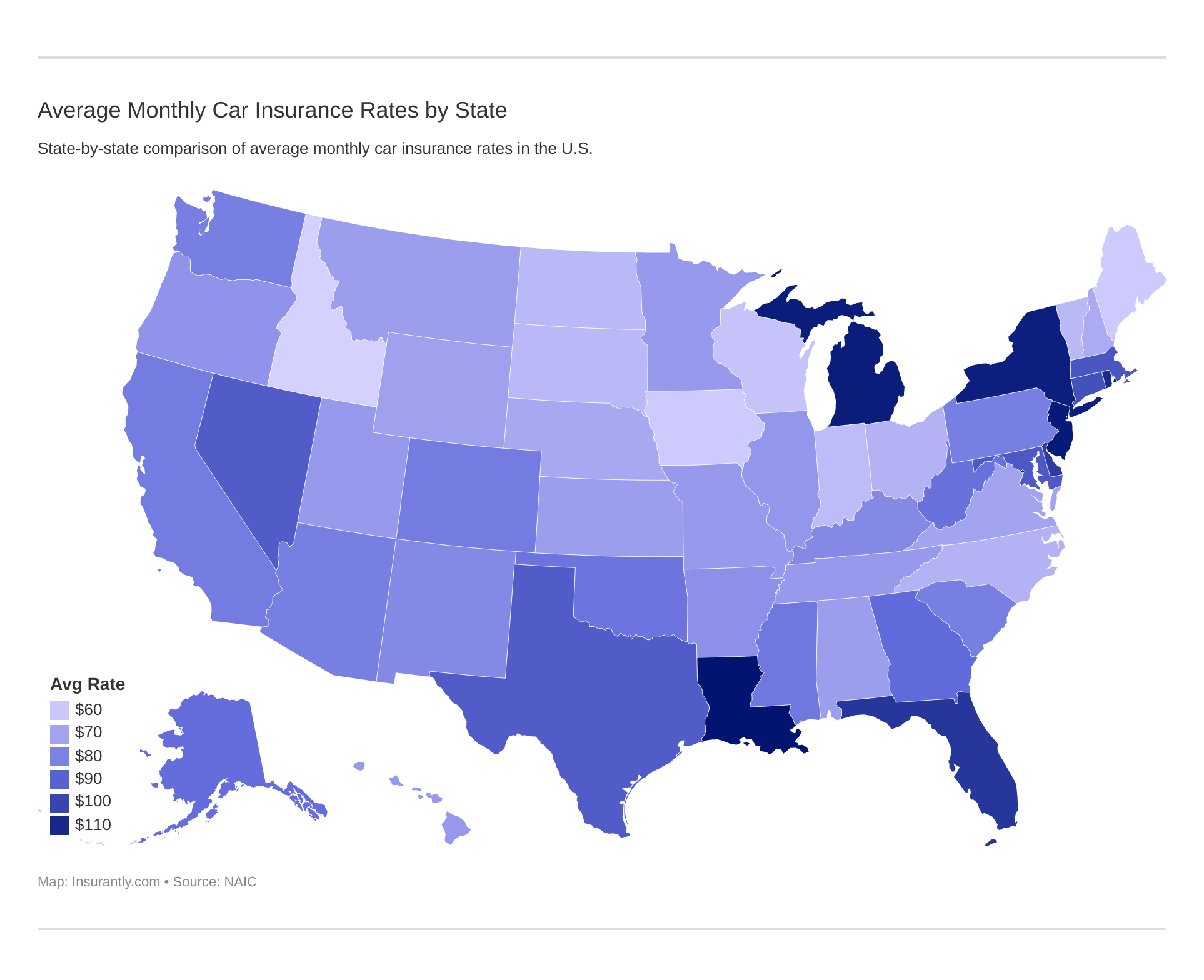

Minimum auto insurance coverage and rates vary from state to state. Compare state to state below:

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Required Amount of Car Insurance:

- Up to $30,000 per injured person

- Up to $60,000 total for all injured persons

- Up to $25,000 for damaged property

Recommended Amount of Car Insurance:

- Up to $100,000 per injured person

- Up to $300,000 total for all injured persons

- Up to $35,000 for damaged property

Your average monthly car insurance rates by coverage may be cheaper than expected for additional coverage like comprehensive. Review rates for car insurance coverage below:

Is car insurance required?

In Texas, you have to be able to prove that you have auto insurance to get a driver’s license, to register a car, or to drive a car. Insurance policyrecords in Texas are fully computerized. If you are pulled over in a traffic stop, your arresting officer can check whether your car is insured even before he or she walks up to your window. An old or a fake SR-22 won’t do you any good in Texas, and trying to use a fake proof of insurance card will most likely get you an additional ticket.

Texas requires drivers to have proof of insurance with 30/60/25 coverage when they are driving their own cars. In Texas, drivers also have to have this level of coverage when they are driving someone else’s car. And if you happen to be visiting Texas from out of state, the policy issued in your home state also has to have this level of coverage for you to avoid a ticket if you are involved in a crash.

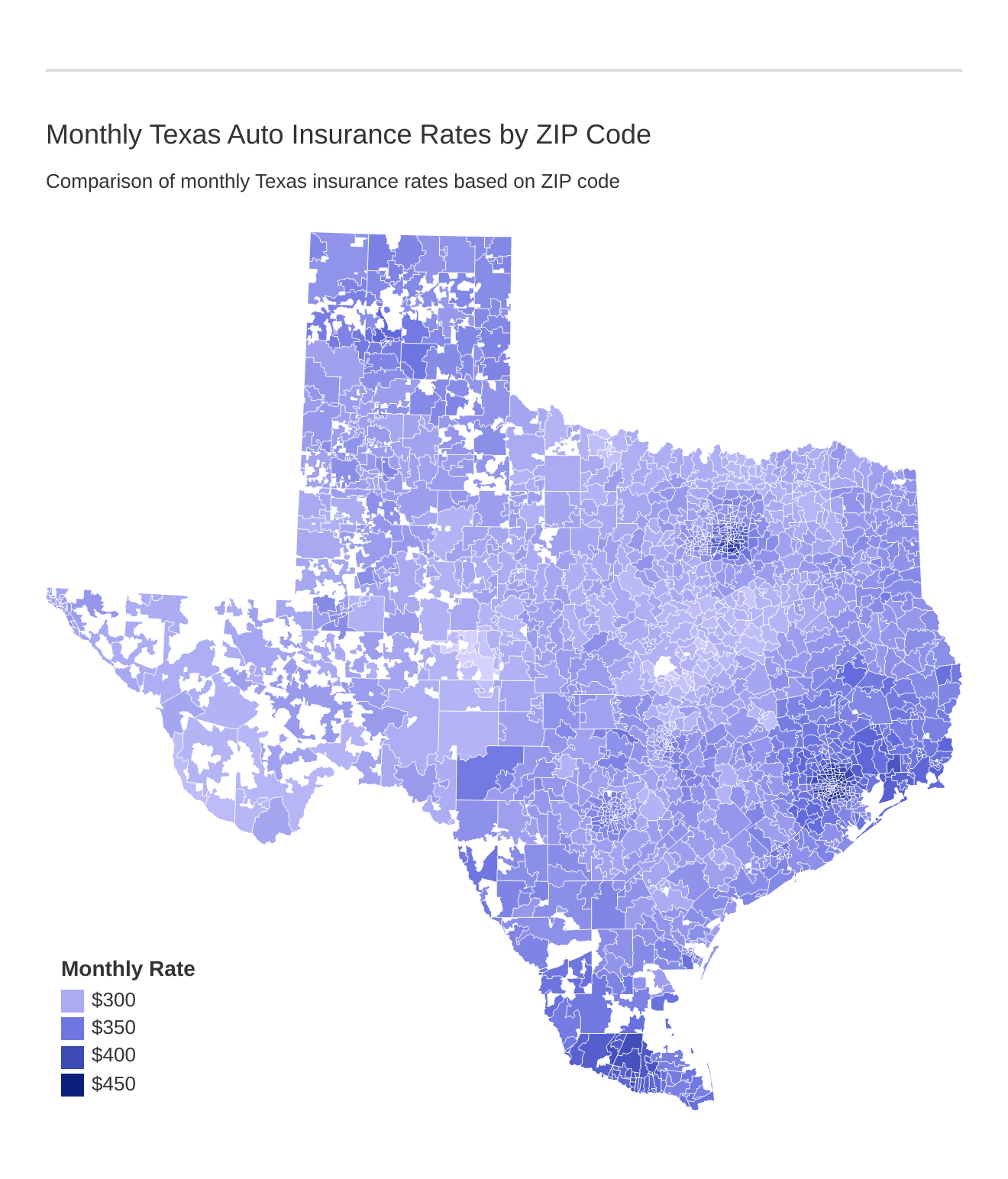

ZIP codes affect auto insurance because of factors like traffic, crime to name a few. Find out how your ZIP code stacks up in TX.

What happens if you drive without car insurance in Texas?

If you drive along Texas highways, you may see a lot of anti-littering signs printed with the slogan “Don’t Mess with Texas.” This also applies to driving without insurance in Texas.

Texas fines first-time offenders who get caught $175 to $350 for driving without liability insurance. Their driver’s licenses are taken away, and they aren’t reissued until the driver submits proof of insurance. Getting that car insurance policy after losing your license for failure to maintain coverage will require a down payment to the auto insurance company for six months of coverage—which can cost you an additional $1200. Under certain circumstances, your car may be impounded until you buy insurance.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How can you save money on car insurance in Texas?

As long as they don’t mess with Texas, the state of Texas offers drivers lots of ways to save money on their car insurance policies. The most popular way to save money on your policy is to take a safe driver course. This is an eight-hour course you take at an insurance agent’s office, at a restaurant or hotel, or online.

If you attend all your sessions and pass a quiz at the end of the course with a score of 80% or higher, then you will get a 10% discount off your premiums for the next three years—even if you had to take the class to get a ticket dismissed.

(In Texas, oddly enough, many tickets don’t go on your driving record and you even get lower insurance rates after you take the class). Teenagers who take driver education are also insurance at a discounted rate, and the discount can apply to more than one car insured on the same policy.

Another way to keep your Texas car insurance premiums lower is to make sure you pay your premiums each and every month. In Texas, you won’t pay more for insurance if your premium is paid just a day or two or even a week or two late. But if you drive for more than 30 days without insurance, your policy premiums will be about 15% to 30% higher than if you maintained insurance whenever you drove your car.

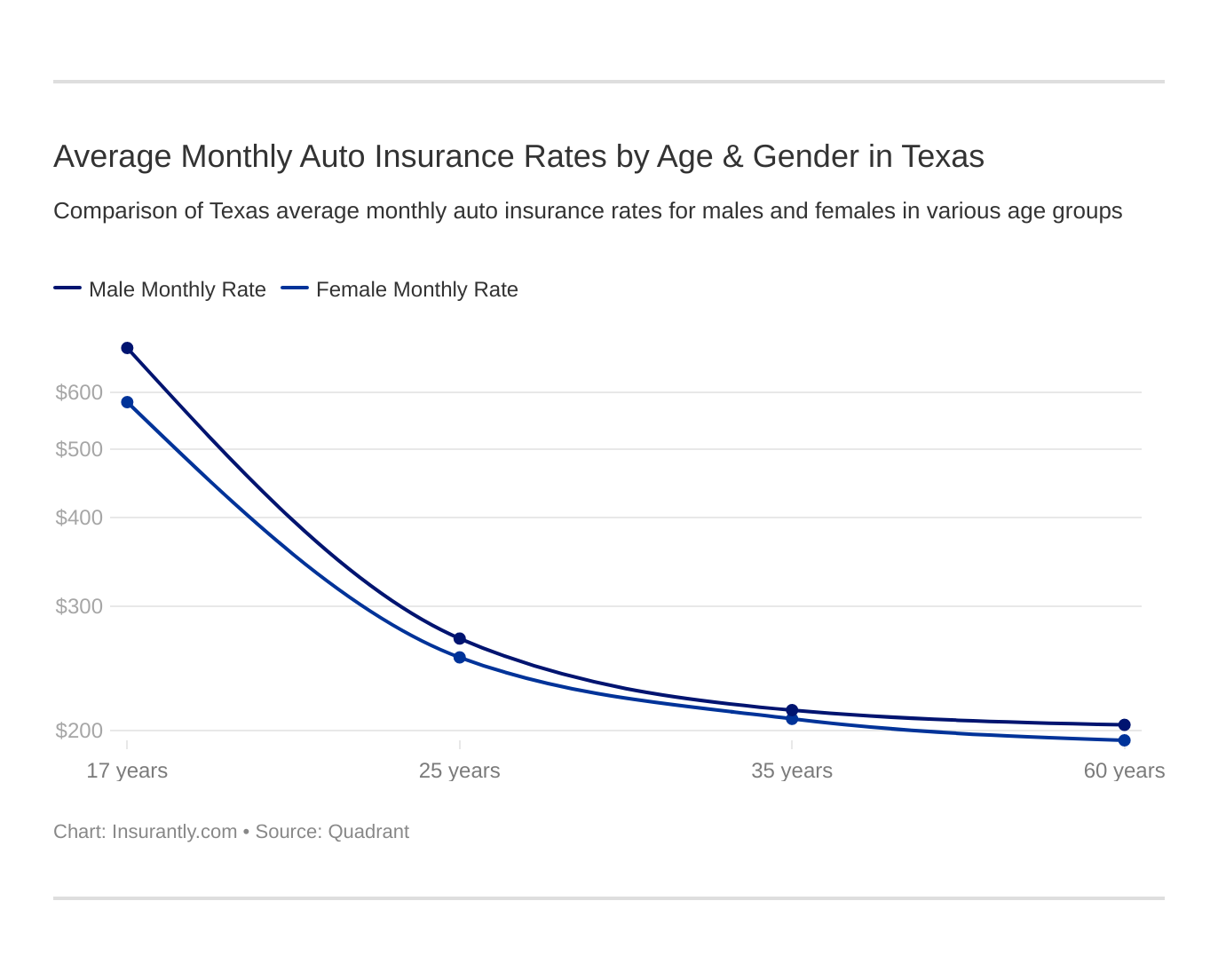

Texas insurers also offer lower rates for women when they turn 21 and men when they turn 25. Many companies offer discounts for drivers under the age of 50. And it’s also a good idea to use just one car for commuting. Texans pretty much have to drive forever to get to and from work. You will pay for your insurance on the car you use for commuting, but not for other cars you own.

Age and gender will affect your car insurance. Younger drivers are often in a high risk class. See if the gender stereotype (males pay more) holds true in TX.

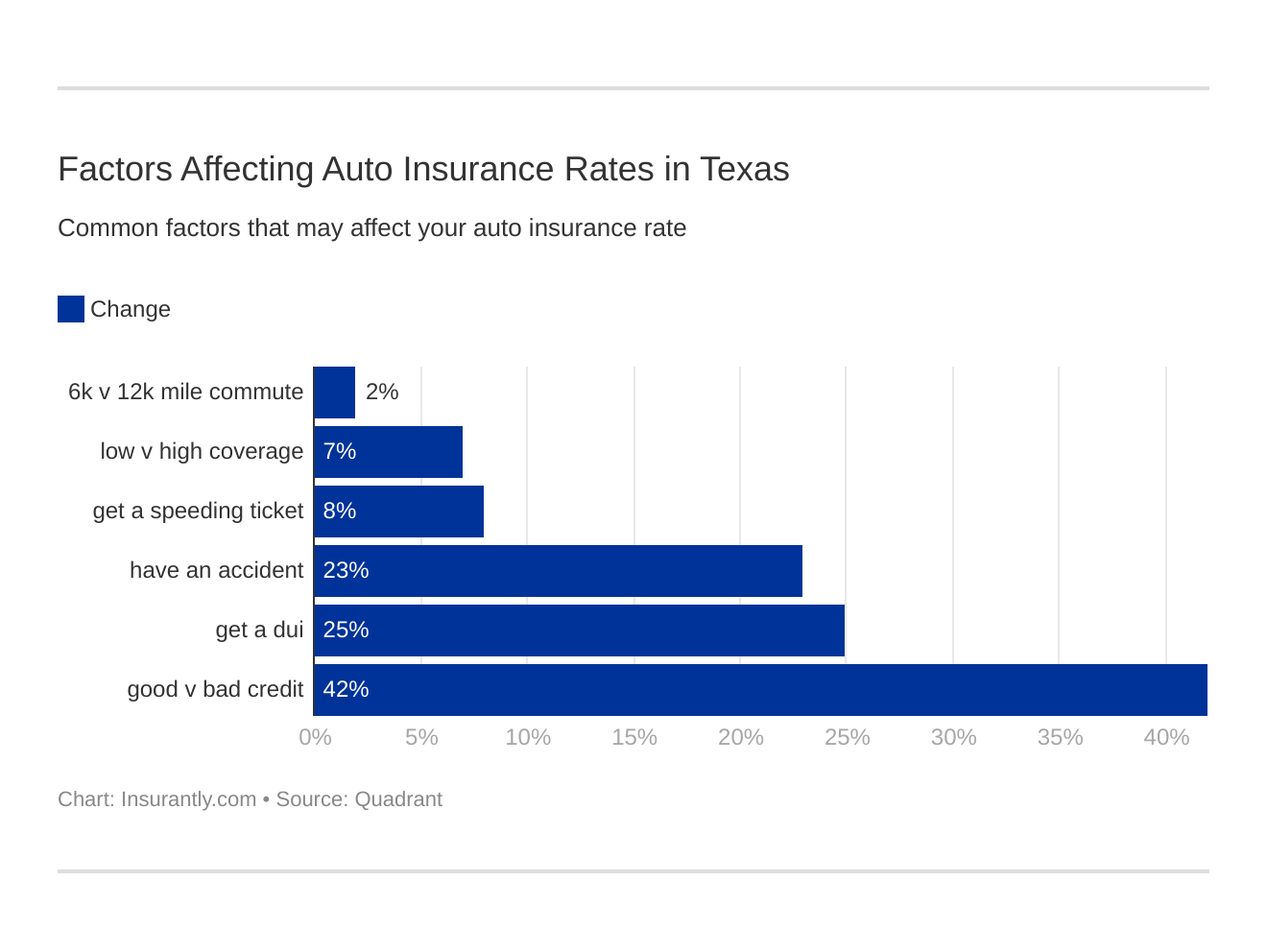

Take a look at these 6 major factors affecting auto insurance rates in Texas.

Some but not all Texas auto insurance companies consider your credit history in rating your policy. If you have bad credit, you may pay more for insurance—unless you choose a company that focuses on your driving record rather than your credit record.

And as in any other state, driving safe with no accidents and no collision or comprehensive claims will help keep your rates low. Everybody needs insurance because the law requires it. But not using your insurance will save you many hundreds or thousands of dollars over the long run.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How do auto accidents affect my Texas car insurance?

Depending on your insurance situation you may need to file what is called SR 22 insurance after the accident. Texas being a tort state means that regardless the accident will be investigated and those at fault are responsible. It is wise to get supplementary insurance in the event you are struck by an uninsured motorist.

If there are injuries after your car accident it is wise to contact a lawyer before proving too much information to an insurance company representative. Learn more about car accidents and car insurance here.

What happens if I cause an accident while driving without insurance?

The penalties are much stiffer. You may have to pay thousands of dollars in fines, and even when you are allowed again, the Department of Public Safety will make monthly contact with your insurance company to make sure you are maintaining liability insurance.

You will be required to carry a proof of insurance form called an SR-22 whenever you drive. And you will still liable in court for any damages you cause to other drivers while you were not insured.

Summary

The penalty for not complying With Texas Financial Responsibility Requirements?

- It could lead to the suspension of your driver’s license and fines.

- If you are convicted of failure to maintain insurance you will pay a flat surcharge of $250.00 per year.

- You may also be required to file an SR-22 or SR-22A.

Who is best suited for a liability only Texas car insurance policy?

Liability costs less than your traditional car insurance policy. If you are really on a tight budget a good way to get cheaper car insurance is to consider liability only coverage.

What does it include in Texas?

It’s going to include both bodily injury and property damage. If you are at fault in an accident it will cover the other parties’ damages.

More information from the state’s minimum car insurance liability coverage requirements.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Should I have full coverage or liability auto insurance coverage in Texas?

The debate of having full coverage vs. liability car insurance is common among drivers looking to save money and find a cheaper rate. If you drive an older car and the cost to replace parts from damage in an auto accident you might consider going with a liability only option to save on Texas auto insurance while still meeting the states requirements.

If you’re in an accident and your insurance provider deems that the cost to repair the car exceeds what the car is worth, they may not repair it. In this example whether you should have full or liability is an easy choice. You would save money by not paying for collision and comprehensive coverage.

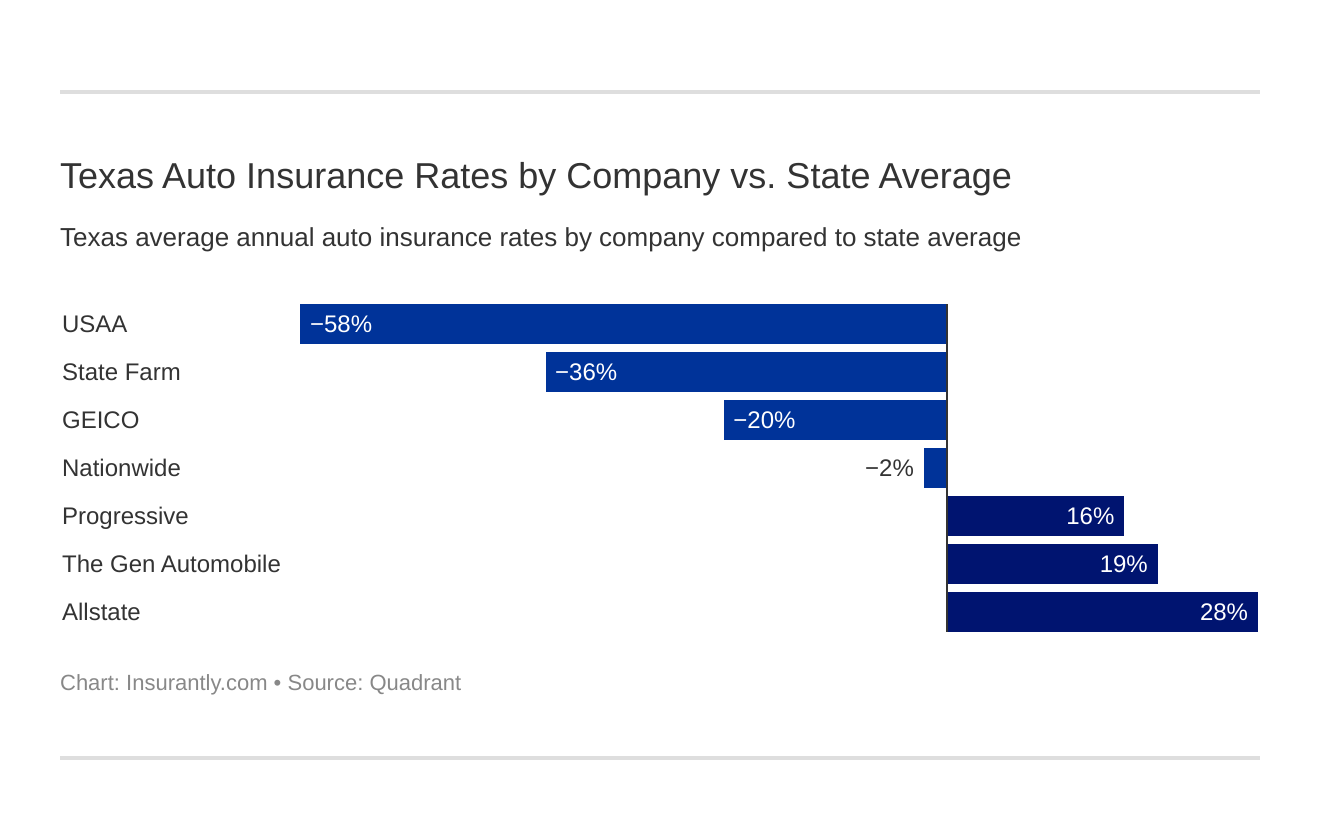

Now let’s see who is the cheapest car insurance company in Texas.

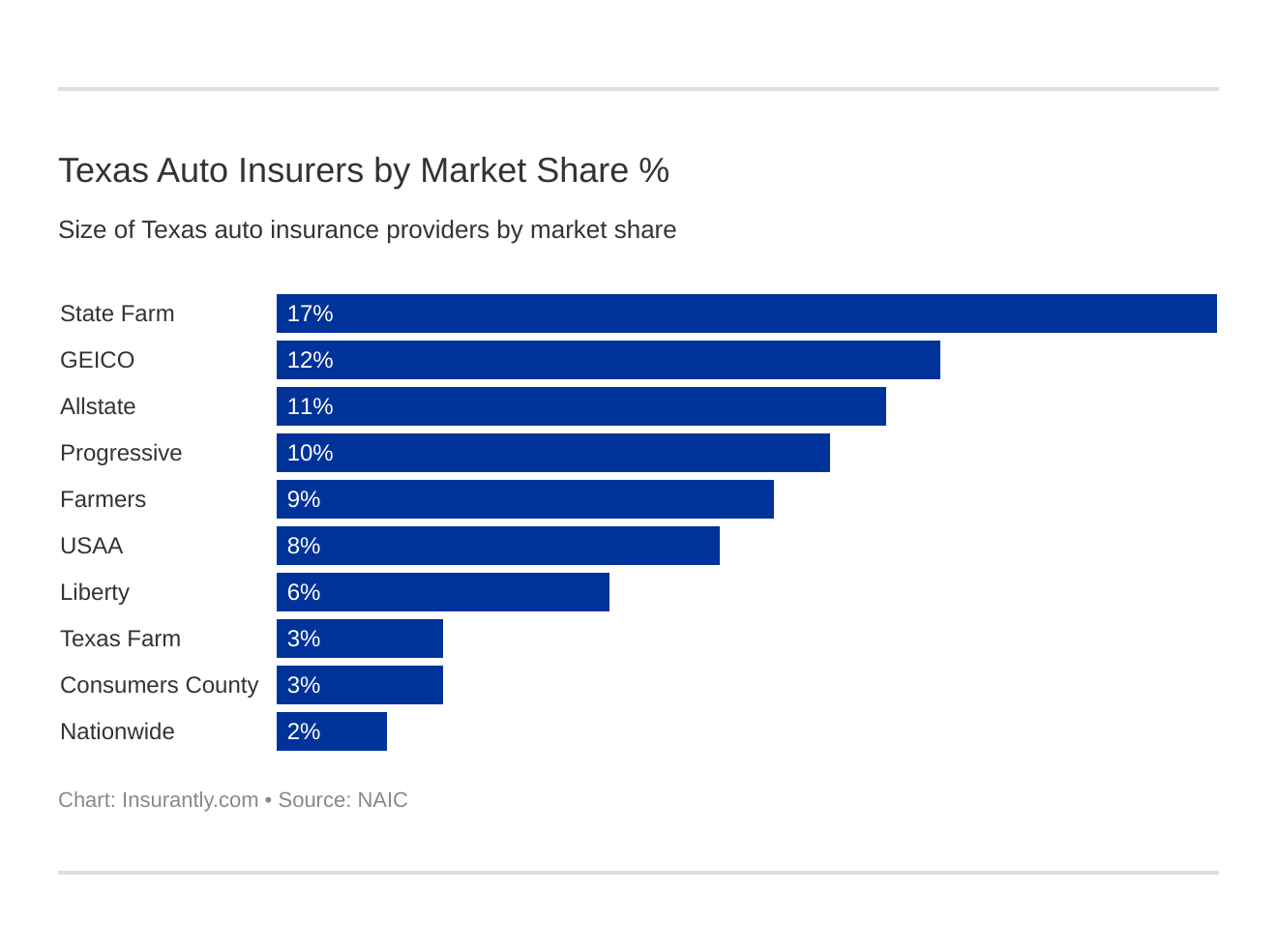

Who are the largest auto insurance companies in TX?

Major Cities in Texas

- Dallas Car Insurance: Live in the Dallas area? Get a Dallas Car Insurance quote and compare rates with Insurantly. Contact an agent and get an online quote.

- Houston Car Insurance: With high rates of DWI and auto accidents Houston area residents pay among the highest rates on auto insurance in the state. Learn more and or contact an agent for a quote.