Alabama Auto Insurance

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| Road Miles | Total in State: 102,018 Vehicle Miles Driven: 65,667 Million |

| Vehicles | Registered: 5,251,076 Total Stolen: 10,141 |

| State Population | 4,887,871 |

| Most Popular Vehicle | F150 |

| Percentage of Motorists Uninsured | 18.40% State Rank: 6th |

| Driving Deaths | Speeding (2008-2017) Total: 2,957 Drunk Driving Total: 1,038 |

| Average Premiums (Annual) | Liability: $394.21 Collision: $317.96 Comprehensive: $146.28 Combined Premium: $817.95 |

| Cheapest Provider | USAA |

Welcome to Alabama! Affectionately referred to as the “Heart of Dixie.” Alabama is called home to 4.86 million people. That is a lot of drivers and cars using Alabama’s over 100,000 miles of road.

Trying to navigate the complex world of the insurance industry can be hard. Not to mention, the laws and regulation to keep you legal on the streets of Alabama. We are going to help you with this process and make it easy!

We will go through rates and the best insurance carriers in the state. We will also visit topics like coverage requirements, seatbelt laws, commuting times, and everything in between! So sit back and let us do the work for you.

And don’t forget, we make extra easy because you can even get quotes right here on this page!

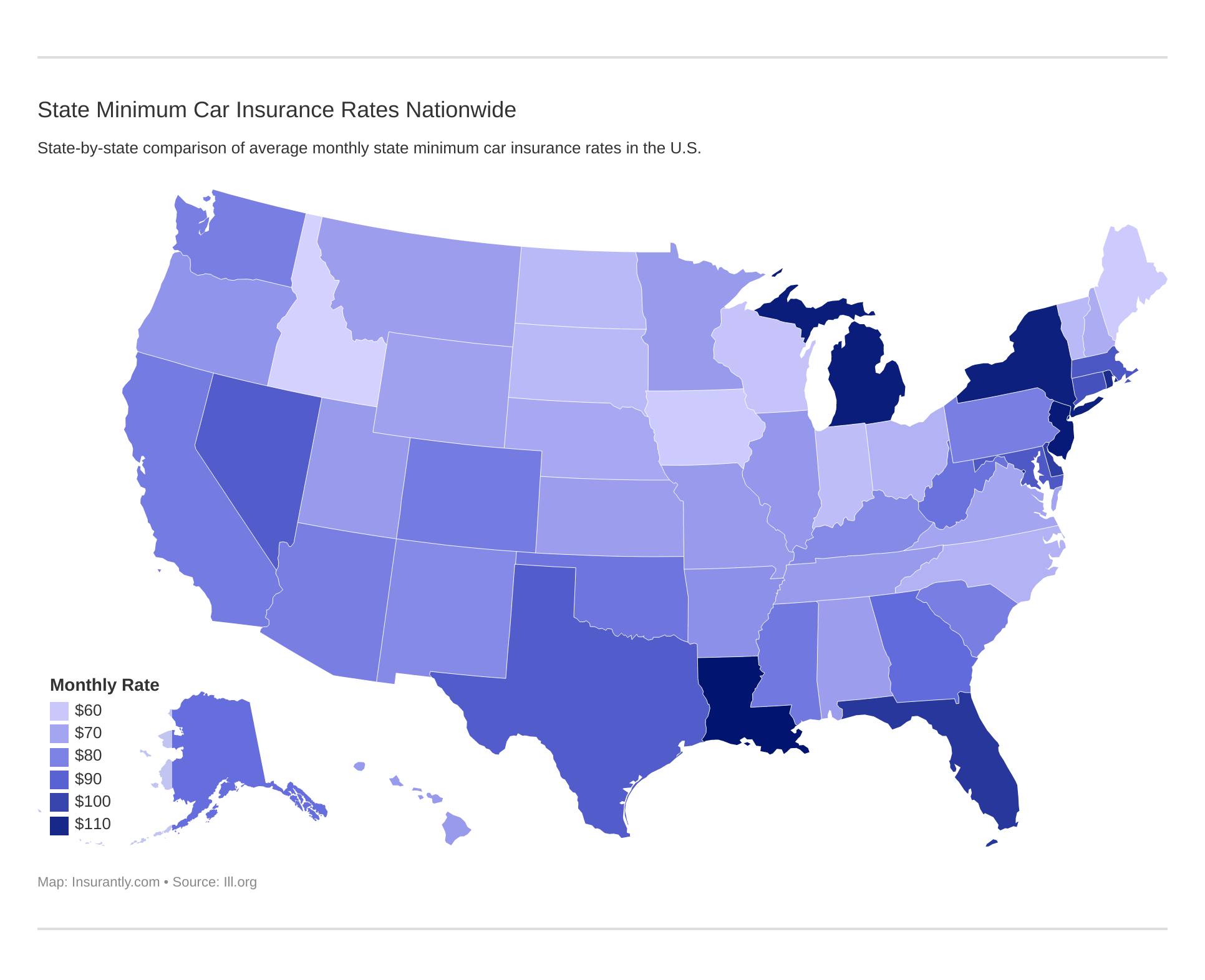

Alabama Car Insurance and Rates

Most states, if not all, require a minimum amount of car insurance to be legal to drive your vehicle on the roads. We are going to cover the minimum limits and also talk about some other endorsements you can add to your policy to make sure you are adequately insured.

We will also take a look at the lowest cities and zip codes in Alabama to purchase insurance! Make sure to check out if your city and where you rank in car premium! (For more information, read our “Best Car Insurance in Your City“).

Alabama Minimum Coverage

| Coverages | Minimum Limits |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per person/$50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

The minimum coverage required to operate a vehicle on a registered auto in Alabama is $25,000 for property damage liability and $25,000 for bodily injury per person and $50,000 per accident. This is the minimum limits. When driving your vehicle, you want to think about how much would cost you if you were to get in an accident. The damage to your car and the damage to persons involved.

Liability coverage only covers others in the event of an accident you are held liable. Meaning in an accident where you are found at fault, this coverage only covers the other person and his or her property damage.

Another important thing to remember is insurance companies only pay out the limits of the policy. Once the limits are exhausted, you are personally held responsible for the rest of the claim. If you are involved in a serious accident or the accident involves a luxury vehicle and only have minimum limits, chances are your coverages wouldn’t cover the entire claim.

Financial Responsibility

It is your financial responsibility to have the required amount of insurance on your vehicle. If you do not have insurance, there are penalties under Alabama law.

If you are convicted of a mandatory insurance violation, your first offense could result in a $500 fine. A second or subsequent violation could result in a $1000 fine and registration suspension. Along with the violation fines, you will also have registration fines. The first registration fine is $200 and subsequent fines can be up to $400 along with more registration suspensions.

Premiums as a Percentage of Income

We know registered cars must have insurance, so now let’s take a look at how much of your income will go towards paying your insurance premiums.

As of 2016, Alabama ranks 36th in auto insurance premiums.

Alabamians are paying 2.50 percent of their disposable income on insurance. Their almost $840 a year premium converts to about $70 a month.

| Year | Full Coverage | Disposable Income | % of Income |

|---|---|---|---|

| 2014 | $837.09 | $33,535.00 | 2.50% |

| 2013 | $811.75 | $32,436.00 | 2.50% |

| 2012 | $788.07 | $32,396.00 | 2.43% |

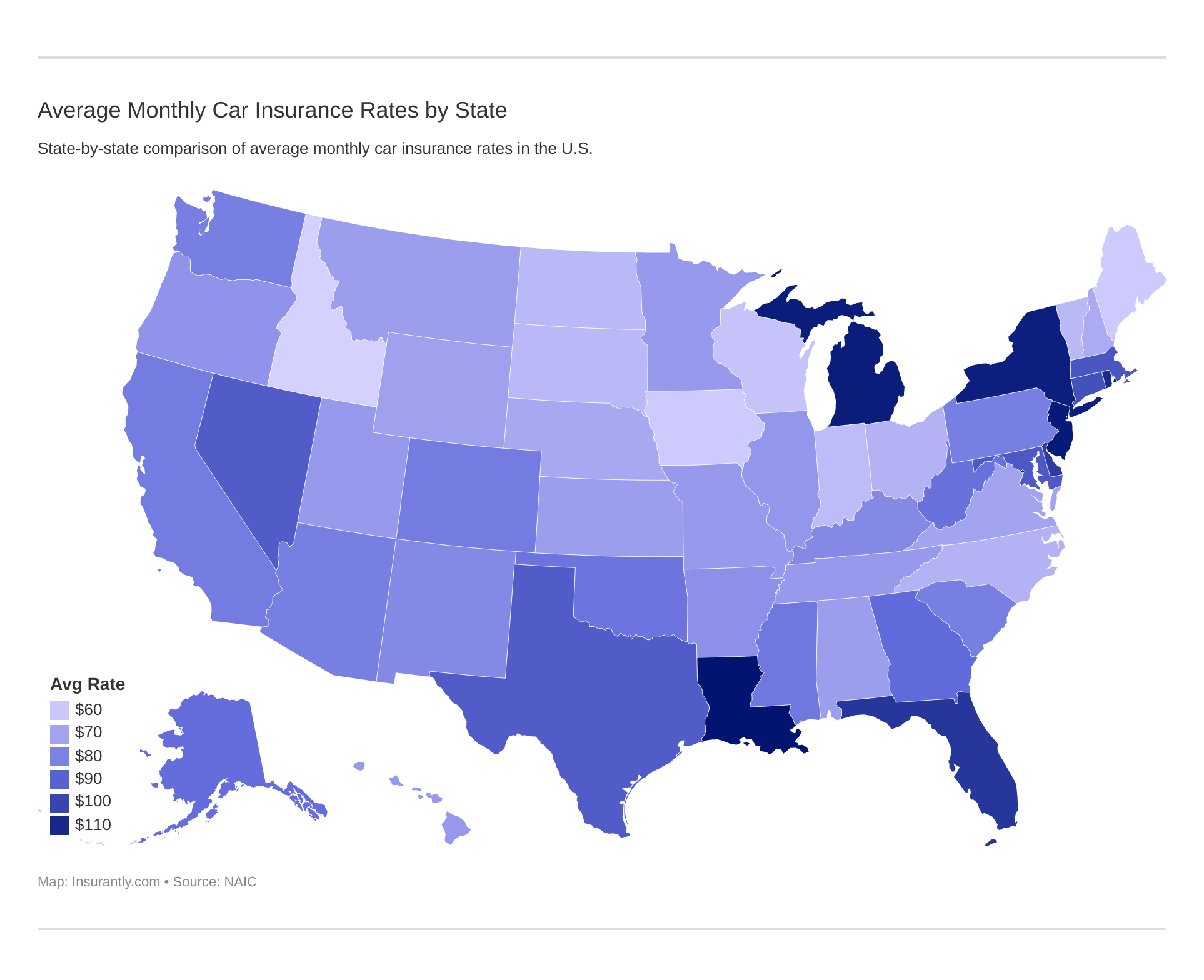

Average Monthly Car Insurance Rates in AL (Liability, Collision, Comprehensive)

The average American pays $1,311 a year for insurance. Drivers in Alabama pay $1,320 each year. Let’s break down what those coverages are and take a look at what they cost.

| Coverage | Average Premium |

|---|---|

| Liability | $372.57 |

| Collision | $299.10 |

| Comprehensive | $146.28 |

| Full Coverage | $817.95 |

Additional Liability Coverages

There are additional liability options you can add to your policy. Alabama requires minimum limits on bodily injury and personal property. There are other liability options you can add to your policy.

Medical payments coverage can be added to your policy to give you extra protection for paying medical bills. This coverage can be used no matter who is at fault. Also, it not only covers you but other passengers in your vehicle at the time of the accident.

Alabama ranks 6th in the country for highest precentages of uninsured motorists!

Loss Ratio is used to calculate loss versus gain. For example, if an insurer pays $50 in claims for every $100 of premium, their loss ratio would be 50 percent. If a company’s loss ratio is too high, they are not making any money. If it is too low, they do not pay out many claims.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (MedPay) | 68% | 67% | 70% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 74% | 76% | 83% |

Add-ons, Endorsements, and Riders

Insurance companies also offer other coverages to be added onto your policy. It is always important to go over your policy needs with your insurance agent. Your agent can go over these endorsements with you to see which ones would benefit you.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

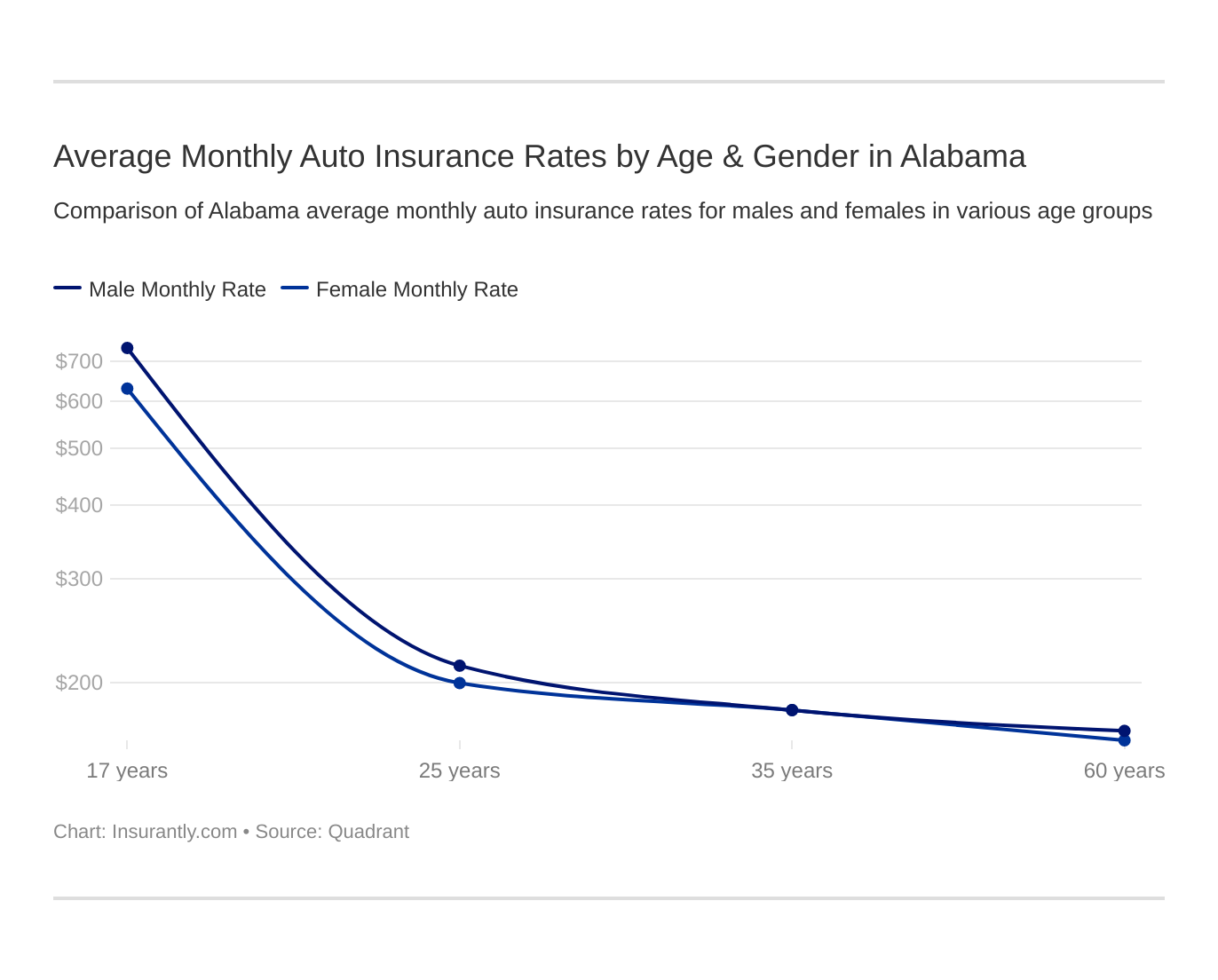

Average Monthly Car Insurance Rates by Age & Gender in AL

| Company | Married 35-year-old female | Married 35-year-old male | Married 60-year-old female | Married 60-year-old male | Single 17-year-old female | Single 17-year-old male | Single 25-year-old female | Single 25-year-old male |

|---|---|---|---|---|---|---|---|---|

| Allstate P&C | $2,003.19 | $1,911.71 | $1,810.29 | $1,845.47 | $6,912.73 | $7,426.75 | $2,248.40 | $2,300.90 |

| Geico Cas | $2,056.10 | $2,040.76 | $1,948.49 | $2,007.68 | $5,383.66 | $5,284.58 | $2,171.19 | $2,018.96 |

| Mid-Century Ins Co | $2,391.72 | $2,374.46 | $2,137.64 | $2,269.18 | $9,212.40 | $9,480.84 | $2,718.78 | $2,828.88 |

| Nationwide Mutual Fire | $1,739.15 | $1,761.83 | $1,583.95 | $1,641.07 | $4,558.03 | $5,880.92 | $1,929.78 | $2,158.89 |

| Progressive Specialty | $2,413.50 | $2,264.79 | $1,979.19 | $2,112.90 | $9,878.37 | $11,026.64 | $2,824.87 | $3,005.15 |

| Safeco Ins Co of IL | $3,086.86 | $3,335.34 | $2,530.47 | $2,830.81 | $11,250.27 | $12,511.44 | $3,289.13 | $3,504.83 |

| State Farm Mutual Auto | $2,934.88 | $2,934.88 | $2,651.27 | $2,651.27 | $8,835.43 | $11,068.85 | $3,314.66 | $3,821.44 |

| Travelers Home & Marine Ins Co | $1,501.32 | $1,524.86 | $1,407.98 | $1,403.64 | $8,037.20 | $12,641.31 | $1,422.13 | $1,631.77 |

| USAA | $1,323.02 | $1,343.67 | $1,235.40 | $1,211.80 | $3,938.27 | $4,367.32 | $1,723.56 | $1,861.50 |

Rates typically are higher for single, younger drivers. Your coverage amounts and driving record will also be a huge part of your premium, but as you can see from the above table, your age and marital status can affect your rate.

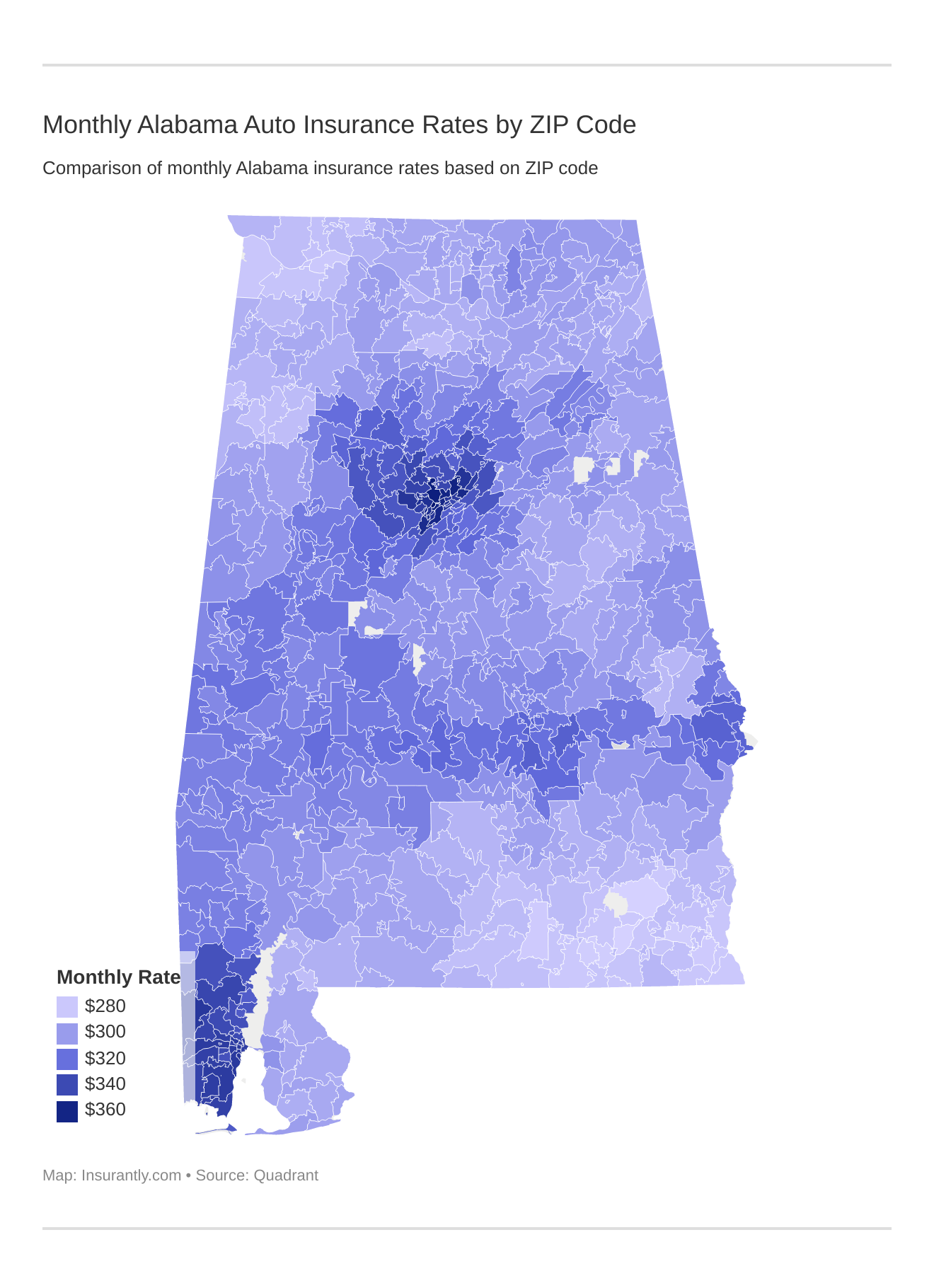

Cheapest Rates by Zip Code

Now let’s take a look at rates by zip code. You can see on this table the least and most expensive zip codes of Alabama. See if your zip code made the list!

| Most Expensive Zip Codes | Average Cost | Least Expensive Zip Code | Average Cost |

|---|---|---|---|

| Birmingham 35218 | $4,428.60 | Dothan 36305 | $3,384.78 |

| Birmingham 35214 | $4,352.20 | Kinston 36453 | $3,384.75 |

| Birmingham 35208 | $4,327.78 | Hartford 36344 | $3,384.66 |

| Birmingham 35217 | $4,326.47 | Sheffield 35660 | $3,384.35 |

| Birmingham 35207 | $4,325.57 | Tuscumbia 35674 | $3,383.56 |

| Birmingham 35204 | $4,313.01 | Cowarts 36321 | $3,381.81 |

| Birmingham 35211 | $4,304.81 | Black 36314 | $3,376.27 |

| Birmingham 35206 | $4,301.59 | Cottonwood 36320 | $3,375.53 |

| Birmingham 35249 | $4,288.29 | Columbia 36319 | $3,371.40 |

| Birmingham 35228 | $4,281.12 | Cherokee 35616 | $3,370.38 |

| Bessemer 35020 | $4,276.93 | Newton 36352 | $3,369.81 |

| Fairfield 35064 | $4,264.43 | Enterprise 36330 | $3,368.24 |

| Birmingham 35224 | $4,249.02 | Pansey 36370 | $3,365.75 |

| Birmingham 35221 | $4,226.77 | Gordon 36343 | $3,362.40 |

| Birmingham 35203 | $4,223.99 | Fort Rucker 36362 | $3,359.23 |

| Birmingham 35215 | $4,220.08 | Samson 36477 | $3,356.68 |

| Birmingham 35234 | $4,217.90 | Muscle Shoals 35661 | $3,354.44 |

| Mobile 36615 | $4,216.38 | Skipperville 36374 | $3,354.03 |

| Saint Elmo 36568 | $4,216.23 | Ashford 36312 | $3,349.21 |

| Dolomite 35061 | $4,215.19 | Opp 36467 | $3,345.94 |

| Mulga 35118 | $4,207.95 | Coffee Springs 36318 | $3,338.62 |

| Birmingham 35254 | $4,202.26 | Dothan 36303 | $3,337.79 |

| Wilmer 36587 | $4,201.84 | Chancellor 36316 | $3,330.05 |

| Birmingham 35212 | $4,190.95 | Daleville 36322 | $3,310.66 |

| Mobile 36605 | $4,190.04 | Ozark 36360 | $3,310.05 |

Rates by City

We also have a table showing rates by city.

| Most Expensive Cities | Average Rate | Least Expensive Cities | Average Rate |

|---|---|---|---|

| FAIRFIELD | $4,264.43 | OZARK | $3,310.05 |

| SAINT ELMO | $4,216.23 | DALEVILLE | $3,310.67 |

| DOLOMITE | $4,215.19 | CHANCELLOR | $3,330.06 |

| MULGA | $4,207.95 | COFFEE SPRINGS | $3,338.62 |

| WILMER | $4,201.84 | OPP | $3,345.93 |

| DOCENA | $4,185.44 | ASHFORD | $3,349.21 |

| THEODORE | $4,176.36 | SKIPPERVILLE | $3,354.03 |

| IRVINGTON | $4,168.74 | MUSCLE SHOALS | $3,354.44 |

| BIRMINGHAM | $4,152.61 | SAMSON | $3,356.68 |

| PLEASANT GROVE | $4,149.20 | FORT RUCKER | $3,359.23 |

| CODEN | $4,143.95 | GORDON | $3,362.40 |

| MOBILE | $4,143.22 | PANSEY | $3,365.75 |

| BAYOU LA BATRE | $4,140.91 | ENTERPRISE | $3,368.24 |

| GRAYSVILLE | $4,137.24 | NEWTON | $3,369.81 |

| ADAMSVILLE | $4,132.10 | CHEROKEE | $3,370.38 |

| NEW CASTLE | $4,131.09 | COLUMBIA | $3,371.40 |

| GRAND BAY | $4,129.30 | COTTONWOOD | $3,375.53 |

| SHANNON | $4,115.23 | DOTHAN | $3,376.27 |

| SEMMES | $4,113.44 | BLACK | $3,376.28 |

| CHUNCHULA | $4,104.58 | COWARTS | $3,381.82 |

| FULTONDALE | $4,101.89 | TUSCUMBIA | $3,383.56 |

| BESSEMER | $4,094.60 | SHEFFIELD | $3,384.35 |

| DORA | $4,089.71 | HARTFORD | $3,384.66 |

| EIGHT MILE | $4,080.85 | KINSTON | $3,384.75 |

| SAYRE | $4,079.32 | GENEVA | $3,389.89 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Alabama Car Insurance Companies

Finding the right insurance company can be hard. Your credit may not be great or you may have a rough driving record. We are going to look at some different companies in the state and show you which ones may be a good fit.

We will briefly cover financial ratings, complaints, rates, and the largest carriers in your state. So sit back and relax, let us do the work for you!

The Largest Companies Financial Rating

Companies have financial ratings from global credit rating agencies. This information helps an insured look and see if their company has good financial standing.

| Allstate Insurance Group | A+ | $345,603 | 10.40% | 49.83% |

| Amtrust NGH Group | A- | $82,940 | 2.50% | 65.13% |

| Farmer's Insurance Group | NR | $79,981 | 2.41% | 53.33% |

| Geico | A++ | $334,835 | 10.07% | 74.78% |

| Liberty Mutual Group | A | $82,140 | 2.47% | 68.13% |

| Nationwide Corp Group | A+ | $92,628 | 2.79% | 67.33% |

| Progressive Group | A+ | $237,440 | 7.14% | 59.82% |

| USAA Group | A++ | $232,334 | 6.99% | 79.17% |

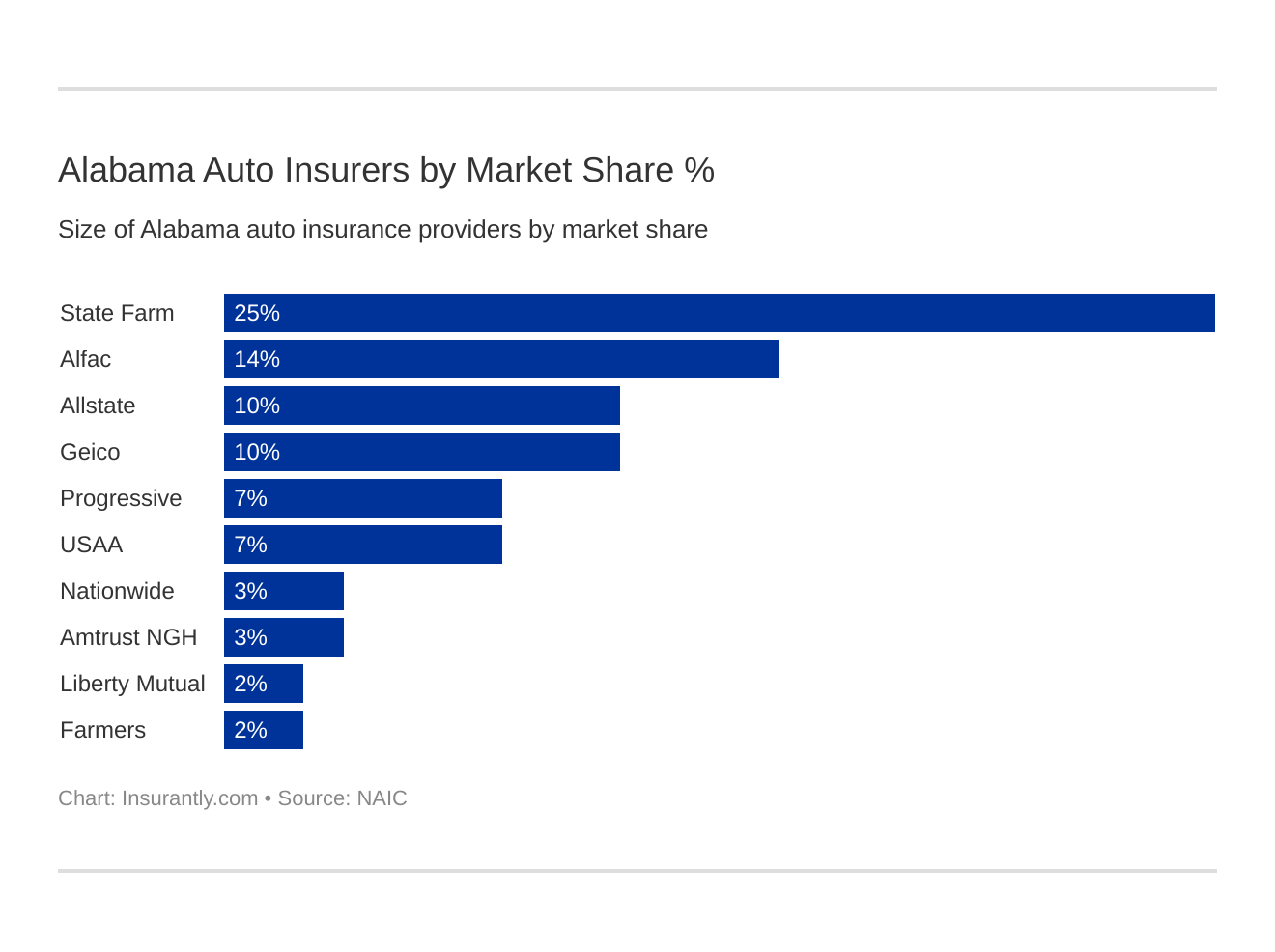

Who are the largest car insurance companies in Alabama?

Companies with Best Customer Ratings

While financial standing is very important since you want your company to pay out for your claim, you also want a company with good customer service. When dealing with a claim or other issue, you want a company willing to go the extra mile. The price point may get you in the door initially, great customer satisfaction will keep you, even when rates may go up.

Companies with Most Complaints in Alabama

Another important factor to look at are complaints filed against the company. Just like with customer service, you do not want to be insured with a company having a reputation of having a lot of complaints.

| Allstate Insurance Group | 0.5 | 163 |

| Amtrust NGH Group | 0 | 2 |

| Farmers Insurance Group | 0 | 0 |

| Geico | .007 | 6 |

| Liberty Mutual Group | 5.95 | 222 |

| Nationwide Corp Group | 0.28 | 25 |

| Progressive Group | 0.75 | 120 |

| USSA Group | 0 | 2 |

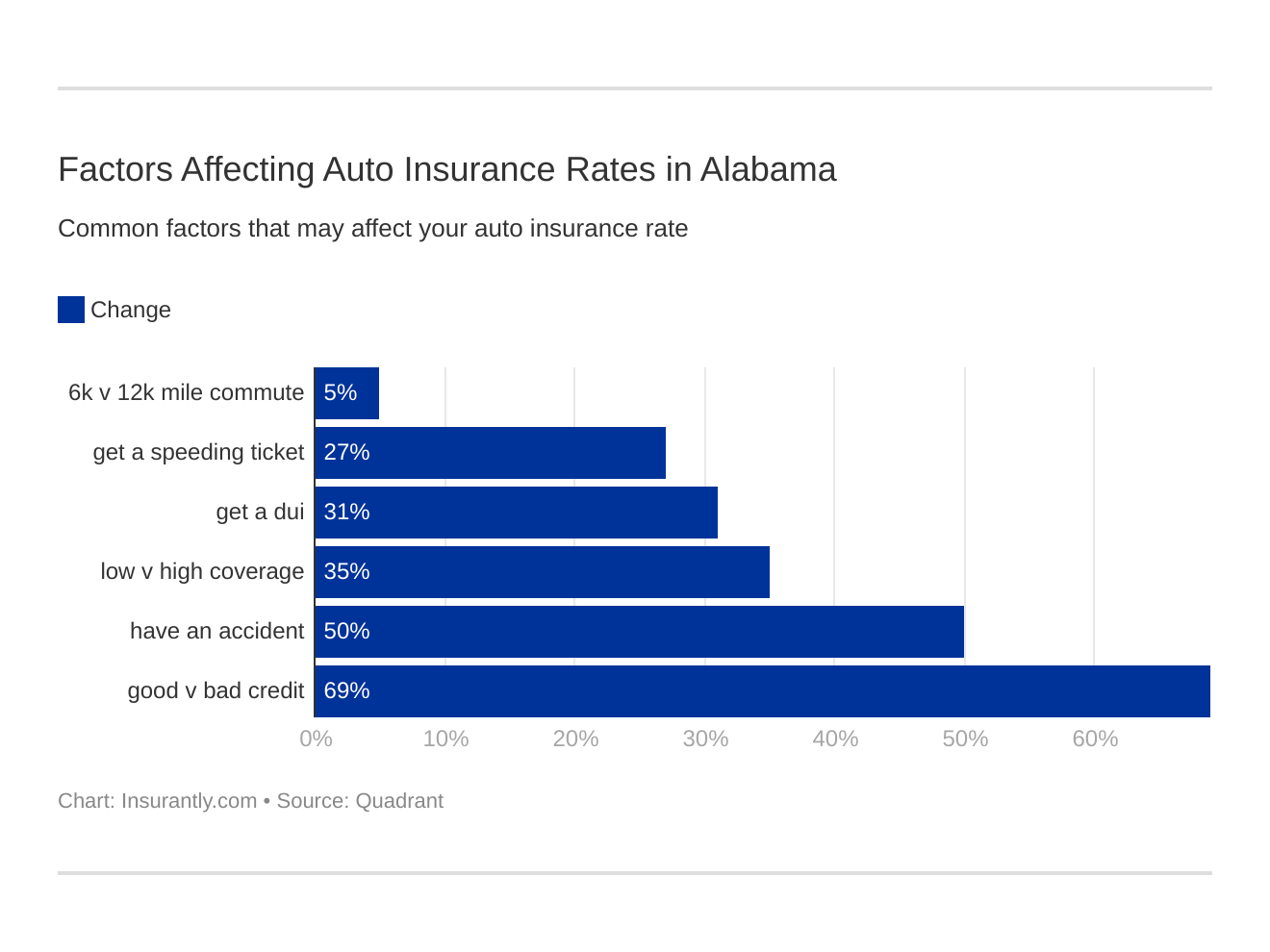

Take a look at these 6 major factors affecting auto insurance rates in Alabama.

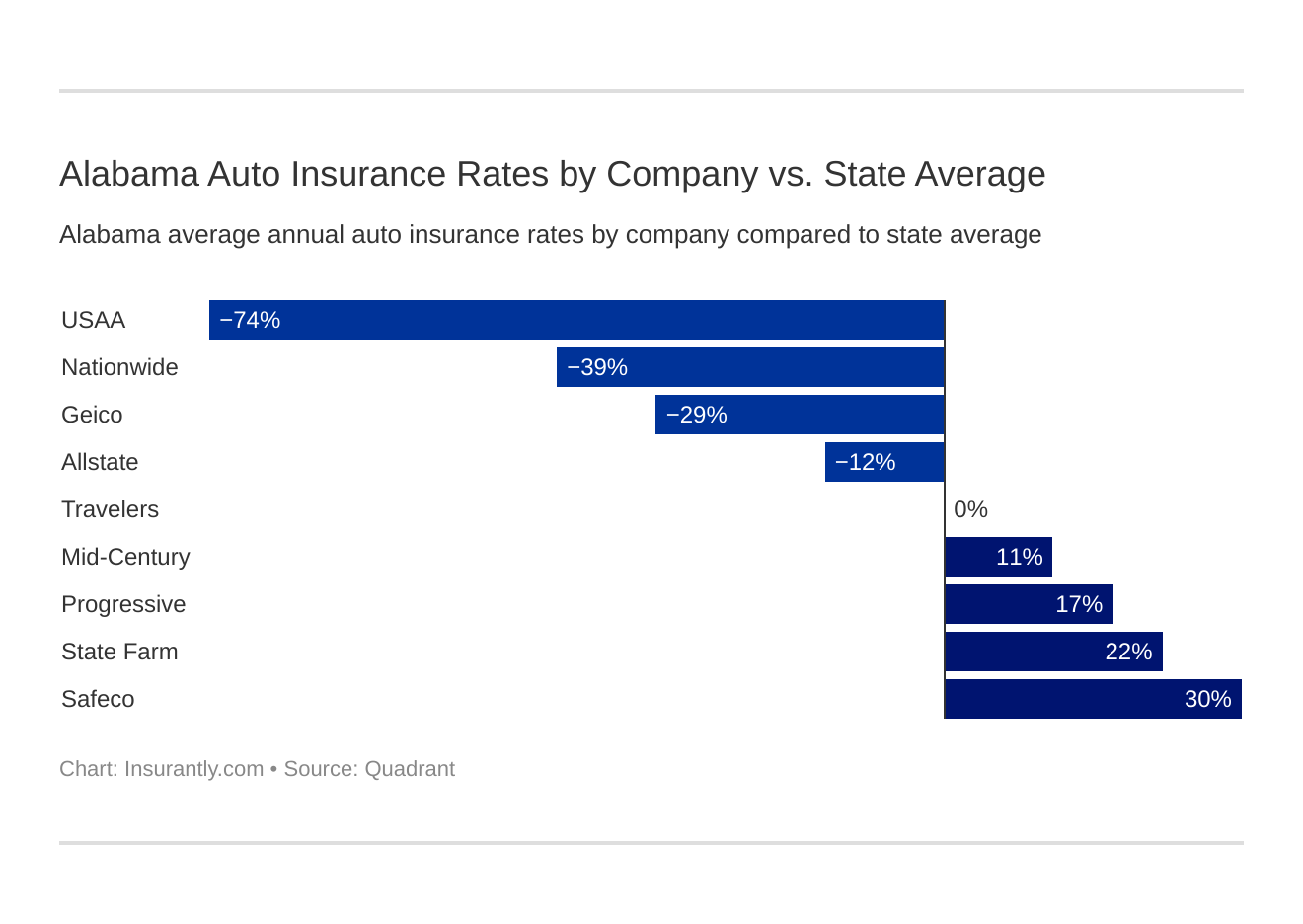

Average Car Insurance Rates by Company

Now let’s look at how these insurers measure up in price point. Below is a table of premiums in comparison with state averages.

| Company | Average | Percentage Compared to State Average | |

|---|---|---|---|

| Allstate P&C | $3,307.43 | -$396.32 | -11.98% |

| Geico | $2,863.93 | -$839.83 | -29.32% |

| Mid-Century Ins Co | $4,176.74 | $472.98 | 11.32% |

| Nationwide Mutual Fire | $2,656.70 | -$1,047.05 | -39.41% |

| Progressive Specialty | $4,438.18 | $734.42 | 16.55% |

| Safeco Ins Co of IL | $5,292.39 | $1,588.64 | 30.02% |

| State Farm Mutual Auto | $4,776.58 | $1,072.83 | 22.46% |

| Travelers Home & Marine Ins Co | $3,696.27 | -$7.48 | -0.20% |

| USAA | $2,125.57 | -$1,578.19 | -74.25% |

Commute Rates by Companies

How your car is used is also a factor in obtaining an accurate quote. Is your car used for work? If so, how long is your commute? Does this really make a huge impact on your premium?

| Company | Commute and Annual Mileage | Annual Average Cost |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $3,307.43 |

| Allstate | 25 miles commute. 12000 annual mileage. | $3,307.43 |

| Farmers | 10 miles commute. 6000 annual mileage. | $4,176.74 |

| Farmers | 25 miles commute. 12000 annual mileage. | $4,176.74 |

| Geico | 10 miles commute. 6000 annual mileage. | $2,811.66 |

| Geico | 25 miles commute. 12000 annual mileage. | $2,916.19 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $5,292.39 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $5,292.39 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,656.70 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,656.70 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,438.18 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,438.18 |

| State Farm | 10 miles commute. 6000 annual mileage. | $4,661.41 |

| State Farm | 25 miles commute. 12000 annual mileage. | $4,891.76 |

| Travelers | 10 miles commute. 6000 annual mileage. | $3,696.27 |

| Travelers | 25 miles commute. 12000 annual mileage. | $3,696.27 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,028.29 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,222.84 |

As you can tell, commuting distances do not usually change the rate of your premium. We are going to talk about what can really change your premium as we continue.

Coverage Level Rates by Companies

How much does the coverage actually cost? Most people, like you, looking for insurance want to know the price. Is the extra coverage really worth the price? Is adding that extra coverage going to raise your premium a significant amount? Let’s take a look.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $3,426.86 |

| Allstate | Medium | $3,301.93 |

| Allstate | Low | $3,193.49 |

| Farmers | High | $4,459.72 |

| Farmers | Medium | $4,123.31 |

| Farmers | Low | $3,947.19 |

| Geico | High | $3,096.97 |

| Geico | Medium | $2,851.46 |

| Geico | Low | $2,643.35 |

| Liberty Mutual | High | $5,558.30 |

| Liberty Mutual | Medium | $5,267.49 |

| Liberty Mutual | Low | $5,051.39 |

| Nationwide | High | $2,693.25 |

| Nationwide | Medium | $2,633.00 |

| Nationwide | Low | $2,643.86 |

| Progressive | High | $4,915.73 |

| Progressive | Medium | $4,414.44 |

| Progressive | Low | $3,984.36 |

| State Farm | High | $5,039.03 |

| State Farm | Medium | $4,770.51 |

| State Farm | Low | $4,520.21 |

| Travelers | High | $3,804.37 |

| Travelers | Medium | $3,769.91 |

| Travelers | Low | $3,514.54 |

| USAA | High | $2,213.25 |

| USAA | Medium | $2,114.13 |

| USAA | Low | $2,049.32 |

As you can see, sometimes the jump from a low coverage to a higher coverage may not be as costly as one would think. Also, from this table, you can see shopping your insurance can be very beneficial. In some cases, the low coverage with one company may be higher than more coverage with another company!

Credit History Rates by Companies

Credit history is another factor insurance companies take into consideration when rating your policy. Most people think of credit history or rating as something used when making a large purchase, like a home or car, but it is also used in obtaining insurance rates. Just like an insured would want to know if a company can pay out for their claim, the company wants to know if the insured can pay their premiums.

| Group | Credit History | Annual Average |

|---|---|---|

| Allstate | Good | $2,625.01 |

| Allstate | Fair | $3,209.78 |

| Allstate | Poor | $4,087.50 |

| Farmers | Good | $3,818.70 |

| Farmers | Fair | $4,029.11 |

| Farmers | Poor | $4,682.41 |

| Geico | Good | $2,350.42 |

| Geico | Fair | $2,598.14 |

| Geico | Poor | $3,643.23 |

| Liberty Mutual | Good | $3,649.25 |

| Liberty Mutual | Fair | $4,648.39 |

| Liberty Mutual | Poor | $7,579.54 |

| Nationwide | Good | $2,262.59 |

| Nationwide | Fair | $2,501.40 |

| Nationwide | Poor | $3,206.13 |

| Progressive | Good | $4,009.47 |

| Progressive | Fair | $4,294.18 |

| Progressive | Poor | $5,010.88 |

| State Farm | Good | $2,663.44 |

| State Farm | Fair | $3,920.59 |

| State Farm | Poor | $7,745.72 |

| Travelers | Good | $3,562.21 |

| Travelers | Fair | $3,495.65 |

| Travelers | Poor | $4,030.96 |

| USAA | Good | $1,660.45 |

| USAA | Fair | $1,859.65 |

| USAA | Poor | $2,856.60 |

The lower your credit rating is the higher your premium is. This chart can give you an idea of what companies may be lower in premium if you have a lower credit rating.

Driving Record Rates by Companies

That speeding ticket can cost you, in court and fees, and also your insurance. But just how much will it cost you?

| Group | Driving Record | Annual Average | Group | Driving Record | Annual Average |

|---|---|---|---|---|---|

| Allstate | With 1 DUI | $3,920.50 | USAA | With 1 speeding violation | $1,768.57 |

| Farmers | With 1 speeding violation | $4,213.26 | Nationwide | With 1 accident | $2,323.90 |

| Farmers | With 1 DUI | $4,434.02 | Allstate | Clean record | $2,816.35 |

| Farmers | With 1 accident | $4,545.66 | USAA | With 1 DUI | $3,047.46 |

| Geico | With 1 DUI | $3,829.62 | USAA | Clean record | $1,634.90 |

| Liberty Mutual | Clean record | $4,150.32 | USAA | With 1 accident | $2,051.34 |

| Liberty Mutual | With 1 speeding violation | $5,590.03 | Nationwide | With 1 DUI | $3,384.37 |

| Liberty Mutual | With 1 DUI | $5,650.89 | Farmers | Clean record | $3,514.01 |

| Liberty Mutual | With 1 accident | $5,778.33 | Travelers | With 1 speeding violation | $3,749.72 |

| Progressive | Clean record | $4,009.21 | Geico | Clean record | $1,935.00 |

| Progressive | With 1 DUI | $4,305.95 | Nationwide | Clean record | $2,323.90 |

| Progressive | With 1 speeding violation | $4,399.76 | Nationwide | With 1 speeding violation | $2,594.63 |

| Progressive | With 1 accident | $5,037.78 | Travelers | With 1 accident | $3,230.82 |

| State Farm | Clean record | $4,314.58 | Geico | With 1 speeding violation | $2,583.05 |

| State Farm | With 1 DUI | $4,725.25 | Geico | With 1 accident | $3,108.04 |

| State Farm | With 1 speeding violation | $4,725.25 | Travelers | Clean record | $3,078.73 |

| State Farm | With 1 accident | $5,341.26 | Allstate | With 1 accident | $3,315.55 |

| Travelers | With 1 DUI | $4,725.83 | Allstate | With 1 speeding violation | $3,177.32 |

A DUI is going to carry a higher premium increase than most other infractions. You can get an idea of what that accident or speeding ticket is going to cost you with different companies.

Number of Insurers in Alabama

There are a lot of insurers in the state of Alabama. Domestic insurers refer to the companies that have headquarters in your state. While foreign companies are companies that may be located in other states but still write business in Alabama.

| Domestic | Foreign | Total Number of Licensed Insurers |

| 18 | 858 | 876 |

Alabama State Laws

We are now going to move onto Alabama state laws. We will discuss licensing regulations, rules of the road, and safety laws.

So let’s get started covering some important regulations to keep you legal and safe on the road!

Car Insurance Laws

The Code of Alabama 1975 is where you can find all the insurance law and regulations for Alabama. It is rather lengthy, so to save you time, we are going to hit some of the major points and break them down. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Windshield Coverage

There is no law requiring zero deductible plans or repair specifications. Some insurers will offer coverage if you have comprehension on your policy.

High-Risk Insurance

Chances are if you are a high-risk driver, you may be required to have an SR-22 filing. SR-22 is a filing with your insurance company required by the state. The state will determine whether a need for the filing is necessary and usually it will last three to five years.

Alabama Auto Insurance Plan can help when trying to obtain insurance that would otherwise be difficult in an open market.

Automobile Insurance Fraud in Alabama

In 2012, Act 12-429 was passed making it a felony to commit to insurance fraud in Alabama. It also requires insurers to report any suspected fraud.

Statute of Limitations

Statute of limitations is the time frame in which you can file a claim from the date of the occurrence. You have two years to file bodily injury and/or property damage liability.

Vehicle Licensing Laws

What is the penalty for driving without insurance? How hard is it to renew your license in Alabama? We are going to touch on some important issues regarding the rules of the road.

Penalties for Driving Without Insurance

Thinking of driving without insurance? Think again. The fines are steep and your registration could be suspended for up to four months.

| 1st Offense | - Fine up to $500 - Registration suspension with $200 reinstatement fee |

| 2nd Offense | - Fine up to $1,000 and/or six-month license suspension - $400 reinstatement fee with four-month registration suspension |

Not to mention, if you get into an accident while uninsured you would be held liable for your damages.

Teen Driver Laws

For a parent having a teen driver can be daunting. Thankfully, Alabama has set a few restrictions regarding teen driving. They have restricted night time driving and how many passengers can be in a vehicle.

| Nighttime restrictions | Midnight to 6 a.m. |

| Passenger restrictions (family members excepted unless noted otherwise) | no more than 1 passenger |

| Minimum age at which restrictions may be lifted | |

| Nighttime restrictions | 17 and licensed for 6 months (minimum age: 17) |

| Passenger restrictions | 17 and licensed for 6 months (minimum age: 17) |

Alabama also has minimum requirements for teens to obtain their license to make sure each teen driver is ready to hit the Alabama roads.

| Mandatory Holding Period | 6 months |

| Minimum Supervised Driving Time | 50 hours (none with driver education) |

| Minimum Age | 16 years old |

New Residents

New residents to Alabama have thirty days to register their vehicle. You must have the title of the vehicle and show your mandatory minimum required insurance limits. You can click here for answers to frequently asked questions.

License Renewal Procedures

Alabama requires your license be renewed every four years. Online renewal, every other renewal period, makes renewing your license a breeze!

Fault vs. No-Fault

Alabama is an at-fault state. Meaning the person at fault in the accident is to file the claim with their insurance and held liable for damages.

Seat Belt and Car Seat Laws

Seat belts can save a life in a tragic accident. Alabama has the below regulations regarding the use of them:

| Effective Since | June 18, 1991 |

| Primary Enforcement | Yes; effective since December 9, 1999 |

| Age/Seats Applicable | 15+ years old in front seat |

| 1st Offense Max Fine | $25 plus fees |

Alabama also recently passed a new law that requires backseat passengers to buckle up. This law went into effect on September 1, 2019. Like most states, Alabama also has requirements for the safety of children riding in a vehicle.

Alabama Car Seat Requirements

| Type of Car Seat Required | Age |

|---|---|

| Rear-Facing Child Restraint | Younger than one year old or less than 20 pounds |

| Forward-Facing Child Restraint | One to four years old or 20 - 40 pounds |

| Child Booster Seat | Five (but under six years old) |

| Adult Belt Permissible | Six through 14 years |

Keep Right and Move Over Laws

Alabama requires slower drivers to stay in the right lane. Passing on the right is permissible with these exceptions. In 2019, Alabama also put a new law into effect allowing officers to ticket drivers who stay in the left lane for more than a mile without passing other vehicles.

The goal of this new law is to reduce road rage on Alabama’s roads.

Alabama also requires drivers to move over a lane or slow down for the following stationary vehicles with flashing lights:

- Emergency vehicles

- Utility vehicles

- Municipal vehicles

- Department of Transportation vehicles

It’s important to obey the move over law, as it protects the people working around the vehicles.

Speed Limits

Speed limits vary from state to state. While they are always posted, it is good to know what your state regulations regarding the limit.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 70 mph |

| Urban Interstates | 65 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 65 mph |

Ridesharing

Effective July 1, 2018, ridesharing companies like Lyft and Uber, can operate statewide in Alabama. This is great news for people that depend on ridesharing companies to get to and from work and school.

A new law, SB262, was also passed requirement certain insurance requirements to close the gap coverage for drivers operating under a ridesharing company.

Automation on the Road

Automation is no longer a thing of the past. As we move forward, most things are becoming more automated and cars are no different. As cars begin driving themselves, Alabama has regulations regarding the operation of automated vehicles.

| Operation | Allowable |

|---|---|

| Driving Allowed | Deployment |

| Operator License Required | Yes |

| Operator Required to be in the Vehicle | Depends on level of vehicle automation |

| Liability Insurance Required | Yes |

Safety Laws

Everyone wants to be safe on the roads. Sometimes you are the safe one, and you are involved in an accident with someone distracted or under the influence. Alabama has laws to deter the use of alcohol and distractions while on the road.

DUI Laws

| Name for Offense | Driving under the influence (DUI) |

|---|---|

| BAC Limit | 0.08 |

| High BAC Limit | 0.15 |

| Criminal Status | 1st to 3rd offenses are misdemeanors; 4th+ in 5 years is a class C felony |

| Look Back Period | 5 years |

If you do find yourself charged with a DUI, below are penalties for your offense. If you have more than one offense, the penalty will become greater.

| DUI - 1st Offense | |

|---|---|

| License Revoked | Mandatory 90 days |

| Jail Time | Up to one year in a municipal or county jail (no time minimum) |

| Fine | $500 to $2,000 +$100 for Impaired Drivers Trust Fund |

| Other | Mandatory DUI school |

| DUI - 2nd Offense | |

|---|---|

| License Revoked | 1 year |

| Jail Time | 48 consecutive hours at least (up to 1 year) OR no less than 20 days of community service |

| Fine | $1,000 to $5,000 +$100 for Impaired Drivers Trust Fund |

| Other | NA |

| DUI - 3rd Offense | |

|---|---|

| License Revoked | 3 years |

| Jail Time | 60 days to 1 year in a municipal or county jail |

| Fine | $2,000 to $10,000 +$100 for Impaired Drivers Trust Fund |

| Other | NA |

| DUI - 4th Offense | |

|---|---|

| License Revoked | 5 years |

| Jail Time | 1 to 10 years |

| Fine | $4,000 to $10,000 |

| Other | NA |

Distracted Driving Laws

Cell phones are owned by most people, including kids. Looking down at a text or missed call for even a second can cause a tragic accident.

| Issue | Group |

|---|---|

| Hand-held ban | 16-year-old drivers; 17-year-old drivers who have held an intermediate license for fewer than 6 months |

| Text ban | All drivers |

| Enforcement | Primary |

Alabama Can’t-Miss Facts

We have covered a lot of information for Alabama residents! Lastly, let us take a brief look at some not so fun things. Accidents happen which means fatalities can occur. Vehicles are stolen. We are going to touch on those topics and a few others.

Vehicle Theft

Below is a table showing the top 10 types of vehicles most commonly stolen.

| Vehicle Make and Model | Vehicle Year | Total Thefts |

|---|---|---|

| Chevrolet Pickup (Full Size) | 2005 | 499 |

| Ford Pickup (Full Size) | 2006 | 357 |

| Toyota Camry | 2014 | 205 |

| Nissan Altima | 2014 | 191 |

| Chevrolet Impala | 2004 | 191 |

| Honda Accord | 1998 | 180 |

| GMC Pickup (Full Size) | 1999 | 152 |

| Dodge Pickup (Full Size) | 1998 | 138 |

| Ford Mustang | 2002 | 122 |

| Ford Explorer | 2002 | 119 |

Let’s also take a look at which cities have the highest rate of stolen vehicles.

| Birmingham | 1,478 |

| Huntsville | 703 |

| Mobile | 681 |

| Phenix City | 270 |

| Prichard | 213 |

| Bessemer | 209 |

| Gadsden | 200 |

| Decatur | 153 |

| Tuscaloosa | 151 |

| Dothan | 109 |

Fatal Crashes by Weather Condition and Light Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 353 | 107 | 259 | 29 | 2 | 750 |

| Rain | 36 | 12 | 34 | 2 | 0 | 84 |

| Snow/Sleet | 0 | 0 | 0 | 1 | 0 | 1 |

| Other | 4 | 3 | 12 | 3 | 0 | 22 |

| Unknown | 2 | 0 | 2 | 0 | 3 | 7 |

| TOTAL | 395 | 122 | 307 | 35 | 5 | 864 |

Most accidents occur in normal conditions during the daylight.

Fatalities by City

| City | Total Killed | Pedestrians Killed | Percent of Total Killed | 2016 City Population | Fatality Rate Per 100,000 Population |

|---|---|---|---|---|---|

| Birmingham | 44 | 10 | 22.7 | 212,157 | 20.74 |

| Montgomery | 27 | 6 | 22.2 | 200,022 | 13.50 |

| Mobile | 35 | 9 | 25.7 | 192,904 | 18.14 |

Traffic Fatalities

| Alabama Traffic Fatalities by Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total | 969 | 848 | 862 | 895 | 865 | 853 | 820 | 850 | 1,083 | 948 |

| Rural | 608 | 512 | 527 | 515 | 510 | 562 | 544 | 590 | 803 | 596 |

| Urban | 359 | 335 | 327 | 378 | 351 | 285 | 274 | 260 | 280 | 352 |

| Unknown | 2 | 1 | 8 | 2 | 4 | 6 | 2 | 0 | 0 | 0 |

Fatalities by Person Type

We can also break down and see what the occupant was driving or a passenger when the fatality occurred.

| 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|

| Passenger Car Occupants | 357 | 337 | 355 | 416 | 395 |

| Light Pickup Truck Occupants | 151 | 150 | 156 | 169 | 145 |

| Light Utility Truck Occupants | 137 | 116 | 111 | 166 | 143 |

| Van Occupants | 20 | 15 | 23 | 24 | 27 |

| Light Truck (Other) Occupants | 1 | 0 | 3 | 9 | 1 |

| Large Truck Occupants | 25 | 15 | 16 | 35 | 20 |

| Bus Occupants | 3 | 0 | 1 | 0 | 0 |

| Other/Unknown Occupants | 12 | 15 | 10 | 25 | 9 |

| Motorcyclists | 80 | 65 | 67 | 112 | 79 |

| Pedestrians | 59 | 96 | 98 | 120 | 119 |

| Bicyclists and Other Cyclists | 6 | 9 | 9 | 3 | 7 |

| Other/Unknown Non-occupants | 2 | 2 | 1 | 4 | 3 |

| State Total | 853 | 820 | 850 | 1,083 | 948 |

Fatalities by Crash Type

Here is a five-year trend of what types of fatalities occur.

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 853 | 820 | 850 | 1,083 | 948 |

| - (1) Single Vehicle | 512 | 508 | 482 | 639 | 564 |

| - (2) Involving a Large Truck | 109 | 84 | 101 | 144 | 99 |

| - (3) Involving Speeding | 253 | 237 | 236 | 329 | 257 |

| - (4) Involving a Rollover | 278 | 249 | 269 | 331 | 290 |

| - (5) Involving a Roadway Departure | 580 | 492 | 540 | 663 | 605 |

| - (6) Involving an Intersection (or Intersection Related) | 123 | 125 | 158 | 208 | 145 |

Five-Year Trend For The Top 10 Counties

Here are the 10 counties with the most fatalities

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Jefferson County | 92 | 77 | 80 | 90 | 83 |

| Mobile County | 65 | 76 | 72 | 77 | 75 |

| Madison County | 33 | 33 | 24 | 45 | 37 |

| Tuscaloosa County | 27 | 38 | 41 | 50 | 37 |

| Baldwin County | 38 | 27 | 32 | 37 | 26 |

| Talladega County | 27 | 15 | 19 | 30 | 26 |

| Etowah County | 13 | 15 | 14 | 31 | 25 |

| Cullman County | 14 | 19 | 25 | 25 | 24 |

| Shelby County | 16 | 20 | 19 | 26 | 24 |

| Blount County | 13 | 6 | 5 | 17 | 23 |

| Top 10 County Total | 377 | 361 | 368 | 465 | 380 |

| State Total (Includes All Counties) | 853 | 820 | 850 | 1,083 | 948 |

Fatalities Involving Speeding by County

Speeding is always risky. This table lists the five-year trend in speeding-related fatalities in all Alabama counties.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Autauga | 4 | 1 | 2 | 3 | 5 |

| Baldwin | 6 | 5 | 7 | 10 | 7 |

| Barbour | 3 | 1 | 0 | 1 | 3 |

| Bibb | 1 | 0 | 0 | 4 | 0 |

| Blount | 3 | 3 | 1 | 9 | 4 |

| Bullock | 5 | 1 | 2 | 1 | 3 |

| Butler | 1 | 3 | 4 | 2 | 5 |

| Calhoun | 4 | 1 | 5 | 9 | 2 |

| Chambers | 5 | 1 | 4 | 5 | 1 |

| Cherokee | 8 | 6 | 3 | 4 | 1 |

| Chilton | 5 | 5 | 9 | 5 | 3 |

| Choctaw | 1 | 3 | 2 | 2 | 3 |

| Clarke | 2 | 5 | 2 | 2 | 1 |

| Clay | 1 | 0 | 1 | 2 | 0 |

| Cleburne | 3 | 1 | 0 | 4 | 0 |

| Coffee | 1 | 4 | 1 | 4 | 2 |

| Colbert | 4 | 4 | 5 | 4 | 11 |

| Conecuh | 1 | 2 | 3 | 2 | 4 |

| Coosa | 2 | 6 | 0 | 6 | 2 |

| Covington | 0 | 7 | 1 | 0 | 2 |

| Crenshaw | 0 | 0 | 2 | 0 | 2 |

| Cullman | 7 | 6 | 6 | 12 | 10 |

| Dale | 3 | 3 | 2 | 4 | 0 |

| Dallas | 1 | 3 | 2 | 5 | 2 |

| Dekalb | 11 | 5 | 5 | 9 | 9 |

| Elmore | 7 | 12 | 9 | 9 | 4 |

| Escambia | 4 | 7 | 7 | 2 | 6 |

| Etowah | 4 | 4 | 1 | 8 | 6 |

| Fayette | 0 | 0 | 1 | 0 | 3 |

| Franklin | 0 | 3 | 2 | 1 | 2 |

| Geneva | 1 | 1 | 4 | 0 | 1 |

| Greene | 5 | 2 | 5 | 0 | 2 |

| Hale | 4 | 3 | 0 | 2 | 2 |

| Henry | 0 | 2 | 0 | 2 | 3 |

| Houston | 4 | 5 | 3 | 10 | 3 |

| Jackson | 3 | 3 | 4 | 8 | 4 |

| Jefferson | 21 | 12 | 17 | 20 | 12 |

| Lamar | 1 | 0 | 2 | 1 | 1 |

| Lauderdale | 4 | 2 | 3 | 4 | 3 |

| Lawrence | 2 | 0 | 0 | 5 | 4 |

| Lee | 2 | 3 | 2 | 2 | 7 |

| Limestone | 5 | 3 | 12 | 14 | 3 |

| Lowndes | 3 | 4 | 0 | 1 | 7 |

| Macon | 6 | 5 | 1 | 8 | 2 |

| Madison | 18 | 3 | 2 | 14 | 9 |

| Marengo | 0 | 3 | 0 | 4 | 1 |

| Marion | 4 | 1 | 2 | 0 | 1 |

| Marshall | 3 | 4 | 7 | 7 | 4 |

| Mobile | 15 | 22 | 16 | 19 | 14 |

| Monroe | 1 | 0 | 3 | 5 | 2 |

| Montgomery | 4 | 2 | 2 | 6 | 2 |

| Morgan | 6 | 2 | 3 | 2 | 5 |

| Perry | 1 | 2 | 1 | 1 | 1 |

| Pickens | 3 | 0 | 3 | 3 | 0 |

| Pike | 2 | 2 | 1 | 1 | 4 |

| Randolph | 3 | 2 | 1 | 1 | 1 |

| Russell | 1 | 4 | 6 | 2 | 5 |

| Shelby | 5 | 2 | 2 | 7 | 5 |

| St. Clair | 2 | 6 | 6 | 2 | 4 |

| Sumter | 0 | 1 | 3 | 3 | 3 |

| Talladega | 10 | 7 | 10 | 11 | 10 |

| Tallapoosa | 2 | 3 | 1 | 7 | 1 |

| Tuscaloosa | 3 | 11 | 13 | 14 | 11 |

| Walker | 7 | 6 | 4 | 4 | 7 |

| Washington | 1 | 2 | 1 | 3 | 4 |

| Wilcox | 2 | 5 | 3 | 1 | 2 |

| Winston | 2 | 0 | 4 | 6 | 4 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

Here’s a look at alcohol-related deaths over the past five years.

| County Name | 2013 Deaths | 2014 Deaths | 2015 Deaths | 2016 Deaths | 2017 Deaths |

|---|---|---|---|---|---|

| Autauga County | 6 | 1 | 3 | 4 | 3 |

| Baldwin County | 9 | 10 | 10 | 9 | 7 |

| Barbour County | 2 | 2 | 2 | 1 | 3 |

| Bibb County | 2 | 0 | 1 | 3 | 2 |

| Blount County | 3 | 3 | 1 | 4 | 4 |

| Bullock County | 4 | 3 | 4 | 4 | 1 |

| Butler County | 1 | 2 | 2 | 3 | 6 |

| Calhoun County | 2 | 3 | 5 | 6 | 3 |

| Chambers County | 5 | 1 | 3 | 7 | 1 |

| Cherokee County | 4 | 0 | 2 | 5 | 0 |

| Chilton County | 5 | 4 | 3 | 3 | 2 |

| Choctaw County | 3 | 1 | 1 | 4 | 4 |

| Clarke County | 3 | 3 | 2 | 1 | 1 |

| Clay County | 1 | 0 | 1 | 0 | 1 |

| Cleburne County | 3 | 1 | 1 | 3 | 0 |

| Coffee County | 1 | 3 | 2 | 8 | 4 |

| Colbert County | 4 | 2 | 2 | 2 | 8 |

| Conecuh County | 0 | 4 | 2 | 3 | 1 |

| Coosa County | 0 | 4 | 1 | 2 | 1 |

| Covington County | 1 | 4 | 0 | 1 | 4 |

| Crenshaw County | 1 | 1 | 1 | 3 | 1 |

| Cullman County | 2 | 5 | 7 | 8 | 8 |

| Dale County | 9 | 4 | 4 | 3 | 3 |

| Dallas County | 5 | 8 | 4 | 6 | 4 |

| Dekalb County | 8 | 3 | 3 | 8 | 7 |

| Elmore County | 4 | 8 | 5 | 9 | 3 |

| Escambia County | 4 | 6 | 6 | 3 | 5 |

| Etowah County | 4 | 6 | 4 | 3 | 4 |

| Fayette County | 1 | 3 | 0 | 0 | 2 |

| Franklin County | 0 | 1 | 1 | 0 | 0 |

| Geneva County | 1 | 2 | 4 | 0 | 3 |

| Greene County | 2 | 2 | 2 | 1 | 3 |

| Hale County | 3 | 0 | 0 | 3 | 3 |

| Henry County | 0 | 0 | 0 | 1 | 0 |

| Houston County | 5 | 4 | 1 | 9 | 1 |

| Jackson County | 2 | 2 | 3 | 3 | 4 |

| Jefferson County | 27 | 24 | 21 | 27 | 26 |

| Lamar County | 2 | 0 | 0 | 1 | 0 |

| Lauderdale County | 3 | 5 | 5 | 7 | 3 |

| Lawrence County | 2 | 4 | 1 | 2 | 3 |

| Lee County | 2 | 3 | 2 | 6 | 6 |

| Limestone County | 5 | 4 | 7 | 5 | 5 |

| Lowndes County | 4 | 2 | 1 | 2 | 5 |

| Macon County | 5 | 4 | 2 | 6 | 6 |

| Madison County | 11 | 10 | 5 | 14 | 16 |

| Marengo County | 2 | 6 | 1 | 1 | 3 |

| Marion County | 2 | 1 | 1 | 0 | 1 |

| Marshall County | 4 | 2 | 3 | 6 | 5 |

| Mobile County | 23 | 24 | 23 | 23 | 21 |

| Monroe County | 1 | 2 | 3 | 1 | 2 |

| Montgomery County | 12 | 11 | 11 | 8 | 5 |

| Morgan County | 4 | 2 | 5 | 3 | 4 |

| Perry County | 1 | 0 | 1 | 2 | 2 |

| Pickens County | 4 | 2 | 1 | 2 | 0 |

| Pike County | 0 | 2 | 7 | 2 | 4 |

| Randolph County | 2 | 2 | 0 | 2 | 1 |

| Russell County | 1 | 6 | 3 | 4 | 3 |

| Shelby County | 2 | 7 | 6 | 7 | 4 |

| St. Clair County | 4 | 3 | 1 | 5 | 4 |

| Sumter County | 2 | 3 | 3 | 1 | 4 |

| Talladega County | 8 | 4 | 4 | 11 | 8 |

| Tallapoosa County | 2 | 1 | 3 | 5 | 1 |

| Tuscaloosa County | 7 | 13 | 19 | 10 | 8 |

| Walker County | 5 | 6 | 5 | 5 | 6 |

| Washington County | 0 | 4 | 2 | 1 | 1 |

| Wilcox County | 4 | 4 | 3 | 1 | 2 |

| Winston County | 1 | 0 | 1 | 0 | 3 |

Teen Drinking and Driving

Here’s how Alabama rated in underage drinking and driving arrests in 2016.

| Number of Under 18 DUI Arrests: | Total Per One Million People (DUI Under 18 Arrests): | Rank: |

| 28 | 25.53 | 48 |

Alabama has a zero tolerance against underage drinking. Any consumption of alcohol and driving underage is against the law and can result in driving suspensions.

EMS Response Time

In the event that you are in an accident or need medical attention on the road, here is a table showing EMS response times.

| Location of Incident | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatalities in Crashes |

|---|---|---|---|---|---|

| Rural | 9.45 min | 13.32 min | 35.28 min | 56.82 min | 715 |

| Urban | 6.25 min | 6.83 min | 27.03 min | 39.50 min | 264 |

Transportation

Lastly, we are going to look at statistics regarding car ownership and commuting.

Car Ownership

On average, most families own two cars in Alabama. Three- and one-car households are the next largest groups respectively.

Commuting in Alabama

Over 80 percent of Alabama’s commuters travel alone to work. Of the remaining 20 percent, most carpool or take public transportation. The most common commute time is between 15-20 minutes, although about two percent have a commute of 90 minutes or more.

Traffic congestion continues to be a problem in Alabama. As we see above, most drive to work alone, causing an increase in traffic on Alabama roadways.

We have covered a lot of information! Now that you have been informed in insurers, coverages, and rates you are well on your way to obtaining the best rate! Let us help you here with a free quote comparison!

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.