Kansas Car Insurance [Rates + Cheap Coverage Guide]

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Mar 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 21, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| Summary | Statistics |

|---|---|

| Miles of Roadway | Total in State: 140,654 Miles Driven: 31,379 million |

| Vehicles | Registered Vehicles: 2,538,531 Vehicle Thefts: 6,957 |

| Population | 2,905,789 |

| Most Popular Vehicle in Kansas | Ford F-150 |

| Uninsured%/Underinsured% | 7.20% |

| Total Driving Related Deaths | Speeding Fatalities: 104 DUI Fatalities: 102 |

| Full Coverage Average Premiums | Liability: $358 Collision: $263 Comprehensive: $241 |

| Cheapest Provider | American Family Mutual |

Kansas is known for a number of things, including but not limited to its appearance in the original Wizard of Oz. Known both as the Sunflower State and the Wheat State, Kansas is statistically proven to be flatter than a pancake. That does mean, though, that it’s at least easy to drive through.

If you’re driving in Kansas, though, you’re going to need car insurance, and shopping for car insurance isn’t easy. The process takes a lot of time and concentration to even begin. Then, you have to figure out what providers you want to compare, what rate variables or discounts are most important to you, and more.

The good news is that you don’t have to undergo that process alone. In fact, we’ve done the bulk of the work for you here, in our comprehensive guide to Kansas’s car insurance. You can learn more about the state’s different providers, their financial ratings, their compliance with state law, and more.

If you want to get a jump on the research process, you can use our FREE online tool to discover affordable car insurance rates in your area.

Ready to get started? Let’s go!

Kansas Car Insurance Coverage and Rates

Let’s lay a solid foundation before diving into the details of Kansas’s car insurance. In this section, we’ll detail the state’s minimum required liability coverage as well as the basic factors that go into determining your car insurance rate.

Kansas Minimum Coverage

Kansas is a no-fault state. This means that, if you happen to get into an accident, both you and the other party involved will have to pay for your own damages.

Minimum liability coverage — and, in particular, Kansas’s legally-required state minimum liability coverage — can help protect you from the cost of getting into an accident. Take a look at the table below to learn more about the kind of coverage Kansas requires its drivers to carry.

| Type of Coverage | Minimum Requirement |

|---|---|

| Bodily Injury Liability | $25,000 per person/$50,000 per accident |

| Property Damage Liability | $25,000 per accident |

| Personal Injury Protection | $4,500/person for medical benefits |

| Uninsured/Underinsured Motorist Coverage | $25,000 per person/ $50,000 per accident |

Note that, because Kansas is a no-fault state, you’ll also be required to purchase Uninsured/underinsured motorist coverage and Personal Injury Protection. Those numbers break down as follows:

Personal Injury Protection

- $4,500 per person for medical expenses

- $900 a month for one year in case of disability or loss of income

- $25 a day for in-home services

- $2,000 for a funeral or other burial rites

- $4,500 for rehabilitation

Uninsured/Underinsured Coverage

- $25,000 per person

- $50,000 per accident

Forms of Financial Responsibility

After you’ve purchased your coverage, be it minimal or otherwise, you’re going to need to keep proof of insurance, otherwise known as forms of financial responsibility in your car in case you ever get pulled over.

Acceptable proof of insurance in the state of Kansas includes:

- A current insurance ID card

- A copy of your insurance policy

- Electric copies of your insurance identification or insurance policy

Show proof of insurance to any law enforcement officers or other bodies who ask to see it, and you’ll get yourself out of a lot of trouble — not to mention extra expense.

Premiums as a Percentage of Income

Your car insurance premium will be directly impacted by the amount of money you bring home on a yearly basis. This income is formally referred to as your per capita disposable income.

Your per capita disposable income is the amount of money you have left to spend on groceries, rent, utilities, and entertainment after you’ve paid your rent for the year.

The average disposable income in Kansas comes in at $41,634. That’s nearly a thousand dollars higher than the national average disposable income, which comes in at $40,859. But what does that income look like when you take car insurance payments into account?

| Details | 2012 | 2013 | 2014 |

|---|---|---|---|

| Disposable Income | $40,424 | $41,140 | $41,634 |

| Full Coverage Premiums | $785.72 | $815.82 | $850.79 |

| Insurance as Percentage of Income | 1.94% | 1.98% | 2.04% |

In short, Kansas residents will spend roughly 2 percent of their annual disposable income on a car insurance premium. That may not seem like a lot, but you’ll want to ensure that you have the money available to you so that your coverage doesn’t lapse.

Average Monthly Car Insurance Rates in KS (Liability, Collision, Comprehensive)

Kansas, according to the National Association of Insurance Commissioners, sees average annual core coverage premiums as follows:

- Liability: $358.24

- Collision: $263.33

- Comprehensive: $358.24

- Combined: $862.93

Note, though, that these numbers come from a 2015 report, and that rates will have increased after 2019.

Additional Liability

As mentioned, Kansas law requires its drivers to maintain uninsured/underinsured motorist coverage and Personal Injury Protection (PIP) coverage in addition to the state’s minimum liability coverage.

These coverage types each come equipped with a loss ratio.

A loss ratio represents the likelihood that a car insurance provider will pay out on a claim.

High loss ratios indicate a company’s coverage is secure financially, but that the company itself may be slow to pay out on claims. Comparatively, low loss ratios indicate a company is willing to pay out on claims, but it may not always be financially secure.

You want to work with a company that has a loss ratio between 60-80 percent. With that in mind, take a look at the loss ratios reported by Kansas providers to the National Association of Insurance Commissioners:

| Type of Coverage | 2013 | 2014 | 2015 |

|---|---|---|---|

| Personal Injury Protection | 61.83% | 61.17% | 66.51% |

| Medical Payments | 92.66% | 76.25% | 91.63% |

| Uninsured/Underinsured Motorist | 66.74% | 69.49% | 76.25% |

Most of Kansas’s optional coverage providers hold fair loss ratios. That means you can take on these additional forms of coverage without worrying about losing money.

Add-Ons, Endorsements, and Riders

You can explore additional, optional coverage by considering some of the add-ons below. Click on the available links to learn more:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Average Monthly Car Insurance Rates by Age & Gender in KS

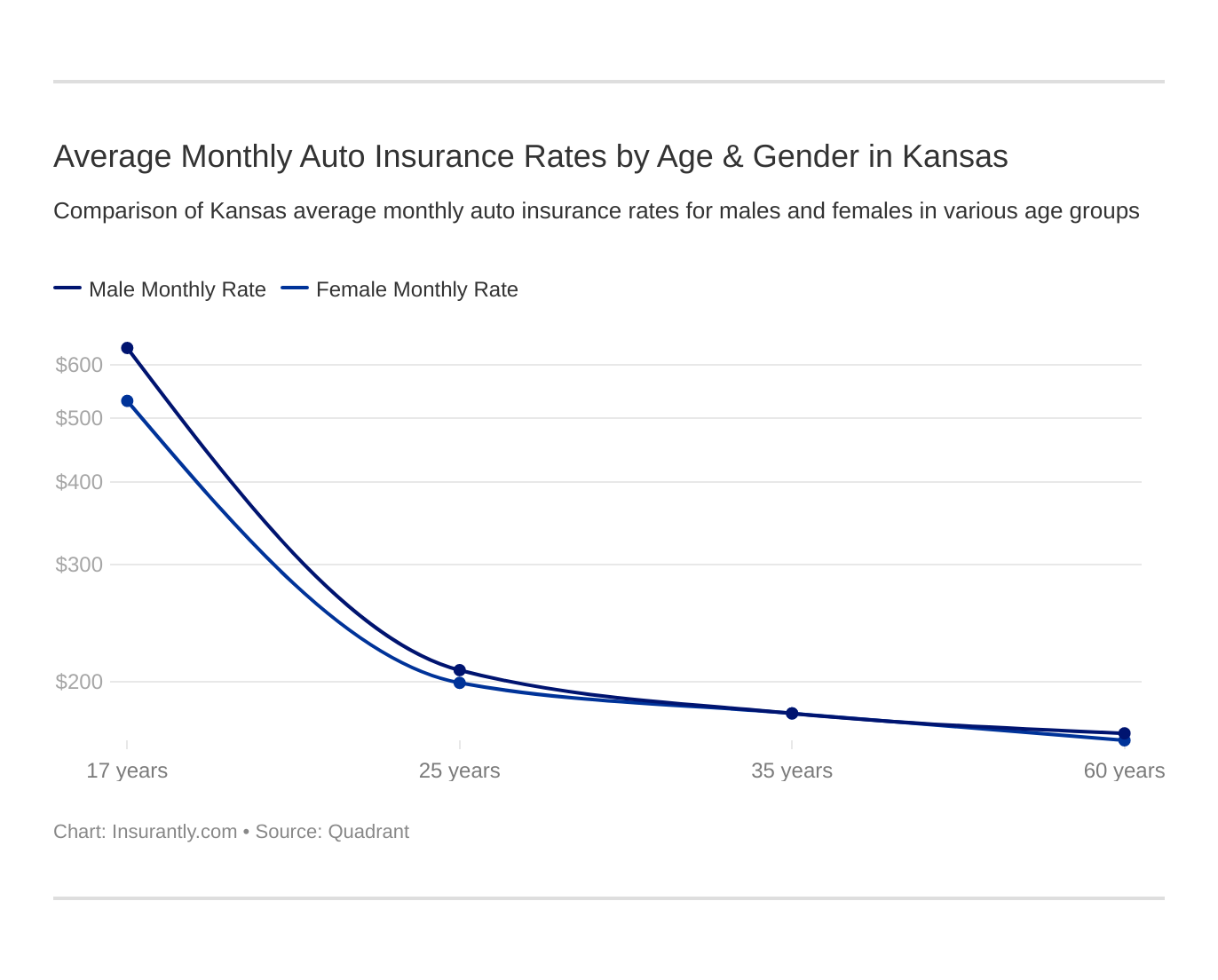

Some driving myths claim women have to pay more for their car insurance, whereas others suggest men’s reckless driving will cost them more in the long run.

| Insurance Company | Single 17-year Old Female | Single 17-year Old Male | Single 25-year Old Female | Single 25-year Old Male | Married 35-year Old Female | Married 35-year Old Male | Married 60-year Old Female | Married 60-year Old Male |

|---|---|---|---|---|---|---|---|---|

| Allied NW Affin PPBM | $3,738.47 | $4,586.41 | $2,123.07 | $2,262.55 | $1,828.05 | $1,886.51 | $1,625.16 | $1,754.49 |

| Allstate F&C | $7,474.95 | $8,345.39 | $2,852.27 | $2,961.36 | $2,762.11 | $2,693.77 | $2,459.67 | $2,532.29 |

| American Family Mutual | $3,254.11 | $3,902.70 | $1,689.32 | $1,896.08 | $1,689.32 | $1,689.32 | $1,525.16 | $1,525.16 |

| Farmers Ins Co | $6,878.76 | $7,120.82 | $2,869.95 | $3,019.19 | $2,550.50 | $2,532.32 | $2,279.13 | $2,379.53 |

| Geico General | $4,611.95 | $6,193.68 | $2,915.19 | $2,128.91 | $2,525.49 | $2,469.16 | $2,548.98 | $2,371.80 |

| Progressive NorthWestern | $8,765.21 | $9,892.22 | $2,832.16 | $3,034.90 | $2,396.45 | $2,286.23 | $1,933.26 | $2,014.64 |

| SAFECO Ins Co of America | $10,903.92 | $12,181.54 | $2,610.47 | $2,825.91 | $2,382.54 | $2,575.62 | $2,265.92 | $2,529.43 |

| State Farm Mutual Auto | $4,733.91 | $6,039.48 | $2,009.84 | $2,268.58 | $1,789.13 | $1,789.13 | $1,564.97 | $1,564.97 |

| Travelers Home & Marine Ins Co | $8,451.14 | $13,203.91 | $2,154.17 | $2,554.14 | $2,105.98 | $2,145.07 | $2,044.19 | $2,072.85 |

| USAA | $4,760.88 | $5,008.53 | $1,867.56 | $1,957.41 | $1,415.31 | $1,445.35 | $1,294.37 | $1,311.44 |

As you can see, age has more of an impact on your rates than gender. The older you get, the more likely you’ll see your rate level out, regardless of your gender. By the time drivers hit middle age, as you can see above, the premiums they’ll see should be balanced. In some cases, women even have to pay more than their male companions.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kansas Car Insurance Companies

With the basics under your belt, let’s take a look at the largest car insurance companies operating in Kansas. In this section, we’ll explore the financial ratings, consumer reviews, and differing rates provided by Kansas’s most popular providers. As we go through the works, you’ll learn a little bit more about your potential rate and which company will save you the most on your coverage.

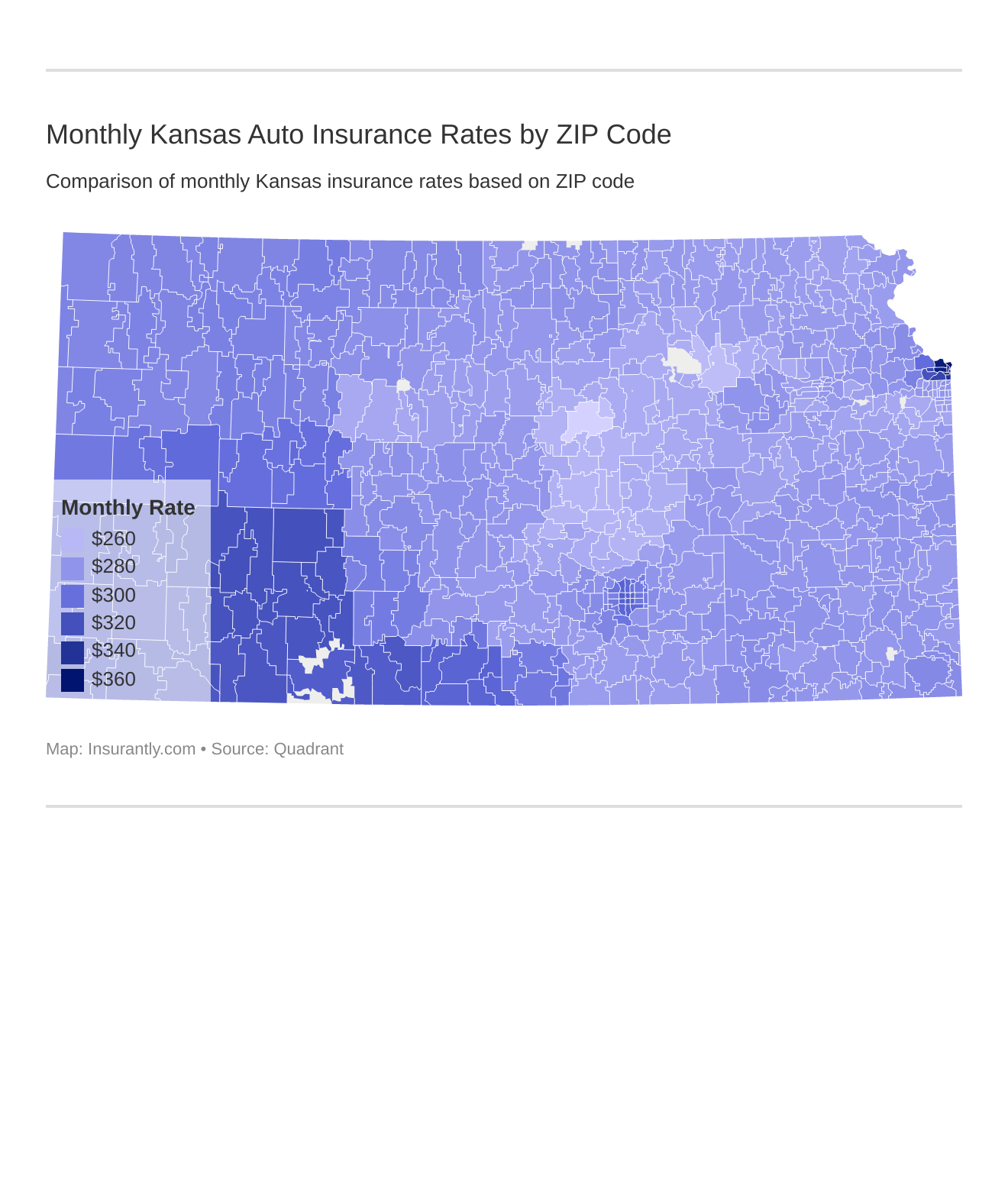

Let’s take a closer look at how ZIP codes affect car insurance in Kansas.

The Largest Companies’ Financial Ratings

A.M. Best outlines individual insurance companies’ financial ratings, as you can see below:

| Insurance Company | AM Best Ratings |

|---|---|

| Allstate Insurance Group | A+ |

| American Family Insurance Group | A |

| Farmers Insurance Group | A |

| Geico | A++ |

| Iowa Farm Bureau Group | NA |

| Liberty Mutual Group | A |

| Nationwide Corp Group | A+ |

| Progressive Group | A+ |

| State Farm Group | A++ |

| USAA Group | A++ |

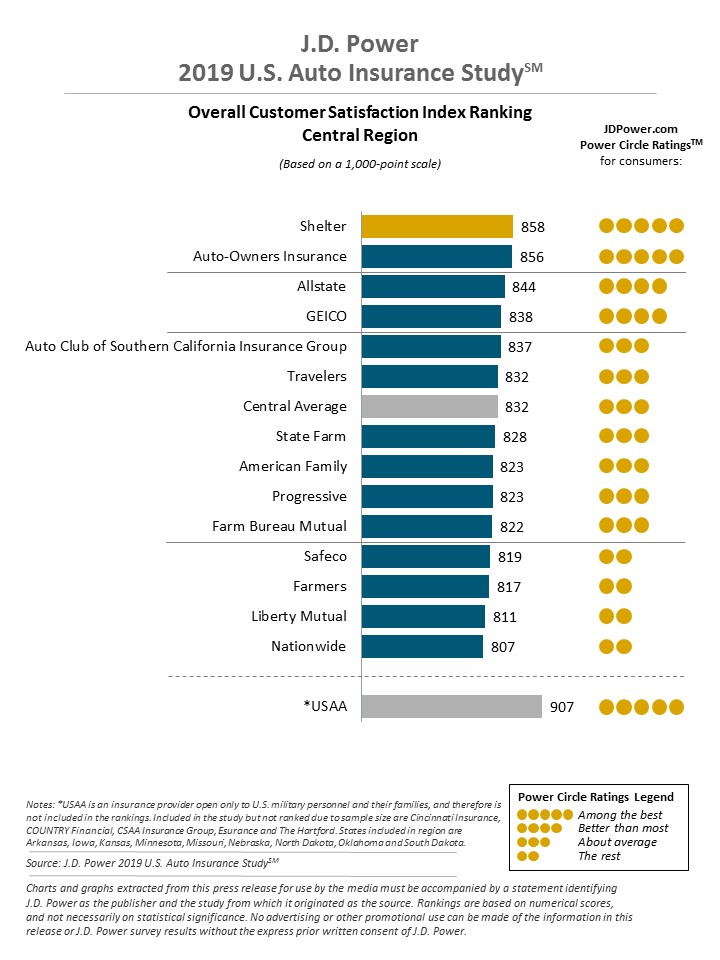

Consumer Reviews of Kansas Auto Insurance Companies

Customer experience and satisfaction also contribute to a company’s state-wide reputation:

Companies With the Most Complaints in Kansas

Complaints are among the most informative forms of data when it comes to insurance. While you can’t always take them at face value, you should keep them in mind when choosing a company to work with.

| Insurance Company | Complaint Numbers |

|---|---|

| Allstate Insurance Group | 163 |

| American Family Insurance Group | 73 |

| Farmers Insurance Group | 0 |

| Geico | 333 |

| Iowa Farm Bureau Group | 32 |

| Liberty Mutual Group | 222 |

| Nationwide Corp Group | 25 |

| Progressive Group | 120 |

| State Farm Group | 1482 |

| USAA Group | 296 |

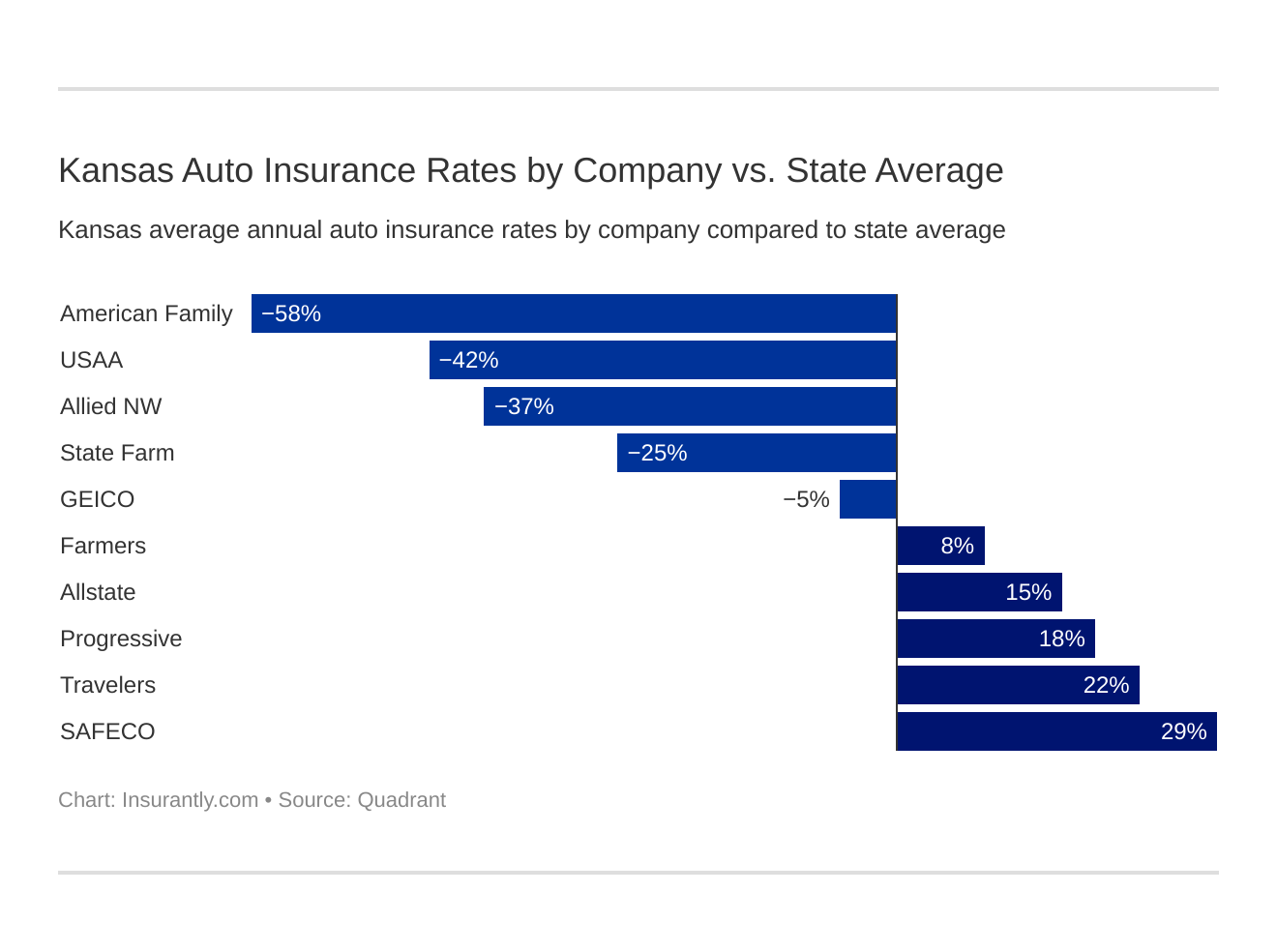

Kansas Car Insurances Rates by Company

We know your budget is one of the biggest factors you have to consider when choosing a car insurance provider. That’s why we’ve gathered a list of the most affordable providers in Kansas for you to peruse.

| Insurance Company | Average Annual Premiums | Compared to State Average (+/-) | Percentage Change (+/-) |

|---|---|---|---|

| Allied NW Affin PPBM | $2,475.59 | -$917.36 | -37.06% |

| Allstate F&C | $4,010.23 | $617.28 | 15.39% |

| American Family Mutual | $2,146.40 | -$1,246.55 | -58.08% |

| Farmers Ins Co | $3,703.77 | $310.83 | 8.39% |

| Geico General | $3,220.65 | -$172.30 | -5.35% |

| Progressive NorthWestern | $4,144.38 | $751.44 | 18.13% |

| SAFECO Ins Co of America | $4,784.42 | $1,391.47 | 29.08% |

| State Farm Mutual Auto | $2,720.00 | -$672.94 | -24.74% |

| Travelers Home & Marine Ins Co | $4,341.43 | $948.48 | 21.85% |

| USAA | $2,382.61 | -$1,010.34 | -42.40% |

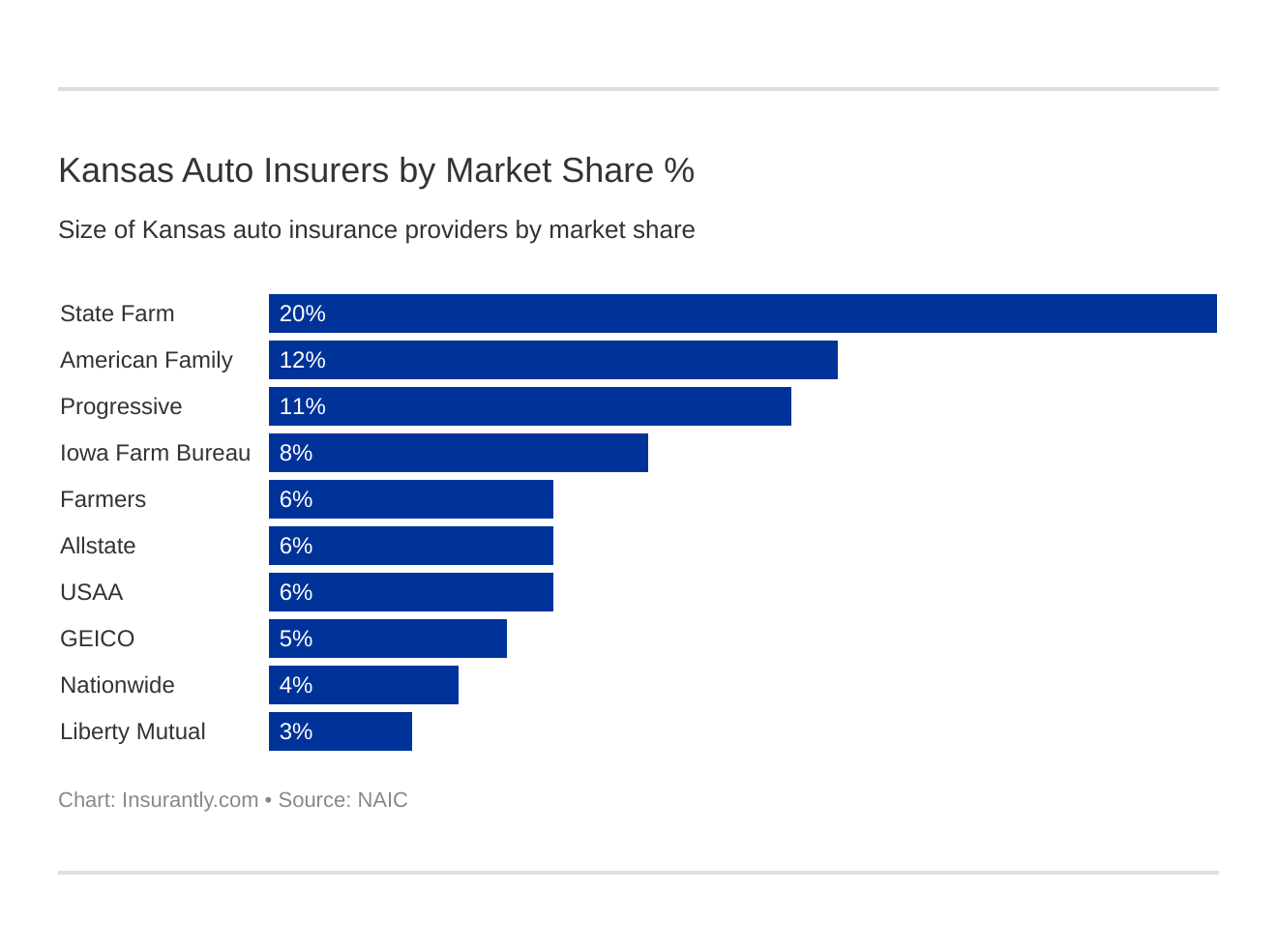

Kansas’s Car Insurance Providers by Market Share

A car insurance provider’s market share reflects its financial standing within their industry. As mentioned above, loss ratio, too, reflects a provider’s ability to pay down the claims that its drivers issues.

| Insurance Company | Direct Written Premiums | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $374,079 | 64.37% | 20.23% |

| American Family Insurance Group | $227,157 | 65.57% | 12.29% |

| Progressive Group | $199,252 | 59.35% | 10.78% |

| Iowa Farm Bureau Group | $138,914 | 64.96% | 7.51% |

| Farmers Insurance Group | $119,885 | 53.98% | 6.48% |

| Allstate Insurance Group | $106,161 | 57.26% | 5.74% |

| USAA Group | $102,544 | 71.90% | 5.55% |

| Geico | $91,086 | 71.81% | 4.93% |

| Nationwide Corp Group | $81,476 | 62.46% | 4.41% |

| Liberty Mutual Group | $61,418 | 57.55% | 3.32% |

Kansas sees a fair divide when it comes to market share. Even so, you don’t always want to work with the provider that has the largest slice of the pie. Take another look at the data above and see if there isn’t a provider that you think will serve your best interests.

Who are the largest car insurance companies in Kansas?

Commute Rates by Company

As you can see in the table below, the distance of your morning commute is going to impact your car insurance rate:

| Insurance Company | 10 Miles Commute/ 6000 Annual Mileage | 25 Miles Commute/ 12000 Annual Mileage |

|---|---|---|

| Allstate | $4,010.23 | $4,010.23 |

| American Family | $2,118.80 | $2,174.00 |

| Farmers | $3,703.77 | $3,703.77 |

| Geico | $3,151.65 | $3,289.64 |

| Liberty Mutual | $4,784.42 | $4,784.42 |

| Nationwide | $2,475.59 | $2,475.59 |

| Progressive | $4,144.38 | $4,144.38 |

| State Farm | $2,652.30 | $2,787.70 |

| Travelers | $4,341.43 | $4,341.43 |

| USAA | $2,312.82 | $2,452.40 |

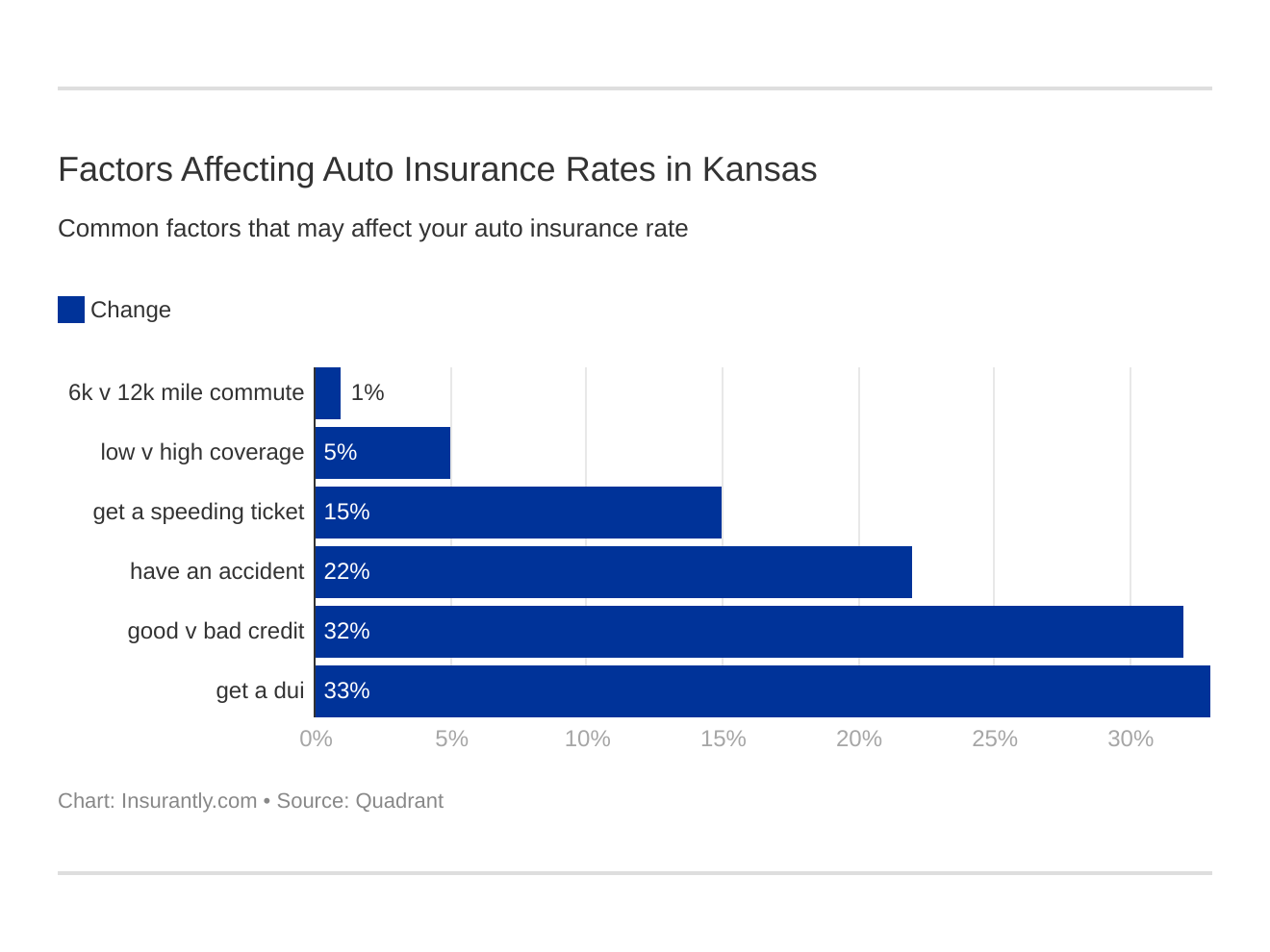

Six major factors affect car insurance rates in Kansas. Which auto insurance factors will affect rates the most? Find out below:

Coverage Levels by Company

Your chosen level of coverage is going to impact the amount you’re expected to pay:

| Insurance Company | Low | Medium | High |

|---|---|---|---|

| Allied NW Affin PPBM | $2,606.75 | $2,448.27 | $2,371.75 |

| Allstate F&C | $3,894.18 | $4,001.70 | $4,134.80 |

| American Family Mutual | $2,168.20 | $2,254.76 | $2,016.23 |

| Farmers Ins Co | $3,555.59 | $3,684.18 | $3,871.56 |

| Geico General | $3,129.09 | $3,216.90 | $3,315.94 |

| Progressive NorthWestern | $3,928.59 | $4,112.75 | $4,391.81 |

| SAFECO Ins Co of America | $4,673.70 | $4,773.50 | $4,906.06 |

| State Farm Mutual Auto | $2,622.97 | $2,727.30 | $2,809.74 |

| Travelers Home & Marine Ins Co | $4,124.45 | $4,347.90 | $4,551.94 |

| USAA | $2,304.88 | $2,376.85 | $2,466.08 |

Credit History Rates by Company

Your credit history reflects your ability to pay back the money you owe to different organizations. Naturally, car insurance providers are going to take your credit history into account when offering you a rate.

| Insurance Company | Poor | Fair | Good |

|---|---|---|---|

| Allstate | $4,970.77 | $3,772.30 | $3,287.61 |

| American Family | $2,802.09 | $1,984.13 | $1,652.97 |

| Farmers | $4,362.96 | $3,472.25 | $3,276.11 |

| Geico | $5,004.81 | $2,647.62 | $2,009.51 |

| Liberty Mutual | $4,784.42 | $4,784.42 | $4,784.42 |

| Nationwide | $2,748.91 | $2,420.86 | $2,257.00 |

| Progressive | $4,757.13 | $3,991.23 | $3,684.80 |

| State Farm | $3,960.45 | $2,366.68 | $1,832.88 |

| Travelers | $5,020.52 | $4,082.52 | $3,921.25 |

| USAA | $3,257.80 | $2,135.09 | $1,754.93 |

Driving Record Rates by Company

Your driving history reflects both your knowledge of the rules of the road and your ability to work within them.

| Insurance Company | Clean record | With 1 accident | With 1 DUI | With 1 speeding violation |

|---|---|---|---|---|

| Allstate | $3,467.53 | $4,037.61 | $4,650.66 | $3,885.11 |

| American Family | $2,108.90 | $2,258.90 | $2,108.90 | $2,108.90 |

| Farmers | $3,124.16 | $4,015.29 | $3,913.78 | $3,761.86 |

| Geico | $2,024.15 | $3,318.87 | $5,130.10 | $2,409.46 |

| Liberty Mutual | $3,614.88 | $5,422.06 | $5,326.24 | $4,774.50 |

| Nationwide | $1,857.04 | $2,137.16 | $3,781.21 | $2,126.95 |

| Progressive | $3,828.81 | $4,477.29 | $3,998.62 | $4,272.82 |

| State Farm | $2,525.63 | $2,914.37 | $2,720.00 | $2,720.00 |

| Travelers | $3,174.28 | $4,130.07 | $5,680.32 | $4,381.05 |

| USAA | $1,744.07 | $2,346.29 | $3,442.84 | $1,997.23 |

As you might have guessed, high-risk drivers are frequently charged more for their coverage than low-risk drivers.

Number of Insurers in Kansas

Domestic and foreign insurers are titles that don’t use their titular terms in the traditional sense. Domestic providers are providers who are present only in a specific state. Foreign insurers, comparatively, are providers who make their policies available just about everywhere.

Kansas is home to a mere 25 domestic providers and a whopping 898 foreign providers.

Kansas State Laws

There are few people capable enough to understand the whole of a state’s roadway laws. Even so, it’s worth it to freshen up on them now and then. Doing so helps you stay on top of your legal responsibilities, which better keeps you out of trouble.

Let’s dive in, then, to Kansas’s state driving laws to see how you can drive more safely on the road.

Car Insurance Laws

Kansas drivers are required by law to have car insurance. If you’re caught driving without insurance in Kansas, you’ll face a number of penalties, including:

- Fines between $300-$1,000 for first-time offenders

- Fines of $800-$2,500 for secondary offenders

- Suspension of vehicle registration with a $100 reinstatement fee

- Six months in prison for repeat violations

The good news is that you’re allowed to carry physical or electronic proof of insurance as a Kansas resident. Law enforcement officers are required to accept proof of insurance as presented via cellphone should you get pulled over, making proof of insurance much simpler to handle.

Fault vs. No-Fault

Kansas is a no-fault state. This means that, regardless of which party is responsible for an accident, you’ll have to pay for repairs to your vehicle, person, or property on your own. You’ll also only be able to issue claims for medical injuries and property damage.

High-Risk Insurance

If you have a spotty driving history, you may have to seek out high-risk insurance. High-risk insurance, or an SR-22, is a type of insurance that high-risk drivers are required to add to their existing coverage after a conviction or similar punishment.

You may be required to get an SR-22 if you’ve received any of the following:

- DUI conviction

- Reprimand for driving without insurance

- Reprimand for driving with a suspended license

- Reprimand for leaving the scene of an accident

Kansas specifically has a Kansas Automobile Insurance Plan in place that’s designed to make it easier for high-risk drivers to obtain car insurance. Established in 1950, this plan requires all insurance companies operating in the state to contribute to the overall protection of Kansas residents.

The state will arbitrarily assign high-risk drivers to each of its operating car insurance providers after those drivers approach a car insurance agent who can write property and causality insurance.

Low-Cost Insurance in Kansas

Kansas does make its Kansas Automobile Insurance Plan available to drivers who might otherwise not be able to obtain car insurance. These drivers, however, are primarily high-risk drivers, not low-income drivers. While you may still speak to a property and causality insurance representative about signing up for the program, you may be denied if you’re not considered a high-risk driver.

If you’re looking to save money on your car insurance coverage, be sure to ask your provider of choice if you or your family are eligible for any of the following discounts:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e. if you have alarms, tracking systems, etc on your vehicle)

- Auto-Pay Discounts (if you were to set up automatic payments from checking — some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-Car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

Be sure you shop around to find the best coverage for you that is equally cost-effective.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Automobile Insurance Fraud in Kansas

The insurance industry sees 10 percent of its operating costs go to enduring fraudulent claims or accounts over the course of a year.

There are two different types of automobile fraud.

- Hard fraud sees a driver deliberately falsifying a claim or faking an accident in order to receive compensation

- Soft fraud sees a driver padding a claim or misrepresenting accident information to an insurance provider

Soft fraud is the more common of these two types of fraud.

Even though you may think you’re just telling a white lie, soft fraud is considered a misdemeanor, and lying on your claim is considered a Class 5 Felony.

Windshield Coverage Laws in Kansas

Several states require drivers to have windshield coverage provided by their insurance company. This kind of coverage keeps drivers from taking to the road with a cracked or broken windshield, as doing so is illegal in Kansas.

That said, Kansas does not require insurance providers to offer windshield coverage, nor does it require drivers to obtain windshield coverage.

That doesn’t mean you shouldn’t consider including windshield coverage in the coverage you take on. Windshield coverage keeps you from having to dig into your bank account to pay for part replacement.

Statute of Limitations

A state’s statute of limitations outlines the amount of time you have after an accident to file a claim with your car insurance provider. Failing to file your claim within this time block allows your provider to deny your claim.

In Kansas, you have one year to file personal injury claims and two years to file property damage claims.

Your time starts on the same day as your accident, so make sure you fill out the applicable paperwork as quickly as you can.

Vehicle Licensing Laws

It’s essential that you drive with the proper license and keep your license updated. If you don’t, you could find yourself inadvertently earning yourself a ticket or comparable consequence.

What are the legalities Kansas has in place, then, to address its licensing laws?

REAL ID

REAL ID is arriving in 2020. All Kansas drivers — and drivers throughout the United States — will need to have REAL ID to get on a plane, be the flight domestic or international.

Teen Driver Laws

Teenagers are often eager to get behind the wheel of a car. In Kansas, teenagers can obtain an instructional permit at the age of 14, so long as they’ve passed a vision and written test. After that point, restrictions on teenage licenses break down as follows:

| Learner Stage Driving Laws in Kansas | Details |

|---|---|

| Minimum Entry Age | 14 |

| Mandatory Holding Period | 12 months |

| Minimum amount of Supervised driving | 25 hours, in learner phase; 25 hours before age 16; 10 of the 50 hours must be at night |

| Minimum Age | 16 |

Note that teenagers in Kansas, as in many other states, earn three different degrees of license. These include the aforementioned instructional permit, a restricted license, and a full license. The table below details the restrictions that a restricted license enforces on young drivers:

| Intermediate Stage: Restrictions on Driving while Unsupervised | Details |

|---|---|

| Unsupervised driving prohibited | 9 p.m. - 5 a.m. |

| Restriction on passengers (family members excepted unless otherwise noted) | No more than one passenger younger than 18 |

| Nighttime restrictions | 6 months or age 17, whichever occurs first (min. age: 16, 6 mos.) |

| Passenger restrictions | 6 months or age 17, whichever occurs first (min. age: 16, 6 mos.) |

These restrictions will be lifted at the age of 17, so long as the driver in question passes a vision, written, and road test. You’ll also have to submit proof of 50 driving practice hours to your BMV.

It’s worth noting, for ambition teens, that drivers who receive no infractions before 16 and a half can complete these requirements six months early. (For more information, read our “What are the best cheap cars for teens to insure?“).

License Renewal Procedures

Kansas residents can use online services to renew their licenses on a six-year cycle. Check out the table below for a more thorough understanding of the license renewal process and what the process requires.

| License Renewal Procedure | General population | Older Population |

|---|---|---|

| License Renewal Cycle | 6 years | 4 years for people 65 and older |

| Proof of Adequate Vision | every renewal | Every renewal |

| Online/Mail Renewal | no (authorize alternative means of renewal but no programs are yet in place) | No (authorize alternative means of renewal but no programs are yet in place) |

Older Driver License Renewal Procedures

It’s worth noting that older drivers, those aged past 65, will need to shift their renewal process onto a four-year cycle. These older drivers must also pass a vision test upon every renewal while also visiting the DMV in person. While the online portal is convenient, Kansas wants to ensure that its older drivers can genuinely operate safely behind the wheel.

New Residents

If you’ve just moved to Kansas, welcome! You’ll need to make sure that your current car insurance coverage meets the state’s minimum liability requirements. You should also register your vehicle with your local DMV within 90 days of your move to avoid confusion, should you get pulled over at any point.

Kansas Rules of the Road

There are several standard practices that actively keep Kansas drivers safer on state motorways. So long as you drive well-informed, you’ll be able to put these practices to good use and see the benefits reflected in your available car insurance rates.

Keep Right and Move Over

If you are driving more slowly than the posted speed limit or are not looking to pass a car in front of you, Kansas law dictates that you must remain in the right-hand lane of the applicable interstate.

You must also move over for vehicles that have their lights flashing, regardless of whether or not they’re clearly marked as emergency vehicles. These vehicles include but are not limited to:

- Police cruisers

- Ambulances

- Firetrucks

- Tow trucks

- Recovery vehicles

Speed Limits

Many drivers, when alone on the highway, may be tempted to push the speed limit. That said, the consequences for speeding can be costly if you’re not careful. Take a look at Kansas’s speed limits below so you can drive more safely on the applicable roadways:

| Type of Road | Speed Limit |

|---|---|

| Residential areas | 30 mph |

| Two-lane paved highways | 55 mph |

| Improved two-lane highways | 65 mph |

| Improved highways in rural areas | 70 mph |

| Kansas turnpike | 75 mph |

| Rural segments of freeway | 75 mph |

Note that these speeds represent the maximum speed you can go on these types of roads. If you’re caught going over the limit, you risk facing the consequences for reckless or negligent driving.

Seat Belt and Car Seat Safety

Only front-seat passengers are required to wear a seat belt in Kansas. That said, seat belt violations constitute primary enforcement. This means police officers won’t need any other reason to stop a vehicle if they see front-seat passengers riding unsecured.

The rules get a little more comprehensive when it comes to car seats. The seats required for each age group breakdown as follows:

- From birth to one-year-old: a rear-facing child seat, unless the child exceeds 20 pounds.

- One to four years old: a forward-facing child seat, unless the child exceeds their seat’s height and weight limitations.

- Four to eight years old: a booster seat, unless, again, the child exceeds their seat’s height and weight regulations.

- Eight years old or older: children may ride in passenger seats like adults would, but always with the protection of a seat belt.

Ridesharing

The rise of ridesharing services like Lyft and Uber has made career driving a little bit more complicated. Luckily, Kansas has not left the matter of insuring career drivers to insurance providers.

Thanks to laws passed in 2015 and 2016, any career driver working for a ridesharing company in Kansas must be provided with insurance coverage courtesy of affiliated Transport Network Companies, or the TNC. This organization will provide drivers with, at a minimum:

- Bodily Injury Liability: $50,000 per person

- Bodily Injury Liability: $100,000 per accidents

- Property Damage Liability: $25,000

The amount of applicable coverage does entirely depend, however, on whether the driver in question is logged in to TNC’s digital network. A driver who is logged in will receive the aforementioned coverage. That coverage increases when a driver is logged in and registered as “engaged in a ride.”

Automation on the Road

Self-driving vehicles are still being tested around the United States, but they’ve yet to take to the roads. Right now, “automation” refers primarily to platooning technology, or technologies designed to keep groups of vehicles together while traveling on the road. Trucks and buses typically use these sorts of technologies to stay within a reasonable distance of one another.

At this point in time, Kansas does not have any definitive legislation in place designed to regulate vehicle automation.

Safety Laws

There is a difference between roadway legalities and laws put in place to keep drivers as safe as possible. These laws, referred to as safety laws, involve driver behavior and the consequences for endangering other people while on the road.

DUI Laws

As is the case in the vast majority of the nation, Kansas does not legally allow drivers to get behind the wheel of a car if their blood alcohol level registers above 0.08 percent. If a driver is caught behind the wheel while intoxicated, she may face any measure of the following consequences:

| Offense | Fine | License Suspension | Vehicle Impounding | Other Penalties |

|---|---|---|---|---|

| First Offense | $500-$1,000 along with court costs, probation and evaluation fees | 30 days suspension, restrictions for the next 330 days | Up to one year | Mandatory prison time of 48 hours or community service of 100 hours. Must attend alcohol and drug safety action education program |

| Second Offense | $1,000-$1,500 along with court costs, probation and evaluation fees | One year suspension after which motorists have to drive with ignition interlock device for a year | Up to one year | Imprisonment for 90 days to one year and mandatory attendance in alcohol abuse treatment program |

| Third Offense | $1,500-$2,500 along with court costs, probation and evaluation fees | One year suspension after which motorists have to drive with ignition interlock device for a year | Up to one year | Imprisonment for 90 days to one year and mandatory attendance in alcohol abuse treatment program |

| Fourth Offense | $2,500 along with court costs, probation and evaluation fees | Suspension for one year after which motorists have to drive with ignition interlock device for a year | Up to one year | Imprisonment for 90 days to one year and mandatory attendance in alcohol abuse treatment program |

| Fifth and Subsequent Offenses | $2,500 along with court costs, probation and evaluation fees | Driving privileges revoked completely | NA | Imprisonment for 90 days to one year |

Distracted Driving Laws

Kansas has similar laws in place designed to keep drivers from texting while driving.

Underage drivers, specifically, will face legal consequences if they’re found talking on the phone while driving. That said, adult drivers will not face these consequences, as they are age-specific.

Comparatively, Kansas’s texting ban applies to all residents and non-residents, regardless of age. If you’re caught texting and driving in Kansas, you may face any of the following consequences:

- A fine of $60, not including additional court charges

- A license suspension for up to 30 days, depending on the type of license the driver held ta the time of the incident

While these consequences may not seem as serious as they could be, they still represent an attempt on the part of the state to keep drivers, pedestrians, and passengers safe while on or near the road. Do what you can to limit texting and driving by leaving your phone on silent or “Do Not Disturb” while you’re behind the wheel.

Driving in Kansas

Legalities can’t, unfortunately, protect everyone from the unique dangers of a state. Kansas sees its fair share of fatalities and theft over the course of a year. In this section, we’ll assess those numbers so you can have a better idea of what kind of situations to look out for as a Kansas resident.

Vehicle Theft in Kansas

It’s not always sports cars that go missing as a result of car theft. As you can see, Honda brand vehicles are far more likely to go missing in Kansas than luxury cars, as are a number of other practical vehicles.

| Rank | Make & Model | Year of Vehicle | Thefts |

|---|---|---|---|

| 1 | Chevrolet Pickup (Full Size) | 1999 | 439 |

| 2 | Ford Pickup (Full Size) | 2003 | 415 |

| 3 | Honda Accord | 1996 | 319 |

| 4 | Honda Civic | 2000 | 220 |

| 5 | Dodge Pickup (Full Size) | 2001 | 160 |

| 6 | GMC Pickup (Full Size) | 1999 | 113 |

| 7 | Chevrolet Impala | 2004 | 98 |

| 8 | Dodge Caravan | 2002 | 89 |

| 8 | Jeep Cherokee/Grand Cherokee | 2000 | 89 |

| 10 | Chevrolet Pickup (Small Size) | 1998 | 88 |

The type of car isn’t the only factor contributing to vehicle theft in Kansas. Some of the state’s cities are more conducive of grand theft auto than others, as you can see below:

| State | Motor Vehicle Theft |

|---|---|

| Abilene | 3 |

| Altamont | 0 |

| Alta Vista | 0 |

| Andale | 0 |

| Andover | 16 |

| Anthony | 3 |

| Arkansas City | 33 |

| Atchison | 27 |

| Atwood | 1 |

| Auburn | 0 |

| Augusta | 17 |

| Basehor | 15 |

| Baxter Springs | 6 |

| Bel Aire | 3 |

| Belle Plaine | 4 |

| Beloit | 1 |

| Bucklin | 0 |

| Burlington | 6 |

| Burns | 0 |

| Caney | 0 |

| Cheney | 1 |

| Cherryvale | 4 |

| Claflin | 0 |

| Clay Center | 3 |

| Clearwater | 2 |

| Coffeyville | 21 |

| Colby | 8 |

| Colony | 0 |

| Columbus | 5 |

| Concordia | 6 |

| Council Grove | 1 |

| Derby | 38 |

| Dodge City | 38 |

| Edwardsville | 20 |

| El Dorado | 36 |

| Ellinwood | 5 |

| Ellsworth | 1 |

| Emporia | 27 |

| Eudora | 8 |

| Fairway | 6 |

| Fort Scott | 16 |

| Fredonia | 3 |

| Frontenac | 6 |

| Galena | 7 |

| Garden City | 35 |

| Gardner | 18 |

| Garnett | 0 |

| Girard | 3 |

| Goddard | 7 |

| Goodland2 | 3 |

| Grandview Plaza | 0 |

| Great Bend | 30 |

| Halstead | 0 |

| Haven | 1 |

| Hays | 22 |

| Haysville | 20 |

| Herington | 2 |

| Hesston | 0 |

| Hiawatha | 6 |

| Hillsboro2 | 11 |

| Holcomb | 1 |

| Holton | 4 |

| Horton | 2 |

| Hutchinson | 138 |

| Independence | 26 |

| Iola | 10 |

| Junction City | 27 |

| Kanopolis | 0 |

| Kingman | 5 |

| Lansing | 11 |

| Larned | 6 |

| Leavenworth | 142 |

| Leawood | 26 |

| Lenexa | 97 |

| Le Roy | 0 |

| Liberal | 16 |

| Lindsborg | 2 |

| Louisburg | 3 |

| Maize | 3 |

| Marysville | 3 |

| McLouth | 1 |

| McPherson | 24 |

| Meade | 2 |

| Merriam | 111 |

| Montezuma | 0 |

| Moran | 0 |

| Mulberry | 0 |

| Mulvane | 13 |

| Neodesha | 1 |

| Newton | 24 |

| North Newton | 1 |

| Norton | 3 |

| Nortonville | 0 |

| Oberlin | 0 |

| Olathe | 152 |

| Osage City | 5 |

| Osawatomie | 1 |

| Oswego | 0 |

| Overland Park | 274 |

| Paola | 9 |

| Park City | 24 |

| Parsons | 22 |

| Pittsburg | 68 |

| Pleasanton | 1 |

| Rose Hill | 2 |

| Russell | 8 |

| Sabetha | 3 |

| Salina | 111 |

| Scott City | 0 |

| Seneca | 1 |

| Shawnee | 138 |

| South Hutchinson | 5 |

| Sterling | 2 |

| Tonganoxie | 8 |

| Topeka | 768 |

| Troy | 0 |

| Ulysses | 4 |

| Valley Center | 23 |

| Valley Falls | 5 |

| Wellington | 32 |

| Wellsville | 0 |

| Westwood | 5 |

| Wichita | 2,478 |

| Winfield | 21 |

These statistics make it seem all the more reasonable to install additional security tools or measures in your car if you want to keep it safe.

Road Fatalities in Kansas

While you’re driving through Kansas, you’ll need to keep an eye on other drivers. Risky driving behaviors can initially be passed off as harmless fun or roadway distraction. If you’re not careful, though, you may end up as a statistic in a year-end report.

Keep some of the following data in mind as you prepare to pull onto Kansas’s interstates.

Most Fatal Highway in Kansas

A Geotab study released in 2017 indicated that Interstate 70 is the most fatal and dangerous highway in the state. Over the past decade, this roadway has seen over 40,000 fatalities.

Traffic Fatalities by Weather Condition and Light Condition

Different weather and light conditions can impact the way that drivers can operate on the road. Take a look at how both factors cause fatalities in Kansas:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 50 | 7 | 29 | 5 | 0 | 91 |

| Rain | 7 | 5 | 9 | 1 | 0 | 22 |

| Snow/Sleet | 3 | 0 | 2 | 0 | 0 | 5 |

| Other | 8 | 1 | 4 | 3 | 0 | 16 |

| Unknown | 141 | 33 | 81 | 18 | 0 | 273 |

| Total | 209 | 46 | 125 | 27 | 0 | 407 |

Fatalities by County

We can’t control the weather or the nature of the highway we’re driving on. There are some fatalities, however, that we have a little more control over. Location, for example, impacts the likelihood of a car accident, as you can see in the table below:

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Allen County | 3 | 2 | 1 | 3 | 6 |

| Anderson County | 2 | 2 | 2 | 2 | 7 |

| Atchison County | 0 | 3 | 2 | 1 | 1 |

| Barber County | 1 | 1 | 0 | 0 | 4 |

| Barton County | 4 | 3 | 5 | 3 | 7 |

| Bourbon County | 7 | 0 | 2 | 1 | 1 |

| Brown County | 1 | 2 | 0 | 5 | 5 |

| Butler County | 12 | 7 | 11 | 9 | 12 |

| Chase County | 1 | 2 | 4 | 4 | 2 |

| Chautauqua County | 3 | 1 | 4 | 0 | 0 |

| Cherokee County | 10 | 5 | 6 | 4 | 3 |

| Cheyenne County | 0 | 0 | 1 | 1 | 0 |

| Clark County | 1 | 0 | 0 | 1 | 1 |

| Clay County | 0 | 1 | 2 | 1 | 4 |

| Cloud County | 3 | 5 | 1 | 3 | 2 |

| Coffey County | 4 | 1 | 1 | 1 | 2 |

| Comanche County | 0 | 0 | 0 | 0 | 3 |

| Cowley County | 5 | 5 | 5 | 4 | 7 |

| Crawford County | 4 | 4 | 4 | 9 | 6 |

| Decatur County | 1 | 0 | 1 | 0 | 1 |

| Dickinson County | 2 | 3 | 4 | 2 | 6 |

| Doniphan County | 0 | 2 | 2 | 2 | 2 |

| Douglas County | 6 | 8 | 7 | 5 | 10 |

| Edwards County | 0 | 1 | 0 | 0 | 5 |

| Elk County | 1 | 1 | 2 | 1 | 0 |

| Ellis County | 7 | 5 | 1 | 2 | 5 |

| Ellsworth County | 5 | 4 | 2 | 0 | 2 |

| Finney County | 4 | 8 | 5 | 6 | 2 |

| Ford County | 5 | 3 | 7 | 4 | 11 |

| Franklin County | 2 | 4 | 3 | 10 | 7 |

| Geary County | 2 | 2 | 4 | 7 | 4 |

| Gove County | 0 | 0 | 4 | 2 | 4 |

| Graham County | 1 | 0 | 0 | 0 | 0 |

| Grant County | 0 | 1 | 3 | 1 | 0 |

| Gray County | 4 | 0 | 2 | 4 | 4 |

| Greeley County | 2 | 1 | 0 | 1 | 1 |

| Greenwood County | 2 | 4 | 2 | 7 | 8 |

| Hamilton County | 1 | 2 | 1 | 0 | 0 |

| Harper County | 0 | 2 | 2 | 2 | 5 |

| Harvey County | 3 | 5 | 7 | 1 | 3 |

| Haskell County | 0 | 0 | 1 | 0 | 2 |

| Hodgeman County | 2 | 0 | 4 | 0 | 1 |

| Jackson County | 2 | 4 | 4 | 2 | 6 |

| Jefferson County | 1 | 9 | 7 | 9 | 6 |

| Jewell County | 0 | 0 | 1 | 0 | 1 |

| Johnson County | 23 | 21 | 24 | 30 | 33 |

| Kearny County | 1 | 2 | 0 | 3 | 1 |

| Kingman County | 2 | 0 | 2 | 1 | 0 |

| Kiowa County | 0 | 3 | 0 | 1 | 2 |

| Labette County | 7 | 7 | 4 | 5 | 4 |

| Lane County | 0 | 0 | 1 | 2 | 0 |

| Leavenworth County | 9 | 7 | 10 | 12 | 13 |

| Lincoln County | 0 | 1 | 0 | 0 | 0 |

| Linn County | 1 | 4 | 0 | 0 | 2 |

| Logan County | 1 | 1 | 1 | 0 | 2 |

| Lyon County | 4 | 3 | 3 | 3 | 2 |

| Marion County | 1 | 6 | 4 | 2 | 7 |

| Marshall County | 1 | 4 | 1 | 2 | 1 |

| Mcpherson County | 4 | 4 | 6 | 8 | 3 |

| Meade County | 2 | 3 | 0 | 2 | 6 |

| Miami County | 6 | 4 | 8 | 4 | 5 |

| Mitchell County | 1 | 2 | 0 | 2 | 2 |

| Montgomery County | 4 | 13 | 4 | 11 | 9 |

| Morris County | 2 | 1 | 3 | 3 | 3 |

| Morton County | 1 | 2 | 0 | 2 | 0 |

| Nemaha County | 1 | 0 | 3 | 3 | 1 |

| Neosho County | 0 | 5 | 3 | 2 | 3 |

| Ness County | 3 | 1 | 2 | 0 | 3 |

| Norton County | 2 | 0 | 0 | 2 | 2 |

| Osage County | 5 | 8 | 2 | 4 | 3 |

| Osborne County | 1 | 2 | 1 | 1 | 0 |

| Ottawa County | 4 | 3 | 1 | 3 | 0 |

| Pawnee County | 2 | 3 | 1 | 0 | 2 |

| Phillips County | 3 | 2 | 2 | 0 | 2 |

| Pottawatomie County | 0 | 5 | 3 | 1 | 9 |

| Pratt County | 5 | 2 | 6 | 1 | 1 |

| Rawlins County | 1 | 0 | 1 | 1 | 2 |

| Reno County | 6 | 9 | 4 | 14 | 9 |

| Republic County | 1 | 0 | 2 | 1 | 0 |

| Rice County | 3 | 2 | 3 | 2 | 1 |

| Riley County | 11 | 3 | 6 | 4 | 3 |

| Rooks County | 2 | 2 | 0 | 3 | 0 |

| Rush County | 1 | 2 | 0 | 2 | 2 |

| Russell County | 0 | 1 | 3 | 4 | 2 |

| Saline County | 6 | 4 | 6 | 13 | 4 |

| Scott County | 1 | 0 | 0 | 1 | 0 |

| Sedgwick County | 45 | 50 | 50 | 57 | 57 |

| Seward County | 2 | 10 | 3 | 7 | 4 |

| Shawnee County | 12 | 22 | 12 | 32 | 15 |

| Sheridan County | 3 | 3 | 3 | 1 | 2 |

| Sherman County | 3 | 1 | 0 | 8 | 2 |

| Smith County | 2 | 0 | 1 | 1 | 1 |

| Stafford County | 2 | 0 | 1 | 3 | 0 |

| Stanton County | 0 | 0 | 0 | 1 | 2 |

| Stevens County | 5 | 4 | 2 | 0 | 2 |

| Sumner County | 5 | 6 | 2 | 10 | 7 |

| Thomas County | 2 | 4 | 2 | 2 | 2 |

| Trego County | 2 | 5 | 2 | 1 | 3 |

| Wabaunsee County | 3 | 1 | 2 | 5 | 4 |

| Wallace County | 0 | 0 | 2 | 0 | 0 |

| Washington County | 5 | 1 | 1 | 2 | 0 |

| Wichita County | 2 | 4 | 1 | 0 | 2 |

| Wilson County | 1 | 3 | 5 | 1 | 5 |

| Woodson County | 0 | 0 | 1 | 1 | 0 |

| Wyandotte County | 14 | 16 | 18 | 22 | 40 |

Traffic Fatalities by Road Type

The type of road you’re driving on may be more prone to accidents than other types of roads. Check out the different road types and their proclivity for fatalities in the table below;

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 295 | 315 | 345 | 314 | 326 | 271 | 298 | 276 | 322 | 316 |

| Urban | 89 | 71 | 86 | 72 | 79 | 79 | 87 | 79 | 105 | 144 |

Fatalities by Person Type

Person type is also likely to impact fatality statistics. “Person type” here refers to a person’s relationship to a vehicle as opposed to any other demographic statistics.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 111 | 136 | 136 | 151 | 157 |

| Light Truck - Pickup | 75 | 86 | 58 | 74 | 86 |

| Light Truck - Utility | 63 | 58 | 48 | 64 | 72 |

| Light Truck - Van | 14 | 16 | 14 | 21 | 28 |

| Light Truck - Other | 2 | 0 | 0 | 2 | 1 |

| Large Truck | 12 | 4 | 16 | 14 | 13 |

| Bus | 1 | 0 | 0 | 0 | 0 |

| Other/Unknown Occupants | 5 | 7 | 11 | 5 | 9 |

| Total Occupants | 283 | 307 | 283 | 331 | 366 |

| Total Motorcyclists | 35 | 48 | 44 | 52 | 56 |

| Pedestrian | 25 | 23 | 24 | 41 | 33 |

| Bicyclist and Other Cyclist | 6 | 7 | 3 | 5 | 5 |

| Other/Unknown Nonoccupants | 1 | 0 | 1 | 0 | 1 |

| Total Nonoccupants | 32 | 30 | 28 | 46 | 39 |

| Total | 350 | 385 | 355 | 429 | 461 |

Passengers are the people most frequently involved in fatalities. Motorists are also high up on the list of potential fatality victims.

Fatalities by Crash Type

There are also specific crash types that most frequently result in fatalities:

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 350 | 385 | 355 | 429 | 461 |

| Single Vehicle | 208 | 198 | 218 | 226 | 241 |

| Involving a Large Truck | 68 | 46 | 65 | 74 | 88 |

| Involving Speeding | 111 | 109 | 128 | 107 | 104 |

| Involving a Rollover | 132 | 132 | 135 | 151 | 153 |

| Involving a Roadway Departure | 228 | 240 | 230 | 241 | 263 |

| Involving an Intersection (or Intersection Related) | 71 | 90 | 70 | 107 | 103 |

Five-Year Trend for the Top 10 Counties

The table below details the top 10 counties in Kansas that happen to see the most accidents over a year. Take a look to see how traffic is trending in the Sunflower State:

| Ranking | Kansas Counties by 2017 Ranking | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Sedgwick County | 45 | 50 | 50 | 57 | 57 |

| 2 | Wyandotte County | 14 | 16 | 18 | 22 | 40 |

| 3 | Johnson County | 23 | 21 | 24 | 30 | 33 |

| 4 | Shawnee County | 12 | 22 | 12 | 32 | 15 |

| 5 | Leavenworth County | 9 | 7 | 10 | 12 | 13 |

| 6 | Butler County | 12 | 7 | 11 | 9 | 12 |

| 7 | Ford County | 5 | 3 | 7 | 4 | 11 |

| 8 | Douglas County | 6 | 8 | 7 | 5 | 10 |

| 9 | Montgomery County | 4 | 13 | 4 | 11 | 9 |

| 10 | Pottawatomie County | 0 | 5 | 3 | 1 | 9 |

| Sub Total 1 | Top Ten Counties | 150 | 166 | 154 | 211 | 209 |

| Sub Total 2 | All Other Counties | 200 | 219 | 201 | 218 | 252 |

| Total | All Counties | 350 | 385 | 355 | 429 | 461 |

Fatalities Involving Speeding

The dangers of speeding are often overlooked in favor of the thrill the practice offers. Who doesn’t, after all, want to make it from Point A to Point B a little faster?

Unfortunately, the habit results in a fair number of Kansas’s yearly fatalities, as you can see in the table below:

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Allen County | 2 | 0 | 0 | 1 | 0 |

| Anderson County | 0 | 0 | 1 | 1 | 2 |

| Atchison County | 0 | 1 | 0 | 0 | 1 |

| Barber County | 1 | 0 | 0 | 0 | 0 |

| Barton County | 0 | 1 | 2 | 2 | 1 |

| Bourbon County | 0 | 0 | 1 | 1 | 0 |

| Brown County | 0 | 0 | 0 | 1 | 0 |

| Butler County | 5 | 2 | 6 | 3 | 2 |

| Chase County | 1 | 1 | 1 | 1 | 0 |

| Chautauqua County | 1 | 0 | 2 | 0 | 0 |

| Cherokee County | 4 | 1 | 2 | 0 | 0 |

| Cheyenne County | 0 | 0 | 0 | 0 | 0 |

| Clark County | 0 | 0 | 0 | 0 | 0 |

| Clay County | 0 | 0 | 0 | 0 | 0 |

| Cloud County | 1 | 0 | 1 | 1 | 1 |

| Coffey County | 1 | 0 | 0 | 0 | 0 |

| Comanche County | 0 | 0 | 0 | 0 | 1 |

| Cowley County | 1 | 1 | 2 | 0 | 0 |

| Crawford County | 1 | 2 | 1 | 2 | 0 |

| Decatur County | 0 | 0 | 0 | 0 | 0 |

| Dickinson County | 0 | 0 | 1 | 0 | 4 |

| Doniphan County | 0 | 1 | 1 | 2 | 1 |

| Douglas County | 1 | 0 | 5 | 1 | 2 |

| Edwards County | 0 | 0 | 0 | 0 | 1 |

| Elk County | 1 | 0 | 2 | 0 | 0 |

| Ellis County | 3 | 0 | 0 | 0 | 1 |

| Ellsworth County | 0 | 1 | 0 | 0 | 0 |

| Finney County | 0 | 1 | 1 | 3 | 0 |

| Ford County | 2 | 1 | 4 | 1 | 1 |

| Franklin County | 0 | 1 | 0 | 3 | 1 |

| Geary County | 0 | 0 | 1 | 2 | 1 |

| Gove County | 0 | 0 | 0 | 0 | 0 |

| Graham County | 1 | 0 | 0 | 0 | 0 |

| Grant County | 0 | 1 | 0 | 0 | 0 |

| Gray County | 0 | 0 | 1 | 1 | 0 |

| Greeley County | 2 | 0 | 0 | 0 | 0 |

| Greenwood County | 1 | 0 | 2 | 0 | 0 |

| Hamilton County | 1 | 1 | 0 | 0 | 0 |

| Harper County | 0 | 2 | 2 | 1 | 1 |

| Harvey County | 0 | 0 | 3 | 0 | 0 |

| Haskell County | 0 | 0 | 0 | 0 | 1 |

| Hodgeman County | 1 | 0 | 1 | 0 | 1 |

| Jackson County | 0 | 0 | 2 | 1 | 0 |

| Jefferson County | 1 | 1 | 2 | 2 | 1 |

| Jewell County | 0 | 0 | 0 | 0 | 0 |

| Johnson County | 12 | 10 | 11 | 10 | 13 |

| Kearny County | 1 | 1 | 0 | 0 | 0 |

| Kingman County | 0 | 0 | 1 | 0 | 0 |

| Kiowa County | 0 | 0 | 0 | 0 | 0 |

| Labette County | 4 | 1 | 0 | 1 | 0 |

| Lane County | 0 | 0 | 0 | 0 | 0 |

| Leavenworth County | 4 | 1 | 5 | 3 | 3 |

| Lincoln County | 0 | 0 | 0 | 0 | 0 |

| Linn County | 0 | 0 | 0 | 0 | 2 |

| Logan County | 0 | 0 | 0 | 0 | 1 |

| Lyon County | 1 | 2 | 2 | 2 | 1 |

| Marion County | 0 | 0 | 0 | 0 | 2 |

| Marshall County | 0 | 0 | 0 | 1 | 0 |

| Mcpherson County | 0 | 1 | 3 | 3 | 1 |

| Meade County | 0 | 0 | 0 | 2 | 0 |

| Miami County | 1 | 1 | 1 | 3 | 1 |

| Mitchell County | 1 | 0 | 0 | 2 | 0 |

| Montgomery County | 1 | 2 | 2 | 1 | 3 |

| Morris County | 0 | 0 | 1 | 0 | 0 |

| Morton County | 0 | 1 | 0 | 0 | 0 |

| Nemaha County | 0 | 0 | 0 | 1 | 0 |

| Neosho County | 0 | 3 | 1 | 1 | 0 |

| Ness County | 1 | 0 | 0 | 0 | 0 |

| Norton County | 1 | 0 | 0 | 0 | 2 |

| Osage County | 2 | 1 | 1 | 1 | 0 |

| Osborne County | 0 | 0 | 0 | 0 | 0 |

| Ottawa County | 2 | 2 | 1 | 0 | 0 |

| Pawnee County | 0 | 1 | 1 | 0 | 0 |

| Phillips County | 1 | 0 | 0 | 0 | 0 |

| Pottawatomie County | 0 | 2 | 2 | 1 | 2 |

| Pratt County | 2 | 0 | 2 | 0 | 0 |

| Rawlins County | 0 | 0 | 0 | 1 | 1 |

| Reno County | 1 | 3 | 1 | 1 | 3 |

| Republic County | 0 | 0 | 0 | 0 | 0 |

| Rice County | 0 | 0 | 1 | 0 | 0 |

| Riley County | 3 | 1 | 4 | 0 | 1 |

| Rooks County | 1 | 2 | 0 | 0 | 0 |

| Rush County | 1 | 0 | 0 | 1 | 0 |

| Russell County | 0 | 0 | 1 | 0 | 0 |

| Saline County | 1 | 2 | 1 | 5 | 0 |

| Scott County | 0 | 0 | 0 | 1 | 0 |

| Sedgwick County | 22 | 25 | 15 | 11 | 15 |

| Seward County | 1 | 0 | 0 | 0 | 1 |

| Shawnee County | 4 | 9 | 6 | 5 | 3 |

| Sheridan County | 1 | 2 | 1 | 0 | 0 |

| Sherman County | 0 | 0 | 0 | 0 | 1 |

| Smith County | 1 | 0 | 0 | 0 | 1 |

| Stafford County | 0 | 0 | 1 | 1 | 0 |

| Stanton County | 0 | 0 | 0 | 0 | 0 |

| Stevens County | 0 | 1 | 0 | 0 | 1 |

| Sumner County | 1 | 1 | 2 | 1 | 1 |

| Thomas County | 0 | 3 | 1 | 2 | 0 |

| Trego County | 2 | 3 | 1 | 1 | 2 |

| Wabaunsee County | 0 | 0 | 0 | 2 | 0 |

| Wallace County | 0 | 0 | 0 | 0 | 0 |

| Washington County | 2 | 0 | 0 | 0 | 0 |

| Wichita County | 0 | 0 | 1 | 0 | 0 |

| Wilson County | 0 | 0 | 2 | 0 | 2 |

| Woodson County | 0 | 0 | 0 | 0 | 0 |

| Wyandotte County | 4 | 9 | 9 | 13 | 17 |

Fatalities Involving an Alcohol-Impaired Driver

Kansas, unfortunately, sees a number of alcohol-related driving fatalities over the course of a year. The table below details the number of individuals who’ve been directly impacted by one person’s decision to drink and drive. Note that these statistics include teenage drivers who’ve decided to drink before getting behind the wheel:

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Allen County | 0 | 0 | 0 | 0 | 0 |

| Anderson County | 0 | 0 | 0 | 0 | 1 |

| Atchison County | 0 | 1 | 0 | 1 | 0 |

| Barber County | 0 | 0 | 0 | 0 | 0 |

| Barton County | 1 | 0 | 2 | 1 | 1 |

| Bourbon County | 3 | 0 | 0 | 0 | 0 |

| Brown County | 0 | 0 | 0 | 2 | 1 |

| Butler County | 3 | 2 | 2 | 2 | 2 |

| Chase County | 0 | 1 | 0 | 0 | 1 |

| Chautauqua County | 1 | 1 | 1 | 0 | 0 |

| Cherokee County | 2 | 3 | 1 | 1 | 0 |

| Cheyenne County | 0 | 0 | 0 | 0 | 0 |

| Clark County | 0 | 0 | 0 | 0 | 0 |

| Clay County | 0 | 0 | 0 | 0 | 1 |

| Cloud County | 2 | 1 | 0 | 0 | 0 |

| Coffey County | 1 | 0 | 0 | 0 | 1 |

| Comanche County | 0 | 0 | 0 | 0 | 0 |

| Cowley County | 1 | 2 | 2 | 1 | 2 |

| Crawford County | 1 | 0 | 1 | 0 | 1 |

| Decatur County | 0 | 0 | 0 | 0 | 0 |

| Dickinson County | 0 | 1 | 2 | 1 | 2 |

| Doniphan County | 0 | 2 | 1 | 1 | 1 |

| Douglas County | 2 | 1 | 3 | 1 | 4 |

| Edwards County | 0 | 1 | 0 | 0 | 2 |

| Elk County | 1 | 1 | 0 | 1 | 0 |

| Ellis County | 2 | 3 | 1 | 0 | 1 |

| Ellsworth County | 0 | 1 | 0 | 0 | 1 |

| Finney County | 1 | 3 | 0 | 1 | 0 |

| Ford County | 1 | 1 | 1 | 0 | 0 |

| Franklin County | 0 | 0 | 0 | 4 | 1 |

| Geary County | 0 | 0 | 1 | 2 | 0 |

| Gove County | 0 | 0 | 0 | 0 | 1 |

| Graham County | 1 | 0 | 0 | 0 | 0 |

| Grant County | 0 | 1 | 1 | 0 | 0 |

| Gray County | 1 | 0 | 0 | 1 | 0 |

| Greeley County | 2 | 1 | 0 | 1 | 0 |

| Greenwood County | 2 | 1 | 0 | 0 | 2 |

| Hamilton County | 0 | 1 | 0 | 0 | 0 |

| Harper County | 0 | 0 | 1 | 1 | 0 |

| Harvey County | 1 | 0 | 0 | 0 | 1 |

| Haskell County | 0 | 0 | 1 | 0 | 0 |

| Hodgeman County | 2 | 0 | 0 | 0 | 0 |

| Jackson County | 2 | 0 | 1 | 0 | 1 |

| Jefferson County | 1 | 3 | 3 | 3 | 1 |

| Jewell County | 0 | 0 | 0 | 0 | 0 |

| Johnson County | 8 | 8 | 9 | 7 | 9 |

| Kearny County | 0 | 1 | 0 | 0 | 0 |

| Kingman County | 0 | 0 | 0 | 0 | 0 |

| Kiowa County | 0 | 2 | 0 | 0 | 0 |

| Labette County | 3 | 1 | 0 | 0 | 0 |

| Lane County | 0 | 0 | 0 | 0 | 0 |

| Leavenworth County | 2 | 1 | 4 | 3 | 4 |

| Lincoln County | 0 | 1 | 0 | 0 | 0 |

| Linn County | 0 | 1 | 0 | 0 | 0 |

| Logan County | 0 | 0 | 0 | 0 | 1 |

| Lyon County | 1 | 1 | 1 | 0 | 2 |

| Marion County | 1 | 1 | 0 | 1 | 1 |

| Marshall County | 1 | 0 | 0 | 1 | 0 |

| Mcpherson County | 0 | 1 | 3 | 0 | 1 |

| Meade County | 0 | 1 | 0 | 2 | 0 |

| Miami County | 2 | 0 | 2 | 1 | 0 |

| Mitchell County | 0 | 0 | 0 | 1 | 0 |

| Montgomery County | 2 | 4 | 0 | 0 | 2 |

| Morris County | 1 | 1 | 1 | 1 | 1 |

| Morton County | 0 | 0 | 0 | 0 | 0 |

| Nemaha County | 1 | 0 | 2 | 2 | 0 |

| Neosho County | 0 | 3 | 0 | 1 | 0 |

| Ness County | 2 | 0 | 0 | 0 | 1 |

| Norton County | 0 | 0 | 0 | 1 | 2 |

| Osage County | 3 | 1 | 0 | 3 | 1 |

| Osborne County | 0 | 0 | 0 | 0 | 0 |

| Ottawa County | 2 | 2 | 1 | 2 | 0 |

| Pawnee County | 0 | 0 | 1 | 0 | 0 |

| Phillips County | 0 | 0 | 0 | 0 | 0 |

| Pottawatomie County | 0 | 2 | 1 | 0 | 1 |

| Pratt County | 0 | 0 | 0 | 0 | 0 |

| Rawlins County | 1 | 0 | 1 | 1 | 1 |

| Reno County | 2 | 2 | 1 | 1 | 4 |

| Republic County | 1 | 0 | 0 | 0 | 0 |

| Rice County | 1 | 1 | 0 | 0 | 0 |

| Riley County | 2 | 0 | 2 | 1 | 1 |

| Rooks County | 0 | 0 | 0 | 0 | 0 |

| Rush County | 0 | 0 | 0 | 0 | 2 |

| Russell County | 0 | 0 | 1 | 1 | 0 |

| Saline County | 1 | 0 | 0 | 3 | 0 |

| Scott County | 0 | 0 | 0 | 1 | 0 |

| Sedgwick County | 11 | 20 | 9 | 14 | 11 |

| Seward County | 0 | 0 | 0 | 2 | 1 |

| Shawnee County | 2 | 7 | 5 | 7 | 3 |

| Sheridan County | 2 | 2 | 2 | 0 | 0 |

| Sherman County | 1 | 0 | 0 | 1 | 0 |

| Smith County | 1 | 0 | 0 | 0 | 1 |

| Stafford County | 1 | 0 | 0 | 0 | 0 |

| Stanton County | 0 | 0 | 0 | 1 | 1 |

| Stevens County | 0 | 0 | 0 | 0 | 0 |

| Sumner County | 2 | 0 | 1 | 3 | 3 |

| Thomas County | 0 | 0 | 1 | 0 | 0 |

| Trego County | 0 | 0 | 0 | 1 | 1 |

| Wabaunsee County | 1 | 0 | 0 | 1 | 1 |

| Wallace County | 0 | 0 | 0 | 0 | 0 |

| Washington County | 1 | 0 | 0 | 0 | 0 |

| Wichita County | 0 | 2 | 1 | 0 | 1 |

| Wilson County | 0 | 1 | 1 | 0 | 1 |

| Woodson County | 0 | 0 | 0 | 0 | 0 |

| Wyandotte County | 5 | 7 | 5 | 8 | 13 |

EMS Response Time

Should you ever get into an accident, you’ll want to know how quickly Emergency Medical Services, or EMS, will arrive on the scene. While response times differ for urban accidents and rural accidents, Kansas’s EMS is still willing to report the average amount of time it takes for drivers and passengers to make it from the scene of an accident to the hospital.

| Type of Road | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 6.97 | 11.96 | 35.70 | 53.03 | 278 |

| Urban | 3.11 | 6.18 | 22.76 | 32.58 | 128 |

As you can see in the table above, EMS services in Kansas can get a person from the scene of an accident into professional medical care within an hour, regardless of where the accident has taken place. That said, the trip will be much faster if that accident takes place in an urban area.

Transportation

With fatalities and other dangers in Kansas out of the way, let’s touch on some of the transportation habits of the state’s residents.

Car Ownership

As is the case for most states in the nation, the average Kansas resident tends to have two vehicles. That said, the number of drivers with three vehicles does significantly outnumber the percentage of drivers with a single vehicle.

Commute Time

But what will your morning drive to work look like as a Kansas resident? The average Kansas commute comes in significantly below the national average.

While the United States averages a 25.5-minute commute, nationwide, Kansas comes in at 18.2 minutes, with fewer than 1 percent of its residents having to commit to a “super commute,” or a commute that exceeds 90 minutes in length.

Commuter Transportation

As is also the case in almost every state, the vast majority of Kansas drivers prefer to make their way to work alone. While carpooling isn’t unheard of, you’re far more likely to encounter single-driver traffic in the mornings and evenings.

Traffic Congestion in Kansas

Good news, commuters! While traffic in Wichita isn’t enjoyable, per se, none of Kansas’s cities appear on the INRIX’s list of the most congested cities in the world.

That said, Wichita does rank as the 62nd-most congested city in the United States. Drivers are said to have lost 22 hours in traffic in 2018 alone. If you’re looking to get around this major city quickly, you’re going to have to drive at low traffic times.

And with that, we’ve come to the end of our Kansas comprehensive insurance guide. If you want to learn more about the rates that are available in your area, you can use our FREE online tool. Just enter your ZIP code to get started.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.