California Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Feb 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 12, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| California | Statistics |

|---|---|

| Road Miles | 225,531 |

| Vehicle Miles (2015) | 332.9 Billion |

| Population Estimate (2018) | 39,557,045 |

| Driving Deaths (2017) | Speeding-related: 1,070 Alcohol-related: 1,120 Total traffic fatalities: 3,602 |

| Vehicles | Registered: 27,872,875 Total Stolen: 151,852 |

| Most Popular Vehicle | Honda Civic |

| Average Premiums (Annual) | Liability: $490 Collision: $397 Comprehensive: $101 Combined Premiums: $987 |

| Percent of Motorists Uninsured | 15.2% State Rank: 12th |

| Cheapest Provider | USAA |

California is simultaneously one of the most influential states in the union and a home for outliers. With 55 electoral college votes, California has a significant hand in the structure of the American government.

With Hollywood’s monumental social influence, California residents have the opportunity to shape the way people elsewhere perceive Californian cities and the rest of the world.

And yet, California is also home to San Francisco, Gay Capital of the United States, and underground music, film, and creative movements that are so niche that you’ve probably never heard of them. How the Eureka State balances its power, popularity, and underdog personality, no one really knows.

What we do know is that while California’s culture may be difficult to compartmentalize, its car insurance providers and policies don’t have to be.

You don’t have to try and understand all of California’s car insurance policies on your own. Our guide to Californian roadways will guide you through the process of finding the most affordable car insurance plan for you.

Want to get started? Enter your zip code into our FREE online tool and find the best auto insurance rates in California.

Then come with us as we explore the car insurance culture of California together.

California Car Insurance Coverage and Rates

Trying to suss out what insurance details matter to you, specifically, is always a trial. Taking on the task alone can be more than frustrating — it can feel impossible.

That’s why we’re here to help. We’ve dug through the data for you and teased out the most important details of California’s car insurance plans. With our help, you’ll be able to find an affordable car insurance plan that fits into your lifestyle perfectly.

What kind of insurance do you need in the Eureka State? Let’s find out together.

California Minimum Coverage

California is an at-fault state. This means that if you get into an accident, an authority will determine whether you or another driver were “at-fault,” or responsible for the accident. If you’re determined to be at-fault, then you’ll have to take on the financial responsibility of that accident.

That means paying your own bills and the other party’s.

As a result, California requires all of its drivers to carry minimum liability insurance in a 15/30/5 ratio. Take a look at that breakdown below:

- $15,000 for bodily injury or death of one person in an accident caused by the owner of the insured vehicle

- $30,000 for total bodily injury or death in an accident caused by the owner of the insured vehicle

- $5,000 for property damage per accident caused by the owner of the insured vehicle

The state does not require you to purchase Medical Payment Coverage, but you will have the option to purchase Med Pay coverage protecting you for up to $1,000 of medical expenses, regardless of which party is at fault.

Likewise, California will not require you to carry Uninsured/Underinsured Motorist (UUM) Coverage. That doesn’t mean you shouldn’t consider integrating the coverage into your plan, though. Because California is an at-fault state, more coverage is never a bad thing.

Forms of Financial Responsibility

You’re also required to carry proof of insurance (forms of financial responsibility) while driving in California. If you happen to get pulled over by an officer of the law, or if you’re just renewing your vehicle registration, then you’ll be able to use these documents in order to prove that you’re complying with the state’s driving requirements.

Forms of financial responsibility in California include:

- A print-out of your insurance policy

- A cash deposit of $35,000 with your local DMV

- A DMV-issued self-insurance certificate

- A surety bond for $25,000 from a company licensed to do business in California

Premiums as a Percentage of Income

A person’s Disposal Personal Income is the amount of money she has available to her after she pays her taxes for the year. When you’re working out your budget, your DPI is the overarching amount of money that you’ll have to work with.

This means that, when you’re researching car insurance plans, you’ll have to include the monthly cost of your policy in your expenses.

Because you have to carry California’s minimum liability coverage in order to legally drive on the road, you can’t get around this expense. Let’s take a look at the breakdown of DPI in California, though, before you worry too much.

| Year | Annual Full Coverage Premium | Annual DPI | Percentage of Income Paid to Car Insurance |

|---|---|---|---|

| 2012 | $891.68 | $42,451.00 | 2.10% |

| 2013 | $922.69 | $41,945.00 | 2.20% |

| 2014 | $951.75 | $43,978.00 | 2.16% |

So, the average Californian makes $43,978 per year.

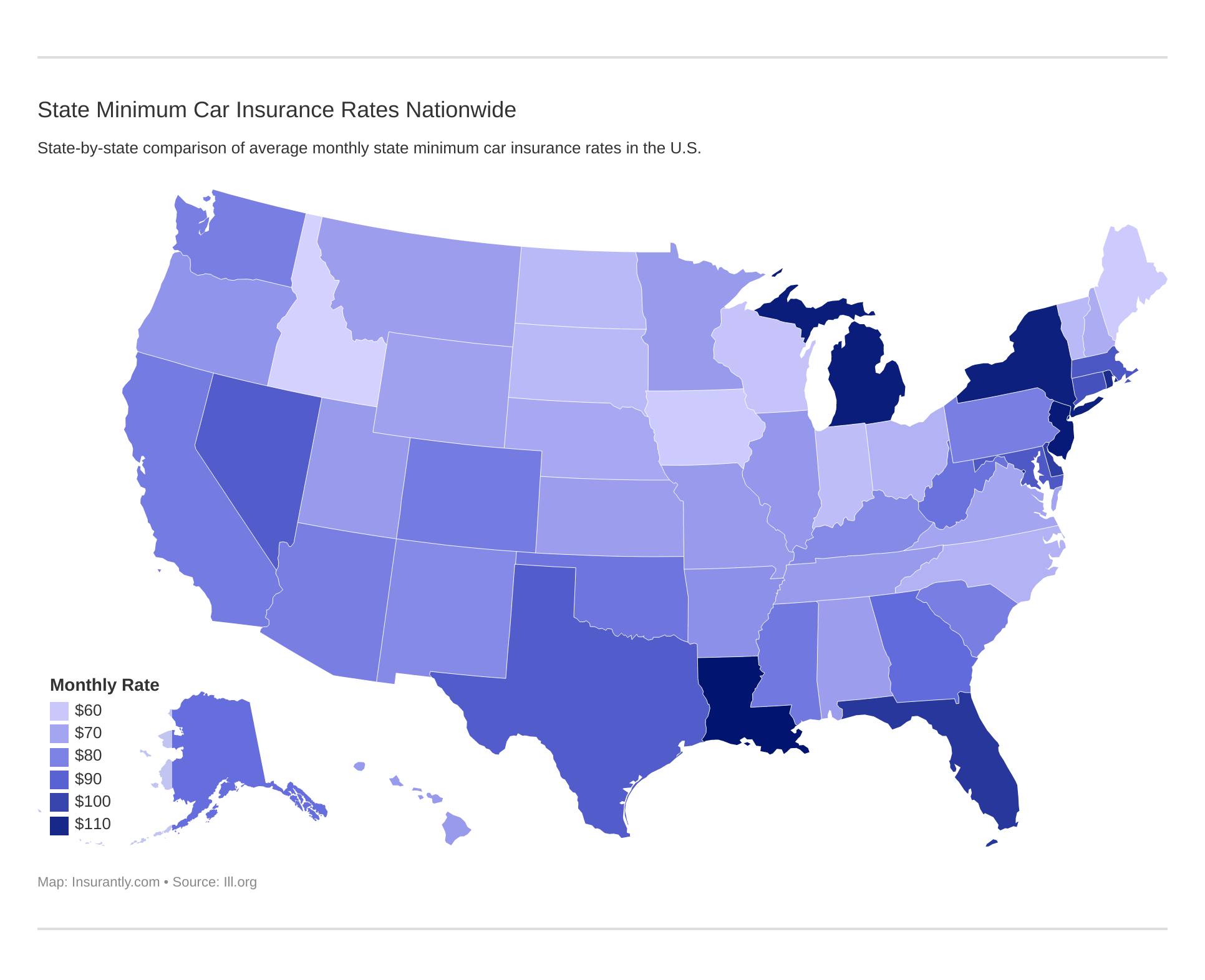

Minimum liability coverage, on average, in California costs roughly $79.31 per month. That’s not so bad, even considering the yearly cost of coverage.

At an average of $951.75 a year, car insurance will take up 2.16 percent of a Californian’s annual DPI.

Average Monthly Car Insurance Rates in CA (Liability, Collision, Comprehensive)

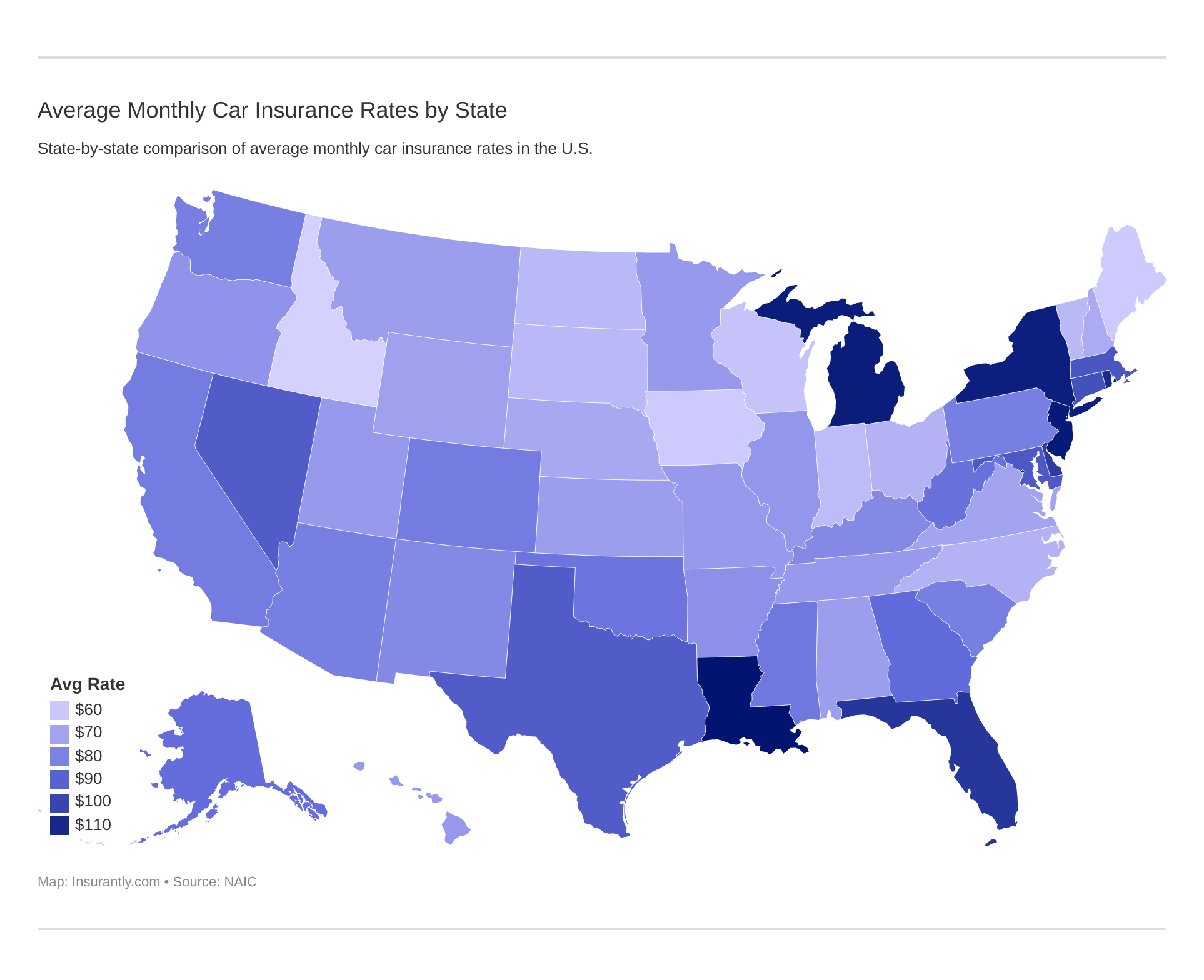

That cost will go up if you look into car insurance add-ons. However, you shouldn’t let an increase in prices intimidate you. Additional car insurance coverage, like those options listed below, can better protect you in an accident than bare-bones coverage.

| Coverage | State Average | National Average | Over/Under National Average |

|---|---|---|---|

| Liability | $489.66 | $538.73 | -$49.07 |

| Collision | $396.55 | $322.61 | +$73.94 |

| Comprehensive | $100.54 | $148.04 | -$47.50 |

| Full Coverage | $986.75 | $1,009.38 | -$22.63 |

Additional Liability

When considering policy averages, though, we need to consider the sheer number of providers that you’ll have the chance to choose a plan from in California. One of the best places to start, when comparing these companies, is with their loss ratios.

A loss ratio describes the amount of money a car insurance provider spends on claims every year. A high loss ratio indicates that a company frequently pays out on claims but that they may also be financially unstable.

| Coverage | Loss Ratio 2012 | Loss Ratio 2013 | Loss Ratio 2014 |

|---|---|---|---|

| Medical Payments (Med Pay) | 73% | 69% | 62% |

| Uninsured/Underinsured Motorist | 60% | 59% | 58% |

Comparatively, companies will lower loss ratios will be more financially stable, but they’ll be less likely to pay out on a claim.

Generally, you want to work with a car insurance provider whose claim is right around average — somewhere in the 80 to 95 percentiles.

Add-ons, Endorsements, and Riders

Different providers will also be able to offer you different car insurance add-ons. These add-ons will ensure that you’re protected from niche accident exposure and can help you financially, in the long run.

Take a look at the listings below to find out more about each of these types of add-ons.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Average Monthly Car Insurance Rates by Age & Gender in CA

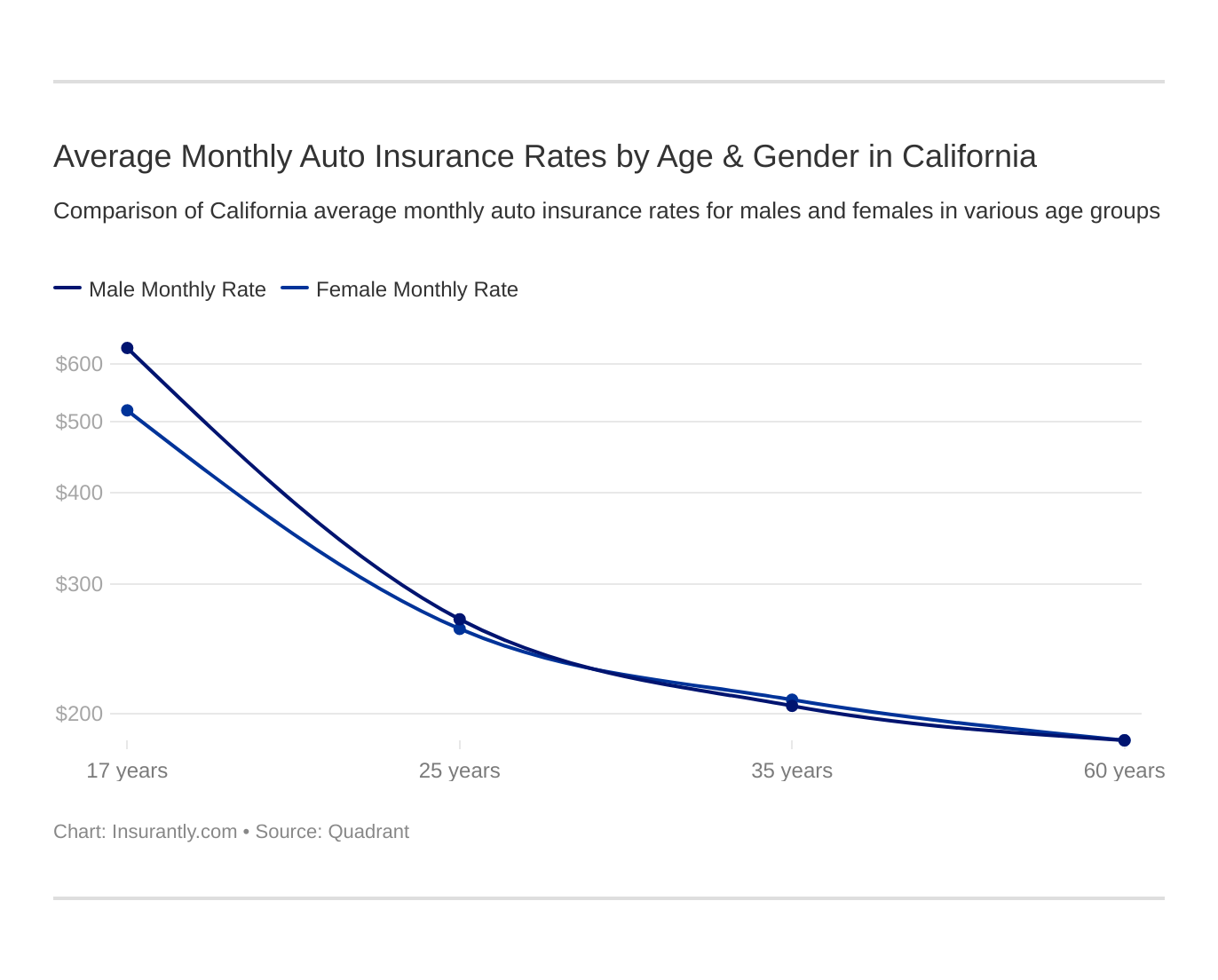

Additional coverage isn’t the only thing that has the potential to impact the rate car insurance providers can offer you in California. There are pervasive gender myths that can impact the amount of money you’ll be expected to pay on a monthly basis.

Generally speaking, it’s said that men have to pay more for their car insurance than women do. Let’s take a look at the data and see if that claim holds any water.

| Company | 17-Year-Old Single | 25-Year-Old Single | 35-Year-Old Married | 60-Year-Old Married |

|---|---|---|---|---|

| Allstate | $9,143.81 | $3,928.97 | $2,922.56 | $2,137.03 |

| AMCO | $8,752.50 | $3,881.60 | $3,198.63 | $2,781.60 |

| Farmers | $11,428.11 | $3,401.82 | $2,715.31 | $2,451.83 |

| Geico | $5,481.52 | $2,595.60 | $1,787.31 | $1,680.52 |

| Safeco | $5,181.45 | $2,607.16 | $2,240.96 | $2,111.11 |

| State Farm | $6,822.45 | $3,720.81 | $3,310.18 | $2,957.44 |

| Travelers | $5,536.17 | $3,214.71 | $2,457.66 | $2,194.59 |

| United Financial | $5,258.22 | $2,674.13 | $1,811.60 | $1,660.63 |

| USAA | $4,416.71 | $2,597.19 | $1,878.60 | $1,886.00 |

By the time most drivers have turned 25, it seems like rates below out. In fact, it’s older women, on some occasions, who have to pay more for car insurance than their male counterparts.

That’s the thing, though — car insurance rates vary less based on gender and far more on age.

| Ranking (least to most expensive) | Single 17-Year-Old | Single 25-Year-Old | Married 35-Year-Old | Married 60-Year-Old |

|---|---|---|---|---|

| 1 | USAA - $4416.71 | USAA - $2597.19 | Geico - $1787.31 | United Financial - $1660.63 |

| 2 | Safeco - $5181.45 | Safeco - $2607.16 | United Financial - $1811.60 | Geico - $1680.52 |

| 3 | United Financial - $5258.22 | United Financial - $2674.13 | USAA - $1878.60 | USAA - $1886.00 |

| 4 | Geico - $5481.52 | Geico - $2595.60 | Safeco - $2240.96 | Safeco - $2111.11 |

| 5 | Travelers - $5536.17 | Travelers - $3214.71 | Travelers - $2457.66 | Allstate - $2137.03 |

| 6 | State Farm - $6822.45 | State Farm - $3720.81 | Farmers - $2715.31 | Travelers - $2194.59 |

| 7 | AMCO - $8752.49 | AMCO - $3881.60 | Allstate - $2922.56 | Farmers - $2451.83 |

| 8 | Allstate - $9143.80 | Allstate - $3928.97 | AMCO - $3198.63 | AMCO - $2781.60 |

| 9 | Farmers - $11428.11 | Farmers - $3401.82 | State Farm - $3310.18 | State Farm - $2957.44 |

As you can see, drivers who are 17 years old are charged significantly more for their coverage than married couples two decades older.

This is because younger drivers are less experienced, sure, but it also means that young people are going to have to work hard in order to cough up nearly four times the average rate of insurance for more established drivers.

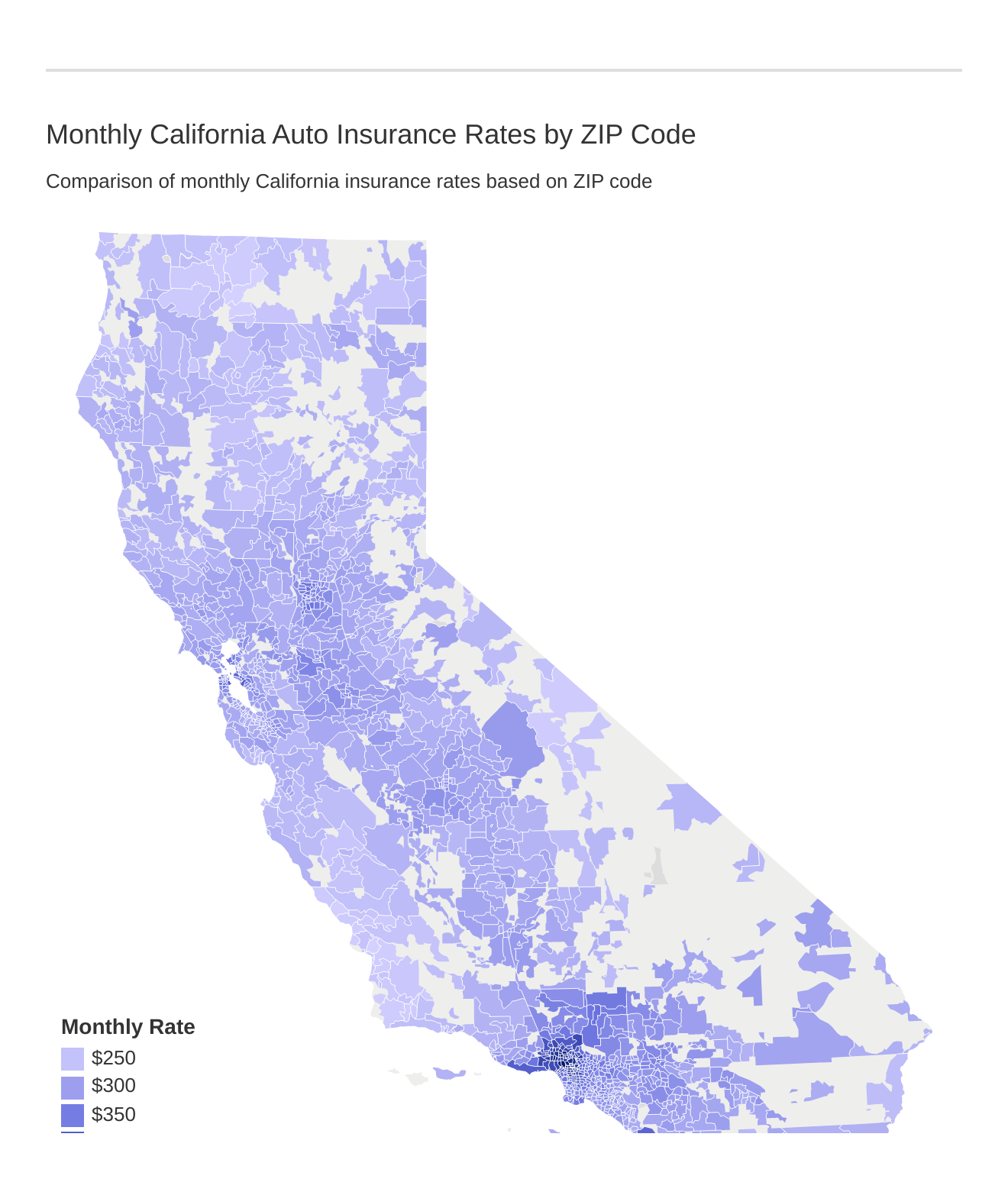

Highest and Lowest Rates by ZIP in California

Not only will age and gender impact your car insurance rate, but the place you live will, too. California has never been billed as an inexpensive state — save during the Gold Rush — but your ZIP code has more of an impact on your car insurance rate than you might guess. Take a look:

Highest and Lowest Rates by City in California

If you want a more specific breakdown of car insurance rates available in various parts of California, you can take a look at rate differentiation by city.

The table below lists the 10 most expensive cities in California.

| California Most Expensive Cities | Average Annual Rate |

|---|---|

| BEVERLY HILLS | $6,188.41 |

| CALABASAS | $5,293.70 |

| CANOGA PARK | $5,306.80 |

| ENCINO | $5,744.64 |

| GLENDALE | $5,556.12 |

| GRANADA HILLS | $5,200.12 |

| LOS ANGELES | $5,301.77 |

| NORTH HILLS | $5,268.19 |

| NORTH HOLLYWOOD | $5,769.36 |

| NORTHRIDGE | $5,350.90 |

For comparison, below you can see the 10 least expensive cities in California.

| California Cheapest Cities | Average Annual Rate |

|---|---|

| ARROYO GRANDE | $2,824.43 |

| ATASCADERO | $2,865.26 |

| BISHOP | $2,837.87 |

| BUELLTON | $2,807.43 |

| CAMBRIA | $2,774.88 |

| CAYUCOS | $2,850.58 |

| CRESTON | $2,862.60 |

| DUNSMUIR | $2,891.51 |

| ETNA | $2,882.83 |

| FORT JONES | $2,885.83 |

Some might expect Los Angeles to have the highest average car insurance rates in California. Not so, not always — which is all the more reason to research your city’s average car insurance costs before moving to the Eureka State.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

California State Car Insurance Companies

When it comes down to it, we know that you want to save money on your car insurance. That’s what the research process is all about — finding the best kind of insurance for your budget and driving style.

Still, digging through all of California’s available providers and their policies on your own is hardly a walk in the park.

That’s why we want to help. We’re able to break down the data from all of California’s car insurance providers and help you save a buck.

So let’s start that break down and explore the different public perceptions and costs of car insurance companies in the Eureka State.

The Largest Companies Financial Rating

Assessing a company’s financial rating via AM Best is one of the best ways to determine a) whether the company’s financially sound and b) whether or not it’ll take your unique financial circumstances into consideration. Naturally, the better the rating, the better the company.

California A.M. Best ratings| Providers (Largest-Smallest) | A.M. Best Rating |

|---|---|

| Allstate | A+ |

| Auto Club Enterprises | A- |

| CSAA | A |

| Farmers | A |

| Geico | A++ |

| Liberty Mutual | A |

| Mercury | A+ |

| Progressive | A+ |

| State Farm | A++ |

| USAA | A++ |

You’ll notice that there’s not a single company in California — at least, not on this list — that drops below an A ranking. That’s good news for you — kinda. It means that these companies are notably reliable. It also means that you haven’t really narrowed down your potential provider pool.

Companies with Best Customer Satisfaction Ratings in California

That’s why we’re diving into customer satisfaction ratings. J.D. Power puts the customer satisfaction of California’s biggest car insurance providers on display for the world to see.

As you can see, companies like State Farm, with its A++ AM Best Ranking, gets put more accurately into place with its 813 customer satisfaction rating.

Companies with Most Complaints in California

On the flip side of satisfaction comes the hot gossip of complaints. Let’s take a look at the customer complaints each provider has racked up over the course of the past several years.

| Company | 2017 Approx. Exposure Count | Complaint Ratio 2017 | Complaint Ratio 2016 | Complaint Ratio 2015 | Justified Complaints 2017 | Justified Complaints 2016 | Justified Complaints 2015 |

|---|---|---|---|---|---|---|---|

| 21st Century Ins Co | 589,781 | 2.0 | 4.9 | 4.6 | 12 | 32 | 30 |

| Access Ins Co | 390,785 | 117.7 | 78.1 | 27.1 | 460 | 263 | 88 |

| Alliance United Ins Co | 949,556 | 9.2 | 16.9 | 15.9 | 87 | 156 | 123 |

| Allied Prop & Cas Ins Co | 134,452 | 2.2 | 1.5 | 1.5 | 3 | 2 | 2 |

| Allstate Northbrook Ind Co | 1,997,214 | 3.1 | 2.5 | 2.2 | 61 | 50 | 38 |

| Amco Ins Co | 293,359 | 0.3 | 2.4 | 2.4 | 1 | 7 | 7 |

| Amica Mut Ins Co | 73,785 | 2.7 | 4.2 | 2.9 | 2 | 3 | 2 |

| Anchor Gen Ins Co | 104,936 | 21.9 | 21.8 | 28.8 | 23 | 28 | 37 |

| California Automobile Ins Co | 300,426 | 3.3 | 4.1 | 3.9 | 10 | 13 | 13 |

| California Capital Ins Co | 72,267 | 1.4 | 2.7 | 1.4 | 1 | 2 | 1 |

| California Cas Ind Exch | 141,781 | 2.1 | 2.9 | 6.0 | 3 | 4 | 8 |

| Coast Natl Ins Co | 224,780 | 4.4 | 5.2 | 8.2 | 10 | 15 | 30 |

| Commerce W Ins Co | 91,857 | 8.7 | 9.5 | 10.5 | 8 | 8 | 10 |

| CSAA Ins Exch | 1,976,557 | 3.2 | 2.9 | 3.5 | 64 | 55 | 63 |

| Esurance Prop & Cas Ins Co | 276,197 | 3.3 | 5.3 | 6.1 | 9 | 14 | 16 |

| Farmers Ins Exch | 1,352,855 | 2.9 | 2.4 | 3.3 | 39 | 32 | 40 |

| Farmers Specialty Ins Co | 116,996 | 7.7 | 7.2 | 2.4 | 9 | 10 | 2 |

| Financial Ind Co | 160,518 | 4.4 | 7.4 | 8.1 | 7 | 10 | 10 |

| Garrison Prop & Cas Ins Co | 140,295 | 4.3 | 2.5 | 1.0 | 6 | 3 | 1 |

| Geico Cas Co | 238,038 | 5.0 | 6.3 | 13.1 | 12 | 13 | 20 |

| Geico Gen Ins Co | 1,522,095 | 2.1 | 3.3 | 7.7 | 32 | 44 | 92 |

| Geico Ind Co | 601,267 | 2.5 | 1.7 | 7.8 | 15 | 9 | 37 |

| Government Employees Ins Co | 397,264 | 2.0 | 1.4 | 6.0 | 8 | 5 | 21 |

| Hartford Underwriters Ins Co | 196,048 | 11.2 | 6.5 | 12.6 | 22 | 14 | 28 |

| IDS Prop Cas Ins Co | 438,249 | 6.8 | 9.2 | 7.6 | 30 | 39 | 31 |

| Infinity Ins Co | 819,470 | 5.6 | 8.4 | 9.2 | 46 | 76 | 86 |

| Integon Natl Ins Co | 209,177 | 12.0 | 22.0 | 26.5 | 25 | 34 | 30 |

| Interins Exch Of The Automobile Club | 2,365,985 | 1.8 | 1.9 | 1.8 | 42 | 43 | 37 |

| Kemper Independence Ins Co | 72,724 | 6.9 | 0.0 | 5.2 | 5 | 0 | 3 |

| Liberty Mut Fire Ins Co | 392,750 | 9.7 | 14.5 | 7.4 | 38 | 55 | 28 |

| Loya Cas Ins Co | 210,387 | 8.6 | 11.5 | 15.4 | 18 | 28 | 38 |

| Mercury Ins Co | 1,551,611 | 2.4 | 2.7 | 2.8 | 38 | 42 | 44 |

| Metropolitan Drt Prop & Cas Ins Co | 144,507 | 9.0 | 9.2 | 6.8 | 13 | 14 | 10 |

| Mid Century Ins Co | 545,680 | 1.6 | 1.3 | 3.3 | 9 | 8 | 23 |

| Nationwide Ins Co Of Amer | 143,688 | 6.3 | 6.8 | 12.4 | 9 | 9 | 15 |

| Permanent Gen Assur Corp | 66,908 | 16.4 | 16.0 | 20.3 | 11 | 9 | 11 |

| Progressive Direct Ins Co | 121,783 | 3.3 | 5.6 | 1.7 | 4 | 7 | 2 |

| Progressive Select Ins Co | 211,936 | 12.3 | 5.6 | 9.1 | 26 | 10 | 15 |

| Progressive West Ins Co | 329,588 | 4.6 | 5.7 | 4.3 | 15 | 19 | 16 |

| Safeco Ins Co Of Amer | 368,833 | 3.0 | 6.1 | 8.3 | 11 | 21 | 28 |

| State Farm Mut Auto Ins Co | 3,773,478 | 2.0 | 3.1 | 5.4 | 77 | 119 | 204 |

| Travelers Commercial Ins Co | 177,157 | 7.9 | 3.2 | 16.9 | 14 | 2 | 1 |

| Trumbull Ins Co | 71,507 | 5.6 | 3.9 | 1.5 | 4 | 3 | 1 |

| United Financial Cas Co | 435,740 | 8.7 | 2.9 | 5.0 | 38 | 12 | 19 |

| United Serv Automobile Assn | 422,767 | 1.4 | 2.4 | 4.0 | 6 | 10 | 17 |

| USAA Cas Ins Co | 482,178 | 1.7 | 3.0 | 5.5 | 8 | 14 | 25 |

| USAA Gen Ind Co | 206,282 | 4.8 | 5.6 | 3.3 | 10 | 10 | 5 |

| Viking Ins Co Of WI | 258,652 | 1.9 | 5.7 | 6.0 | 5 | 13 | 12 |

| Wawanesa Gen Ins Co | 506,086 | 4.1 | 4.6 | 3.5 | 21 | 23 | 17 |

| Western Gen Ins Co | 86,864 | 40.3 | 57.8 | 86.4 | 35 | 41 | 41 |

Read more: 21st Century Auto Insurance

Now, while customer complaints aren’t everything, you should definitely take them into account when considering which car insurance provider to work with. Complaints reflect a provider’s ability to respond to consumer needs, and if they can’t handle that gracefully, then they’re not worth your business.

California Car Insurance Rates by Company

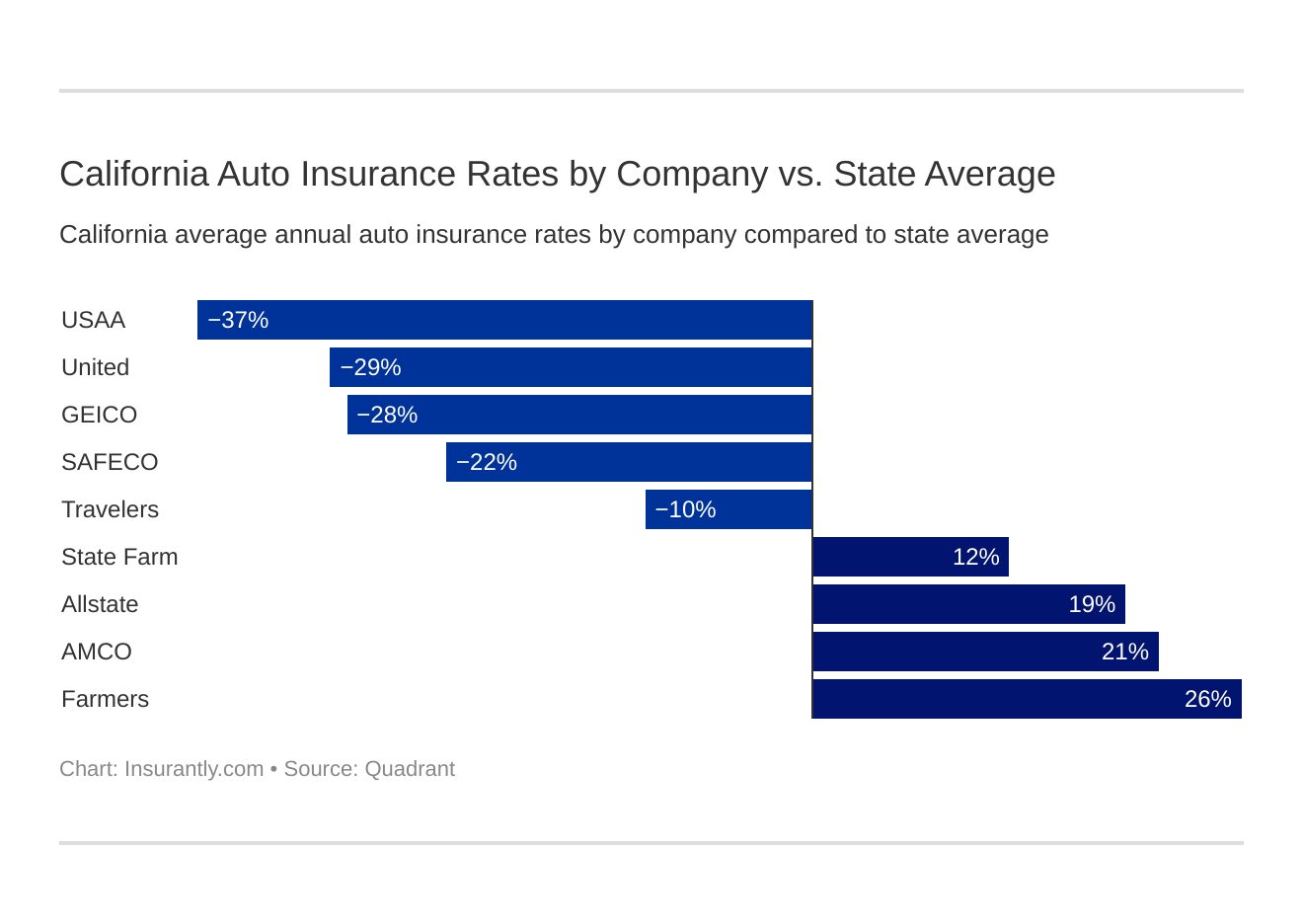

You can also break California rates down by individual company. Different companies, based on reputation, loss ratio, and other factors, will be able to offer you different rates based solely on their financial standing, as you can see below.

| Company | Average | Compared to State Average | Percentage Over/Under State Average |

|---|---|---|---|

| Allstate | $4,533.09 | +$843.47 | +18.61% |

| AMCO | $4,653.58 | +$963.96 | +20.71% |

| Farmers | $4,999.27 | +$1,309.64 | +26.20% |

| Geico | $2,886.24 | -$803.38 | -27.84% |

| Safeco | $3,035.17 | -$654.45 | -21.56% |

| State Farm | $4,202.72 | +$513.10 | +12.21% |

| Travelers | $3,350.78 | -$338.84 | -10.11% |

| United Financial | $2,851.14 | -$838.48 | -29.41% |

| USAA | $2,694.62 | -$995.00 | -36.93% |

Commute Rates by Company

We touch on California’s commutes later in this guide, but you can already imagine the different ways that a longer commute could cost you more money.

| Company | 10-mile commute | 25-mile commute |

|---|---|---|

| Allstate | $4,086.25 | $4,979.93 |

| Farmers | $4,535.69 | $5,462.84 |

| Geico | $2,621.93 | $3,150.55 |

| Liberty Mutual | $2,786.10 | $3,284.23 |

| Nationwide | $4,108.79 | $5,198.37 |

| Progressive | $2,587.19 | $3,115.09 |

| State Farm | $4,049.89 | $4,355.54 |

| Travelers | $3,014.07 | $3,687.49 |

| USAA | $2,482.96 | $2,906.28 |

As you can see, some car insurance providers will charge you more money for a longer commute, too. This is naturally to keep your car safe while you’re on the road for more hours of the day, but that extra cost could also factor into your decision on where to move as well as which provider you want to work with.

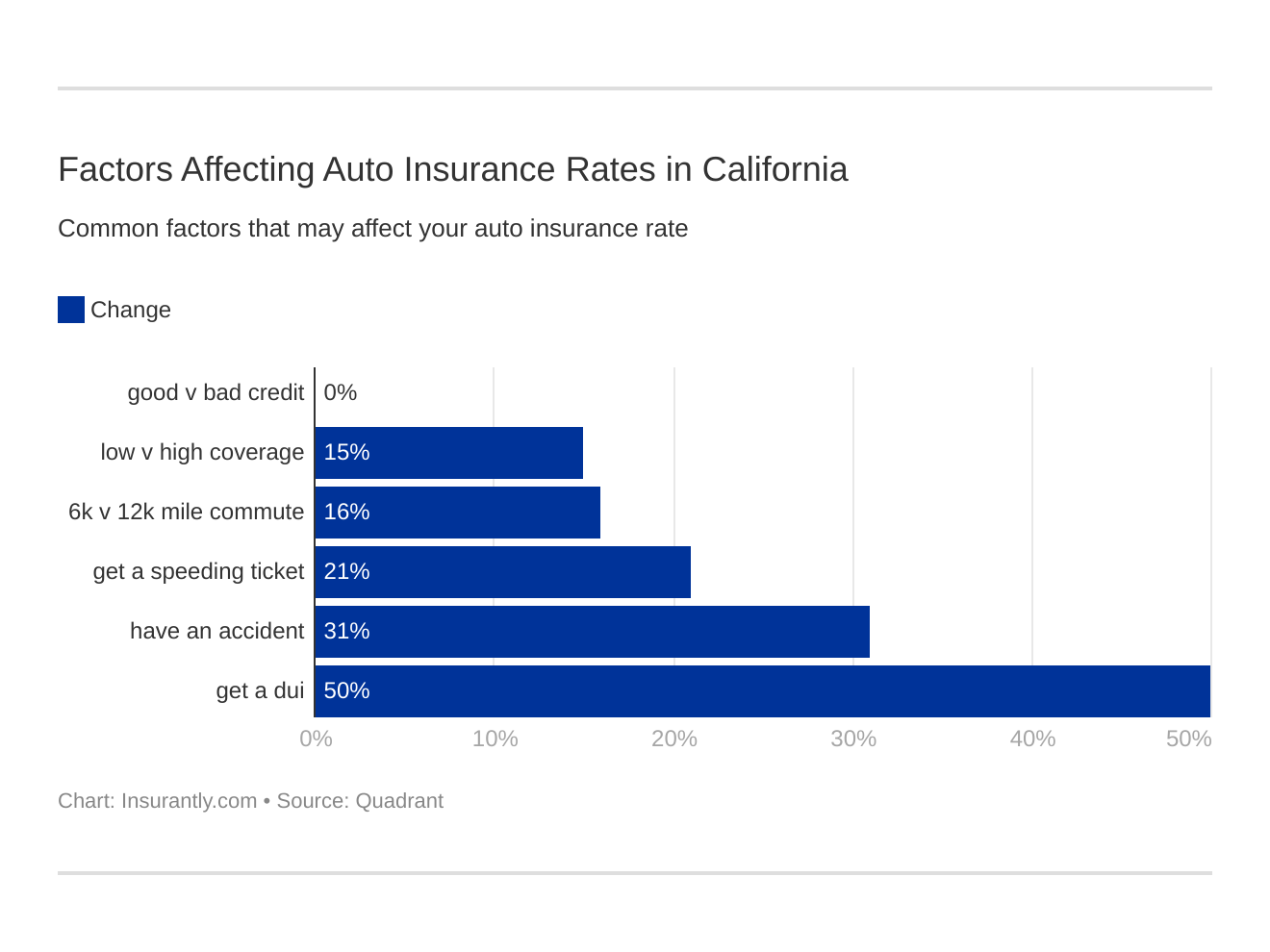

Some states have banned discrimination based on your credit score when it comes to auto insurance rates, and this is one of those States.

Coverage Level Rates by Company

The amount of coverage you want to have also impacts how much a company is going to charge you.

| Company | Low Coverage Level | Medium Coverage Level | High Coverage Level |

|---|---|---|---|

| Allstate | $4,287.09 | $4,572.72 | $4,739.46 |

| Farmers | $4,651.83 | $5,038.58 | $5,307.39 |

| Geico | $2,612.92 | $2,918.49 | $3,127.30 |

| Liberty Mutual | $2,824.01 | $3,061.95 | $3,219.54 |

| Nationwide | $4,179.52 | $4,734.55 | $5,046.66 |

| Progressive | $2,555.04 | $2,936.65 | $3,061.73 |

| State Farm | $3,793.44 | $4,273.41 | $4,541.30 |

| Travelers | $2,924.52 | $3,440.36 | $3,687.46 |

| USAA | $2,445.05 | $2,746.50 | $2,892.32 |

California’s minimum state coverage, for example, does cost less than comprehensive coverage the vast majority of the time. That price difference shouldn’t keep you from considering more comprehensive options, though.

Credit History Rates by Company

Normally, your credit history would directly impact your offered car insurance rates. In California, though, your rates will stay relatively standard regardless of your credit history.

| Group | Credit History - Annual Average |

|---|---|

| Allstate | $4,533.09 |

| Farmers | $4,999.27 |

| Geico | $2,886.24 |

| Liberty Mutual | $3,035.17 |

| Nationwide | $4,653.58 |

| Progressive | $2,851.14 |

| State Farm | $4,202.72 |

| Travelers | $3,350.78 |

| USAA | $2,694.62 |

Driving Record Rates by Company

It’s going to be your driving record that has a greater impact on your offered rate than most other factors.

| Company | Clean record | With one speeding violation | With one at-fault accident | With one DUI |

|---|---|---|---|---|

| Allstate | $2,728.84 | $3,582.21 | $4,597.86 | $7,223.45 |

| Farmers | $3,697.25 | $4,998.06 | $5,033.47 | $6,268.29 |

| Geico | $2,018.18 | $2,503.62 | $3,114.92 | $3,908.23 |

| Liberty Mutual | $2,634.50 | $2,791.65 | $3,529.11 | $3,185.41 |

| Nationwide | $3,246.63 | $4,162.31 | $4,162.31 | $7,043.06 |

| Progressive | $1,865.51 | $2,687.54 | $3,171.49 | $3,680.03 |

| State Farm | $2,998.34 | $3,480.06 | $3,576.40 | $6,756.08 |

| Travelers | $2,234.04 | $3,290.14 | $3,644.10 | $4,234.85 |

| USAA | $1,790.02 | $1,960.95 | $2,664.41 | $4,363.10 |

As you can see, one DUI can as much as raise your rate by $1,000, if not more. That’s all the more reason to drive with caution, if you ask us.

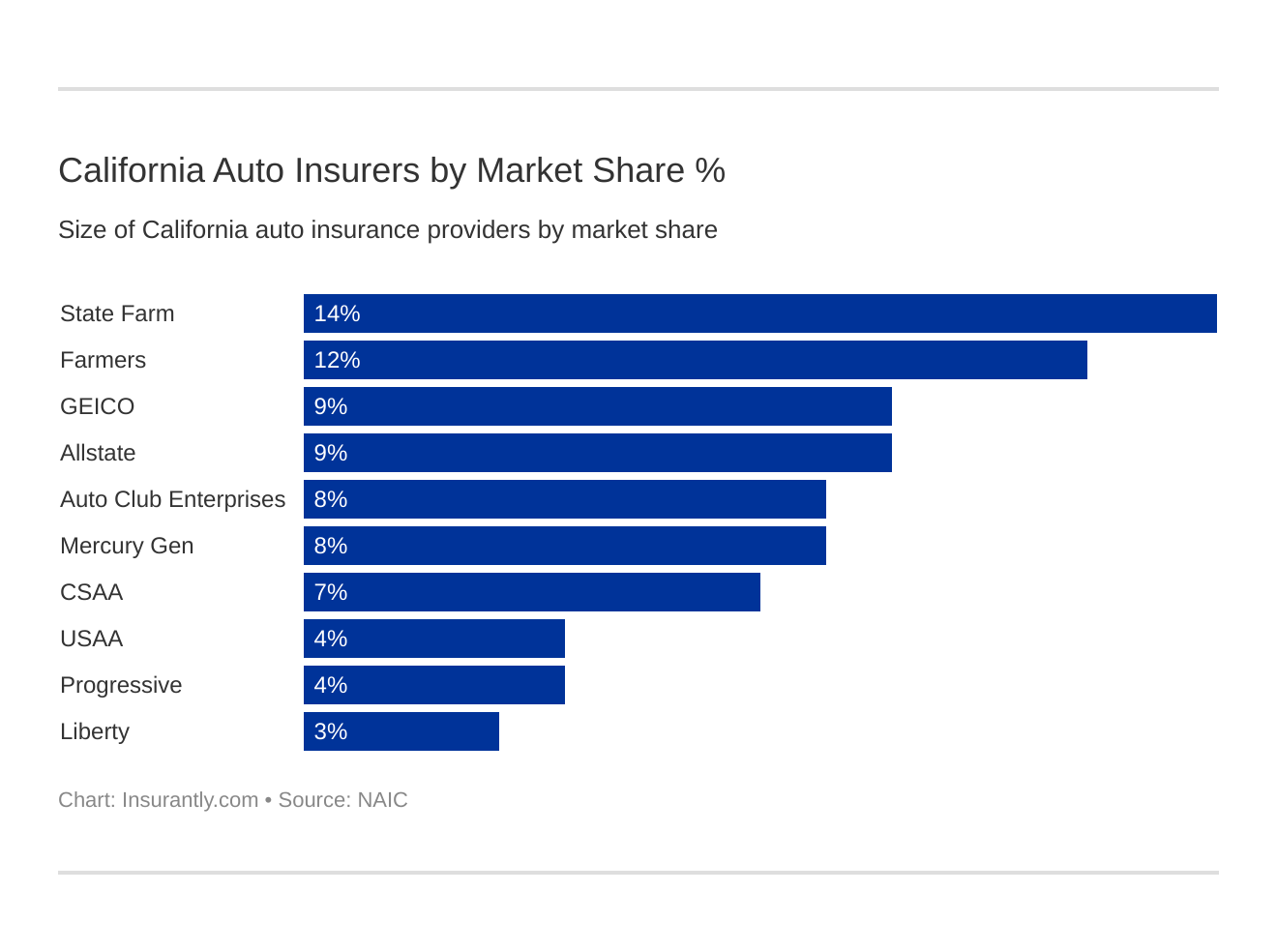

Largest Car Insurance Companies in California

The size of a company will also impact that number of clients it can take on and the coverage it can offer. Take a look at the largest car insurance providers in California and, subsequently, the rates they’re able to offer you.

| Company | 2017 Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| Allstate | $2,446,564,000 | 64.73% | 8.97% |

| Auto Club Enterprises | $2,312,230,000 | 65.03% | 8.48% |

| CSAA | $1,950,257,000 | 64.30% | 7.15% |

| Farmers Insurance | $3,158,814,000 | 68.26% | 11.59% |

| Geico | $2,502,854,000 | 84.78% | 9.18% |

| Liberty Mutual | $929,058,000 | 77.26% | 3.41% |

| Mercury | $2,095,531,000 | 61.91% | 7.69% |

| Progressive | $1,147,186,000 | 62.78% | 4.21% |

| State Farm | $3,910,351,000 | 75.94% | 14.34% |

| USAA | $1,218,792,000 | 72.98% | 4.47% |

Number of Insurers in California

Finally, note that you’ll have the option to choose between domestic providers (providers who are only present in the state of California) and foreign providers (providers with plans available nationally) when researching your preferred coverage.

- Domestic: 99

- Foreign: 671

You’ll note that your foreign options vastly outweigh your domestic options. Give domestic providers a fair shake, though, and you may find that local rates are more amenable to your budget than nationally-reaching ones.

California’s Laws and Legalities

Maybe you like a challenge. Maybe you’re the type of person who crushes it at trivia night and who could, feasibly, memorize all of California’s driving laws over the course of several weeks.

If you are, we salute you.

If you’re not, though, it’s good to have a guide to the different laws and legalities that dictate how you’re supposed to drive on California’s roadways.

High-Risk Insurance

If you have a number of infractions on your license, have been in more than one accident in your lifetime, or have wracked up tickets, then car insurance providers will consider you a high-risk driver. If you’re not quite sure whether or not you make the high-risk cut, ask yourself:

Have I had to fill out an SR-22?

SR-22 forms allow you to have your license reinstated after a suspension. The state of California will require you to fill out one of these forms in the case of:

- Driving while uninsured and getting in an accident

- Receiving a DUI

- Receiving a wet-reckless suspension or revocation

- Being declared a negligent operator

Note that providers in California are not required to provide high-risk drivers with car insurance. If you’ve been denied car insurance within thirty days, though, due to your driving history, you may be able to qualify for the California Automobile Assigned Risk Plan, or CAARP.

You’ll need to complete an online questionnaire to see whether or not you qualify for this type of coverage. Alternatively, you can call the following number to speak with an appropriate representative: 1-800-622-0954.

Be aware that even though you can get coverage through CAARP, this coverage won’t be any less expensive than normal coverage. In many cases, it will even cost more than a standard plan.

Low-Cost Insurance

Most states don’t have a low-cost insurance program. Luckily, California’s always been a little different. California’s Low-Cost Auto, or CLCA, is available to drivers with clean driving histories who don’t make enough money a month to pay for the state’s minimum required liability coverage.

In order to qualify for CLCA, you must:

- Have a valid California driver’s license

- Meet the program’s income eligibility guidelines

- Own a vehicle valued at $25,000 or less

- Be at least 16 years old

You will also need the following to apply for the program:

- A valid driver’s license

- A current vehicle registration

- An initial deposit for payment

- And any of the forms of income proof listed here

Read more: Registration in Same State?

Windshield Coverage

California doesn’t have any specific laws that tell your car insurance providers whether or not they have to pay for your windshield to be replaced upon its damaging. Your provider of choice, however, may dictate what kind of repair shop you have to go to in order to be covered for that damage.

You are able to use aftermarket parts through California insurance companies so long as you have written notice and the replacement is at least equal in terms of fit, quality, performance, and warranty through the OEM. Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Automobile Insurance Fraud in California

It’s pretty difficult to commit car insurance fraud by accident. That said, it’s not impossible. Insurance fraud is the second most common economic crime in the United States, and a number of states crack down hard on anyone who commits it for any reason.

You can break down auto insurance fraud one of two ways:

- Hard Fraud — when a claim has been deliberately fabricated or faked

- Soft Fraud — padding a claim or misinterpreting information to your provider

Naturally, insurance providers see more soft fraud than they do hard fraud. What some drivers think of as simple comeuppance is actually illegal, though. Don’t misrepresent the facts to your provider after an accident just to get a little extra money. You may well end up paying much, much more in the long run.

Statute of Limitations

A statute of limitations refers to the amount of time after an accident you have to file an insurance claim. In California, you have two years to file for personal injury and three years to file for property damage.

Penalties for Driving Without Insurance

We’ve already noted that it is illegal to drive in California if you don’t have the state’s minimum liability coverage. If you get caught on the road without insurance, there are significant consequences for your actions, as you can see in the table below.

| Offense | Penalty |

|---|---|

| First Offense | Fine up to $200 + penalty assessments Possible vehicle impounding |

| Second Offense (within three years) | Fine up to $500 + penalty assessments Possible vehicle impounding |

You absolutely need car insurance while driving in California, if only because the state is an at-fault state. If you get into an accident without insurance, you could easily go bankrupt paying for your own and the other driver’s long-term expenses. These expenses can encompass everything from hospital bills, car repairs, and the cost of a personal injury lawyer.

Teen Driver Laws

It’s an exciting — and sometimes terrifying — time when a teenager first learns how to drive. However, because teenagers are so inexperienced behind the wheel, the state of California has specific rules and regulations in place designed to keep teen drivers safe on the road.

| Restriction | Permit | Provisional License | Full License |

|---|---|---|---|

| Minimum Age | 15 1/2 | 16 | 18 |

| Prerequisites | Teen and parent must bring proof of residency, SSN, and a copy of the birth certificate to a driver exam office. Teen must pass a written test. Teen must have completed or be enrolled in a driver education course | Must have completed: 50 hours behind the wheel (10 of which at night) Drivers education program Pass a driving test | None |

| Passenger | Must be accompanied by a licensed parent, guardian, spouse, or instructor over 25 years old | No passengers under 20 except when accompanied by a licensed driver over 25 | No restrictions |

| Cell Phone | Cell phones prohibited (even hands-free) | Cell phones prohibited (even hands-free) | Hand-held prohibited. Hands-free cell phone use allowed |

| Time of Day | No restrictions | First 12 months: no driving between 11 pm and five am (some exceptions) | No restrictions |

As you can see, teenagers are required to meet a minimum supervised driving time and be at least 16 years old before they can get their license.

The rules for intermediate licensing differ slightly. Drivers with intermediate licenses in California cannot have passengers in the car who are under 20 years old unless those passengers are related to them. These drivers are also not allowed to drive in California between the hours of 11 pm and 5 am.

Older Driver License Renewal Procedures

As we age, we become slightly less reliable drivers. As such, the rules for older drivers’ license registration in California are designed with road safety in mind.

| Renewal Action | General Population | Older Population |

|---|---|---|

| License Renewal Cycle | 5 years | 5 years |

| Proof of adequate vision required at renewal | when renewing in person | 70 and older, every renewal |

| Mail or online renewal permitted | both, limited to 2 consecutive renewals | not permitted 70 and older |

Once you reach 70 years old, you’ll need to show proof of adequate vision every time you renew your license. You’ll also have to go to the DMV in person as opposed to using the Internet or renewing your license via the mail.

New Residents

New California residents should get a state license within 30 days of moving into the state. Otherwise, so long as your car insurance meets the state’s minimum required amount and your vehicle is registered with a nearby DMV, you’ll be as golden as the state itself.

License Renewal Procedures

California drivers need to have their licenses renewed on a five-year basis.

The good news is that so long as you’re under 70 years old, you can renew your license online or via the mail. However, you can only do so two cycles in a row. After 10 years, you’ll need to visit the DMV in person to get your license renewed.

Negligent Operator Treatment System (NOTS)

The California Negligent Operator Treatment System (NOTS) was created by the state’s DMV to keep “negligent operators” from driving. The system assigns a point value to various traffic offensives as seen in the table below:

| One-Point Violation | One-Point Violation | One-Point Violation | One-Point Violation | One-Point Violation | One-Point Violation | One-Point Violation | One-Point Violation | One-Point Violation | Two-Point Violation |

|---|---|---|---|---|---|---|---|---|---|

| Disobedience to traffic officer | Illegal movement/yellow light/arrow | Driving on sidewalk | Yielding right-of-way to horseback rider | Basic/prima facie speed limit | Stop required/railroad crossing | Unsafe/unlawfully equipped vehicle | Airbrake system | Removable containers/regulations | Evading peace officer/reckless driving |

| Evading peace officer | Illegal movement/red/light/arrow | Freeway ramp/entering/exiting | Yielding right-of-way to emergency vehicle | Exceeding posted/freeway speed limit | Stop for school bus | Operation after notice by officer | Emergency stopping system | Explosives transportation | Driving while suspended/revoked |

| Disobedience to fire official | Traffic signals | Load obstructing driver's view | Unsafe operation of emergency vehicle | Maximum speed 70 mph | Speed contest/aiding or abetting | Lighting equipment | Vacuum brakes | Inhalation hazard transportation | Driving, suspended/revoked for refusing test |

| Unsafe vehicle load | Disobedience to flashing signals | Interfering with driver's control of vehicle | Yielding right-of-way to pedestrian | Speed in excess of local limits | Transporting person in truck load space | Failure to dim lights | Child Passenger restraint | Inhalation hazard transportation | Hit and run/injury/property damage |

| Disregarding non-student crossing guard | Double lines/one broken line | Driving hours limitation | Due care for pedestrian on roadway | Speed in excess of local limits | Driving on trails and paths | Lamps/flag for extended load | Child seat belt | Tank vehicle regulations | Driving wrong side/divided highway |

| Youth bus/children crossing highway | Use of two-way left turn lane | Following too closely | Prohibited use of freeway | Speed/construction zone | Drinking while driving | Lamps on projecting load | Motorcycle/passengers and equipment | Driving hours limitations | Speed over 100 MPH |

| Disregarding funeral escort officer | Disobedience to traffic control device | Driving in fire area | Yielding right-of-way to blind pedestrian | Restricted speed/weather conditions | Marijuana or open container/driving | Brakes | Fifth wheel connecting/locking device | Driving hours, equipment, maintenance, operation | Reckless driving |

| Crossing safety flares/cones | Keep right | Driving in safety zone | Turning and U-turns | Speed/traffic lanes | Ignition interlock verification | Brakes/combination vehicles | Hitch and coupling device | Safety regulation violation | Reckless driving/causing bodily injury |

| Violation of license restrictions | Crossing divided highway | Towed vehicle swerving | Unsafe starting/backing of vehicle | Driving too slow | Defeating ignition interlock device | Forklift truck brakes | Towed vehicle coupling | Vanpool vehicle maintenance inspection | Speed contest /exhibition of speed |

| Disregarding traffic officer's directions | Entering highway from service road | Unlawful riding/towing | Signaling turns and stops | Speed/bridge/tunnel | Disobedience to toll highway officer | All wheel service brakes | Pole dolly/load and length | Violation of special permit | Minor driving with BAC of 0.05% or more |

| Driving in bicycle lane | Lane use/slow moving vehicle | Turning across bicycle lane | School bus signaling | Maximum designated vehicle speed | Unauthorized towing | Brakes/stopping distance | Caldecott tunnel restrictions | Extralegal load/weight | DUI/alcoholic beverage or drugs |

| Disobedience to traffic signs/controller | High-occupancy vehicle lane/entering/exiting | Illegal passing | Speed/use of designated lanes | Speed/solid/metal tires | Width/load of vehicle at crossing | Braking system/towing vehicles | Hazardous waste transportation | Lift-carrier/speed | DUI/causing bodily injury or death |

| Illegal movement/green light/arrow | Improper lane use | Right-of-way | Maximum speed | Speed limit on grades | Disobedience to sign/vehicle crossing | Adjustment/use of air brakes | Farm labor vehicle/unsafe operation | Bale wagon load width during darkness | Explosives transportation |

The severity of warnings and sanctions increases as points accumulate. These not only impact your driver status in California but may also cause an increase in your insurance rates.

| Level | Point Count | Time Period |

|---|---|---|

| Level I Warning Letter | 2 | Within 12 months |

| Level I Warning Letter | 4 | Within 24 months |

| Level I Warning Letter | 6 | Within 36 months |

| Level II Notice of Intent to Suspend | 3 | Within 12 months |

| Level II Notice of Intent to Suspend | 5 | Within 24 months |

| Level II Notice of Intent to Suspend | 7 | Within 36 months |

| Level III Probation/Suspension | 4 | Within 12 months |

| Level III Probation/Suspension | 6 | Within 24 months |

| Level III Probation/Suspension | 8 | Within 36 months |

Rules of the Road

That’s the deal with insurance, though. What do the rules of the road look like in California?

Fault vs. No-Fault

As we’ve mentioned, California is an at-fault state. You need to be especially careful while driving, or else you may find yourself responsible for not only your property damage and personal injury bills but someone else’s.

Keep Right and Move Over Laws

If you’re driving more slowly than an interstate’s posted speed limit, California state law requires you stay to the right side of the road.

Similarly, you’re required to move to the right side of the road if you see an oncoming EMS vehicle or state vehicle with its lights flashing. These vehicles are not limited to but include:

- Firefighters

- Ambulances

- Utility Workers

- Law Enforcement

- Utility Trucks

- Drivers with Hazard Lights on

Speed Limits

The speed limits in California will vary based on the location of the road. Note, though, that the below-mentioned speed limits are the MAXIMUM speed you can go on these types of roads.

| Roadway | Speed Limit | Truck Speed Limit |

|---|---|---|

| Rural interstates (mph) | 70 | 55 |

| Urban interstates (mph) | 65 | 55 |

| Other limited access roads (mph) | 70 | 55 |

| Other roads (mph) | 65 | 55 |

Take it easy, Speed Racer, and don’t get into any trouble.

Seat Belt and Car Seat Laws

The seat belt laws in California are reasonably straightforward. Put into effect as of 1986, not wearing a seat belt is a primarily enforceable act. This means that if law enforcement spots you driving without wearing a seat belt or spots one of your passengers riding without a seat belt, they need no other reason to pull you over.

Anyone who is over 16 years old needs to be wearing a seat belt while in a moving vehicle in California.

There are varying rules for children under the age of 16. Car seats are required for any child under 7 years of age.

- Children who are under 2 years old, weigh less than 40 pounds, and who are less than 40 inches tall need to be in a rear-facing seat NOT PLACED in the front passenger’s seat of your car.

- Children between the ages of 2 and 7 who are between 40 and 57 inches tall are able to sit in forward-facing seats.

- Boost seats are appropriate for any child who weighs more than 40 pounds.

Once a child is over 57 inches tall or older than 8, they’ll only be required to wear an adult seat belt. However, any child under 57 inches tall will need to remain in the back passenger’s seats until they hit another growth spurt.

Ridesharing

With the rise of Lyft and Uber, more drivers have taken car-sharing into their career considerations. If you’re interested in using your car for a ridesharing service, you’ll need a particular type of car insurance. At present, the car insurance providers in the state of California who support ridesharing car insurance include:

- Allstate

- Farmers

- Liberty Mutual

- Mercury

- Metlife

- Metromile

- State Farm

- USAA

However, the California governor recently signed a new bill (AB 5) that could negatively affect rideshare drivers.

The majority of rideshare drivers for Uber and Lyft will now fall under the status of employees, meaning most rideshare drivers can no longer work as independent contractors for rideshare companies in California.

DUI Laws

Under no circumstances should you be driving while under the influence of alcohol. However, these things have happened before.

According to MADD, California ranks 25th in the United States for drunk driving fatalities.

If you get caught driving with a blood-alcohol level above .08 in California, you’ll face the following consequences:

| Penalty Type | First Offense | Second Offense (in 10 years) | Third and Subsequent Offenses |

|---|---|---|---|

| License Suspension | Four months | One year | One year |

| Imprisonment | 96 hours to six months with 48 hours continuous | 96 hours to six months with 48 hours continuous | 30 days to one year with 48 hours continuous |

| Fine | $390 - $1000 plus $125 license reinstatement fee | $390 - $1000 plus $125 license reinstatement fee | $390 - $1000 plus $125 license reinstatement fee |

| SR-22 Requirement | yes | yes | yes |

| Other | Completion of a DUI program for license reinstatement | Completion of a DUI program for license reinstatement Installation and use of an ignition interlock device (IID) for license reinstatement | Completion of a DUI program for license reinstatement Installation and use of an IID for license reinstatement |

Distracted Driving Laws

Cellphones are also actively causing some problems for drivers in California. At present, the state has banned all hand-held devices, and drivers under the age of 18 are not allowed to use their cellphones while in the car. No drivers are legally allowed to text while driving, either.

Texting while driving is a primarily enforceable crime, meaning law enforcement can stop you if they spot you with your phone out and need no other reason to do so. Calling while driving, comparatively, is a secondarily enforceable act.

Driving in California

With the rules of the road out of the way, let’s explore some of the other facts that keep a driver’s life in California interesting.

Vehicle Theft in California

You might expect sports cars to be among the most commonly stolen cars in California. Not so. Take a look at the top 10 most frequently stolen cars in the state and see if you’re classy enough to crack the list.

| City | Motor vehicle thefts |

|---|---|

| Los Angeles | 14,382 |

| San Jose | 7926 |

| Oakland | 6833 |

| San Diego | 6143 |

| San Francisco | 5866 |

| Fresno | 4057 |

| Bakersfield | 2937 |

| Sacramento | 2861 |

| San Bernardino | 2691 |

| Long Beach | 2355 |

| Stockton | 2143 |

| Riverside | 1718 |

| Anaheim | 1681 |

| Hayward | 1671 |

| Richmond | 1510 |

| Salinas | 1488 |

| Santa Ana | 1459 |

| Modesto | 1389 |

| Antioch | 1217 |

| Vallejo | 1209 |

| Ontario | 1091 |

| Fontana | 999 |

| Pomona | 956 |

| South Gate | 913 |

| San Leandro | 912 |

| Downey | 846 |

| Moreno Valley | 826 |

| Compton | 799 |

| Chula Vista | 781 |

| Escondido | 772 |

| Rialto | 771 |

| Concord | 768 |

| Jurupa Valley | 763 |

| Santa Maria | 730 |

| Fremont | 669 |

| Berkeley | 664 |

| Oxnard | 664 |

| Inglewood | 640 |

| Victorville | 637 |

| Fairfield | 629 |

| Pittsburg | 629 |

| Visalia | 619 |

| Huntington Park | 589 |

| El Monte | 576 |

| Indio | 572 |

| Norwalk | 564 |

| Hemet | 559 |

| Lynwood | 554 |

| Redding | 549 |

| Garden Grove | 539 |

| Paramount | 504 |

| West Covina | 501 |

| Montebello | 496 |

| Corona | 490 |

| Carson | 489 |

| Bellflower | 487 |

| Perris | 482 |

| Rancho Cucamonga | 478 |

| El Cajon | 462 |

| Delano | 443 |

| Turlock | 425 |

| National City | 415 |

| Hesperia | 409 |

| Sunnyvale | 404 |

| Lancaster | 403 |

| Oceanside | 400 |

| Upland | 399 |

| Merced | 395 |

| Santa Clara | 393 |

| Colton | 386 |

| Hawthorne | 386 |

| Chico | 382 |

| Coachella | 380 |

| Montclair | 373 |

| Tulare | 371 |

| Buena Park | 369 |

| Redlands | 368 |

| Palmdale | 367 |

| Lodi | 365 |

| Baldwin Park | 363 |

| Torrance | 362 |

| Fullerton | 359 |

| Highland | 355 |

| San Pablo | 353 |

| Citrus Heights | 345 |

| Huntington Beach | 345 |

| Ceres | 339 |

| Westminster | 336 |

| Pico Rivera | 335 |

| San Rafael | 332 |

| Union City | 332 |

| Yuba City | 332 |

| Alameda | 330 |

| Vista | 329 |

| Manteca | 327 |

| Menifee | 310 |

| Santa Rosa | 309 |

| Gardena | 307 |

| Clovis | 305 |

| Cathedral City | 302 |

| Costa Mesa | 296 |

| Palm Springs | 296 |

| Daly City | 291 |

| Lakewood | 287 |

| Pasadena | 287 |

| Milpitas | 285 |

| Chino | 277 |

| Commerce | 277 |

| Calexico | 275 |

| Orange | 272 |

| Bell Gardens | 271 |

| Watsonville | 266 |

| Ventura | 257 |

| Madera | 256 |

| Whittier | 253 |

| Glendale | 251 |

| Santa Clarita | 249 |

| Selma | 249 |

| San Jacinto | 244 |

| Santa Fe Springs | 241 |

| Temecula | 240 |

| Roseville | 238 |

| Gilroy | 235 |

| Tracy | 235 |

| Alhambra | 234 |

| La Mesa | 233 |

| Porterville | 233 |

| Vacaville | 231 |

| Santa Cruz | 228 |

| Industry | 226 |

| Redwood City | 226 |

| Rancho Cordova | 225 |

| Apple Valley | 223 |

| Burbank | 219 |

| Cerritos | 218 |

| Lake Elsinore | 218 |

| Monterey Park | 209 |

| West Sacramento | 209 |

| Campbell | 206 |

| Murrieta | 206 |

| Woodland | 194 |

| Hanford | 193 |

| Elk Grove | 190 |

| Eureka | 182 |

| Martinez | 181 |

| South San Francisco | 181 |

| Newark | 173 |

| Azusa | 171 |

| San Marcos | 170 |

| Livermore | 168 |

| Santa Monica | 165 |

| Rosemead | 164 |

| Walnut Creek | 163 |

| Oroville | 160 |

| Atwater | 158 |

| Covina | 157 |

| Stanton | 156 |

| San Mateo | 155 |

| Emeryville | 154 |

| Loma Linda | 153 |

| Pleasant Hill | 153 |

| Irvine | 149 |

| Desert Hot Springs | 141 |

| Maywood | 136 |

| Eastvale | 135 |

| Marysville | 135 |

| Mountain View | 135 |

| Adelanto | 133 |

| Redondo Beach | 133 |

| Palm Desert | 132 |

| Simi Valley | 132 |

| Banning | 130 |

| East Palo Alto | 130 |

| Napa | 130 |

| Yucaipa | 130 |

| McFarland | 128 |

| La Puente | 125 |

| Novato | 125 |

| Orange Cove | 125 |

| Carlsbad | 124 |

| El Centro | 124 |

| El Cerrito | 123 |

| Anderson | 120 |

| Santa Barbara | 120 |

| South El Monte | 119 |

| Suisun City | 119 |

| Pleasanton | 117 |

| Culver City | 115 |

| La Habra | 114 |

| La Mirada | 114 |

| Sanger | 114 |

| Arvin | 113 |

| Brentwood | 113 |

| Tustin | 113 |

| Reedley | 112 |

| Lemon Grove | 110 |

| Parlier | 108 |

| Los Banos | 107 |

| Santee | 107 |

| Vernon | 106 |

| Newport Beach | 104 |

| San Ramon | 104 |

| Beaumont | 103 |

| Barstow | 102 |

| Imperial Beach | 101 |

| West Hollywood | 99 |

| Morgan Hill | 98 |

| Patterson | 98 |

| Cypress | 97 |

| Lawndale | 96 |

| Oakley | 94 |

| Dinuba | 92 |

| San Bruno | 91 |

| Thousand Oaks | 91 |

| La Quinta | 90 |

| Clearlake | 89 |

| Lemoore | 88 |

| Chino Hills | 87 |

| Davis | 87 |

| Monrovia | 86 |

| Shafter | 85 |

| Oakdale | 84 |

| Kerman | 83 |

| Wildomar | 83 |

| Cudahy | 82 |

| Pinole | 82 |

| Lompoc | 80 |

| Placentia | 80 |

| Signal Hill | 80 |

| Norco | 78 |

| Bell | 77 |

| Dublin | 77 |

| Red Bluff | 77 |

| Riverbank | 77 |

| Camarillo | 76 |

| Petaluma | 76 |

| Albany | 75 |

| Santa Paula | 75 |

| Paradise | 74 |

| Fountain Valley | 73 |

| Hollister | 73 |

| Folsom | 72 |

| San Fernando | 72 |

| Encinitas | 71 |

| Glendora | 71 |

| Pacifica | 71 |

| Grass Valley | 69 |

| Lomita | 69 |

| Claremont | 68 |

| Palo Alto | 67 |

| San Dimas | 67 |

| Brea | 66 |

| Diamond Bar | 66 |

| Galt | 64 |

| Rohnert Park | 64 |

| San Luis Obispo | 63 |

| Arcadia | 62 |

| Central Marin | 61 |

| Arcata | 60 |

| Rocklin | 60 |

| Grand Terrace | 59 |

| Brawley | 56 |

| Greenfield | 56 |

| San Gabriel | 56 |

| Artesia | 55 |

| Duarte | 55 |

| Dos Palos | 54 |

| Kingsburg | 54 |

| Yucca Valley | 54 |

| Monterey | 53 |

| San Clemente | 53 |

| El Segundo | 52 |

| Hawaiian Gardens | 52 |

| Seaside | 51 |

| South Pasadena | 51 |

| Benicia | 50 |

| Lindsay | 50 |

| Piedmont | 50 |

| Cupertino | 49 |

| Hercules | 48 |

| La Verne | 47 |

| Soledad | 47 |

| Corcoran | 46 |

| South Lake Tahoe | 46 |

| Yorba Linda | 46 |

| Burlingame | 45 |

| Dixon | 45 |

| Poway | 45 |

| Ridgecrest | 45 |

| Irwindale | 44 |

| Lincoln | 44 |

| Chowchilla | 43 |

| Laguna Hills | 43 |

| Lake Forest | 43 |

| Los Gatos | 43 |

| Mendota | 43 |

| Paso Robles | 42 |

| Port Hueneme | 42 |

| Waterford | 42 |

| Beverly Hills | 41 |

| Fowler | 41 |

| Huron | 41 |

| Twentynine Palms | 41 |

| Mission Viejo | 40 |

| Belmont | 39 |

| Los Alamitos | 39 |

| Corning | 38 |

| Rancho Mirage | 37 |

| Taft | 37 |

| Manhattan Beach | 36 |

| Newman | 36 |

| Rancho Palos Verdes | 36 |

| Walnut | 36 |

| Blythe | 35 |

| Farmersville | 35 |

| Grover Beach | 35 |

| Hermosa Beach | 35 |

| Coalinga | 34 |

| Seal Beach | 33 |

| Temple City | 33 |

| American Canyon | 32 |

| Needles | 32 |

| Arroyo Grande | 30 |

| Livingston | 30 |

| Placerville | 30 |

| Laguna Niguel | 29 |

| Coronado | 28 |

| Danville | 28 |

| Lafayette | 28 |

| Marina | 28 |

| Menlo Park | 28 |

| Tehachapi | 28 |

| Capitola | 27 |

| Ukiah | 27 |

| Auburn | 26 |

| Laguna Beach | 26 |

| Moorpark | 26 |

| Atascadero | 25 |

| La Palma | 25 |

| Dana Point | 24 |

| King City | 24 |

| Fortuna | 23 |

| Gridley | 23 |

| Malibu | 23 |

| Ripon | 23 |

| Colma | 22 |

| San Juan Capistrano | 22 |

| Moraga | 21 |

| Solana Beach | 21 |

| Susanville | 21 |

| Aliso Viejo | 20 |

| Carpinteria | 20 |

| Colusa | 20 |

| Fillmore | 20 |

| Foster City | 20 |

| Gustine | 20 |

| Hughson | 20 |

| Lakeport | 20 |

| Willits | 20 |

| California City | 19 |

| Escalon | 19 |

| Exeter | 19 |

| Gonzales | 19 |

| Avalon | 18 |

| Avenal | 17 |

| Los Altos | 17 |

| Pacific Grove | 17 |

| Sonora | 17 |

| Crescent City | 16 |

| Orland | 16 |

| Woodlake | 16 |

| Calimesa | 15 |

| Fort Bragg | 15 |

| Imperial | 15 |

| Nevada City | 15 |

| Rio Vista | 15 |

| Canyon Lake | 14 |

| Kensington | 14 |

| Yreka | 14 |

| Goleta | 13 |

| Rancho Santa Margarita | 13 |

| Agoura Hills | 12 |

| Big Bear Lake | 12 |

| Cloverdale | 12 |

| Pismo Beach | 12 |

| Sausalito | 12 |

| Winters | 12 |

| Del Mar | 11 |

| Guadalupe | 11 |

| La Canada Flintridge | 11 |

| Scotts Valley | 11 |

| Clayton | 10 |

| Laguna Woods | 10 |

| Saratoga | 10 |

| Sonoma | 10 |

| Holtville | 9 |

| Morro Bay | 9 |

| Willows | 9 |

| Healdsburg | 8 |

| Indian Wells | 8 |

| Ione | 8 |

| Mill Valley | 8 |

| Ojai | 8 |

| Orinda | 8 |

| Sebastopol | 8 |

| Williams | 8 |

| Windsor | 8 |

| Calabasas | 7 |

| Cotati | 7 |

| Jackson | 7 |

| Mount Shasta | 7 |

| Rolling Hills Estates | 7 |

| Truckee | 7 |

| Brisbane | 6 |

| Broadmoor | 6 |

| Fairfax | 6 |

| Mammoth Lakes | 6 |

| Sierra Madre | 6 |

| Westlake Village | 6 |

| Yountville | 6 |

| Biggs | 5 |

| Wheatland | 5 |

| Bishop | 4 |

| Palos Verdes Estates | 4 |

| Sand City | 4 |

| Solvang | 4 |

| Atherton | 3 |

| Calistoga | 3 |

| Carmel | 3 |

| City of Angels | 3 |

| Dorris | 3 |

| Firebaugh | 3 |

| Rio Dell | 3 |

| Ross | 3 |

| Sutter Creek | 3 |

| Weed | 3 |

| Alturas | 2 |

| Bradbury | 2 |

| Hillsborough | 2 |

| La Habra Heights | 2 |

| Lake Shastina | 2 |

| St. Helena | 2 |

| Belvedere | 1 |

| Buellton | 1 |

| Dunsmuir | 1 |

| Ferndale | 1 |

| Los Altos Hills | 1 |

| Monte Sereno | 1 |

| San Marino | 1 |

| Bear Valley | 0 |

| Del Rey Oaks | 0 |

| Etna | 0 |

| Fort Jones | 0 |

| Hidden Hills | 0 |

| Isleton | 0 |

| Montague | 0 |

| Rolling Hills | 0 |

| Stallion Springs | 0 |

| Tiburon | 0 |

| Tulelake | 0 |

| Villa Park | 0 |

| Westmorland | 0 |

Read more:

It’s Hondas and Nissans that really have to worry. Do what you can, then, to lock up your car and keep an eye on it over the course of a day. There are even insurance providers who offer additional discounts on your rate for specialized security features. If you like saving money and staying safe, why not give them a gander?

Risky Driving Behavior

That said, there are some cities in California that are more dangerous than others. The fatality rates in the to-be mentioned cities, for example, should encourage you to drive a little more cautiously in urban areas.

| County | Fatalities 2013 | Fatalities 2014 | Fatalitites 2015 | Fatalities 2016 | Fatalitites 2017 | Rates per 100K Population 2013 | Rates per 100K Population 2014 | Rates per 100K Population 2015 | Rates per 100K Population 2016 | Rates per 100K Population 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Alameda | 86 | 83 | 90 | 79 | 99 | 5.43 | 5.15 | 5.5 | 4.78 | 5.95 |

| Alpine | 1 | 1 | 1 | 7 | 4 | 88.73 | 92.25 | 91.91 | 662.25 | 357.14 |

| Amador | 5 | 7 | 8 | 14 | 12 | 13.65 | 19.05 | 21.59 | 37.36 | 31.07 |

| Butte | 21 | 24 | 33 | 36 | 38 | 9.47 | 10.73 | 14.68 | 15.89 | 16.57 |

| Calaveras | 7 | 8 | 11 | 9 | 20 | 15.67 | 17.91 | 24.47 | 19.86 | 43.79 |

| Colusa | 9 | 7 | 5 | 5 | 10 | 42.18 | 32.91 | 23.43 | 23.1 | 45.86 |

| Contra Costa | 50 | 44 | 76 | 81 | 63 | 4.56 | 3.96 | 6.75 | 7.11 | 5.49 |

| Del Norte | 12 | 8 | 15 | 8 | 6 | 43.12 | 29.41 | 55.04 | 29.14 | 21.84 |

| El Dorado | 26 | 23 | 26 | 19 | 26 | 14.32 | 12.55 | 14.06 | 10.2 | 13.76 |

| Fresno | 119 | 117 | 102 | 150 | 156 | 12.48 | 12.15 | 10.49 | 15.31 | 15.77 |

| Glenn | 5 | 12 | 6 | 11 | 9 | 17.94 | 43 | 21.55 | 39.33 | 32.04 |

| Humboldt | 28 | 33 | 28 | 21 | 39 | 20.83 | 24.52 | 20.71 | 15.39 | 28.52 |

| Imperial | 28 | 46 | 28 | 34 | 23 | 15.8 | 25.72 | 15.57 | 18.79 | 12.58 |

| Inyo | 3 | 0 | 6 | 7 | 11 | 16.32 | 0 | 32.97 | 38.82 | 61.02 |

| Kern | 131 | 111 | 138 | 149 | 182 | 15.16 | 12.73 | 15.69 | 16.83 | 20.38 |

| Kings | 16 | 12 | 35 | 30 | 25 | 10.62 | 8.01 | 23.26 | 20.03 | 16.66 |

| Lake | 22 | 7 | 17 | 15 | 17 | 34.45 | 10.92 | 26.43 | 23.46 | 26.46 |

| Lassen | 9 | 5 | 9 | 10 | 8 | 28.01 | 15.76 | 28.67 | 32.32 | 25.67 |

| Los Angeles | 625 | 639 | 651 | 837 | 658 | 6.24 | 6.34 | 6.43 | 8.25 | 6.47 |

| Madera | 21 | 32 | 29 | 39 | 26 | 13.83 | 20.77 | 18.78 | 25.17 | 16.57 |

| Marin | 14 | 10 | 8 | 12 | 12 | 5.41 | 3.83 | 3.06 | 4.59 | 4.6 |

| Mariposa | 3 | 5 | 3 | 5 | 7 | 16.84 | 28.2 | 17 | 28.53 | 39.84 |

| Mendocino | 14 | 19 | 10 | 25 | 30 | 16.06 | 21.75 | 11.45 | 28.54 | 34.08 |

| Merced | 48 | 37 | 54 | 72 | 70 | 18.27 | 13.95 | 20.19 | 26.78 | 25.67 |

| Modoc | 3 | 3 | 3 | 1 | 0 | 32.77 | 33.03 | 33.15 | 11.18 | 0 |

| Mono | 1 | 5 | 6 | 1 | 5 | 7.14 | 35.53 | 43 | 7.09 | 35.29 |

| Monterey | 33 | 32 | 49 | 55 | 51 | 7.7 | 7.43 | 11.32 | 12.6 | 11.65 |

| Napa | 16 | 6 | 15 | 12 | 14 | 11.43 | 4.26 | 10.6 | 8.47 | 9.93 |

| Nevada | 15 | 5 | 13 | 12 | 16 | 15.31 | 5.07 | 13.17 | 12.11 | 16.03 |

| Orange | 186 | 173 | 183 | 204 | 178 | 5.97 | 5.52 | 5.79 | 6.42 | 5.58 |

| Placer | 21 | 13 | 21 | 40 | 29 | 5.74 | 3.52 | 5.62 | 10.53 | 7.51 |

| Plumas | 3 | 6 | 5 | 10 | 6 | 15.87 | 32.14 | 26.99 | 53.23 | 32.01 |

| Riverside | 228 | 246 | 242 | 297 | 294 | 9.95 | 10.6 | 10.29 | 12.44 | 12.13 |

| Sacramento | 123 | 114 | 139 | 169 | 172 | 8.43 | 7.72 | 9.29 | 11.17 | 11.24 |

| San Benito | 7 | 9 | 9 | 11 | 9 | 12.2 | 15.52 | 15.42 | 18.54 | 14.92 |

| San Bernardino | 262 | 285 | 260 | 273 | 271 | 12.56 | 13.55 | 12.26 | 12.77 | 12.56 |

| San Diego | 198 | 233 | 246 | 243 | 231 | 6.16 | 7.15 | 7.48 | 7.33 | 6.92 |

| San Francisco | 35 | 33 | 38 | 36 | 25 | 4.16 | 3.87 | 4.39 | 4.11 | 2.83 |

| San Joaquin | 93 | 83 | 98 | 119 | 116 | 13.21 | 11.63 | 13.54 | 16.21 | 15.56 |

| San Luis Obispo | 28 | 32 | 34 | 32 | 34 | 10.15 | 11.49 | 12.13 | 11.34 | 11.34 |

| San Mateo | 57 | 25 | 33 | 52 | 33 | 7.6 | 3.29 | 4.3 | 6.76 | 4.28 |

| Santa Barbara | 31 | 23 | 35 | 34 | 39 | 7.11 | 5.22 | 7.88 | 7.62 | 8.7 |

| Santa Clara | 95 | 106 | 133 | 114 | 105 | 5.08 | 5.59 | 6.93 | 5.9 | 5.42 |

| Santa Cruz | 14 | 20 | 19 | 20 | 19 | 5.2 | 7.37 | 6.93 | 7.27 | 6.89 |

| Shasta | 24 | 22 | 40 | 26 | 29 | 13.45 | 12.29 | 22.41 | 14.54 | 16.12 |

| Sierra | 2 | 0 | 1 | 1 | 3 | 66.01 | 0 | 33.4 | 33.74 | 100.03 |

| Siskiyou | 6 | 9 | 12 | 11 | 14 | 13.78 | 20.74 | 27.68 | 25.28 | 31.92 |

| Solano | 39 | 49 | 45 | 37 | 31 | 9.19 | 11.4 | 10.35 | 8.4 | 6.96 |

| Sonoma | 30 | 40 | 46 | 45 | 35 | 6.06 | 8.01 | 9.16 | 8.93 | 6.94 |

| Stanislaus | 54 | 62 | 49 | 79 | 74 | 10.29 | 11.71 | 9.16 | 14.59 | 13.51 |

| Sutter | 14 | 11 | 17 | 8 | 23 | 14.78 | 11.58 | 17.8 | 8.33 | 23.8 |

| Tehama | 11 | 14 | 19 | 18 | 13 | 17.48 | 22.29 | 30.1 | 28.37 | 20.34 |

| Trinity | 4 | 8 | 5 | 8 | 5 | 29.8 | 60.97 | 38.19 | 62.31 | 39.34 |

| Tulare | 54 | 60 | 75 | 80 | 85 | 11.9 | 13.14 | 16.35 | 17.36 | 18.3 |

| Tuolumne | 13 | 11 | 17 | 11 | 14 | 24.07 | 20.43 | 31.72 | 20.45 | 25.81 |

| Ventura | 66 | 46 | 56 | 57 | 47 | 7.86 | 5.45 | 6.6 | 6.7 | 5.5 |

| Yolo | 21 | 19 | 26 | 36 | 20 | 10.16 | 9.1 | 12.24 | 16.67 | 9.13 |

| Yuba | 17 | 9 | 9 | 10 | 11 | 23.24 | 12.22 | 12.13 | 13.3 | 14.28 |

Traffic Fatalities by Road Type

It’s no surprise that bigger cities see more fatalities. That said, rural roads in California see far more fatalities than their urban counterparts.

| Road Type | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 1,324 | 1,320 | 1,162 | 1,190 | 1,200 | 1,201 | 1,170 | 1,404 | 1,593 | 1,404 |

| Urban | 2,110 | 1,770 | 1,558 | 1,626 | 1,766 | 1,906 | 1,931 | 1,982 | 2,244 | 2,195 |

| Total | 3,434 | 3,090 | 2,720 | 2,816 | 2,966 | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

This is likely because rural roads have less of an authoritative presence, making speeding and other risky behaviors all the more likely.

Fatalities by Weather

One thing drivers can’t control, though, is the weather. Weather and light contribute significantly to the number of fatalities that occur in California on a yearly basis, as you can see below:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total (2015) |

|---|---|---|---|---|---|---|

| Normal | 1,286 | 883 | 779 | 136 | 5 | 3,089 |

| Rain | 51 | 58 | 54 | 6 | 0 | 169 |

| Snow/Sleet | 4 | 0 | 4 | 1 | 0 | 9 |

| Other | 10 | 7 | 17 | 0 | 0 | 34 |

| Unknown | 0 | 2 | 1 | 0 | 0 | 3 |

| TOTAL | 1,351 | 950 | 855 | 143 | 5 | 3,304 |

It should be noted that this data does not account for California wildfires and any car-related fatalities that occur in or near those cases.

Fatalities by Person Type

But how does a person type play into the number of fatalities a state sees in a year? Note that here, “person type” refers to a person’s relationship to the car in question — are they a pedestrian, a passenger, and so on.

| California Traffic Deaths by Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Motorcyclists | 463 | 522 | 494 | 576 | 529 |

| Pedestrians | 734 | 709 | 819 | 933 | 858 |

| Bicyclists | 147 | 129 | 136 | 155 | 124 |

| Passenger Car Occupants | 1,098 | 1,066 | 1,170 | 1,357 | 1,269 |

| Pick-up Truck Occupants | 239 | 209 | 294 | 278 | 279 |

| Utility Truck Occupants | 241 | 271 | 288 | 307 | 336 |

| Van Occupants | 67 | 79 | 88 | 88 | 84 |

| Large Truck Occupants | 38 | 33 | 32 | 48 | 53 |

| Bus Occupants | 11 | 17 | 1 | 20 | 3 |

| State Total | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

Passenger car occupants see far more fatalities than most other types of people, with pedestrians close behind and motorcyclists following them. This, if nothing else, is a call for awareness while on the road.

Fatalities by Crash Type

Crash types can also vary and impact the fatality rate of a state.

| Crash Type | 2013 Fatalities | 2014 Fatalities | 2015 Fatalities | 2016 Fatalities | 2017 Fatalities |

|---|---|---|---|---|---|

| Single Vehicle Crash | 1,922 | 1,861 | 1,987 | 2,273 | 2,067 |

| Large Truck Involved | 259 | 301 | 305 | 354 | 361 |

| Speeding Involved | 992 | 995 | 1,032 | 1,151 | 1,070 |

| Rollover Involved | 697 | 696 | 770 | 800 | 796 |

| Involving an Intersection | 797 | 811 | 881 | 1,024 | 927 |

| Roadway Departure Involved | 1,442 | 1,374 | 1,530 | 1,754 | 1,588 |

| Total | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

As you can see, single-car crashes and fatalities are far more common than the other types of crashes in California.

Five-Year Trend For The Top 10 Counties

With those statistics out of the way, how has the rate of fatalities changed over the past five years in California, and where, based on this data, do we see it going in the years to come?

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Fresno | 119 | 117 | 102 | 150 | 156 |

| Kern | 131 | 111 | 138 | 149 | 182 |

| Los Angeles | 625 | 639 | 651 | 837 | 658 |

| Orange | 186 | 173 | 183 | 204 | 178 |

| Riverside | 228 | 246 | 242 | 297 | 294 |

| Sacramento | 123 | 114 | 139 | 169 | 172 |

| San Bernardino | 262 | 285 | 260 | 273 | 271 |

| San Diego | 198 | 233 | 246 | 243 | 231 |

| San Joaquin | 93 | 83 | 98 | 119 | 116 |

| Santa Clara | 95 | 106 | 133 | 114 | 105 |

| 10 County Total | 2,060 | 2,107 | 2,192 | 2,555 | 2,363 |

| State Total | 3,107 | 3,102 | 3,387 | 3,837 | 3,602 |

While 2016-17 saw a drop off in fatalities, it seems for the most part as though driving in California is getting more dangerous. This is all the more reason to consider investing in a bit more car insurance than the state’s minimum liability coverage. The more coverage you have, the safer you are.

Fatalities Involving Speeding by County

Unlike the weather, speeding is something drivers can control. And yet, the number of fatalities related to speeding in California continues to fluctuate.

| County | Fatalities 2013 | Fatalities 2014 | Fatalities 2015 | Fatalities 2016 | Fatalities 2017 | Rate per 100K Population 2013 | Rate per 100K Population 2014 | Rate per 100K Population 2015 | Rate per 100K Population 2016 | Rate per 100K Population 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Alameda | 33 | 24 | 37 | 25 | 32 | 2.08 | 1.49 | 2.26 | 1.51 | 1.92 |

| Alpine | 1 | 1 | 0 | 6 | 1 | 88.73 | 92.25 | 0 | 567.64 | 89.29 |

| Amador | 0 | 1 | 0 | 2 | 0 | 0 | 2.72 | 0 | 5.34 | 0 |

| Butte | 6 | 11 | 13 | 4 | 15 | 2.71 | 4.92 | 5.78 | 1.77 | 6.54 |

| Calaveras | 2 | 2 | 1 | 3 | 4 | 4.48 | 4.48 | 2.22 | 6.62 | 8.76 |

| Colusa | 1 | 1 | 2 | 2 | 2 | 4.69 | 4.7 | 9.37 | 9.24 | 9.17 |

| Contra Costa | 16 | 13 | 26 | 36 | 17 | 1.46 | 1.17 | 2.31 | 3.16 | 1.48 |

| Del Norte | 4 | 2 | 2 | 5 | 1 | 14.37 | 7.35 | 7.34 | 18.21 | 3.64 |

| El Dorado | 5 | 8 | 6 | 9 | 13 | 2.75 | 4.36 | 3.25 | 4.83 | 6.88 |

| Fresno | 26 | 24 | 22 | 44 | 51 | 2.73 | 2.49 | 2.26 | 4.49 | 5.16 |

| Glenn | 1 | 1 | 2 | 3 | 2 | 3.59 | 3.58 | 7.18 | 10.73 | 7.12 |

| Humboldt | 7 | 9 | 8 | 6 | 8 | 5.21 | 6.69 | 5.92 | 4.4 | 5.85 |

| Imperial | 8 | 11 | 9 | 3 | 7 | 4.51 | 6.15 | 5 | 1.66 | 3.83 |

| Inyo | 1 | 0 | 1 | 0 | 2 | 5.44 | 0 | 5.5 | 0 | 11.1 |

| Kern | 32 | 27 | 40 | 49 | 45 | 3.7 | 3.1 | 4.55 | 5.54 | 5.04 |

| Kings | 3 | 3 | 11 | 5 | 6 | 1.99 | 2 | 7.31 | 3.34 | 4 |

| Lake | 6 | 0 | 6 | 4 | 3 | 9.4 | 0 | 9.33 | 6.25 | 4.67 |

| Lassen | 3 | 1 | 5 | 1 | 1 | 9.34 | 3.15 | 15.93 | 3.23 | 3.21 |

| Los Angeles | 245 | 240 | 231 | 308 | 214 | 2.45 | 2.38 | 2.28 | 3.03 | 2.11 |

| Madera | 5 | 7 | 8 | 10 | 4 | 3.29 | 4.54 | 5.18 | 6.45 | 2.55 |

| Marin | 5 | 3 | 1 | 3 | 6 | 1.93 | 1.15 | 0.38 | 1.15 | 2.3 |

| Mariposa | 0 | 2 | 0 | 0 | 1 | 0 | 11.28 | 0 | 0 | 5.69 |

| Mendocino | 5 | 5 | 3 | 3 | 9 | 5.74 | 5.72 | 3.44 | 3.42 | 10.23 |

| Merced | 12 | 9 | 16 | 14 | 16 | 4.57 | 3.39 | 5.98 | 5.21 | 5.87 |

| Modoc | 1 | 0 | 0 | 0 | 0 | 10.92 | 0 | 0 | 0 | 0 |

| Mono | 0 | 2 | 0 | 0 | 0 | 0 | 14.21 | 0 | 0 | 0 |

| Monterey | 3 | 7 | 4 | 9 | 11 | 0.7 | 1.63 | 0.92 | 2.06 | 2.51 |

| Napa | 7 | 2 | 2 | 3 | 1 | 5 | 1.42 | 1.41 | 2.12 | 0.71 |

| Nevada | 7 | 3 | 5 | 4 | 4 | 7.14 | 3.04 | 5.07 | 4.04 | 4.01 |

| Orange | 62 | 56 | 51 | 53 | 60 | 1.99 | 1.79 | 1.61 | 1.67 | 1.88 |

| Placer | 6 | 3 | 2 | 11 | 10 | 1.64 | 0.81 | 0.54 | 2.9 | 2.59 |

| Plumas | 2 | 2 | 2 | 4 | 1 | 10.58 | 10.71 | 10.8 | 21.29 | 5.34 |

| Riverside | 66 | 93 | 87 | 95 | 84 | 2.88 | 4.01 | 3.7 | 3.98 | 3.47 |

| Sacramento | 40 | 35 | 42 | 56 | 53 | 2.74 | 2.37 | 2.81 | 3.7 | 3.46 |

| San Benito | 3 | 5 | 0 | 2 | 2 | 5.23 | 8.62 | 0 | 3.37 | 3.32 |

| San Bernardino | 92 | 90 | 82 | 72 | 88 | 4.41 | 4.28 | 3.87 | 3.37 | 4.08 |

| San Diego | 67 | 71 | 75 | 76 | 78 | 2.08 | 2.18 | 2.28 | 2.29 | 2.34 |

| San Francisco | 11 | 8 | 10 | 12 | 5 | 1.31 | 0.94 | 1.15 | 1.37 | 0.57 |

| San Joaquin | 36 | 26 | 34 | 36 | 35 | 5.12 | 3.64 | 4.7 | 4.9 | 4.7 |

| San Luis Obispo | 8 | 11 | 7 | 8 | 13 | 2.9 | 3.95 | 2.5 | 2.83 | 4.59 |

| San Mateo | 17 | 5 | 12 | 16 | 11 | 2.27 | 0.66 | 1.56 | 2.08 | 1.43 |

| Santa Barbara | 11 | 6 | 10 | 14 | 18 | 2.52 | 1.36 | 2.25 | 3.14 | 4.02 |

| Santa Clara | 28 | 32 | 39 | 33 | 29 | 1.5 | 1.69 | 2.03 | 1.71 | 1.5 |

| Santa Cruz | 7 | 11 | 5 | 4 | 7 | 2.6 | 4.05 | 1.82 | 1.45 | 2.54 |

| Shasta | 6 | 6 | 19 | 4 | 6 | 3.36 | 3.35 | 10.65 | 2.24 | 3.33 |

| Sierra | 1 | 0 | 0 | 0 | 3 | 33 | 0 | 0 | 0 | 100.03 |

| Siskiyou | 1 | 2 | 2 | 2 | 4 | 2.3 | 4.61 | 4.61 | 4.6 | 9.12 |

| Solano | 15 | 22 | 23 | 14 | 6 | 3.53 | 5.12 | 5.29 | 3.18 | 1.35 |

| Sonoma | 5 | 17 | 11 | 12 | 11 | 1.01 | 3.4 | 2.19 | 2.38 | 2.18 |

| Stanislaus | 17 | 27 | 12 | 13 | 17 | 3.24 | 5.1 | 2.24 | 2.4 | 3.1 |

| Sutter | 1 | 1 | 1 | 4 | 9 | 1.06 | 1.05 | 1.05 | 4.16 | 9.31 |

| Tehama | 4 | 6 | 4 | 3 | 1 | 6.36 | 9.55 | 6.34 | 4.73 | 1.56 |

| Trinity | 2 | 5 | 1 | 2 | 0 | 14.9 | 38.1 | 7.64 | 15.58 | 0 |

| Tulare | 8 | 13 | 15 | 13 | 17 | 1.76 | 2.85 | 3.27 | 2.82 | 3.66 |

| Tuolumne | 3 | 2 | 0 | 1 | 2 | 5.55 | 3.71 | 0 | 1.86 | 3.69 |

| Ventura | 19 | 9 | 12 | 16 | 14 | 2.26 | 1.07 | 1.41 | 1.88 | 1.64 |

| Yolo | 7 | 6 | 10 | 9 | 8 | 3.39 | 2.87 | 4.71 | 4.17 | 3.65 |

| Yuba | 2 | 6 | 3 | 5 | 2 | 2.73 | 8.15 | 4.04 | 6.65 | 2.6 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver

While we’ve discussed the consequences of drinking and driving, it’s still worth noting the counties that see the most alcohol-related fatalities in California.

Between 2003 and 2012, the state of California saw 10,327 deaths due to drunk driving, with .9 percent of those deaths being teenager deaths.

| County | Fatalities 2013 | Fatalities 2014 | Fatalities 2015 | Fatalities 2016 | Fatalities 2017 | Fatallitiy Rate per 100K Population 2013 | Fatallitiy Rate per 100K Population 2014 | Fatallitiy Rate per 100K Population 2015 | Fatallitiy Rate per 100K Population 2016 | Fatallitiy Rate per 100K Population 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Alameda | 22 | 17 | 20 | 21 | 33 | 1.39 | 1.05 | 1.22 | 1.27 | 1.98 |

| Alpine | 1 | 0 | 0 | 0 | 2 | 88.73 | 0 | 0 | 0 | 178.57 |

| Amador | 1 | 0 | 2 | 4 | 4 | 2.73 | 0 | 5.4 | 10.67 | 10.36 |

| Butte | 7 | 10 | 14 | 12 | 15 | 3.16 | 4.47 | 6.23 | 5.3 | 6.54 |

| Calaveras | 2 | 4 | 5 | 3 | 6 | 4.48 | 8.95 | 11.12 | 6.62 | 13.14 |

| Colusa | 0 | 1 | 0 | 0 | 4 | 0 | 4.7 | 0 | 0 | 18.34 |

| Contra Costa | 13 | 14 | 19 | 23 | 22 | 1.19 | 1.26 | 1.69 | 2.02 | 1.92 |

| Del Norte | 4 | 2 | 2 | 2 | 3 | 14.37 | 7.35 | 7.34 | 7.29 | 10.92 |

| El Dorado | 16 | 11 | 5 | 5 | 7 | 8.81 | 6 | 2.7 | 2.68 | 3.7 |

| Fresno | 31 | 32 | 29 | 35 | 52 | 3.25 | 3.32 | 2.98 | 3.57 | 5.26 |

| Glenn | 2 | 1 | 2 | 1 | 5 | 7.18 | 3.58 | 7.18 | 3.58 | 17.8 |

| Humboldt | 5 | 11 | 9 | 7 | 16 | 3.72 | 8.17 | 6.66 | 5.13 | 11.7 |

| Imperial | 6 | 9 | 4 | 9 | 5 | 3.38 | 5.03 | 2.22 | 4.97 | 2.73 |

| Inyo | 1 | 0 | 1 | 2 | 3 | 5.44 | 0 | 5.5 | 11.09 | 16.64 |

| Kern | 34 | 33 | 39 | 40 | 48 | 3.94 | 3.78 | 4.43 | 4.52 | 5.37 |

| Kings | 3 | 3 | 8 | 7 | 9 | 1.99 | 2 | 5.32 | 4.67 | 6 |

| Lake | 5 | 2 | 6 | 5 | 6 | 7.83 | 3.12 | 9.33 | 7.82 | 9.34 |

| Lassen | 3 | 1 | 4 | 5 | 1 | 9.34 | 3.15 | 12.74 | 16.16 | 3.21 |

| Los Angeles | 187 | 172 | 149 | 240 | 192 | 1.87 | 1.71 | 1.47 | 2.36 | 1.89 |

| Madera | 2 | 11 | 7 | 15 | 7 | 1.32 | 7.14 | 4.53 | 9.68 | 4.46 |

| Marin | 2 | 4 | 2 | 2 | 3 | 0.77 | 1.53 | 0.76 | 0.76 | 1.15 |

| Mariposa | 2 | 2 | 2 | 2 | 5 | 11.22 | 11.28 | 11.33 | 11.41 | 28.46 |

| Mendocino | 6 | 3 | 1 | 11 | 7 | 6.88 | 3.43 | 1.15 | 12.56 | 7.95 |

| Merced | 14 | 8 | 17 | 21 | 18 | 5.33 | 3.02 | 6.36 | 7.81 | 6.6 |

| Modoc | 1 | 1 | 2 | 0 | 0 | 10.92 | 11.01 | 22.1 | 0 | 0 |

| Mono | 0 | 1 | 2 | 0 | 4 | 0 | 7.11 | 14.33 | 0 | 28.23 |

| Monterey | 3 | 8 | 11 | 16 | 15 | 0.7 | 1.86 | 2.54 | 3.67 | 3.43 |

| Napa | 5 | 1 | 7 | 3 | 4 | 3.57 | 0.71 | 4.95 | 2.12 | 2.84 |

| Nevada | 6 | 1 | 3 | 1 | 5 | 6.12 | 1.01 | 3.04 | 1.01 | 5.01 |

| Orange | 51 | 41 | 49 | 55 | 47 | 1.64 | 1.31 | 1.55 | 1.73 | 1.47 |

| Placer | 5 | 3 | 5 | 10 | 10 | 1.37 | 0.81 | 1.34 | 2.63 | 2.59 |

| Plumas | 1 | 3 | 2 | 1 | 3 | 5.29 | 16.07 | 10.8 | 5.32 | 16.01 |

| Riverside | 81 | 71 | 76 | 92 | 95 | 3.53 | 3.06 | 3.23 | 3.85 | 3.92 |

| Sacramento | 41 | 35 | 47 | 54 | 54 | 2.81 | 2.37 | 3.14 | 3.57 | 3.53 |

| San Benito | 3 | 6 | 1 | 1 | 2 | 5.23 | 10.35 | 1.71 | 1.69 | 3.32 |

| San Bernardino | 67 | 89 | 74 | 80 | 76 | 3.21 | 4.23 | 3.49 | 3.74 | 3.52 |

| San Diego | 54 | 55 | 71 | 83 | 78 | 1.68 | 1.69 | 2.16 | 2.5 | 2.34 |

| San Francisco | 7 | 7 | 7 | 7 | 4 | 0.83 | 0.82 | 0.81 | 0.8 | 0.45 |

| San Joaquin | 34 | 25 | 19 | 43 | 38 | 4.83 | 3.5 | 2.62 | 5.86 | 5.1 |

| San Luis Obispo | 4 | 8 | 12 | 11 | 13 | 1.45 | 2.87 | 4.28 | 3.9 | 4.59 |

| San Mateo | 17 | 4 | 7 | 14 | 6 | 2.27 | 0.53 | 0.91 | 1.82 | 0.78 |

| Santa Barbara | 6 | 8 | 8 | 10 | 15 | 1.38 | 1.82 | 1.8 | 2.24 | 3.35 |

| Santa Clara | 28 | 36 | 30 | 34 | 30 | 1.5 | 1.9 | 1.56 | 1.76 | 1.55 |

| Santa Cruz | 5 | 5 | 8 | 5 | 5 | 1.86 | 1.84 | 2.92 | 1.82 | 1.81 |

| Shasta | 10 | 12 | 11 | 10 | 10 | 5.6 | 6.7 | 6.16 | 5.59 | 5.56 |

| Sierra | 0 | 0 | 1 | 0 | 1 | 0 | 0 | 33.4 | 0 | 33.34 |

| Siskiyou | 2 | 4 | 5 | 2 | 3 | 4.59 | 9.22 | 11.53 | 4.6 | 6.84 |

| Solano | 11 | 11 | 13 | 10 | 12 | 2.59 | 2.56 | 2.99 | 2.27 | 2.69 |

| Sonoma | 7 | 16 | 10 | 12 | 15 | 1.41 | 3.2 | 1.99 | 2.38 | 2.97 |

| Stanislaus | 14 | 23 | 16 | 23 | 26 | 2.67 | 4.34 | 2.99 | 4.25 | 4.75 |

| Sutter | 1 | 2 | 6 | 3 | 8 | 1.06 | 2.11 | 6.28 | 3.12 | 8.28 |

| Tehama | 5 | 5 | 5 | 6 | 5 | 7.95 | 7.96 | 7.92 | 9.46 | 7.82 |

| Trinity | 2 | 5 | 2 | 2 | 2 | 14.9 | 38.1 | 15.28 | 15.58 | 15.74 |

| Tulare | 16 | 13 | 17 | 24 | 30 | 3.53 | 2.85 | 3.71 | 5.21 | 6.46 |

| Tuolumne | 2 | 3 | 7 | 3 | 6 | 3.7 | 5.57 | 13.06 | 5.58 | 11.06 |

| Ventura | 10 | 15 | 11 | 19 | 20 | 1.19 | 1.78 | 1.3 | 2.23 | 2.34 |

| Yolo | 8 | 5 | 7 | 9 | 6 | 3.87 | 2.39 | 3.3 | 4.17 | 2.74 |

| Yuba | 6 | 0 | 3 | 5 | 2 | 8.2 | 0 | 4.04 | 6.65 | 2.6 |

Note that the aforementioned statistics include teenage drivers.

EMS Response Time

If you happen to get in an accident, you’ll need to get in touch with EMS as quickly as you can. California’s EMS have recorded response times that will vary based on where an accident takes place, but in general, you’ll be able to make it from the site of an accident to the hospital in under an hour.