Louisiana Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

Purchasing budget-friendly car insurance anywhere in the United States can prove to be a challenge. In Louisiana, though, calling it a “challenge” is an understatement.

Nowadays, Louisiana’s insurance providers and legislators are working together to try and bring the rates in the state down to a reasonable level. Even so, residents of the Pelican State should keep an eye out for different environmental factors that can negatively impact the rates that providers can make available to them.

If you’re looking for car insurance in Louisiana, don’t feel as though you have to tackle the challenge on your own. Researching and comparing car insurance rates without a little help can make even the calmest of consumers pull their hair out.

That’s why we’re here to help. In this guide to Louisiana’s car insurance providers and rates, we’ll touch on the rates, laws, and state-wide factors that contribute to Louisiana’s infamous rates.

With our help, you’ll be able to find an insurance rate that fits into your budget and protects you from all the wiles that Louisiana’s motorways may throw at you.

If you want to start comparing ASAP, why not take advantage of our FREE online tool? You just need your zip code to get started.

| Louisiana Statistics Summary | Stats |

|---|---|

| Road Miles in State | 48,252 |

| Number of Vehicles Registered | 3,772,692 |

| Population | 4,659,978 |

| Most popular vehicle | F150 |

| Uninsured % | 13% |

| Total Driving Related Deaths | Speeding: 177 DUI: 225 |

| Full Coverage Annual Premiums | Liability: $775.83 Collision: $414.36 Comprehensive: $215.17 |

| Cheapest Providers | USAA and State Farm |

Louisiana Car Insurance Coverage and Rates

There’s no other way to split it:

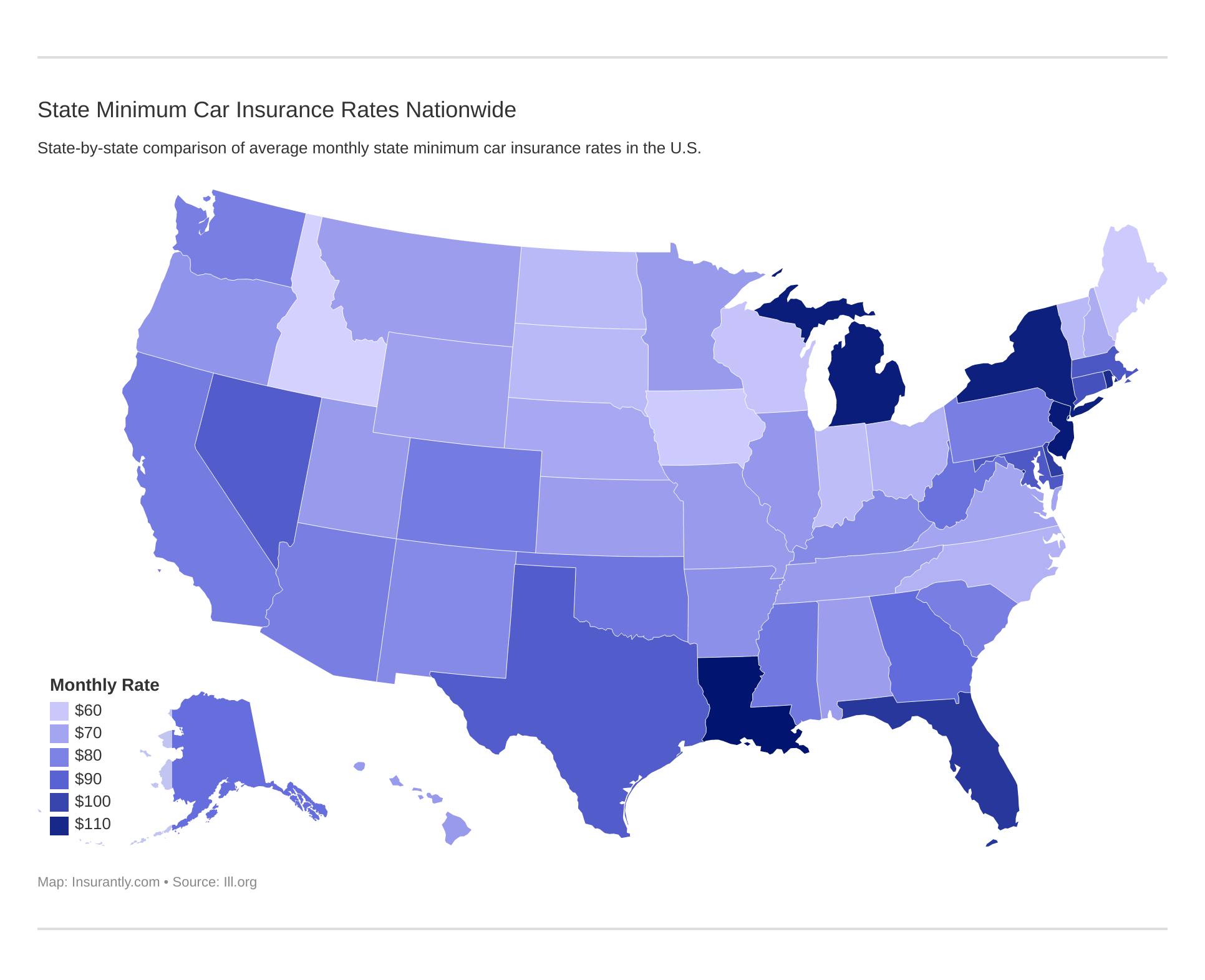

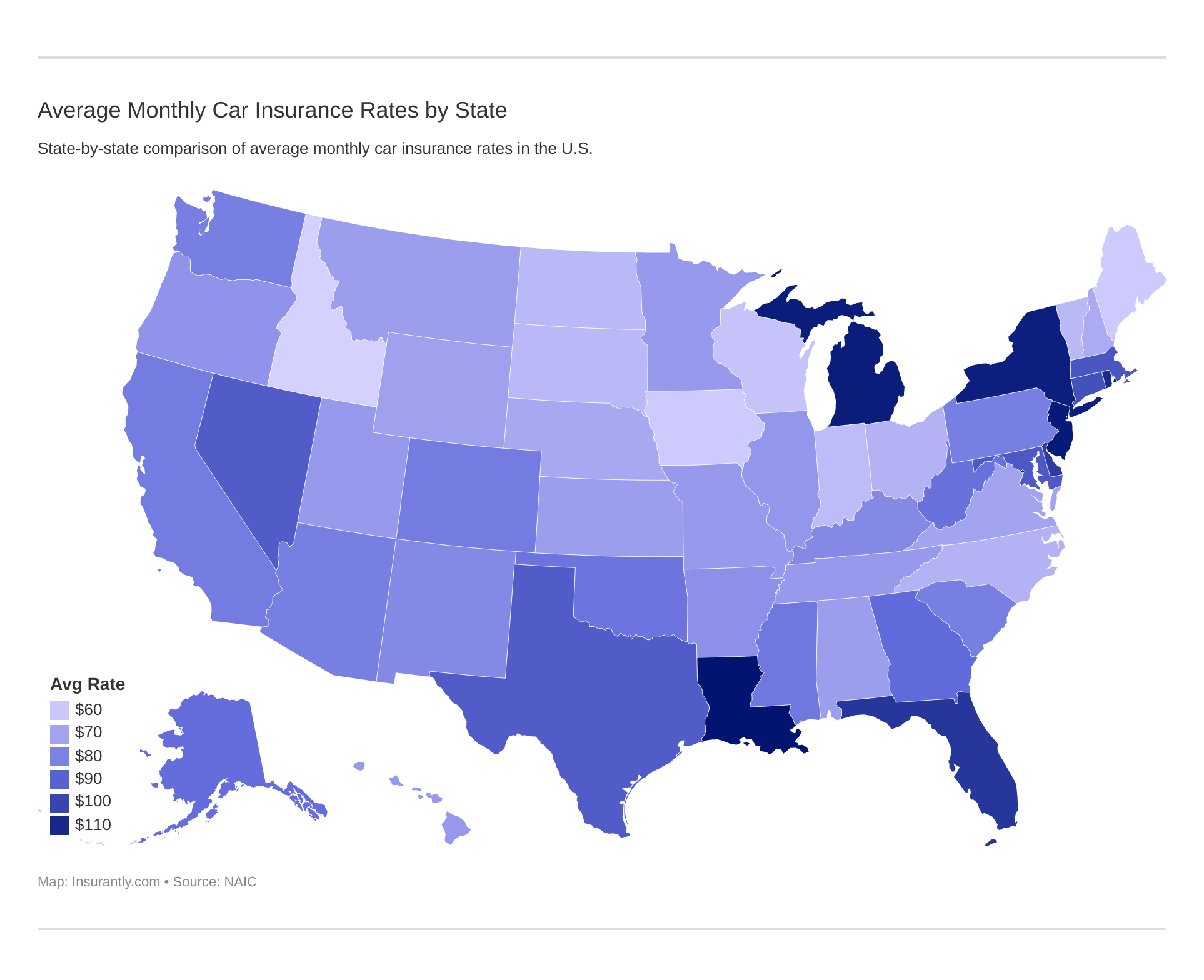

If you live in Louisiana, you’re paying for some of the most expensive car insurance premiums in the country.

We’ll touch on the reasons why later on in this guide. For now, let’s start by looking at the basics.

Minimum Car Insurance Requirements in Louisiana

Every state requires its drivers to meet a minimum liability coverage requirement so that each driver on the road is covered. Louisiana’s minimum required are displayed below:

| Insurance Required | Limits |

|---|---|

| Bodily Injury Coverage | $15,000 per person $30,000 per accident |

| Property Damage Coverage | $25,000 |

In short, Louisiana requires that its drivers have the following:

- $15,000 in injury/death coverage for a single person

- $30,000 in injury/death coverage for more than one person

- $25,000 in coverage for property damage

Why do you need to meet these minimums? Because Louisiana is an at-fault state. That means that one party involved in an accident will be determined the “faulted” party. That party will then be responsible for paying for the whole cost of the accident.

Minimum coverage allows drivers a modicum of financial safety while on the road.

Forms of Financial Responsibility

Louisiana’sOffice of Motor Vehicles will not allow you to register your car with the state government unless you present a representative with proof of insurance, or a form of financial responsibility. Do note that these terms are interchangeable.

You need proof of insurance for more than just registering your car. You should always carry proof of insurance with you while on the road, just in case you happened to get pulled over. Proof of insurance ensures that you won’t be wrongly charged for driving without coverage.

Proof of insurance in Louisiana includes:

- An insurance card

- A copy of your insurance policy

- A copy of your policy declaration page

- Unencumbered negotiable securities worth a minimum of $30,000

- A surety bond worth $30,000

- A statement from your insurer that is a) printed on company letterhead, b) signed by your insurance agent or a company representative, c) completely and accurately describe the vehicle you are presently in, and d) include your VIN

Premiums as a Percentage of Income

Every year, you’ll have to dedicate a percentage of your income to your car insurance payment. When you’re doing your initial policy shopping, it’s good to know just how much money you have to spend on a policy.

In 2014, Louisiana’s annual per capital disposable personal income registered at $37,787. After residents paid their taxes, they had an average monthly budget of $3,148.

The average cost of car insurance in that same year in Louisiana came in at $1,364. Every month, then, Louisiana residents paid an average of $125 to continue their car insurance coverage.

That DPI percentage — a whopping 3.6 percent — is the highest in the United States, second only to Michigan.

Read more: Michigan Car Insurance (The Only Guide You’ll Ever Need)

Average Monthly Car Insurance Rates in LA (Liability, Collision, Comprehensive)

That said, there are different types of coverage available to all drivers in Louisiana. Take a look at the breakdown, as according to the National Association of Insurance Commissioners, below:

| Coverage Types | Annual Costs in 2015 |

|---|---|

| Liability | $775.83 |

| Collision | $414.36 |

| Comprehensive | $215.17 |

| Combined | $1,405.36 |

It’s worth noting that the national average for full coverage across the United States is $1,009.38. As you can see in the table above, Louisiana’s average annual cost of that same coverage comes in at over $400 more expensive.

Additional Liability

To continue driving home Louisiana’s expensive point, the vast majority of car insurance providers recommend that drivers — especially those operating in at-fault states — purchase more than their state’s minimum liability coverage.

Why?

Because if you happen to be at-fault in an accident, it’ll be on you to pay off both your and the other party’s expenses.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (Med Pay) | 85.88 | 85.62 | 86.66 |

| Uninsured/Underinsured Motorist | 92.10 | 100.11 | 99.68 |

The above table makes note of the loss ratios that both Med Pay and Uninsured/Underinsured insurance have garnered in the past. These numbers are notable because they reveal how much money car insurance providers, on average, spend on claims versus how much they take in on premiums.

In short, the closer a loss ratio is to 100 percent, the more claims the company in question pays. That said, a company at 100 percent loss ratio is also losing money. Comparatively, companies with lower loss ratios aren’t paying out on their clients’ claims.

When shopping for car insurance, you’ll want to look for a company with a loss ratio somewhere in the 60 to 70 percent range.

Add-ons, Endorsements, and Riders

You can explore additional, optional coverage by considering some of the add-ons below. Click on the available links to learn more:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

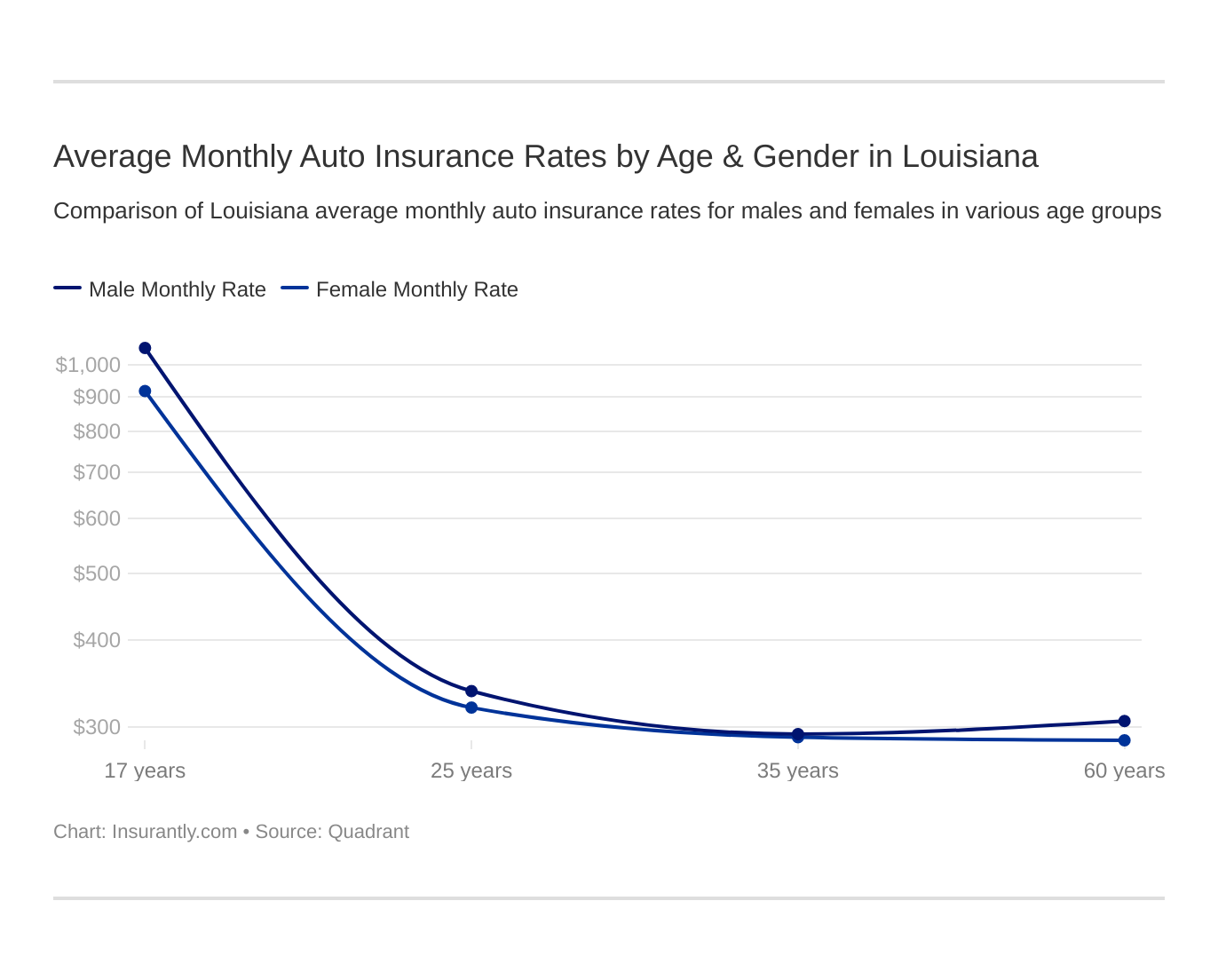

Male vs. Female Rates

There’s an old myth that claims men have to pay more for their car insurance than women do. As it turns out, this isn’t always the case:

| Company | Married 35-year Old Female | Married 35-year Old Male | Married 60-year Old Female | Married 60-year Old Male | Single 25-year Old Female | Single 25-year Old Male | Single 17-year Old Female | Single 17-year Old Male | Average Rate (Over 17) | Average Rate (17 year olds) | The Difference |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Allstate | $4,254.40 | $4,254.40 | $4,394.91 | $4,394.91 | $4,694.46 | $5,083.73 | $9,256.33 | $11,657.16 | $4,512.80 | $10,456.75 | $5,943.94 |

| Geico | $3,430.68 | $3,952.72 | $4,103.66 | $5,009.51 | $3,309.53 | $3,204.45 | $12,767.36 | $13,458.88 | $3,835.09 | $13,113.12 | $9,278.03 |

| Progressive | $4,158.02 | $3,880.90 | $3,483.46 | $3,762.32 | $4,746.19 | $4,834.20 | $16,529.91 | $18,373.77 | $4,144.18 | $17,451.84 | $13,307.66 |

| State Farm | $2,851.05 | $2,851.05 | $2,619.17 | $2,619.17 | $3,180.57 | $3,569.11 | $8,404.12 | $10,538.72 | $2,948.35 | $9,471.42 | $6,523.07 |

| USAA | $2,678.38 | $2,634.64 | $2,612.63 | $2,591.11 | $3,286.33 | $3,597.39 | $8,021.04 | $9,403.41 | $2,900.08 | $8,712.23 | $5,812.15 |

As drivers age, though, premiums tend to even out. By the time drivers hit middle age, as you can see above, the premiums they’ll see should be balanced. In some cases, women even have to pay more than their male companions!

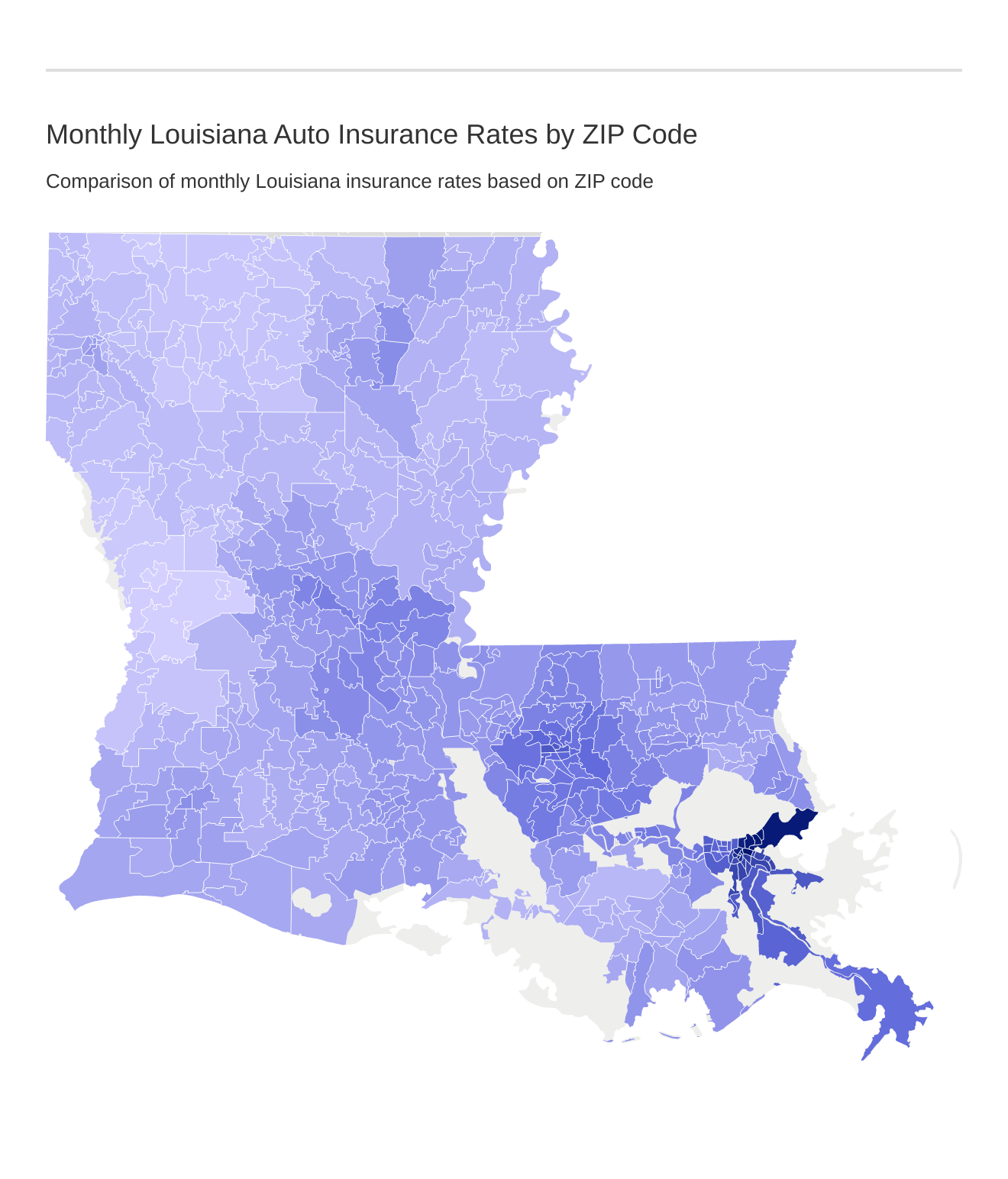

Cheapest Rates by Zip Code

It’s not just age and gender than can impact the premium you’re offered. Your zip code can have a significant impact on your initial rate, as you can see below:

| Zipcode | Highest Average Rate | Zipcode | Lowest Average Rate |

|---|---|---|---|

| 70117 | $9,303.50 | 71439 | $4,332.48 |

| 70127 | $9,249.23 | 71443 | $4,355.93 |

| 70128 | $9,203.05 | 71459 | $4,397.96 |

| 70126 | $9,155.48 | 71446 | $4,408.37 |

| 70129 | $9,123.75 | 71403 | $4,430.85 |

| 70113 | $9,085.51 | 71474 | $4,435.33 |

| 70145 | $9,034.55 | 71461 | $4,440.21 |

| 70146 | $9,034.55 | 71475 | $4,471.44 |

| 70116 | $9,013.80 | 71075 | $4,474.44 |

| 70122 | $8,940.09 | 71429 | $4,476.94 |

| 70148 | $8,877.46 | 71071 | $4,477.35 |

| 70119 | $8,860.80 | 71449 | $4,546.33 |

| 70139 | $8,675.04 | 71426 | $4,568.59 |

| 70163 | $8,547.15 | 71486 | $4,580.26 |

| 70130 | $8,542.14 | 71462 | $4,587.34 |

| 70112 | $8,540.11 | 71468 | $4,591.96 |

| 70170 | $8,521.57 | 71016 | $4,592.82 |

| 70125 | $8,459.50 | 71072 | $4,595.44 |

| 70114 | $8,180.81 | 71048 | $4,601.27 |

| 70032 | $8,001.83 | 71001 | $4,604.07 |

| 70058 | $7,919.05 | 71045 | $4,608.94 |

| 70131 | $7,899.82 | 71460 | $4,610.51 |

| 70053 | $7,895.98 | 71406 | $4,610.84 |

| 70072 | $7,857.95 | 71068 | $4,613.19 |

| 70043 | $7,852.33 | 71038 | $4,630.28 |

| 70056 | $7,824.69 | 71040 | $4,632.87 |

| 70092 | $7,818.35 | 71003 | $4,639.42 |

| 70075 | $7,760.22 | 71024 | $4,639.92 |

| 70118 | $7,747.84 | 71028 | $4,641.55 |

| 70115 | $7,732.02 | 70659 | $4,645.62 |

| 70085 | $7,346.93 | 71064 | $4,645.70 |

| 70062 | $7,340.04 | 71039 | $4,650.77 |

| 70805 | $7,334.20 | 71256 | $4,654.01 |

| 70037 | $7,306.56 | 71268 | $4,657.55 |

| 70812 | $7,301.04 | 70639 | $4,658.17 |

| 70067 | $7,282.71 | 71055 | $4,660.13 |

| 70036 | $7,257.44 | 71079 | $4,660.84 |

| 70082 | $7,254.34 | 71251 | $4,663.50 |

| 70124 | $7,206.30 | 70653 | $4,664.29 |

| 70814 | $7,180.13 | 70634 | $4,665.62 |

| 70065 | $7,161.92 | 71222 | $4,674.32 |

| 70094 | $7,150.36 | 71275 | $4,677.70 |

| 70801 | $7,118.77 | 71080 | $4,677.85 |

| 70040 | $7,070.65 | 71247 | $4,678.96 |

| 70002 | $7,066.36 | 71073 | $4,685.29 |

| 70802 | $7,033.77 | 71277 | $4,688.61 |

| 70003 | $7,033.74 | 71008 | $4,689.21 |

| 70006 | $7,027.62 | 71270 | $4,690.53 |

| 70792 | $7,025.29 | 71419 | $4,693.28 |

| 70121 | $7,015.83 | 71065 | $4,699.98 |

| 70738 | $7,011.06 | 71018 | $4,714.83 |

| 70005 | $7,010.97 | 71245 | $4,726.31 |

| 70001 | $7,002.78 | 71110 | $4,727.74 |

| 70093 | $6,989.21 | 71235 | $4,736.22 |

| 70083 | $6,988.27 | 71067 | $4,753.20 |

| 70811 | $6,947.41 | 71037 | $4,756.05 |

| 70825 | $6,939.10 | 71272 | $4,765.72 |

| 70815 | $6,926.34 | 71052 | $4,766.89 |

| 70807 | $6,904.20 | 71452 | $4,789.46 |

| 70123 | $6,871.22 | 71029 | $4,793.33 |

| 70819 | $6,845.44 | 71457 | $4,796.31 |

| 70806 | $6,814.23 | 71450 | $4,797.79 |

| 70818 | $6,807.96 | 71006 | $4,798.33 |

| 70726 | $6,776.73 | 71023 | $4,799.07 |

| 70081 | $6,775.22 | 71070 | $4,817.83 |

| 70827 | $6,759.59 | 71063 | $4,817.94 |

| 70041 | $6,756.68 | 71111 | $4,824.86 |

| 70091 | $6,749.62 | 71019 | $4,834.32 |

| 70714 | $6,694.24 | 71044 | $4,835.35 |

| 70719 | $6,692.25 | 71002 | $4,838.19 |

| 70836 | $6,681.68 | 71230 | $4,838.30 |

| 70816 | $6,665.48 | 71324 | $4,838.30 |

| 70739 | $6,620.59 | 71049 | $4,839.58 |

| 70767 | $6,608.68 | 71069 | $4,842.92 |

| 70706 | $6,580.44 | 71411 | $4,845.05 |

| 70810 | $6,558.95 | 71456 | $4,845.44 |

| 70769 | $6,544.80 | 71082 | $4,846.74 |

| 70813 | $6,542.04 | 71469 | $4,851.25 |

| 70786 | $6,539.93 | 71232 | $4,852.48 |

| 70087 | $6,532.10 | 71066 | $4,853.47 |

| 70809 | $6,527.54 | 71414 | $4,853.47 |

| 70776 | $6,516.44 | 71034 | $4,854.61 |

| 70817 | $6,502.58 | 71428 | $4,856.89 |

| 70076 | $6,499.95 | 71061 | $4,858.20 |

| 70084 | $6,484.83 | 71243 | $4,862.01 |

| 70785 | $6,478.62 | 71249 | $4,862.01 |

| 70803 | $6,476.80 | 71051 | $4,866.20 |

| 70051 | $6,457.92 | 71260 | $4,867.89 |

| 71359 | $6,449.41 | 71032 | $4,884.44 |

| 70788 | $6,434.24 | 71480 | $4,885.54 |

| 70031 | $6,432.59 | 71282 | $4,889.41 |

| 70710 | $6,429.37 | 71295 | $4,900.73 |

| 70449 | $6,427.45 | 71050 | $4,901.10 |

| 70733 | $6,425.41 | 71043 | $4,902.77 |

| 70774 | $6,416.76 | 71479 | $4,905.83 |

| 70780 | $6,416.16 | 71060 | $4,907.18 |

| 70734 | $6,402.82 | 71471 | $4,913.03 |

| 70729 | $6,399.28 | 71422 | $4,915.10 |

| 70721 | $6,395.14 | 71112 | $4,915.77 |

| 70778 | $6,363.35 | 71410 | $4,921.95 |

| 70737 | $6,362.71 | 71440 | $4,938.05 |

| 70764 | $6,354.68 | 71483 | $4,938.22 |

| 70770 | $6,341.58 | 71027 | $4,940.23 |

| 70728 | $6,340.37 | 71233 | $4,942.62 |

| 71301 | $6,332.95 | 71241 | $4,944.62 |

| 71302 | $6,315.66 | 70301 | $4,945.12 |

| 70079 | $6,304.63 | 71425 | $4,959.59 |

| 70725 | $6,294.02 | 71105 | $4,963.35 |

| 70754 | $6,262.62 | 70392 | $4,967.95 |

| 70718 | $6,255.12 | 71078 | $4,973.76 |

| 70820 | $6,246.23 | 70660 | $4,975.14 |

| 71351 | $6,238.19 | 71219 | $4,980.21 |

| 70791 | $6,237.30 | 71342 | $4,981.09 |

| 70808 | $6,212.81 | 71046 | $4,984.64 |

| 71341 | $6,211.59 | 70656 | $4,988.30 |

| 70462 | $6,206.02 | 71473 | $5,000.91 |

| 70068 | $6,204.45 | 71465 | $5,001.82 |

| 70052 | $6,200.11 | 71004 | $5,002.12 |

| 70777 | $6,195.69 | 71030 | $5,003.23 |

| 70730 | $6,186.88 | 71336 | $5,007.82 |

| 70047 | $6,182.60 | 71031 | $5,009.77 |

| 71331 | $6,169.88 | 71340 | $5,011.45 |

| 70763 | $6,166.52 | 71357 | $5,011.68 |

| 70723 | $6,157.22 | 70662 | $5,018.43 |

| 71303 | $6,154.73 | 71401 | $5,022.30 |

| 71322 | $6,153.13 | 71415 | $5,022.51 |

| 71355 | $6,142.36 | 71441 | $5,022.51 |

| 71350 | $6,139.16 | 71033 | $5,026.41 |

| 70740 | $6,123.33 | 71007 | $5,026.83 |

| 70057 | $6,094.67 | 71276 | $5,026.84 |

| 70736 | $6,083.93 | 71286 | $5,029.89 |

| 70722 | $6,083.12 | 71404 | $5,030.42 |

| 70039 | $6,082.66 | 71435 | $5,032.28 |

| 70789 | $6,078.89 | 71363 | $5,036.79 |

| 71367 | $6,078.82 | 71237 | $5,037.57 |

| 70071 | $6,055.12 | 71047 | $5,042.96 |

| 70761 | $6,041.85 | 70310 | $5,044.37 |

| 70049 | $6,038.84 | 70591 | $5,046.65 |

| 71320 | $6,034.19 | 71377 | $5,052.96 |

| 70460 | $6,029.95 | 71115 | $5,054.94 |

| 70773 | $6,022.62 | 71334 | $5,055.96 |

| 70086 | $6,017.20 | 70652 | $5,057.64 |

| 70453 | $6,013.38 | 71227 | $5,060.30 |

| 71330 | $6,009.54 | 71218 | $5,060.43 |

| 70524 | $6,009.01 | 71378 | $5,064.92 |

| 70586 | $6,007.69 | 71368 | $5,065.91 |

| 70341 | $6,002.95 | 71343 | $5,070.64 |

| 71333 | $5,990.63 | 71254 | $5,070.84 |

| 70346 | $5,990.28 | 70342 | $5,071.03 |

| 70403 | $5,986.52 | 70380 | $5,076.36 |

| 70421 | $5,984.89 | 71366 | $5,082.18 |

| 70744 | $5,984.70 | 71250 | $5,083.10 |

| 70455 | $5,984.64 | 71279 | $5,086.48 |

| 70576 | $5,980.02 | 71375 | $5,088.06 |

| 70585 | $5,980.02 | 70372 | $5,088.83 |

| 71202 | $5,977.73 | 70538 | $5,092.16 |

| 70748 | $5,977.70 | 71107 | $5,092.43 |

| 71348 | $5,969.26 | 71269 | $5,093.57 |

| 71369 | $5,969.01 | 71264 | $5,093.69 |

| 70358 | $5,964.63 | 70395 | $5,094.15 |

| 70580 | $5,961.98 | 70352 | $5,098.58 |

| 70070 | $5,953.09 | 70364 | $5,112.05 |

| 70711 | $5,947.14 | 71223 | $5,112.69 |

| 71362 | $5,942.83 | 71266 | $5,113.61 |

| 70752 | $5,942.66 | 70549 | $5,115.09 |

| 70554 | $5,930.78 | 71259 | $5,115.72 |

| 70458 | $5,929.32 | 71434 | $5,121.33 |

| 70436 | $5,926.89 | 70657 | $5,125.34 |

| 70501 | $5,917.81 | 70637 | $5,138.41 |

| 70601 | $5,914.32 | 71263 | $5,141.88 |

| 71339 | $5,912.26 | 71371 | $5,143.25 |

| 70782 | $5,902.58 | 71326 | $5,149.81 |

| 70461 | $5,902.24 | 71416 | $5,153.77 |

| 70454 | $5,882.16 | 71280 | $5,158.80 |

| 70445 | $5,877.10 | 71129 | $5,165.17 |

| 70749 | $5,869.96 | 71119 | $5,169.22 |

| 71345 | $5,863.48 | 70360 | $5,174.33 |

| 70456 | $5,857.51 | 71373 | $5,177.17 |

| 71327 | $5,855.37 | 70359 | $5,178.86 |

| 71203 | $5,855.14 | 70581 | $5,182.11 |

| 70753 | $5,850.05 | 70356 | $5,186.66 |

| 71356 | $5,846.26 | 70633 | $5,189.62 |

| 70772 | $5,834.62 | 71226 | $5,192.78 |

| 71329 | $5,832.51 | 70447 | $5,199.02 |

| 70402 | $5,829.64 | 70514 | $5,199.59 |

| 70401 | $5,820.05 | 70546 | $5,200.88 |

| 71365 | $5,816.23 | 71432 | $5,207.54 |

| 70357 | $5,814.56 | 71242 | $5,209.60 |

| 71405 | $5,807.23 | 71253 | $5,209.60 |

| 71360 | $5,806.72 | 70433 | $5,210.88 |

| 70344 | $5,804.03 | 70522 | $5,215.06 |

| 71323 | $5,800.00 | 70540 | $5,215.06 |

| 70354 | $5,795.38 | 70537 | $5,217.42 |

| 70762 | $5,795.30 | 70640 | $5,224.96 |

| 71346 | $5,791.34 | 71234 | $5,229.17 |

| 70506 | $5,788.14 | 71118 | $5,232.10 |

| 71325 | $5,782.65 | 70644 | $5,240.58 |

| 70503 | $5,778.85 | 70448 | $5,245.09 |

| 70615 | $5,775.18 | 70650 | $5,259.25 |

| 70517 | $5,774.33 | 70645 | $5,270.39 |

| 70583 | $5,773.98 | 70648 | $5,275.18 |

| 70465 | $5,771.41 | 71229 | $5,277.80 |

| 70756 | $5,769.12 | 71238 | $5,279.01 |

| 70757 | $5,767.27 | 70531 | $5,279.16 |

| 70715 | $5,765.28 | 70523 | $5,284.73 |

| 70784 | $5,762.35 | 71455 | $5,284.73 |

| 70787 | $5,762.35 | 70363 | $5,285.68 |

| 71409 | $5,759.78 | 70543 | $5,287.17 |

| 70747 | $5,755.09 | 70556 | $5,289.01 |

| 70427 | $5,754.64 | 71354 | $5,290.62 |

| 71358 | $5,754.57 | 70532 | $5,291.15 |

| 71485 | $5,746.82 | 71291 | $5,292.91 |

| 71108 | $5,746.69 | 70658 | $5,295.76 |

| 70467 | $5,739.96 | 71104 | $5,296.44 |

| 71328 | $5,739.48 | 70394 | $5,296.79 |

| 70080 | $5,737.15 | 70661 | $5,297.68 |

| 70589 | $5,737.11 | 71454 | $5,298.13 |

| 70443 | $5,732.27 | 70548 | $5,302.06 |

| 70760 | $5,731.76 | 70534 | $5,303.25 |

| 70570 | $5,731.23 | 70544 | $5,305.58 |

| 70592 | $5,730.58 | 70559 | $5,307.78 |

| 70508 | $5,728.78 | 70516 | $5,309.21 |

| 70466 | $5,728.50 | 70375 | $5,312.37 |

| 71477 | $5,727.25 | 70654 | $5,315.50 |

| 71431 | $5,719.30 | 70471 | $5,316.94 |

| 70446 | $5,717.24 | 70643 | $5,324.60 |

| 70513 | $5,716.36 | 70374 | $5,324.61 |

| 70441 | $5,715.66 | 70343 | $5,327.46 |

| 71424 | $5,712.28 | 71101 | $5,327.47 |

| 71209 | $5,710.81 | 70373 | $5,330.37 |

| 71212 | $5,710.81 | 70632 | $5,334.20 |

| 70393 | $5,707.98 | 70515 | $5,340.46 |

| 70605 | $5,706.10 | 70397 | $5,342.07 |

| 70755 | $5,704.60 | 70651 | $5,345.41 |

| 70529 | $5,702.92 | 71261 | $5,351.50 |

| 70519 | $5,699.49 | 71427 | $5,365.27 |

| 71353 | $5,699.14 | 70647 | $5,368.14 |

| 70577 | $5,694.74 | 70631 | $5,372.44 |

| 71448 | $5,692.98 | 70464 | $5,373.04 |

| 70518 | $5,689.41 | 70355 | $5,374.93 |

| 70560 | $5,687.75 | 70542 | $5,382.91 |

| 70552 | $5,687.29 | 70655 | $5,387.81 |

| 70353 | $5,682.38 | 70431 | $5,395.68 |

| 70426 | $5,681.82 | 71418 | $5,396.82 |

| 70712 | $5,679.71 | 70668 | $5,398.24 |

| 70750 | $5,675.98 | 70526 | $5,414.78 |

| 70452 | $5,675.26 | 70090 | $5,417.96 |

| 70504 | $5,675.00 | 71447 | $5,420.14 |

| 70444 | $5,668.65 | 70528 | $5,421.79 |

| 70775 | $5,668.29 | 70377 | $5,427.02 |

| 70582 | $5,666.31 | 71467 | $5,434.90 |

| 70507 | $5,665.07 | 70420 | $5,445.30 |

| 70520 | $5,655.10 | 71225 | $5,447.19 |

| 70575 | $5,650.08 | 70578 | $5,447.80 |

| 70783 | $5,649.05 | 71407 | $5,449.77 |

| 70584 | $5,646.94 | 71109 | $5,453.14 |

| 70438 | $5,646.11 | 70345 | $5,455.31 |

| 70609 | $5,644.94 | 71316 | $5,464.98 |

| 70629 | $5,644.94 | 71106 | $5,467.22 |

| 70437 | $5,643.22 | 70535 | $5,472.19 |

| 70732 | $5,640.33 | 70663 | $5,473.48 |

| 71292 | $5,637.72 | 71472 | $5,476.28 |

| 70510 | $5,637.13 | 70533 | $5,478.38 |

| 71430 | $5,634.27 | 71417 | $5,490.13 |

| 70450 | $5,627.59 | 70630 | $5,492.98 |

| 70563 | $5,624.06 | 70555 | $5,497.94 |

| 71240 | $5,611.83 | 71433 | $5,502.09 |

| 71201 | $5,611.17 | 71220 | $5,502.64 |

| 70463 | $5,603.34 | 70646 | $5,504.82 |

| 70442 | $5,603.21 | 71466 | $5,505.73 |

| 70457 | $5,603.03 | 70611 | $5,506.39 |

| 70422 | $5,602.02 | 70030 | $5,511.13 |

| 70390 | $5,591.04 | 70638 | $5,512.15 |

| 70759 | $5,586.74 | 71463 | $5,518.58 |

| 71438 | $5,583.70 | 70525 | $5,519.96 |

| 70607 | $5,583.31 | 70512 | $5,529.89 |

| 70665 | $5,574.77 | 70669 | $5,532.66 |

| 71103 | $5,562.83 | 70435 | $5,533.74 |

| 71423 | $5,557.97 | 70339 | $5,545.61 |

Let’s take a closer look at how ZIP codes affect car insurance in Louisiana.

Cheapest Rates by City

Your offered car insurance rate will vary based on the city you live in:

| City | Average |

|---|---|

| Abbeville | $5,637.13 |

| Abita Springs | $5,445.30 |

| Acme | $5,464.98 |

| Addis | $6,429.37 |

| Aimwell | $5,022.30 |

| Akers | $5,984.89 |

| Albany | $5,947.14 |

| Alexandria | $6,267.78 |

| Ama | $6,432.59 |

| Amite | $5,602.02 |

| Anacoco | $4,430.85 |

| Angie | $5,681.82 |

| Angola | $5,679.71 |

| Arabi | $8,001.83 |

| Arcadia | $4,604.07 |

| Archibald | $5,060.43 |

| Arnaudville | $5,529.89 |

| Ashland | $4,838.19 |

| Athens | $4,639.43 |

| Atlanta | $5,030.42 |

| Avery Island | $5,716.36 |

| Baker | $6,694.24 |

| Baldwin | $5,199.59 |

| Ball | $5,807.23 |

| Barataria | $7,257.44 |

| Barksdale Afb | $4,727.74 |

| Basile | $5,340.46 |

| Baskin | $4,980.21 |

| Bastrop | $5,502.65 |

| Batchelor | $5,765.28 |

| Baton Rouge | $6,787.56 |

| Belcher | $5,002.11 |

| Bell City | $5,492.97 |

| Belle Chasse | $7,147.89 |

| Belle Rose | $6,002.95 |

| Belmont | $4,610.84 |

| Bentley | $5,449.77 |

| Benton | $4,798.33 |

| Bernice | $4,674.32 |

| Berwick | $5,071.03 |

| Bethany | $5,026.83 |

| Bienville | $4,689.21 |

| Bogalusa | $5,754.64 |

| Bonita | $5,112.69 |

| Bordelonville | $6,034.19 |

| Bossier City | $4,870.32 |

| Bourg | $5,327.46 |

| Boutte | $6,082.66 |

| Boyce | $5,759.78 |

| Braithwaite | $7,070.65 |

| Branch | $5,309.21 |

| Breaux Bridge | $5,774.33 |

| Brittany | $6,255.13 |

| Broussard | $5,689.41 |

| Brusly | $6,692.25 |

| Bunkie | $6,153.13 |

| Buras | $6,756.68 |

| Burnside | $7,011.06 |

| Bush | $5,395.68 |

| Cade | $5,699.49 |

| Calhoun | $5,447.19 |

| Calvin | $4,921.95 |

| Cameron | $5,372.44 |

| Campti | $4,845.05 |

| Carencro | $5,655.10 |

| Carville | $6,395.14 |

| Castor | $4,592.82 |

| Center Point | $5,800.00 |

| Centerville | $5,215.06 |

| Chalmette | $7,852.33 |

| Charenton | $5,284.73 |

| Chase | $4,838.30 |

| Chataignier | $6,009.01 |

| Chatham | $5,192.78 |

| Chauvin | $5,804.03 |

| Cheneyville | $5,782.65 |

| Choudrant | $5,060.30 |

| Church Point | $5,519.95 |

| Clarence | $4,853.47 |

| Clarks | $5,022.51 |

| Clayton | $5,149.81 |

| Clinton | $6,083.11 |

| Cloutierville | $5,153.77 |

| Colfax | $5,490.13 |

| Collinston | $5,277.80 |

| Columbia | $5,396.82 |

| Convent | $6,157.22 |

| Converse | $4,693.28 |

| Cotton Valley | $4,714.83 |

| Cottonport | $5,855.37 |

| Coushatta | $4,834.32 |

| Covington | $5,372.31 |

| Creole | $5,334.20 |

| Crowley | $5,414.78 |

| Crowville | $4,838.30 |

| Cut Off | $5,455.31 |

| Darrow | $6,294.02 |

| Delcambre | $5,421.79 |

| Delhi | $4,852.47 |

| Delta | $4,942.62 |

| Denham Springs | $6,678.59 |

| Dequincy | $5,189.62 |

| Deridder | $4,665.62 |

| Des Allemands | $5,511.12 |

| Destrehan | $6,182.60 |

| Deville | $5,739.48 |

| Dodson | $4,915.10 |

| Donaldsonville | $5,990.29 |

| Donner | $5,098.58 |

| Downsville | $5,229.17 |

| Doyline | $4,799.07 |

| Dry Creek | $5,138.41 |

| Dry Prong | $5,557.97 |

| Dubach | $4,736.22 |

| Dubberly | $4,639.92 |

| Dulac | $5,682.38 |

| Duplessis | $6,340.37 |

| Dupont | $5,832.51 |

| Duson | $5,702.92 |

| Echo | $6,009.54 |

| Edgard | $6,038.84 |

| Effie | $6,169.88 |

| Egan | $5,279.16 |

| Elizabeth | $5,512.15 |

| Elm Grove | $4,866.20 |

| Elmer | $5,712.28 |

| Elton | $5,291.15 |

| Enterprise | $4,959.59 |

| Epps | $5,037.57 |

| Erath | $5,478.38 |

| Eros | $5,279.01 |

| Erwinville | $6,399.28 |

| Estherwood | $5,303.25 |

| Ethel | $6,186.88 |

| Eunice | $5,472.20 |

| Evangeline | $5,217.42 |

| Evans | $4,658.17 |

| Evergreen | $5,990.63 |

| Fairbanks | $5,611.83 |

| Farmerville | $4,944.62 |

| Fenton | $5,224.96 |

| Ferriday | $5,055.96 |

| Fisher | $4,568.59 |

| Flatwoods | $5,365.27 |

| Flora | $4,856.89 |

| Florien | $4,476.94 |

| Fluker | $5,926.89 |

| Folsom | $5,643.22 |

| Fordoche | $5,640.33 |

| Forest | $5,209.60 |

| Forest Hill | $5,634.27 |

| Fort Necessity | $4,862.01 |

| Fort Polk | $4,397.96 |

| Franklin | $5,092.16 |

| Franklinton | $5,646.10 |

| French Settlement | $6,425.41 |

| Frierson | $4,940.23 |

| Galliano | $5,795.38 |

| Garden City | $5,215.06 |

| Gardner | $5,719.30 |

| Garyville | $6,457.92 |

| Geismar | $6,402.82 |

| Georgetown | $5,207.55 |

| Gheens | $5,374.93 |

| Gibsland | $4,641.55 |

| Gibson | $5,186.66 |

| Gilbert | $5,007.82 |

| Gilliam | $4,793.33 |

| Glenmora | $5,502.10 |

| Gloster | $5,003.23 |

| Glynn | $6,083.93 |

| Golden Meadow | $5,814.56 |

| Goldonna | $5,009.76 |

| Gonzales | $6,362.71 |

| Gorum | $5,121.33 |

| Grambling | $4,726.31 |

| Gramercy | $6,200.11 |

| Grand Cane | $4,884.44 |

| Grand Chenier | $5,324.60 |

| Grand Isle | $5,964.63 |

| Grant | $5,240.58 |

| Gray | $5,178.86 |

| Grayson | $5,032.28 |

| Greensburg | $5,715.66 |

| Greenwell Springs | $6,620.59 |

| Greenwood | $5,026.41 |

| Gretna | $7,860.34 |

| Grosse Tete | $6,123.33 |

| Gueydan | $5,382.91 |

| Hackberry | $5,270.39 |

| Hahnville | $6,094.67 |

| Hall Summit | $4,854.61 |

| Hamburg | $5,912.26 |

| Hammond | $5,878.74 |

| Harrisonburg | $5,011.45 |

| Harvey | $7,919.05 |

| Haughton | $4,756.05 |

| Hayes | $5,504.82 |

| Haynesville | $4,630.28 |

| Heflin | $4,650.77 |

| Hessmer | $6,211.59 |

| Hineston | $5,583.70 |

| Hodge | $4,678.96 |

| Holden | $5,984.70 |

| Homer | $4,632.87 |

| Hornbeck | $4,332.48 |

| Hosston | $4,902.77 |

| Houma | $5,190.69 |

| Husser | $5,603.21 |

| Ida | $4,835.35 |

| Independence | $5,732.27 |

| Innis | $5,755.09 |

| Iota | $5,287.17 |

| Iowa | $5,368.15 |

| Jackson | $5,977.70 |

| Jamestown | $4,608.94 |

| Jarreau | $5,869.96 |

| Jeanerette | $5,305.58 |

| Jena | $4,981.09 |

| Jennings | $5,200.88 |

| Jigger | $4,862.01 |

| Jones | $5,083.10 |

| Jonesboro | $4,663.50 |

| Jonesville | $5,070.64 |

| Joyce | $4,938.05 |

| Kaplan | $5,302.06 |

| Keatchie | $4,984.64 |

| Keithville | $5,042.96 |

| Kelly | $5,022.51 |

| Kenner | $7,250.98 |

| Kentwood | $5,668.65 |

| Kilbourne | $5,209.60 |

| Kinder | $5,275.18 |

| Krotz Springs | $5,675.98 |

| Kurthwood | $4,355.93 |

| La Place | $6,204.45 |

| Labadieville | $5,088.83 |

| Lacassine | $5,259.25 |

| Lacombe | $5,877.09 |

| Lafayette | $5,758.94 |

| Lafitte | $7,282.72 |

| Lake Arthur | $5,115.09 |

| Lake Charles | $5,682.17 |

| Lake Providence | $5,070.84 |

| Lakeland | $5,942.66 |

| Larose | $5,330.37 |

| Lebeau | $5,863.48 |

| Leblanc | $5,345.41 |

| Lecompte | $5,791.34 |

| Leesville | $4,408.37 |

| Lena | $5,420.14 |

| Lettsworth | $5,850.05 |

| Libuse | $5,969.26 |

| Lillie | $4,654.01 |

| Lisbon | $4,601.27 |

| Livingston | $6,262.62 |

| Livonia | $5,704.60 |

| Lockport | $5,324.61 |

| Logansport | $4,839.58 |

| Longleaf | $5,692.98 |

| Longstreet | $4,901.10 |

| Longville | $5,057.64 |

| Loranger | $5,717.24 |

| Loreauville | $5,687.29 |

| Lottie | $5,769.12 |

| Luling | $5,953.09 |

| Lutcher | $6,055.12 |

| Madisonville | $5,199.02 |

| Mamou | $5,930.78 |

| Mandeville | $5,281.02 |

| Mangham | $5,115.72 |

| Mansfield | $4,766.90 |

| Mansura | $6,139.16 |

| Many | $4,546.33 |

| Maringouin | $5,767.27 |

| Marion | $4,867.89 |

| Marksville | $6,238.19 |

| Marrero | $7,857.95 |

| Marthaville | $4,797.79 |

| Mathews | $5,312.37 |

| Maurepas | $6,427.46 |

| Maurice | $5,497.94 |

| Melrose | $4,789.46 |

| Melville | $5,699.14 |

| Mer Rouge | $5,351.50 |

| Meraux | $7,760.22 |

| Mermentau | $5,289.01 |

| Merryville | $4,664.29 |

| Metairie | $7,028.30 |

| Minden | $4,660.13 |

| Mittie | $5,315.50 |

| Monroe | $5,773.13 |

| Montegut | $5,427.02 |

| Monterey | $5,290.62 |

| Montgomery | $5,298.13 |

| Mooringsport | $4,907.18 |

| Mora | $5,284.73 |

| Moreauville | $6,142.36 |

| Morgan City | $5,076.36 |

| Morganza | $5,586.74 |

| Morrow | $5,846.26 |

| Morse | $5,307.78 |

| Mount Airy | $6,499.95 |

| Mount Hermon | $5,627.59 |

| Napoleonville | $5,591.04 |

| Natchez | $4,845.44 |

| Natchitoches | $4,796.31 |

| Negreet | $4,610.51 |

| New Iberia | $5,655.91 |

| New Orleans | $8,512.85 |

| New Roads | $5,731.76 |

| Newellton | $5,011.68 |

| Newllano | $4,440.21 |

| Noble | $4,587.33 |

| Norco | $6,304.63 |

| Norwood | $6,041.85 |

| Oak Grove | $5,141.88 |

| Oak Ridge | $5,093.69 |

| Oakdale | $5,518.58 |

| Oberlin | $5,387.80 |

| Oil City | $4,858.20 |

| Olla | $5,001.82 |

| Opelousas | $5,731.23 |

| Oscar | $5,795.30 |

| Otis | $5,505.73 |

| Palmetto | $5,754.56 |

| Paradis | $5,737.15 |

| Patterson | $4,967.95 |

| Paulina | $6,166.52 |

| Pearl River | $5,675.26 |

| Pelican | $4,817.95 |

| Perry | $5,650.08 |

| Pierre Part | $5,545.61 |

| Pilottown | $6,775.22 |

| Pine Grove | $6,013.37 |

| Pine Prairie | $5,980.02 |

| Pineville | $6,128.07 |

| Pioneer | $5,113.61 |

| Pitkin | $4,988.30 |

| Plain Dealing | $4,645.70 |

| Plaquemine | $6,354.68 |

| Plattenville | $5,707.98 |

| Plaucheville | $5,942.83 |

| Pleasant Hill | $4,699.98 |

| Pointe A La Hache | $7,254.34 |

| Pollock | $5,434.90 |

| Ponchatoula | $5,882.16 |

| Port Allen | $6,608.68 |

| Port Barre | $5,694.74 |

| Port Sulphur | $6,988.28 |

| Powhatan | $4,853.47 |

| Prairieville | $6,544.80 |

| Pride | $6,341.58 |

| Princeton | $4,753.20 |

| Provencal | $4,591.96 |

| Quitman | $4,657.55 |

| Raceland | $5,296.79 |

| Ragley | $5,125.34 |

| Rayne | $5,447.80 |

| Rayville | $5,093.57 |

| Reddell | $5,961.98 |

| Reeves | $5,295.76 |

| Reserve | $6,484.83 |

| Rhinehart | $5,036.79 |

| Ringgold | $4,613.19 |

| Roanoke | $5,182.11 |

| Robeline | $4,851.25 |

| Robert | $5,984.64 |

| Rodessa | $4,842.92 |

| Rosedale | $5,834.62 |

| Roseland | $5,857.51 |

| Rosepine | $4,645.62 |

| Rougon | $6,022.62 |

| Ruby | $5,816.23 |

| Ruston | $4,728.13 |

| Saint Amant | $6,416.76 |

| Saint Benedict | $5,603.03 |

| Saint Bernard | $7,346.93 |

| Saint Francisville | $5,668.29 |

| Saint Gabriel | $6,516.44 |

| Saint James | $6,017.20 |

| Saint Joseph | $5,082.18 |

| Saint Landry | $6,078.82 |

| Saint Martinville | $5,666.31 |

| Saint Maurice | $4,913.03 |

| Saint Rose | $6,532.10 |

| Saline | $4,817.82 |

| Sarepta | $4,477.35 |

| Schriever | $5,094.15 |

| Scott | $5,773.98 |

| Shongaloo | $4,595.44 |

| Shreveport | $5,294.25 |

| Sibley | $4,685.29 |

| Sicily Island | $5,065.91 |

| Sieper | $5,476.28 |

| Sikes | $5,000.91 |

| Simmesport | $5,969.01 |

| Simpson | $4,435.33 |

| Simsboro | $4,677.70 |

| Singer | $4,975.14 |

| Slagle | $4,471.44 |

| Slaughter | $6,195.69 |

| Slidell | $5,953.84 |

| Sondheimer | $5,026.84 |

| Sorrento | $6,363.35 |

| Spearsville | $4,688.60 |

| Springfield | $6,206.02 |

| Springhill | $4,474.44 |

| Starks | $5,297.68 |

| Start | $5,086.48 |

| Sterlington | $5,158.80 |

| Stonewall | $4,973.76 |

| Sugartown | $5,018.43 |

| Sulphur | $5,524.13 |

| Summerfield | $4,660.84 |

| Sun | $5,603.34 |

| Sunset | $5,646.94 |

| Sunshine | $6,416.16 |

| Talisheek | $5,373.04 |

| Tallulah | $4,889.41 |

| Tangipahoa | $5,771.41 |

| Taylor | $4,677.85 |

| Theriot | $5,342.07 |

| Thibodaux | $4,994.75 |

| Tickfaw | $5,728.50 |

| Tioga | $5,727.25 |

| Transylvania | $5,029.88 |

| Trout | $5,143.25 |

| Tullos | $4,905.83 |

| Tunica | $5,902.58 |

| Turkey Creek | $5,980.02 |

| Uncle Sam | $7,025.29 |

| Urania | $4,885.54 |

| Vacherie | $5,417.96 |

| Varnado | $5,739.96 |

| Venice | $6,749.62 |

| Ventress | $5,649.05 |

| Vidalia | $5,177.17 |

| Ville Platte | $6,007.69 |

| Vinton | $5,398.24 |

| Violet | $7,818.35 |

| Vivian | $4,846.74 |

| Wakefield | $5,762.35 |

| Walker | $6,478.62 |

| Washington | $5,737.11 |

| Waterproof | $5,088.06 |

| Watson | $6,539.93 |

| Welsh | $5,046.65 |

| West Monroe | $5,465.32 |

| Westlake | $5,532.66 |

| Westwego | $7,150.36 |

| Weyanoke | $5,762.35 |

| White Castle | $6,434.24 |

| Wildsville | $5,052.96 |

| Wilson | $6,078.89 |

| Winnfield | $4,938.22 |

| Winnsboro | $4,900.73 |

| Wisner | $5,064.92 |

| Woodworth | $5,746.82 |

| Youngsville | $5,730.58 |

| Zachary | $6,237.30 |

| Zwolle | $4,580.26 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

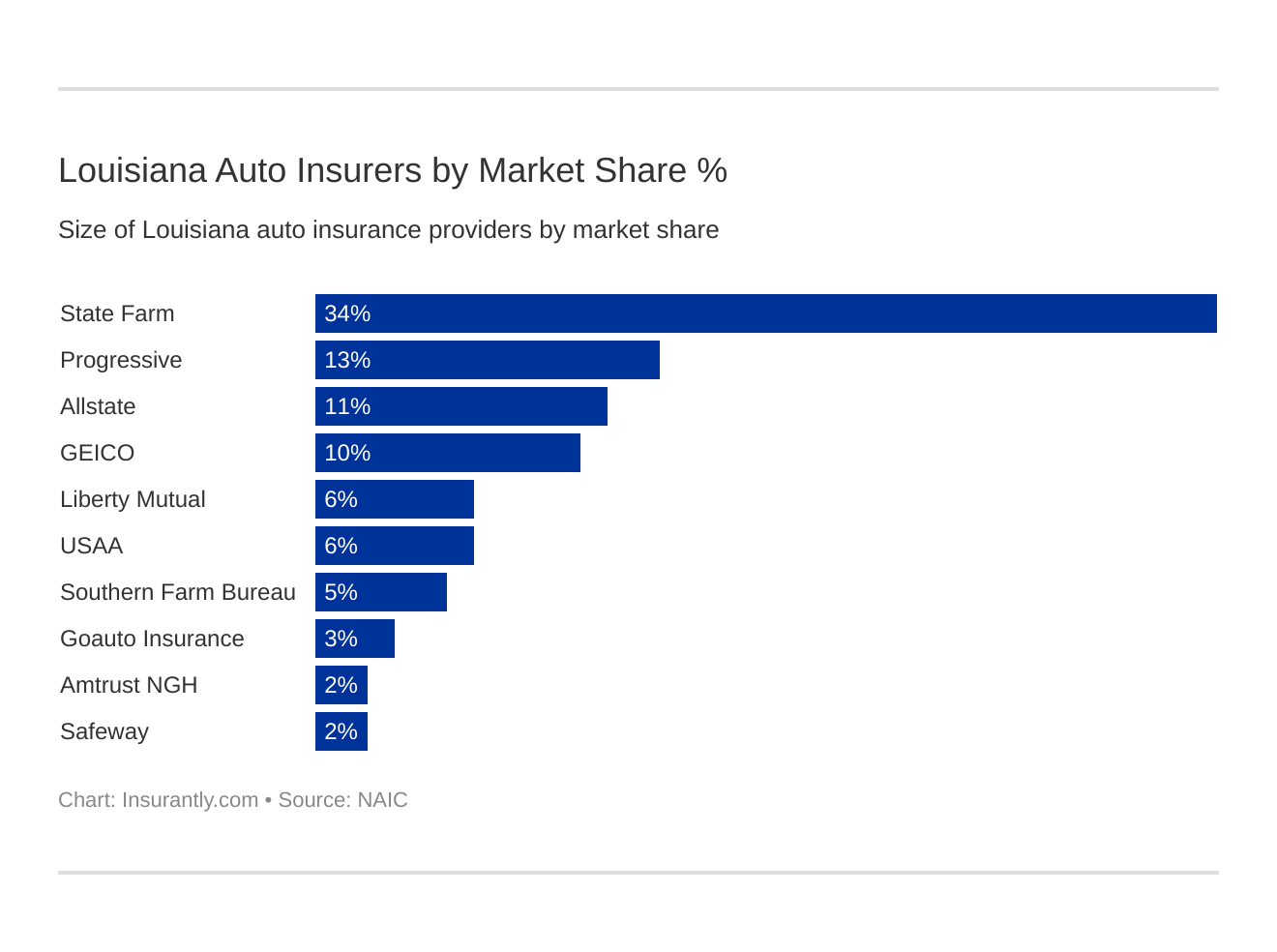

Best State Car Insurance Companies

If you want to start considering your different car insurance options, then you’ll probably want to look at their available rates. In this section, we’ll let you know which providers in Louisiana have the most hold over the state and which, of those applicable, have accessible rates.

The Largest Companies’ Financial Ratings

A.M. Best outlines individual insurance companies’ financial ratings, as you can see below:

| Company | Financial Rating |

|---|---|

| Allstate Insurance Group | A+ |

| Amtrust NGH Group | Not Rated (NR) |

| Geico | A++ |

| Goauto Insurance Co | Not Rated (NR) |

| Liberty Mutual Group | A |

| Progressive Group | A+ |

| Safeway Insurance Group | A |

| Southern Farm Bureau Casualty Group | A+ |

| State Farm Group | A++ |

| USAA Group | A++ |

Predictably, the more pluses a car insurance provider has, the more financially reliable they are. In this car, State Farm, Geico, and USAA all look fairly shiny in the eyes of A.M. Best.

Companies with the Best Ratings

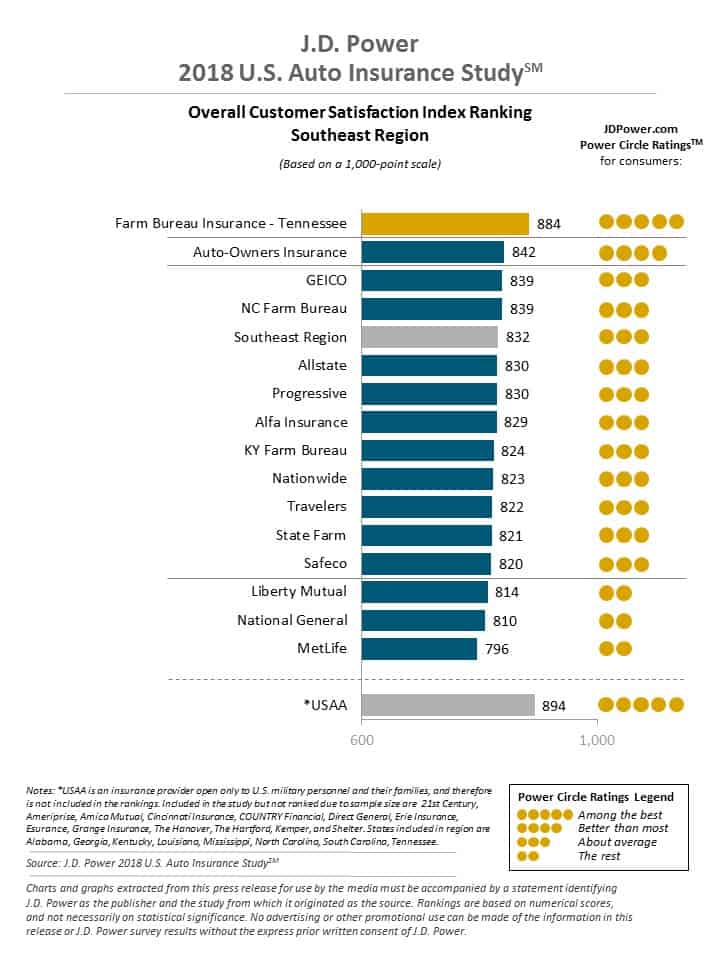

Customer experience and satisfaction also contribute to a company’s state-wide reputation, as you can see here:

For Louisiana residents, Geico once again stands out from the crowd.

Read more: Progressive Car Insurance Guide [Data + Expert Review]

Companies with the Most Complaints in Louisiana

On the flip side of customer satisfaction comes customer complaints. While we shouldn’t always take complaints at face value, they’re a useful asset to consider when choosing a company to work with:

| Company | Direct Premiums Written | Market Share | Number of Complaints | Complaint Index |

|---|---|---|---|---|

| Allstate Insurance Co | $126,806,438 | 2.81% | 41 | 1.488225 |

| Allstate Property & Casulty | $334,999,133 | 7.43% | 25 | 0.343496 |

| Geico | $310,652,097 | 6.89% | 70 | 1.037169 |

| GoAuto | $144,626,094 | 3.21% | 74 | 2.355109 |

| Liberty | $114,475,768 | 2.54% | 38 | 1.527904 |

| Louisiana Farm Bureau | $224,526,282 | 4.98% | 25 | 0.512505 |

| Progressive | $435,995,441 | 9.68% | 59 | 0.622868 |

| Progressive | $166,568,349 | 3.70% | 39 | 1.0777 |

| Safeco | $109,688,794 | 2.43% | 10 | 0.419627 |

| State Farm | $1,417,799,324 | 31.46% | 223 | 0.723962 |

As the table above depicts, GoAuto has the highest complaint index of the providers in Louisiana, even though State Farm attracts a higher number. The complaint index differs because GoAuto is a smaller provider, whereas State Farm operates internationally.

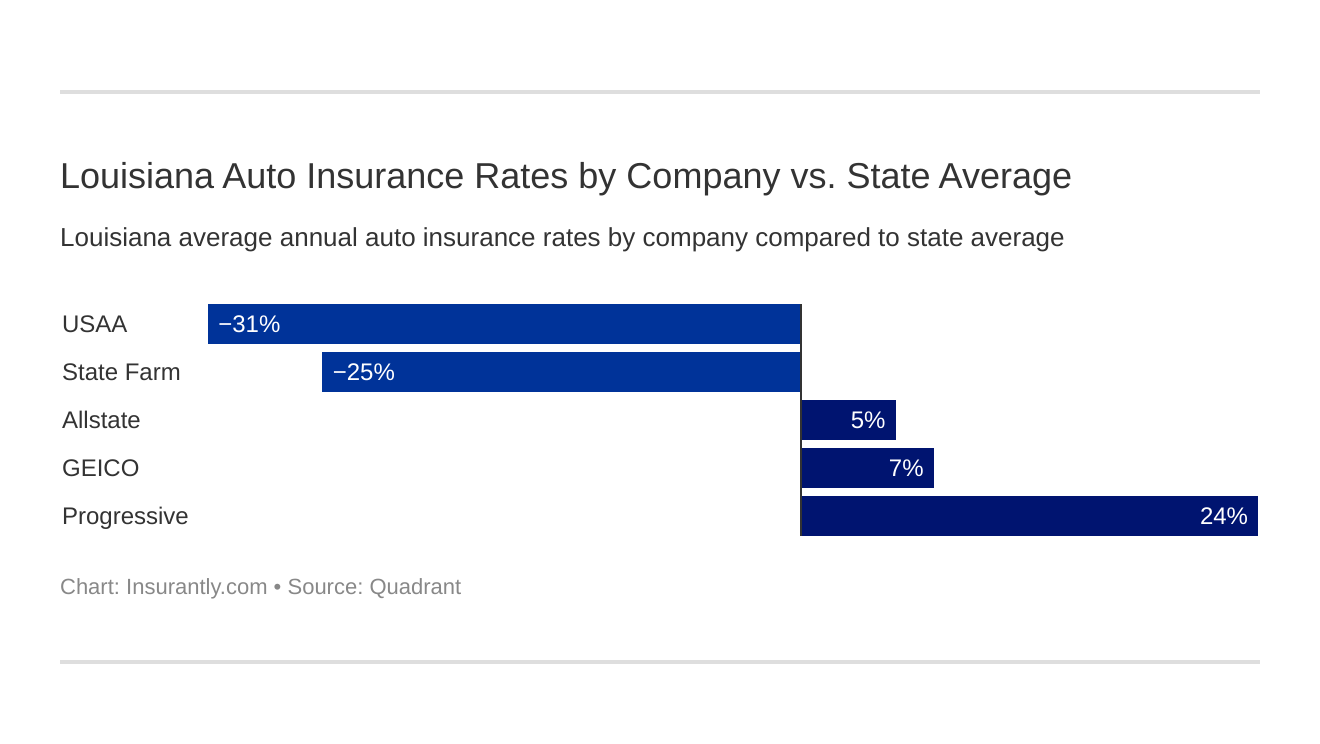

Cheapest Companies in Louisiana

It’s difficult to call any of the rates in Louisiana cheap. Even so, there are some companies that fall far below the state’s average premium cost:

| Company | Average | Compared to State Average | Percentage Separation |

|---|---|---|---|

| Allstate P&C | $5,998.79 | $287.44 | 4.79% |

| Geico Cas | $6,154.60 | $443.25 | 7.20% |

| Progressive Security Ins. | $7,471.10 | $1,759.75 | 23.55% |

| State Farm Mutual Auto | $4,579.12 | -$1,132.22 | -24.73% |

| USAA | $4,353.12 | -$1,358.23 | -31.20% |

Once again, USAA stands out among the crowd by offering a rate over $1,000 below the state’s national average.

Commute Rates by Company

The distance of your morning commute is going to impact your car insurance rate, as you can see below:

| Company | 10 miles commute / 6,000 annual mileage | 25 miles commute / 12,000 annual mileage |

|---|---|---|

| Allstate | $5,998.79 | $5,998.79 |

| Geico | $6,034.79 | $6,274.40 |

| Progressive | $7,471.10 | $7,471.10 |

| State Farm | $4,461.13 | $4,697.11 |

| USAA | $4,218.32 | $4,487.91 |

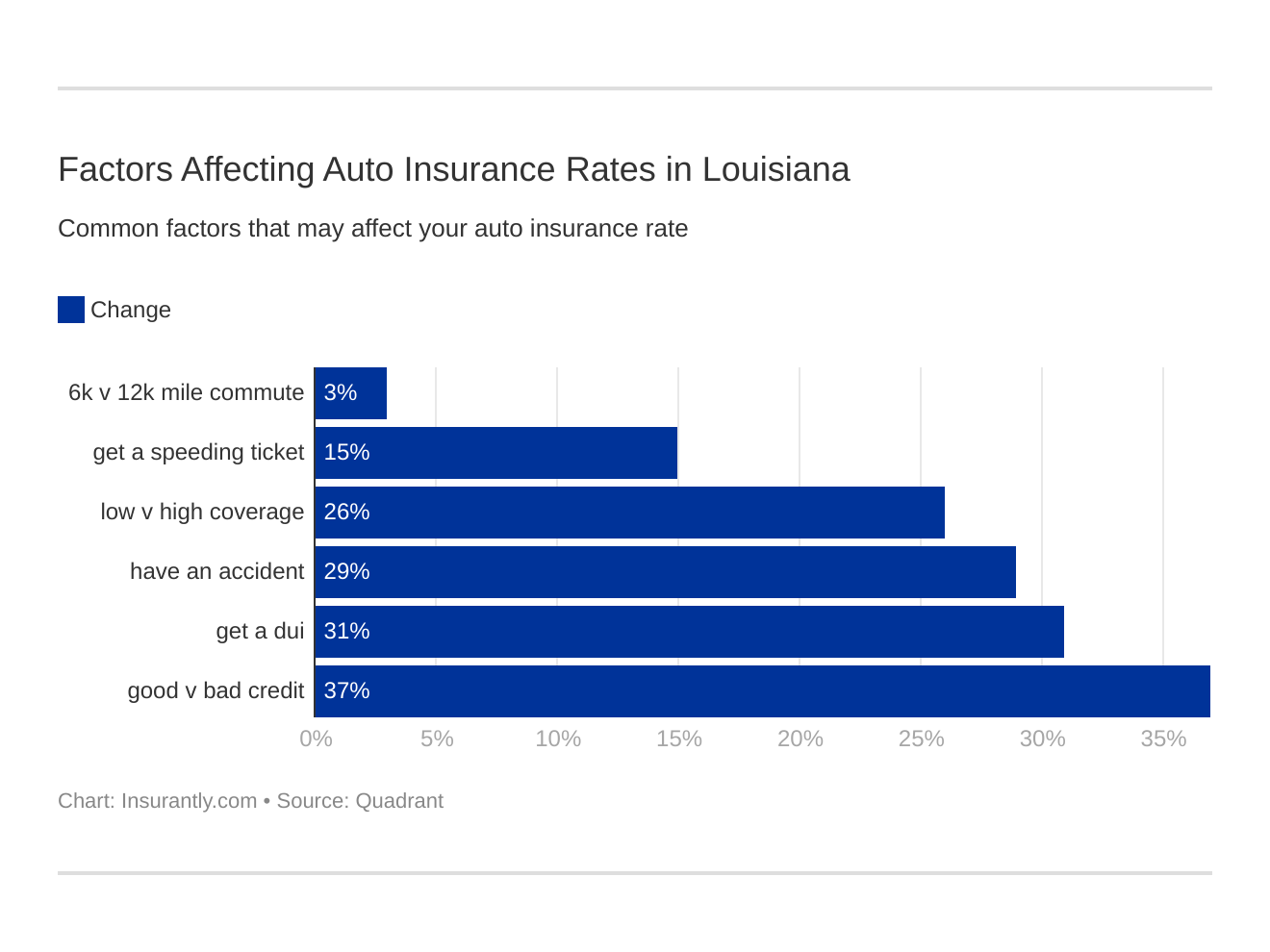

Six major factors affect auto insurance rates in LA. Which car insurance factors will affect your rates the most? Find out below:

Coverage Level Rates by Company

Your chosen level of coverage is going to impact the amount you’re expected to pay:

| Group | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $5,185.16 | $6,109.21 | $6,702.00 |

| Geico | $5,086.66 | $6,176.92 | $7,200.21 |

| Progressive | $6,193.86 | $7,406.27 | $8,813.16 |

| State Farm | $3,962.47 | $4,568.03 | $5,206.86 |

| USAA | $3,776.25 | $4,420.47 | $4,862.64 |

Credit History Rates by Company

Your credit history reflects your ability to pay back money you owe to different organizations. Naturally, car insurance providers are going to take your credit history into account when offering you a rate.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $4,726.27 | $7,236.85 | $8,444.80 |

| Geico | $4,788.40 | $6,353.32 | $7,859.57 |

| Progressive | $6,731.64 | $5,410.52 | $7,322.08 |

| State Farm | $3,300.33 | $4,086.69 | $6,350.34 |

| USAA | $3,207.81 | $3,841.14 | $6,010.39 |

Driving Record Rates by Company

Your driving history reflects both your knowledge of the rules of the road and your ability to work within them.

| Company | Clean record | One Speeding Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $4,753.81 | $7,221.89 | $7,221.89 | $6,443.95 |

| Geico | $4,180.19 | $6,755.09 | $6,755.09 | $8,315.63 |

| Progressive | $6,223.20 | $8,352.66 | $8,352.66 | $8,027.23 |

| State Farm | $4,196.97 | $4,961.27 | $4,961.27 | $4,579.12 |

| USAA | $3,321.63 | $4,611.20 | $4,611.20 | $5,514.32 |

As you might guess, high-risk drivers are charged more for their coverage than low-risk drivers.

Number of Insurers in Louisiana

There is also a difference between local providers and national providers.

Local providers, or domestic providers, operate solely within Louisiana. Comparatively, foreign insurers operate all throughout the United States. Take a look at Louisiana’s breakdown below:

| Property & Casualty Insurance | Number |

|---|---|

| Domestic | 34 |

| Foreign | 819 |

| Total | 953 |

Louisiana Driving Laws

The reality is that legislation in Louisiana directly impacts the kind of rates that car insurance providers are able to make available to you.

Consider this: Louisiana is a “direct action” state. That mean that an injured passenger, if they choose to forgo the aid of the driver determined to be at-fault, is able to sue the appropriate insurance provider for lack of coverage.

On one hand, this means that a body with significantly more funds — aka, the insurance provider — is sometimes forced to cover the cost of an accident. On the other hand, though, this means that Louisiana providers will charge more for their premiums to make a profit.

The law allowing for this redirection has been in place since 1918, making it exceptionally difficult for modern Louisiana legislators to overcome the financial and cultural barrier it represents. You can read more about this law here.

Louisiana providers have made alternative moves to make insurance more affordable. Drivers have the option to work with “economic-only” coverage, or uninsured/underinsured motorists coverage. This coverage became available in 1997 under the unofficially named “No Pay, No Play,” act.

Do note that No Pay, No Play coverage will only cover the applicable drivers for hard dollar damages — property damage, wages lost due to the accident, and medical bills. Anything outstanding will be left to the injured party.

Car Insurance Laws

With those complicating factors out of the way, let’s look at the types of coverage or insurance that Louisiana legislation also works to make available to the state’s drivers.

Windshield Coverage

Legislation in Louisiana does not require the state’s car insurance providers to offer you windshield repair or replacement. If you want to include this coverage in your plan, you’ll need to discuss the option with your provider of choice.

It is worth noting, though, that Louisiana law does allow insurance providers to utilize aftermarket crash parts when estimating the cost of replacement, but that the applicable deductibles cannot exceed $250.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

High-Risk Insurance

If you happen to have a DUI or a significant number of points on your license, you’re in luck. Louisiana offers its Louisiana Automobile Insurance Plan to high-risk drivers. This plan operates through a company called AIPSO, and while they will not take responsibility for your behavior, they will ensure that you have the state minimum liability coverage, regardless of your driving history.

Low-Cost Insurance

Louisiana does not offer car insurance programs for low income families that would ease the pressure of paying for car insurance. However, drivers can seek out discounts to make the cost of insurance more bearable.

Be sure to ask your provider of choice if you or your family are eligible forany of the following discounts:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e. if you have alarms, tracking systems, etc on your vehicle)

- Auto-Pay Discounts (if you were to set up automatic payments from checking – some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

Be sure you shop around in order to find the best coverage for you that is equally cost-effective.

Automobile Fraud in Louisiana

It’s difficult to commit insurance fraud by accident.

That said, the insurance industry sees 10 percent of its operating costs go to enduring fraudulent claims or accounts over the course of a year.

There are two different types of automobile fraud.

- Hard fraud sees a driver deliberately falsifying a claim or faking an accident in order to receive compensation

- Soft fraud sees a driver padding a claim or misrepresenting accident information to an insurance provider

Soft fraud is the more common of these two types of fraud.

Even though you may think you’re just telling a white lie, soft fraud is considered a misdemeanor, and lying on your claim is considered a class 5 felony.

Statute of Limitations

A statute of limitations dictates the amount of time you have to submit a claim to your provider of choice after an accident.

Louisiana law states that property damage and personal injury claims need to be submitted within a year of the applicable accident taking place.

Vehicle Licensing Laws

With claim legislation under your belt, let’s take a look at licensing laws.

Real ID

You’d figure that your driver’s license would qualify as a REAL ID without any modifications, right? Not anymore.

Real ID is a phenomena arriving in 2020. All Louisiana drivers — and drivers throughout the United States — will need to have REAL ID to get on a plane, be the flight domestic or international.

Penalties for Driving Without Insurance

While it may seem like driving would be less expensive without car insurance in Louisiana, it’s not. The aforementioned “No Pay, No Play” act dictates that uninsured drivers come away from their accidents already in debt:

Anyone caught driving without insurance in Louisiana will already owe $25,000 in property damages and $15,000 in personal damages to the person they happen to get into an accident with.

This is by far the most severe approach a state can take to dissuade uninsured driving. It also means that, even with Louisiana’s outrageous rates, it’ll be less expensive for you to purchase a plan than to go without one.

Teen Driver Laws

Teen drivers, upon turning 15, will have to progress through two different types of provisional licenses to driver safely on Louisiana’s roadways. Take a look at the age, passenger, and time restrictions listed in the table below.

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit | 15; obtain a temporary instruction permit (TIP) from the OMV; completion of driver education course; TIP is exchanged for a learner's permit | no more than one passenger younger than 21 between the hours of 6 pm-5 am; no passenger restriction from 5 am-6 pm | 11 p.m. - 5 a.m. |

| Provisional License | 6 months holding period 50 hours, 15 of which must be at night | no more than one passenger younger than 21 between the hours of 6 pm-5 am; no passenger restriction from 5 am-6 pm | 11 p.m. - 5 a.m. |

| Full License | 16 | lifted at age 17 | lifted at age 17 |

License Renewal Procedures

Older drivers are expected to undergo the same license renewal procedures as the other, non-teenage drivers in Louisiana. You can take a look at the required processes in the table below:

| Renewal Procedures | General Population | Older Population |

|---|---|---|

| License renewal cycle | 6 years | 6 years |

| Mail or online renewal permitted | both, every other renewal | not permitted 70 and older |

| Proof of adequate vision required at renewal | when renewing in person | 70 and older, every renewal |

The only exceptions Louisiana makes is for those drivers 70 years and older who also have a medically diagnosed disability.

If the aforementioned person is unable to renew their license in person, they must have a sworn, physician-certified affidavit submit a statement noting that the driver in question possesses all of the faculties and cognitive functions that would allow them to operate safely on the road.

New Residents

If you’ve recently moved to Louisiana, make sure you complete the following tasks within 20 days of your residency:

- Obtain a Louisiana driver’s license

- Purchase an auto insurance policy

- Register your car with the local OMV

Rules of the Road

That takes car of legislation — but what do the rules of the road in Louisiana consist of?

Fault vs. No-Fault

As was previously mentioned, Louisiana is an at-fault state. The driver who is determined to be responsible for the accident in question will be responsible for all charges applying to that accident. Again, though, the complexities of “No Pay, No Play,” challenge the straightforward nature of that process.

Seat Belt and Car Seat Laws

Louisiana’s car seat and seat belt laws primarily apply to children who are 5 years old or younger. If a child is within that age group and/or weighs less than 60 pounds, they need to be confined to an appropriate car seat, or else the driver in question will face a $100 fine.

After a child turns 6 or weighs more than 60 pounds, she is free to sit wherever in a vehicle she likes, save for the cargo area. No one is allowed to ride in the cargo area of a pickup truck unless:

- The passenger is older than 12 years old and not on a major highway

- The passenger is in a parade and moving at a pace slower than 15 mph

- There is a state-wide or local emergency declared

Keep Right and Move Over Laws

If you are driving more slowly than the posted speed limit, or if you are not looking to pass a car in front of you, then Louisiana law dictates that you must remain in the right-hand lane of the applicable interstate.

You must also move over for vehicles that have their lights flashing, regardless of whether or not they’re clearly marked as emergency vehicles. These vehicles include but are not limited to:

- Police cruisers

- Ambulances

- Firetrucks

- Tow trucks

- Recovery vehicles

Speed Limits

Across Louisiana, you’ll be able to spot the following maximum speed limits:

- Rural areas — 75

- Urban Areas — 70

- Limited Access Roads — 70

- All Other Roads — 65

Ridesharing

The rise of Uber and Lyft have made it easier than ever for people to get to the places they need to go. These companies have also created a new industry for drivers across the United States. If you currently work with either company or one of their competitors, or if you’ve thought about using your vehicle for a job before, you’ll need to get ridesharing insurance.

Safety Laws

Let’s dive into the legislation that applies to more serious concerns that seat belts and speed limits. If you drive while impaired in Louisiana, you’ll likely face serious legal consequences.

DUI Laws

Louisiana’s position on drinking and driving is reasonably lenient, especially when compared to the legislation in place in other states. Take a look at the table below to see how the consequences of a DUI vary based on a driver’s history:

| Penalty | First Offense | Second Offense | Third Offense | Fourth and Subsequent Offenses |

|---|---|---|---|---|

| License Suspension | 1 year/hBAC 2 years | 2 years/hBAC 4 years | 3 years | vehicle seized |

| Imprisonment | 48 hours in jail + up to 6 months OR fine; up to 2 years probation | 48 hours+ | 1-5 years w/ or w/o hard labor | 10-30 years, two years served w/o suspension or parole + home incarceration for at least 1 year |

| Fine | $300-$1000 +$100 reinstatement fee | $750-$1000 +$200 reinstatement fee | $2000 +$300 reinstatement fee | $5000 +$300 reinstatement fee |

| Other | 30 hours reeducation, 32+ hours community service, half must be street garbage pickup | possible 30 days community service +reeducation requirements of 1st DWI | 30 days community service, evaluation for addictive disorder, IID, probabtion and home incarceration for any part of suspended sentence | 40 days community service |

Distracted Driving Laws

If you’re caught driving with a phone in hand in Louisiana, you’ll face immediate consequences. The distracted driving laws in Louisiana receive primary enforcement, which means that law enforcement needs no other reason to stop you if they spot you on your phone.

That legislation reads as follows:

- Handheld bans apply to all drivers in signed school zones

- Learner’s permit holders and intermediate license holders are not allowed to utilize cellphones while driving

- Any driver under 18 cannot use a cellphone while driving, even if the phone operates through a car’s speakers or Bluetooth

- Cellphones cannot be used in the car of first-year drivers, regardless of the driver’s age

After a driver turns 18 and has been driving her car for a year or more, then cellphone use becomes a secondarily enforced matter. This means that law enforcement will need a primary reason to pull a car over before giving out a handheld ban citation.

Driving in Louisiana

So, now you have a better idea of what safety legislation looks like in Louisiana. That said, how safe are Louisiana’s roadways?

Vehicle Theft in Louisiana

There are certain types of vehicles that are more likely to be stolen in Louisiana than others, as you can see in the table below:

| Vehicle | Number of Thefts (2016) |

|---|---|

| Chevrolet Pickup (Full Size) | 671 |

| Ford Pickup (Full Size) | 584 |

| GMC Pickup (Full Size) | 253 |

| Toyota Camry | 224 |

| Dodge Pickup (Full Size) | 222 |

| Nissan Altima | 215 |

| Honda Accord | 209 |

| Chevrolet Impala | 177 |

| GMC Yukon | 125 |

| Chevrolet Tahoe | 114 |

It’s pickup trucks, not sports cars, that attract the eye of a thief. That means that local drivers will want to keep an eye on their cars while making their way from Point A to Point B.

Vehicle Theft by City

Your location can also impact the likelihood of vehicular theft. As you can see below, there are some cities in Louisiana that see far more thefts than others:

| City | # of Stolen Cars |

|---|---|

| Baton Rouge | 506 |

| New Orleans | 2,143 |

| Shreveport | 504 |

Road Fatalities in Louisiana

Road fatalities occur for a number of different reasons. Louisiana saw a 11.19 fatality rate per 100,000 people in 2017, and which driving growing ever more complicated, that number seems set to rise.

Let’s break the reasoning for that rate down.

Most Fatal Highway in Louisiana

Louisiana’s U.S. 90 sees the most fatalities in the state on a yearly basis, according to the National Highway Traffic Safety Administration. It’s normal for this highway to produce 27 fatal — fatal — accidents over the course of a year, due primarily to the highway’s popularity.

Fatal Crashes by Weather Condition and Light Condition

Different weather and light conditions can impact the way that drivers are able to operate on the road. Take a look at how both factors cause fatalities across Louisiana:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 276 | 93 | 219 | 32 | 1 | 621 |

| Rain | 20 | 15 | 16 | 4 | 0 | 55 |

| Snow/Sleet | 1 | 0 | 0 | 0 | 0 | 1 |

| Other | 2 | 4 | 8 | 0 | 0 | 14 |

| Unknown | 0 | 1 | 1 | 0 | 3 | 5 |

| TOTAL | 299 | 113 | 244 | 36 | 4 | 696 |

Traffic Fatalities

Location also impacts the likelihood of a car accident, as you can see in the table below:

| Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 760 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 488 |

| Motorcyclist Fatalities | 96 |

| Drivers Involved in Fatal Crashes | 1,041 |

| Pedestrian Fatalities | 11 |

| Bicyclist and other Cyclist Fatalities | 22 |

Fatalities by Person Type

Person type is also likely to impact fatality statistics. “Person type” here refers to a person’s relationship to a vehicle as opposed to any other demographic statistics.

| Person Type | Number |

|---|---|

| Occupants (Enclosed Vehicles) | 529 |

| Motorcyclists | 96 |

| Nonoccupants | 135 |

As you can see, passengers are the people most frequently involved in fatalities. Motorists are also high up on the list of potential fatality victims.

Fatalities by Crash Type

There are also specific crash types that most frequently result in fatalities:

| Crash Type | Number |

|---|---|

| Single Vehicle | 440 |

| Involving a Large Truck | 102 |

| Involving Speeding | 177 |

| Involving a Rollover | 204 |

| Involving a Roadway Departure | 421 |

| Involving an Intersection (or Intersection Related) | 141 |

Five-Year Trend for the Top 10 Counties

The table below relays the top 10 counties in Louisiana that happen to see the most accidents over the course of a year.

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Ascension Parish | 23 | 23 | 19 | 21 | 28 |

| Caddo Parish | 29 | 40 | 36 | 27 | 36 |

| Calcasieu Parish | 24 | 24 | 36 | 47 | 38 |

| East Baton Rouge Parish | 41 | 50 | 43 | 52 | 65 |

| Jefferson Parish | 22 | 24 | 26 | 34 | 28 |

| Orleans Parish | 53 | 50 | 50 | 55 | 44 |

| Ouachita Parish | 22 | 23 | 21 | 20 | 28 |

| St. Tammany Parish | 20 | 22 | 26 | 23 | 30 |

| Tangipahoa Parish | 26 | 22 | 36 | 40 | 31 |

| Terrebonne Parish | 22 | 19 | 16 | 20 | 29 |

Note that there’s no commonality between these individual counties’ traffic trends. The number of fatalities in East Baton Rouge Parish, for example, are on the rise. Comparatively, Ascension Parish has seen a fluctuation. This simply means that no matter where you are in the state, you need to drive cautiously.

Fatalities Involving Speeding by County

It’s tempting to play Speed Racer while you’re on the road. However, Louisiana sees its fair share of speeding-related fatalities over the course of a year, as you can see below:

| County | Fatalities |

|---|---|

| Acadia Parish | 2 |

| Allen Parish | 0 |

| Ascension Parish | 7 |

| Assumption Parish | 1 |

| Avoyelles Parish | 0 |

| Beauregard Parish | 0 |

| Bienville Parish | 0 |

| Bossier Parish | 4 |

| Caddo Parish | 9 |

| Calcasieu Parish | 6 |

| Caldwell Parish | 2 |

| Cameron Parish | 0 |

| Catahoula Parish | 0 |

| Claiborne Parish | 0 |

| Concordia Parish | 0 |

| De Soto Parish | 2 |

| East Baton Rouge Parish | 5 |

| East Carroll Parish | 0 |

| East Feliciana Parish | 4 |

| Evangeline Parish | 2 |

| Franklin Parish | 1 |

| Grant Parish | 1 |

| Iberia Parish | 2 |

| Iberville Parish | 1 |

| Jackson Parish | 0 |

| Jefferson Davis Parish | 1 |

| Jefferson Parish | 3 |

| La Salle Parish | 0 |

| Lafayette Parish | 5 |

| Lafourche Parish | 11 |

| Lincoln Parish | 2 |

| Livingston Parish | 8 |

| Madison Parish | 1 |

| Morehouse Parish | 0 |

| Natchitoches Parish | 0 |

| Orleans Parish | 7 |

| Ouachita Parish | 6 |

| Plaquemines Parish | 1 |

| Pointe Coupe Parish | 2 |

| Rapides Parish | 4 |

| Red River Parish | 2 |

| Richland Parish | 1 |

| Sabine Parish | 1 |

| St. Bernard Parish | 1 |

| St. Charles Parish | 4 |

| St. Helena Parish | 1 |

| St. James Parish | 0 |

| St. John the Baptist Parish | 1 |

| St. Landry Parish | 2 |

| St. Martin Parish | 7 |

| St. Mary Parish | 1 |

| St. Tammany Parish | 10 |

| Tangipahoa Parish | 14 |

| Tensas Parish | 0 |

| Terrebonne Parish | 11 |

| Union Parish | 0 |

| Vermilion Parish | 0 |

| Vernon Parish | 6 |

| Washington Parish | 4 |

| Webster Parish | 1 |

| West Baton Rouge Parish | 4 |

| West Carroll Parish | 1 |

| West Feliciana Parish | 0 |

| Winn Parish | 2 |

The maximum speed limit on Louisiana’s rural roads is 75 mph. If that isn’t enough to satisfy you, then you may want to take up a hobby that’ll lead you to the Indy 500.

Fatalities in Crashes Involving an Alcohol-Impaired Driver

We’ve already mentioned that drinking and driving is a terrible combination. Louisiana may be lenient with its drinking and driving laws, but that doesn’t mean the number of accidents involving an inebriated driver are any lower:

| County | Fatalities |

|---|---|

| Acadia Parish | 4 |

| Allen Parish | 0 |

| Ascension Parish | 7 |

| Assumption Parish | 0 |

| Avoyelles Parish | 3 |

| Beauregard Parish | 1 |

| Bienville Parish | 0 |

| Bossier Parish | 3 |

| Caddo Parish | 14 |

| Calcasieu Parish | 12 |

| Caldwell Parish | 1 |

| Cameron Parish | 1 |

| Catahoula Parish | 0 |

| Claiborne Parish | 0 |

| Concordia Parish | 0 |

| De Soto Parish | 1 |

| East Baton Rouge Parish | 19 |

| East Carroll Parish | 0 |

| East Feliciana Parish | 2 |

| Evangeline Parish | 3 |

| Franklin Parish | 2 |

| Grant Parish | 2 |

| Iberia Parish | 2 |

| Iberville Parish | 2 |

| Jackson Parish | 1 |

| Jefferson Davis Parish | 2 |

| Jefferson Parish | 6 |

| La Salle Parish | 1 |

| Lafayette Parish | 5 |

| Lafourche Parish | 5 |

| Lincoln Parish | 2 |

| Livingston Parish | 4 |

| Madison Parish | 1 |

| Morehouse Parish | 1 |

| Natchitoches Parish | 0 |

| Orleans Parish | 16 |

| Ouachita Parish | 8 |

| Plaquemines Parish | 1 |

| Pointe Parish | 3 |

| Rapides Parish | 2 |

| Red River Parish | 2 |

| Richland Parish | 1 |

| Sabine Parish | 2 |

| St. Bernard Parish | 0 |

| St. Charles Parish | 2 |

| St. Helena Parish | 6 |

| St. James Parish | 1 |

| St. John the Baptist Parish | 0 |

| St. Landry Parish | 7 |

| St. Martin Parish | 6 |

| St. Mary Parish | 3 |

| St. Tammany Parish | 6 |

| Tangipahoa Parish | 7 |

| Tensas Parish | 0 |

| Terrebonne Parish | 13 |

| Union Parish | 0 |

| Vermilion Parish | 2 |

| Vernon Parish | 3 |

| Washington Parish | 2 |

| Webster Parish | 3 |

| West Baton Rouge Parish | 5 |

| West Carroll Parish | 0 |

| West Feliciana Parish | 1 |

| Winn Parish | 0 |

Teen Drinking and Driving

The aforementioned numbers don’t include teens who happen to be convicted of drinking and driving. Louisiana arrests more intoxicated teen drivers on average than the nation as a whole:

| Teens and Drunk Driving | Data |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 1.3 |

| Higher/Lower Than National Average (1.2) | higher |

| DUI Arrest (Under 18 years old) | 32 |

| DUI Arrests (Under 18 years old) Total Per Million People | 28.73 |

Teach your teens early on that they don’t need to have alcohol to have fun — and especially not while on the road.

EMS Response Time

When you know how long, on average, it takes EMS to arrive at the scene of an accident, you can address the situation a little more calmly.

| Location | Time of Crash to Notification | Arrival | Arrival at Scene to Hospital | Time of Crash to Hospital |

|---|---|---|---|---|

| Rural | 5 minutes | 14 minutes | 45 minutes | 1 hour, 3 minutes |

| Urban | 4 minutes | 8 minutes | 33 minutes | 35 minutes |

As you can see, urban drivers have a slight advantage over rural drivers in terms of EMS response time. Drivers involved in accidents in urban areas will likely reach a hospital under an hour after they’ve been in an accident. Comparatively, rural drivers will reach hospitals one hour after they’ve been in a registered accident.

Transportation

With those numbers out of the way, let’s take a look at an average day of driving in Louisiana and the kind of traffic you may have to deal with.

Car Ownership

As is the case with most states, Louisiana homeowners frequently keep two cars in their garages.

However, the next highest statistic reveals that Louisiana car owners are more likely to own a single car than they are to own three.

Commute Time

The average daily commute in Louisiana takes 24.2 minutes. This means that, in at least one area, Louisiana ranks below the national average — though, admittedly, not by much.

The national average commute time comes in at 25.3 minutes, giving Louisiana drivers a minute of leeway.

Even so, 2.88 percent of Louisiana drivers have to endure a “super commute” — a commute that lasts longer than 90 minutes.

Commuter Transportation

The vast majority of drivers in Louisiana also prefer to drive alone to and from work. Nearly 10 percent of commuters carpool and about one-half that many walk or ride their bikes to work. (For more information, read our “Can you drive alone with a driver’s permit?“).

—

Traffic Congestion in Louisiana

With so many folks driving on their own on a daily basis, you might expect Louisiana’s roadways to be especially crowded. According to the INRIX Scorecard, though, only one of Louisiana’s cities has any cause for concern: New Orleans. Even then, New Orleans ranks at number 137 on the list, with 74 hours of drivers’ time being lost to congestion.

And with that, we come to the end of our guide to Louisiana’s car insurance. If you’re interested in learning more about the car insurance rates available in your area, use your zip code to access our FREE online tool.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.