Progressive Car Insurance Guide [Data + Expert Review]

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 23, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| Key Info | Provider Specifics |

|---|---|

| Year Founded | 1937 |

| Current Executives | CEO: Tricia Griffith CMO: Jeff Charney |

| Numbers of Employees | 30,000 |

| Total Sales Total Assets (2018) | $32 billion $46.575 billion |

| HQ Address | 6300 Wilson Mills Road, Mayfield Village, OH 44143 |

| Phone Number | (800) 776-4737 |

| Company Website | https://www.progressive.com/ |

| Direct Premiums Written (2017) | $27 billion |

| Loss Ratio | 64.49% |

| Best For | Drivers with good driving records |

Need a new insurance provider? It can be overwhelming trying to narrow down your options. The worst thing to do is rush the process and end up with a provider with high rates or poor coverages.

If you are thinking of Progressive as a provider, look no further than our review.

We’ve worked hard to collect information about Progressive, from ratings to usage-based apps. By reading our guide, you’ll be prepared to make an informed decision about Progressive as a provider.

So stick with us to see if Progressive is right for you and your vehicle. Let’s dive right in.

If you want to start comparison shopping today, enter your ZIP code in our free tool at the bottom of this post.

Rating Agency

When you purchase something important, you probably look at ratings first. To save you time digging through dozens of reviews, we’ve collected ratings from important review sites.

Keep reading to learn about Progressive’s financial ratings and customer satisfaction ratings. This way, you can get a clear picture of what others think of the company.

A.M. Best

The first financial rating we want to look at is A.M. Best’s. This rating website looks at a company’s financial strength and rates companies on a letter grade scale.

So what did Progressive earn?

A.M. Best gave Progressive Group an A+ rating.

Only an A++ rating is higher, so Progressive has a great rating from A.M. Best. What does an A+ rating mean? Progressive has a superior ability to meet its financial obligations. In other words, Progressive won’t bankrupt itself while paying claims and employees.

Better Business Bureau

You may have seen the Better Business Bureau (BBB) symbol on a business before, such as an auto repair shop. BBB creates its ratings from multiple factors, including customer complaint data.

Because BBB’s focus is on promoting ethical business practices, it is a great rating to look at. Like A.M. Best, BBB grades on a letter scale.

Because BBB asks for a state when searching for a rating, we looked at Progressive’s rating in Pennsylvania.

In Pennsylvania, BBB gave Progressive Insurance a B- rating.

You can certainly check BBB’s rating in your state, but a B- rating is indicative that Progressive is mediocre. While a B- is okay, it shows that Progressive may have some issues with its business practices.

Moody’s Rating

Moody’s is a well-known rating agency that looks at the ability of companies to meet their financial obligations (creditworthiness).

Progressive has an A2 rating from Moody’s.

This is a strong rating, as it means Progressive has a low level of credit risk. While an A2 rating isn’t the highest rating possible, it is a decent rating that shows Progressive is financially strong.

S&P Rating

Standard and Poor (S&P) is another major site that rates companies’ creditworthiness. Like the other credit score ratings we’ve covered, S&P uses a letter scale (AAA is the highest score).

S&P gave Progressive an A rating.

This is a decent rating. It means S&P believes Progressive has strong creditworthiness. However, an A rating also means Progressive is more susceptible to poor economic conditions, so a drop in the economy could prove detrimental to the company.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) collects complaint data on major companies. By comparing the number of complaints to the number of total customers, NAIC formulates a complaint index.

In 2017, Progressive Group received 120 complaints, resulting in a 0.75 complaint ratio.

This complaint index is decent. It is lower than the national complaint index of one.

It is also important to remember that it’s not just the number of complaints that matter. A company’s handling of complaints is an equally important part of dealing with customers.

J.D. Power

J.D. Power is another rating website that looks at how Progressive serves its customers. In 2019, J.D. Power conducted an extensive study that surveyed car insurance customers’ satisfaction levels with major companies.

The rating scale is as follows (circles are assigned based on score):

- Five Power Circles: “Among the best”

- Four Power Circles: “Better than most”

- Three Power Circles: “About average”

- Two Power Circles: “The rest”

Below is the power circle rating that Progressive received in each U.S. region.

| Region | JD Power Circle Rating | Score (out of 1,000) |

|---|---|---|

| California Region | About average | 821 |

| Central Region | About average | 823 |

| Florida Region | The rest | 809 |

| Mid-Atlantic Region | The rest | 828 |

| New England Region | About average | 825 |

| New York Region | The rest | 815 |

| North Central Region | About average | 828 |

| Northwest Region | The rest | 797 |

| Southeast Region | The rest | 824 |

| Southwest Region | The rest | 807 |

| Texas Region | The rest | 816 |

Unfortunately, Progressive didn’t score well at J.D. Power. Progressive only has two or three power circles in all U.S. regions, which isn’t great. J.D. Power’s ratings suggest that Progressive isn’t the best company for great customer service.

Consumer Reports

Before we dismiss Progressive’s customer service, we want to look at a few other customer satisfaction reviews. One of these review sites is Consumer Reports.

Consumer Reports 2017 study surveyed 23,609 consumers. Progressive earned the following scores.

| Claim Process | Satisfaction Rating |

|---|---|

| Reader Score | 87 |

| Ease of Reaching an Agent | Very Good |

| Simplicity of the Process | Very Good |

| Promptness of the Response | Very Good |

| Damage Amount | Very Good |

| Agent Courtesy | Very Good |

| Timely Payment | Excellent |

| Freedom to Select | Very Good |

| Being Kept Informed of Claim Status | Very Good |

Progressive received decent ratings, even earning an excellent in the category timely payments. Consumer Reports’s rating of Progressive is definitely more encouraging than J.D. Power’s rating.

Consumer Affairs

One last customer satisfaction review that we want to look at is Consumer Affairs.

Currently, Progressive has almost four stars out of five on Consumer Affairs.

This is a good rating, and it’s based on over 2,700 reviews. Because Consumer Reports and Consumer Affairs’s ratings of Progressive are decent, they help balance out J.D. Power’s mostly negative region ratings.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Company History

In 1937, a pair of young lawyers, Joseph Lewis and Jack Green, decided to found a car insurance company. Little did the founders imagine that their company would grow far beyond auto insurance.

Part of the reason for Progressive’s growth is that it is an innovative company. Progressive was one of the first insurers to create a website after the invention of the Internet. Today, Progressive uses its innovative improvements to promote its auto, life, and home insurance.

Wondering why we are sharing facts about Progressive’s history?

Looking at a company’s history is an important part of determining a company’s future. So stick with us as we look at Progressive’s market shares, awards, and more, so we can create an informed picture of how Progressive will fare.

Let’s jump in.

Progressive Market Share

As an insurer that has been around for almost a century, Progressive controls a significant portion of the insurance market. Below is the NAIC’s data on Progressive’s market shares over the years.

| Progressive Market Shares | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Percentage of Market | 8.7 | 9.15 | 9.84 | 10.97 |

Progressive’s market growth is impressive. Since 2015, Progressive has managed to increase its share in the market by over 2 percent. This is quite a large amount to secure in the market. It shows that Progressive is a major contender.

Progressive’s Position for the Future

Progressive became a major insurer for a reason. It has great financial ratings from multiple review sites, which tells us Progressive has a stable future.

While Progressive has some below-average customer satisfaction ratings, it has still managed to increase its market shares and attract new customers. So while Progressive may struggle with customer satisfaction, there is little chance of Progressive going bankrupt anytime soon.

Progressive’s Online Presence

Want to find out more about Progressive? The company has multiple outreach methods that consumers can use.

- Online — Visit Progressive’s website to find information and get free quotes.

- Agents — Find and talk to an independent agent in your area.

- Phone — Call 1-866-407-4844 to talk to Progressive customer service.

- Email/Mail — Email Progressive or send mail to its headquarters.

Progressive offers independent agents, which is useful if you want to meet someone in-person to discuss car insurance policies. The company also has a strong online presence with its website, although consumers can also call or email the company for information.

Progressive’s Commercials

Progressive’s spokesperson, Flo, has been cropping up on commercial breaks for years. Having a spokesperson is useful, as it helps a company’s commercials stick in the viewer’s mind.

(For example, Geico’s commercials use the same tactic as Progressive — think: Geico’s memorable “mascots,” the gecko and the caveman. But we aren’t here to discuss Geico versus Progressive.)

We want to see how effective Progressive is at advertising its wares, as marketing is an important part of attracting customers.

The interesting thing about Progressive is that it doesn’t have a catchy jingle or phrase like other insurers. Instead, Progressive relies on humor and Flo to make its commercials stick.

There are dozens of more commercials like this, using humor to promote Progressive’s home and auto insurance. If you think of Flo when you think of Progressive, Progressive’s marketing technique has been successful.

Progressive in the Community

When consumers shop for car insurance, a company that is actively involved in the community is more attractive to the majority of consumers.

So what does Progressive do to help the community?

- The Progressive Insurance Foundation — Progressive will match employees’ donations.

- Volunteer Website — Progressive’s employee website lets employees find volunteer opportunities.

- STEM Progress Program — Progressive’s program has employees visit schools and use insurance concepts to teach students skills.

- Keys to Progress — Progressive gifts vehicles to veterans and their families.

Progressive takes an active role in the community, not just donating money but also volunteering.

Progressive’s Employees

We know Progressive’s employees are active volunteers, but how happy they at their job? Our goal in this section is to discover what Progressive employees think about the company they work at because a company with happy employees is doing something right. If employees hate a company, it’s likely customers are also less than satisfied.

Progressive is rated by a Great Place to Work, which gives detailed information about employees’ ages, tenures, and opinions about Progressive.

Let’s start by seeing what generations dominate Progressive’s workplace.

| Employee Generation | Percentage |

|---|---|

| Millennials (Born Between 1981 and 1997) | 47% |

| Gen X (Born Between 1965 and 1980) | 39% |

| Baby Boomers (Born Between 1945 and 1964) | 13% |

Millennials and Gen Xers make up the largest portion of employees at Progressive. So how long do these generations stay at Progressive?

| Employee Tenure | Percentage |

|---|---|

| >2 years | 28% |

| 2-5 years | 26% |

| 6-10 years | 10% |

| 11-15 years | 13% |

| 16-20 years | 12% |

| Over 20 years | 11% |

The majority of Progressive employees stay five years or less. A small percentage (11 percent) stay over 20 years.

Now that we know how long employees stay, let’s see what they think of their experience at Progressive.

| Statement | Percentage in Agreement |

|---|---|

| When you join the company, you are made to feel welcome. | 97% |

| Management is honest and ethical in its business practices. | 94% |

| Our executives fully embody the best characteristics of our company. | 93% |

| I am given the resources and equipment to do my job. | 93% |

| I'm proud to tell others I work here. | 93% |

| Progressive is a great place to work. | 92% |

Employees gave Progressive great ratings on a Great Place to Work. To make sure we are getting a complete picture of Progressive’s workplace, though, we want to look at Glassdoor’s rating.

- Progressive has 3.7 stars out of five on Glassdoor (from over 2,000 reviews)

- 70 percent of Progressive employees would recommend the company to a friend

- 91 percent of Progressive employees approve of the CEO

These ratings are a little less positive than on a Great Place to Work. The negative reviews about working at Progressive mention long hours and poor work/life balance. Reviews also talk about the difficulty of working at Progressive’s call center.

However, positive reviews talk about how Progressive has a great work environment and benefits.

Finally, before we end the discussion on Progressive’s employees, we want to look at Payscale’s ratings.

Based on over 100 reviews, Progressive received 3.8 stars out of five.

This rating is broken down into the following categories.

| Category | Rating (out of 5) |

|---|---|

| Appreciation | 3.6 |

| Company Outlook | 4.5 |

| Fair Pay | 3.1 |

| Learning and Development | 3.9 |

| Manager Communication | 4.0 |

| Manager Relationship | 4.1 |

| Pay Policy | 2.9 |

| Pay Transparency | 3.2 |

Progressive employees gave pay policy the lowest score. However, company outlook and manager communication/relationship all earned high scores.

Awards and Accolades

Now that we know what Progressive’s employees think of the company, we want to see what awards and accolades Progressive has earned for its business.

Below is a complete list of Progressive’s awards from a Great Place to Work.

| Year of Award | Award |

|---|---|

| 2019 | #5 in Best Workplaces in Financial Services & Insurance |

| 2019 | #31 in Best Workplaces in Texas |

| 2019 | #76 in 2019 Fortune 100 Best Companies to Work For |

| 2018 | #78 in Fortune 100 Best Companies to Work For |

| 2018 | #15 in Best Workplaces in Texas |

| 2018 | #6 in Best Workplaces in Financial Services & Insurance |

| 2018 | #10 in Best Workplaces for Millennials |

| 2018 | #17 in Best Workplaces for Women |

| 2018 | #26 in Best Workplaces for Parents |

| 2018 | #10 in Best Workplaces for Diversity |

| 2017 | #30 in Best Workplaces for Working Parents |

Progressive has won numerous awards for its inclusion in the workplace, as well as its work environment.

Cheap Car Insurance Rates

We know price is an important factor for consumers. If you are thinking of purchasing a Progressive policy, you’ve probably already checked the average prices. However, we want to go in-depth into what you’ll be paying at Progressive. This way, you can be prepared for Progressive’s rates and calculate it into your budget.

We’ve partnered with Quadrant to bring you important data about Progressive’s rates.

Keep reading to learn about what factors will change your rates.

Progressive Availability and Rates by State

Have you ever moved to a new state and had to scramble for a new insurance provider? Sometimes, insurers don’t provide insurance in all states.

Luckily, Progressive provides insurance in all 50 U.S. states. This means that no matter where you go, you can keep Progressive as your provider. However, Progressive’s rates won’t stay the same as you move from state to state. As the table below shows, there will be a change in rates.

| State | State Average Annual Premium | Progressive Average Annual Premium |

|---|---|---|

| Alaska | $3,421.51 | $3,062.85 |

| Alabama | $3,566.96 | $4,450.52 |

| Arkansas | $4,124.98 | $5,312.09 |

| Arizona | $3,770.97 | $3,577.50 |

| California | $3,688.93 | $2,849.67 |

| Colorado | $3,876.39 | $4,231.92 |

| Connecticut | $4,618.92 | $4,920.35 |

| District of Columbia | $4,439.24 | $4,970.26 |

| Delaware | $5,986.32 | $4,181.83 |

| Florida | $4,680.46 | $5,583.30 |

| Georgia | $4,966.83 | $4,499.22 |

| Hawaii | $2,555.64 | $2,177.93 |

| Iowa | $2,981.28 | $2,395.50 |

| Idaho | $2,979.09 | Data Not Available |

| Illinois | $3,305.48 | $3,536.65 |

| Indiana | $3,414.97 | $3,898.00 |

| Kansas | $3,279.62 | $4,144.38 |

| Kentucky | $5,195.40 | $5,547.63 |

| Louisiana | $5,711.34 | $7,471.10 |

| Maine | $2,953.28 | $3,643.59 |

| Maryland | $4,582.70 | $4,094.86 |

| Massachusetts | $2,678.85 | $3,835.11 |

| Michigan | $10,498.64 | $5,364.55 |

| Minnesota | $4,403.25 | Data Not Available |

| Missouri | $3,328.93 | $3,419.14 |

| Mississippi | $3,664.57 | $4,308.85 |

| Montana | $3,220.84 | $4,330.76 |

| North Carolina | $3,393.11 | $2,382.61 |

| North Dakota | $4,165.84 | $3,623.06 |

| Nebraska | $3,283.68 | $3,758.01 |

| New Hampshire | $3,151.77 | $2,694.45 |

| New Jersey | $5,515.21 | $3,972.72 |

| New Mexico | $3,463.64 | $3,119.18 |

| Nevada | $4,861.70 | $4,062.57 |

| New York | $4,289.88 | $3,771.15 |

| Ohio | $2,709.71 | $3,436.96 |

| Oklahoma | $4,142.33 | $4,832.35 |

| Oregon | $3,467.77 | $3,629.13 |

| Pennsylvania | $4,034.50 | $4,451.00 |

| Rhode Island | $5,003.36 | $5,231.09 |

| South Carolina | $3,781.14 | $4,573.08 |

| South Dakota | $3,982.27 | $3,752.81 |

| Tennessee | $3,660.89 | $3,656.91 |

| Texas | $4,043.28 | $4,664.69 |

| Utah | $3,611.89 | $3,830.10 |

| Virginia | $2,357.87 | $2,498.58 |

| Vermont | $3,234.13 | $5,217.14 |

| Washington | $3,059.32 | $3,209.52 |

| West Virginia | $2,595.36 | Data Not Available |

| Wisconsin | $3,606.06 | $3,128.91 |

| Wyoming | $3,200.08 | $4,401.17 |

In most states, Progressive’s rates are lower than the state average. This is not always the case, though. For example, Progressive costs almost $2,000 more in Vermont than the state’s average rate.

Depending on where you move, you may want to look into other providers.

Comparing the Top 10 Companies by Market Share

You now know what Progressive charges by state, but how good are Progressive rates when compared to other providers’?

The Top Ten Insurance Providers' Rates by State| State | Average by State | Allstate | American Family | Farmers | Geico | Liberty Mutual | Nationwide | Progressive | State Farm | Travelers | USAA |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Alabama | $3,566.96 | $3,311.52 | Data Not Available | $4,185.80 | $2,866.60 | $4,005.48 | $2,662.66 | $4,450.52 | $4,798.15 | $3,697.80 | $2,124.09 |

| Alaska | $3,421.51 | $3,145.31 | $4,153.07 | Data Not Available | $2,879.96 | $5,295.55 | Data Not Available | $3,062.85 | $2,228.12 | Data Not Available | $2,454.21 |

| Arizona | $3,770.97 | $4,904.10 | Data Not Available | $5,000.08 | $2,264.71 | Data Not Available | $3,496.08 | $3,577.50 | $4,756.25 | $3,084.74 | $3,084.29 |

| Arkansas | $4,124.98 | $5,150.03 | Data Not Available | $4,257.87 | $3,484.63 | Data Not Available | $3,861.79 | $5,312.09 | $2,789.03 | $5,973.33 | $2,171.06 |

| California | $3,688.93 | $4,532.96 | Data Not Available | $4,998.78 | $2,885.65 | $3,034.42 | $4,653.19 | $2,849.67 | $4,202.28 | $3,349.54 | $2,693.87 |

| Colorado | $3,876.39 | $5,537.17 | $3,733.02 | $5,290.24 | $3,091.69 | $2,797.74 | $3,739.47 | $4,231.92 | $3,270.77 | Data Not Available | $3,338.87 |

| Connecticut | $4,618.92 | $5,831.60 | Data Not Available | Data Not Available | $3,073.66 | $7,282.87 | $3,672.34 | $4,920.35 | $2,976.24 | $6,004.29 | $3,190.00 |

| Delaware | $5,986.32 | $6,316.06 | Data Not Available | Data Not Available | $3,727.29 | $18,360.02 | $4,330.21 | $4,181.83 | $4,466.85 | $4,182.36 | $2,325.98 |

| District of Columbia | $4,439.24 | $6,468.92 | Data Not Available | Data Not Available | $3,692.81 | Data Not Available | $4,848.98 | $4,970.26 | $4,074.05 | Data Not Available | $2,580.44 |

| Florida | $4,680.46 | $7,440.46 | Data Not Available | Data Not Available | $3,783.63 | $5,368.15 | $4,339.60 | $5,583.30 | $3,397.67 | Data Not Available | $2,850.41 |

| Georgia | $4,966.83 | $4,210.70 | Data Not Available | Data Not Available | $2,977.20 | $10,053.44 | $6,484.90 | $4,499.22 | $3,384.88 | Data Not Available | $3,157.46 |

| Hawaii | $2,555.64 | $2,173.49 | Data Not Available | $4,763.82 | $3,358.86 | $3,189.55 | $2,551.83 | $2,177.93 | $1,040.28 | Data Not Available | $1,189.35 |

| Idaho | $2,979.09 | $4,088.76 | $3,728.79 | $3,168.28 | $2,770.68 | $2,301.51 | $3,032.19 | Data Not Available | $1,867.96 | $3,226.29 | $1,877.61 |

| Illinois | $3,305.48 | $5,204.41 | $3,815.31 | $4,605.20 | $2,779.16 | $2,277.65 | $2,711.81 | $3,536.65 | $2,344.88 | $2,499.76 | $2,770.21 |

| Indiana | $3,414.97 | $3,978.81 | $3,679.68 | $3,437.55 | $2,261.07 | $5,781.35 | Data Not Available | $3,898.00 | $2,408.94 | $3,393.75 | $1,630.86 |

| Iowa | $2,981.28 | $2,965.86 | $3,021.81 | $2,435.72 | $2,296.16 | $4,415.28 | $2,735.44 | $2,395.50 | $2,224.51 | $5,429.38 | $1,852.57 |

| Kansas | $3,279.62 | $4,010.23 | $2,146.40 | $3,703.77 | $3,220.65 | $4,784.42 | $2,475.59 | $4,144.38 | $2,720.00 | $4,341.43 | $2,382.61 |

| Kentucky | $5,195.40 | $7,143.92 | Data Not Available | Data Not Available | $4,633.59 | $5,930.97 | $5,503.23 | $5,547.63 | $3,354.32 | $6,551.68 | $2,897.89 |

| Louisiana | $5,711.34 | $5,998.79 | Data Not Available | Data Not Available | $6,154.60 | Data Not Available | Data Not Available | $7,471.10 | $4,579.12 | Data Not Available | $4,353.12 |

| Maine | $2,953.28 | $3,675.59 | Data Not Available | $2,770.15 | $2,823.05 | $4,331.39 | Data Not Available | $3,643.59 | $2,198.68 | $2,252.97 | $1,930.79 |

| Maryland | $4,582.70 | $5,233.17 | Data Not Available | Data Not Available | $3,832.63 | $9,297.55 | $2,915.69 | $4,094.86 | $3,960.87 | Data Not Available | $2,744.14 |

| Massachusetts | $2,678.85 | $2,708.53 | Data Not Available | Data Not Available | $1,510.17 | $4,339.35 | Data Not Available | $3,835.11 | $1,361.86 | $3,537.94 | $1,458.99 |

| Median | $3,660.89 | $4,532.96 | $3,698.77 | $3,907.99 | $3,073.66 | $5,295.55 | $3,187.20 | $3,935.36 | $2,731.48 | $3,729.32 | $2,489.49 |

| Michigan | $10,498.64 | $22,902.59 | Data Not Available | $8,503.60 | $6,430.11 | $20,000.04 | $6,327.38 | $5,364.55 | $12,565.52 | $8,773.97 | $3,620.00 |

| Minnesota | $4,403.25 | $4,532.01 | $3,521.29 | $3,137.45 | $3,498.54 | $13,563.61 | $2,926.49 | Data Not Available | $2,066.99 | Data Not Available | $2,861.60 |

| Mississippi | $3,664.57 | $4,942.11 | Data Not Available | Data Not Available | $4,087.21 | $4,455.94 | $2,756.53 | $4,308.85 | $2,980.48 | $3,729.32 | $2,056.13 |

| Missouri | $3,328.93 | $4,096.15 | $3,286.90 | $4,312.19 | $2,885.33 | $4,518.67 | $2,265.35 | $3,419.14 | $2,692.91 | Data Not Available | $2,525.78 |

| Montana | $3,220.84 | $4,672.10 | Data Not Available | $3,907.55 | $3,602.35 | $1,326.11 | $3,478.26 | $4,330.76 | $2,417.74 | Data Not Available | $2,031.89 |

| Nebraska | $3,283.68 | $3,198.83 | $2,215.13 | $3,997.29 | $3,837.49 | $6,241.52 | $2,603.94 | $3,758.01 | $2,438.71 | Data Not Available | $2,330.78 |

| Nevada | $4,861.70 | $5,371.62 | $5,441.18 | $5,595.56 | $3,662.09 | $6,201.55 | $3,477.14 | $4,062.57 | $5,796.34 | $5,360.41 | $3,069.07 |

| New Hampshire | $3,151.77 | $2,725.01 | Data Not Available | Data Not Available | $1,615.02 | $8,444.41 | $2,491.10 | $2,694.45 | $2,185.46 | Data Not Available | $1,906.96 |

| New Jersey | $5,515.21 | $5,713.58 | Data Not Available | $7,617.00 | $2,754.94 | $6,766.62 | Data Not Available | $3,972.72 | $7,527.16 | $4,254.49 | Data Not Available |

| New Mexico | $3,463.64 | $4,200.65 | Data Not Available | $4,315.53 | $4,458.30 | Data Not Available | $3,514.38 | $3,119.18 | $2,340.66 | Data Not Available | $2,296.77 |

| New York | $4,289.88 | $4,740.97 | Data Not Available | Data Not Available | $2,428.24 | $6,540.73 | $4,012.93 | $3,771.15 | $4,484.58 | $4,578.79 | $3,761.69 |

| North Carolina | $3,393.11 | $7,190.43 | Data Not Available | Data Not Available | $2,936.69 | $2,182.71 | $2,848.03 | $2,382.61 | $3,078.65 | $3,132.66 | Data Not Available |

| North Dakota | $4,165.84 | $4,669.31 | $3,812.40 | $3,092.49 | $2,668.24 | $12,852.83 | $2,560.35 | $3,623.06 | $2,560.53 | Data Not Available | $2,006.80 |

| Ohio | $2,709.71 | $3,197.22 | $1,515.17 | $3,423.01 | $1,867.19 | $4,429.74 | $3,300.89 | $3,436.96 | $2,507.88 | $3,135.16 | $1,478.46 |

| Oklahoma | $4,142.33 | $3,718.62 | Data Not Available | $4,142.40 | $3,437.34 | $6,874.62 | Data Not Available | $4,832.35 | $2,816.80 | Data Not Available | $3,174.15 |

| Oregon | $3,467.77 | $4,765.95 | $3,527.28 | $3,753.52 | $3,220.12 | $4,334.55 | $3,176.83 | $3,629.13 | $2,731.48 | $2,892.19 | $2,587.15 |

| Pennsylvania | $4,034.50 | $3,984.12 | Data Not Available | Data Not Available | $2,605.22 | $6,055.20 | $2,800.37 | $4,451.00 | $2,744.23 | $7,842.47 | $1,793.37 |

| Rhode Island | $5,003.36 | $4,959.45 | Data Not Available | Data Not Available | $5,602.63 | $6,184.12 | $4,409.63 | $5,231.09 | $2,406.51 | $6,909.45 | $4,323.98 |

| South Carolina | $3,781.14 | $3,903.43 | Data Not Available | $4,691.85 | $3,178.01 | Data Not Available | $3,625.49 | $4,573.08 | $3,071.34 | Data Not Available | $3,424.77 |

| South Dakota | $3,982.27 | $4,723.72 | $4,047.47 | $3,768.80 | $2,940.29 | $7,515.99 | $2,737.66 | $3,752.81 | $2,306.23 | Data Not Available | Data Not Available |

| Tennessee | $3,660.89 | $4,828.85 | Data Not Available | $3,430.07 | $3,283.42 | $6,206.69 | $3,424.96 | $3,656.91 | $2,639.30 | $2,738.52 | $2,739.28 |

| Texas | $4,043.28 | $5,485.44 | $4,848.72 | Data Not Available | $3,263.28 | Data Not Available | $3,867.55 | $4,664.69 | $2,879.94 | Data Not Available | $2,487.89 |

| Utah | $3,611.89 | $3,566.42 | $3,698.77 | $3,907.99 | $2,965.57 | $4,327.76 | $2,986.57 | $3,830.10 | $4,645.83 | Data Not Available | $2,491.10 |

| Vermont | $3,234.13 | $3,190.38 | Data Not Available | Data Not Available | $2,195.71 | $3,621.08 | $2,128.21 | $5,217.14 | $4,382.84 | Data Not Available | $1,903.55 |

| Virginia | $2,357.87 | $3,386.80 | Data Not Available | Data Not Available | $2,061.53 | Data Not Available | $2,073.00 | $2,498.58 | $2,268.95 | Data Not Available | $1,858.38 |

| Washington | $3,059.32 | $3,540.52 | $3,713.02 | $2,962.00 | $2,568.65 | $3,994.73 | $2,129.84 | $3,209.52 | $2,499.78 | Data Not Available | $2,262.16 |

| West Virginia | $2,595.36 | $3,820.68 | Data Not Available | Data Not Available | $2,120.80 | $2,924.39 | Data Not Available | Data Not Available | $2,126.32 | Data Not Available | $1,984.62 |

| Wisconsin | $3,606.06 | $4,854.41 | $1,513.27 | $3,777.49 | $3,926.20 | $6,758.85 | $5,224.99 | $3,128.91 | $2,387.53 | Data Not Available | $2,975.74 |

| Wyoming | $3,200.08 | $4,373.93 | Data Not Available | $3,069.35 | $3,496.56 | $1,989.36 | $3,187.20 | $4,401.17 | $2,303.55 | Data Not Available | $2,779.53 |

Read more:

- 60 Day Waiting Period on New Texas Auto Insurance Policies

- Kentucky Auto Insurance (Cheap Rates, Best Companies, and More)

Progressive rates, while generally lower than the state averages, are not the cheapest. Other providers, such as Geico, have cheaper rates than Progressive.

If you are looking for the cheapest rates in your state, Progressive may not be the best choice.

Average Progressive Male vs. Female Car Insurance Rates

It may surprise you to learn that car insurance companies use your gender as a price factor. However, some states have banned this practice.

States that prohibit gender as price factor: California, Hawaii, Massachusetts, Montana, Pennsylvania, North Carolina, and parts of Michigan.

Basing rates on gender is only outlawed in a handful of states, so let’s take a look at what Progressive charges based on gender and age.

| Progressive Demographic Rates | |

|---|---|

| Married 60-year-old female | $1,991.49 |

| Married 60-year-old male | $2,048.63 |

| Married 35-year-old female | $2,296.90 |

| Married 35-year-old male | $2,175.27 |

| Single 25-year-old female | $2,697.73 |

| Single 25-year-old male | $2,758.66 |

| Single 17-year-old female | $8,689.95 |

| Single 17-year-old male | $9,625.49 |

Surprisingly, Progressive charges 35-year-old females more than males. Normally, males pay more than females in all age categories because insurers believe males to be riskier drivers based on accident data. As a result, most insurers charge male drivers more, especially those under age 25.

Average Progressive Rates by Make and Model — Last 5 Year Average

When you get a new car, you may be surprised to see your insurance rates drop slightly. Cars with safety features generally have a lower premium, while high-risk vehicles (sports cars) with poor crash ratings will cost more to insure.

Below are Progressive’s rates for different vehicle makes and models.

| Make and Model | Progressive Average Rate |

|---|---|

| 2018 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $4,528.90 |

| 2015 Honda Civic Sedan LX with 2.0L 4cyl and CVT | $4,429.56 |

| 2018 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,962.58 |

| 2015 Ford F-150 Lariat SuperCab with 2WD 6.5 foot bed and 2.7L V6 | $3,914.05 |

| 2018 Toyota RAV4 XLE | $3,730.78 |

| 2015 Toyota RAV4 XLE | $3,647.22 |

At Progressive, the most expensive car to insure is a Honda Civic Sedan. On the other hand, a Toyota RAV4 will cost about $1,000 less to insure.

Average Progressive Commute Rates

Some companies will charge customers more for longer commutes. While it’s generally around $100 more, these small increases can add up to a pricy insurance bill at the end of the year.

| Group | 10 Miles Commute / 6,000 Annual Mileage | 25 Miles Commute / 12,000 Annual Mileage |

|---|---|---|

| Progressive | $4,030.02 | $4,041.01 |

Progressive’s average increase for commute distance is small. An $11 price increase is low compared to other companies and is great for those with long commutes.

Progressive Coverage Level Rates

Thinking of upgrading your coverage level? Let’s take a look at Progressive’s price increases for different coverage levels.

| Coverage Level | Low | Medium | High |

|---|---|---|---|

| Progressive Average Rate | $3,737.13 | $4,018.46 | $4,350.96 |

Progressive’s rates are fairly normal. It costs about $281 to go from low to medium coverage and $613 to upgrade from low to high coverage. This is a good rate, as some insurers can charge over $1,000 for upgrades.

While it’s not the lowest upgrade cost, it is reasonable.

Average Company Credit History Rates

The law permits insurers to base rates on consumers’ credit scores. If drivers have a poor or fair credit score, they will have higher rates.

The average credit score in the U.S. is 675.

If your credit score is lower than 675, your insurer may charge you more. Let’s see what Progressive charges based on credit score.

| Credit Score | Good | Fair | Poor |

|---|---|---|---|

| Progressive Average Rate | $3,628.85 | $3,956.31 | $4,737.64 |

Progressive’s rate increase from good to poor credit may seem high, but it is normal. Most insurers charge about $1,000 for poor credit.

Average Progressive Driving Record Rates

Equally as important as a credit score is a driver’s driving record.

| Driving Record | Clean Record | With 1 DUI | With 1 Speeding Violation | With 1 Accident |

|---|---|---|---|---|

| Progressive Average Rate | $3,393.09 | $3,969.65 | $4,002.28 | $4,777.04 |

At Progressive, a DUI costs less than a speeding ticket. Still, each offense will cost a hefty sum. For example, an accident will cost drivers over $1,000.

The average rates shown above are for a first offense. If drivers have multiple offenses on their record, they will have higher rates and may have to purchase high-risk insurance.

Coverages Offered

Now that we’ve covered Progressive’s prices, we want to see if Progressive’s coverages are worth the price. While it can be tempting to go with the cheapest insurer, a lower price could mean poor coverage.

So let’s see what Progressive has to offer.

Stick with us as we go through coverages and programs at Progressive.

Types of Coverages Offered

Progressive offers a wide range of car insurance coverages.

Progressive Auto Insurance Coverage| Coverage | Purpose | Example of Coverage Use |

|---|---|---|

| Bodily Injury Liability | This coverage pays for another driver's medical bills/loss of income in an accident you caused. | You glance down to check the GPS instructions and rear-end another car, injuring the driver. |

| Classic Car | Covers classic cars for less than regular auto insurance policies. | Vintage cars used just for pleasure -- driving around on a sunny day. |

| Collision | Pays for repairs to your vehicle in accidents with another vehicle or object. | You hydroplane and crash into a tree. |

| Commercial | Covers vehicles used for business. | You own a flower shop and have a delivery van used for your business. |

| Comprehensive | Pays for repairs in accidents not caused by another vehicle. These accidents include theft, natural disasters and animal collisions. | Your car is parked outside when heavy winds knock a tree onto your car. |

| Gap Coverage | Pays the difference between your vehicle's actual value and what you still owe on your loan/lease. | You total your car. Your car is worth 10,000, but you still owe 15,000 on your car loan. |

| Medical Payments | Pays for your and your passenger's medical costs in an accident. | An accident gave you a mild concussion, and you need to be treated at a hospital. |

| Personal Injury Protection | Pays for your medical bills and other accident costs (such as lost income). | Your concussion from an accident leaves you unable to work for a month, resulting in medical bills and lost income. |

| Property Damage Liability | Pays for damages to another person's vehicle/property in an accident you caused. | You accidentally scrape another person's car pulling into a tight parking spot. |

| Rental Reimbursement | Provides access to a rental car if your car is in shop after a covered accident. | Your car will be in the repair shop for at least a few days, so you need another vehicle to get around. |

| Rideshare | Covers rideshare drivers. | You want to work for Uber or Lyft as a rideshare driver. |

| Umbrella | Provides extra liability coverage. | You were in an accident the other parties are suing you. |

| Underinsured Motorist | Helps you if you are in an accident with an underinsured motorist. | A driver hits you, but has such poor insurance that the driver can't cover your medical and property damage bills. |

| Uninsured Motorist | Helps in hit-and-run accidents or an accident with an uninsured motorist. | You come out of the store and someone has run into your car before fleeing the scene. |

As the table above shows, Progressive has all the basic car insurance coverages, plus a few extras.

Factors That Affect Your Rate

We’ve gone through some factors such as driving records. However, there are other ways to reduce rates. Because Progressive offers insurance other than car insurance, customers can bundle policies to save money.

| Insurance Type | Covers: |

|---|---|

| Vehicle and Recreational | ATV, Auto, Boat, Classic Car, Golf Cart, Motorcycle, PWC, RV/Trailer, Segway, and Snowmobile. |

| Home and Property | Condo, Flood, Homeowners, Homeshare, Mobile Home, and Renters. |

| Everything Else (Includes Life and Health Insurance) | Business, Commercial, Electronic Device, Health, Home Financing, Home Refinancing, Home Security, Home Warranty, ID Theft, Life, Personal Loans, Pet, Travel, and Wedding and Event. |

For example, customers can bundle a home and auto policy to receive a discount.

https://youtu.be/Ix5_5KGnksk

Getting the Best Rate with Progressive

While having a clean record and bundling policies can help lower rates, discounts are also important. Progressive has one of the highest numbers of discounts among its competitors.

Below, you can see which discounts Progressive offers, as well as the percentage saved (when known).

| Progressive Discounts | Percentage Saved (when available) |

|---|---|

| Adaptive Cruise Control | x |

| Adaptive Headlights | x |

| Anti-lock Brakes | x |

| Anti-Theft | x |

| Claim Free | x |

| Continuous Coverage | x |

| Daytime Running Lights | x |

| Defensive Driver | 10% |

| Distant Student | x |

| Driver's Ed | 10% |

| Driving Device/App | 20% |

| Early Signing | x |

| Electronic Stability Control | x |

| Family Legacy | x |

| Forward Collision Warning | x |

| Full Payment | x |

| Good Credit | x |

| Good Student | x |

| Homeowner | x |

| Lane Departure Warning | x |

| Low Mileage | x |

| Loyalty | x |

| Married | x |

| Multiple Policies | 12% |

| Multiple Vehicles | 10% |

| Newer Vehicle | x |

| Online Shopper | 7% |

| Paperless Documents | $50 |

| Paperless/Auto Billing | x |

| Passive Restraint | x |

| Safe Driver | 31% |

| Stable Residence | x |

| Switching Provider | x |

| Vehicle Recovery | x |

| VIN Etching | x |

| Young Driver | x |

| Total Discounts Provided | 36 |

Progressive has 36 discounts, making it easy to save. Simply getting paperless billing can save customers $50. So make sure to take advantage of Progressive’s discounts, as it can help lower costs significantly.

Progressive’s Programs

Progressive also has a wide range of programs intended to help customers out.

- Accident Forgiveness — Progressive offers accident forgiveness to customers, which means rates won’t go up for a customer’s first accident.

- Car Buying Service — Progressive partnered with TruCar to help customers shop for cars.

- Custom Parts and Equipment Value — Covers anything not installed by the original manufacturer, such as a new stereo.

- Roadside Assistance — Helps customers with flat tires, lock-outs, gas refueling, and towing.

- Usage-Based Insurance — Progressive’s Snapshot app measures how well customers drive and adjusts rates accordingly.

Progressive has several programs, more so than most providers. A majority of them are meant to save customers money, such as accident forgiveness.

What Stands Out and What’s Missing

We’ve gone through Progressive’s rates and coverages, so let’s take a moment to reflect on what stands out and what’s missing.

- What Stands Out — Progressive has a large number of discounts. It also has coverages and programs that go beyond the basics.

- What’s Missing — Progressive lacks a military discount, which is usually common.

Progressive offers more than it lacks, although Progressive’s prices are higher than average. So while you’ll get a wide range of coverages, you’ll also be paying more.

So make sure to use Progressive’s discounts.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Canceling Your Policy

Thinking of breaking up with Progressive? We want to see if Progressive will maturely handle the breakup, or if the company will demand fees and complicated paperwork in retribution.

So stick with us as we go through the aspects of canceling a policy at Progressive.

From fees to when you can cancel, it is all covered here.

Cancellation Fee

Progressive isn’t clear on if it charges a fee for cancellation. However, there may be a fee for canceling before the end of a renewal cycle. This fee shouldn’t be more than $100, and customers shouldn’t be charged a fee at all if they cancel at the end of a renewal cycle.

To see what Progressive will charge you, give customer service a call.

Is there a refund?

Once again, Progressive doesn’t mention this on their website. If you paid for three months of coverage and cancel in the second month, though, Progressive should refund you for a month. However, this refund could be minus a possible cancellation fee.

How to Cancel

You’ve decided to cancel, so now what? We are going to go through the must-know steps of canceling a policy at Progressive.

Step One: Have a New Insurer Before Canceling

If you are switching providers, you need to have a new provider before canceling. Otherwise, you’ll have a lapse in coverage. Insurers will see this lapse and charge you more. (For more information, read our “Auto Insurance Companies That Accept Lapses in Coverage“).

Most insurers also require proof of a new insurer if you are canceling, so have the policy number of your new insurer ready. If you aren’t switching providers because you no longer need insurance (such as selling your car), then you need proof (such as a bill of sale).

Step Two: Call Progressive

Progressive requires customers to call 1-800-776-4737 to cancel a policy. The agent you speak to will probably try to convince you to stay with Progressive. They may try to help you get discounts to lower coverages or offer a new service.

Unless you can change your Progressive policy to your satisfaction, be firm and stick to canceling your policy. You can also ask your new insurer for help canceling at Progressive.

When can I cancel?

You can cancel at any time. However, canceling before a renewal cycle may result in a cancellation fee. If you want to avoid hidden fees, cancel at the end of a renewal cycle. Your cancellation should go into effect immediately, no matter when you cancel.

Are you on automatic billing? Check to make sure Progressive stopped your payments after cancellation.

Read More: How to Cancel Progressive Auto Insurance

How to Make a Claim

Unfortunately, most drivers will make a claim at some point in their driving career. This is why it’s important to make sure you are with a company that has a fast claim process and is reliable.

Stick with us as we look at Progressive’s claims process, from how to file a claim to how many claims are paid out.

Let’s get started.

Ease of Making a Claim

Progressive makes it easy to file a claim. Keep reading to see the different methods, from online to app filing.

Filing Online

Progressive customers can file a claim online. Progressive claims it takes about five to eight minutes to complete the online claim form. Customers will need answers to the following to file a claim online (and for all other methods of filing):

- Type of claim you’re filing (auto, home, etc.)

- The date of the accident

- The location of the accident

- Your policy information

- The vehicles involved

- The people involved

If you file online, you can periodically sign in and check your claim status.

Filing with Progressive’s Mobile App

Have Progressive’s mobile app? If you don’t feel like opening up a laptop, you can file a claim on Progressive’s app. This is a convenient method, especially because you can take pictures of the accident damage and instantly upload them to your claim form.

It also means you can file on the scene of the accident, rather than waiting until you get home and have access to a computer.

Filing over the Phone

Progressive customers can also file a claim by calling 1-800-776-4737 (claim hotline). If you have an agent, you can also call your agent directly to file a claim. (For more information, read our “Can You Get Cheaper Car Insurance Over the Phone?“).

Premiums Written

How do premiums written relate to claims? Well, the higher the number of premiums written, the less customers have to pay. For example, a company with few written premiums will have to charge customers more to cover the cost of accident claims.

So let’s take a look at the NAIC’s data on Progressive’s written premiums.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Written Premiums | $16,566,932,000 | $19,634,834,000 | $22,786,034,000 | $27,058,768,000 |

Progressive has nearly doubled its written premiums since 2015. This is impressive and should help keep rates lower at Progressive.

Loss Ratio

Loss ratio ties directly into written premiums and claims. So what exactly is a loss ratio?

A loss ratio calculates the number of written premiums compared to the number of claims. A company with a 60 percent loss ratio is paying $60 on claims for every $100 earned from written premiums.

A high loss ratio may seem good, but anything over 100 percent means a company is risking bankruptcy. On the other hand, too low of a loss ratio means a company isn’t paying out a good number of claims.

So let’s take a look at Progressive’s loss ratios to see how many claims the company pays out.

| Year | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Loss Ratio | 64.23% | 66.74% | 63.32% | 62% |

Progressive’s loss ratio took a small dip in 2017 and 2018. However, it is still above 60 percent, which is a good loss ratio.

How to Get a Quote Online

Getting a quote is a great way to compare prices between insurers. Most insurers offer free quotes, and Progressive is one of them.

Since the last thing you want is to sign up with an insurer outside your price range, keep reading to learn how to get a free quote from Progressive.

Let’s begin.

Step One: Visit Progressive’s Website

The first thing to do is to visit Progressive’s website. On the homepage, you’ll see the option to get a quote filling up most of the screen.

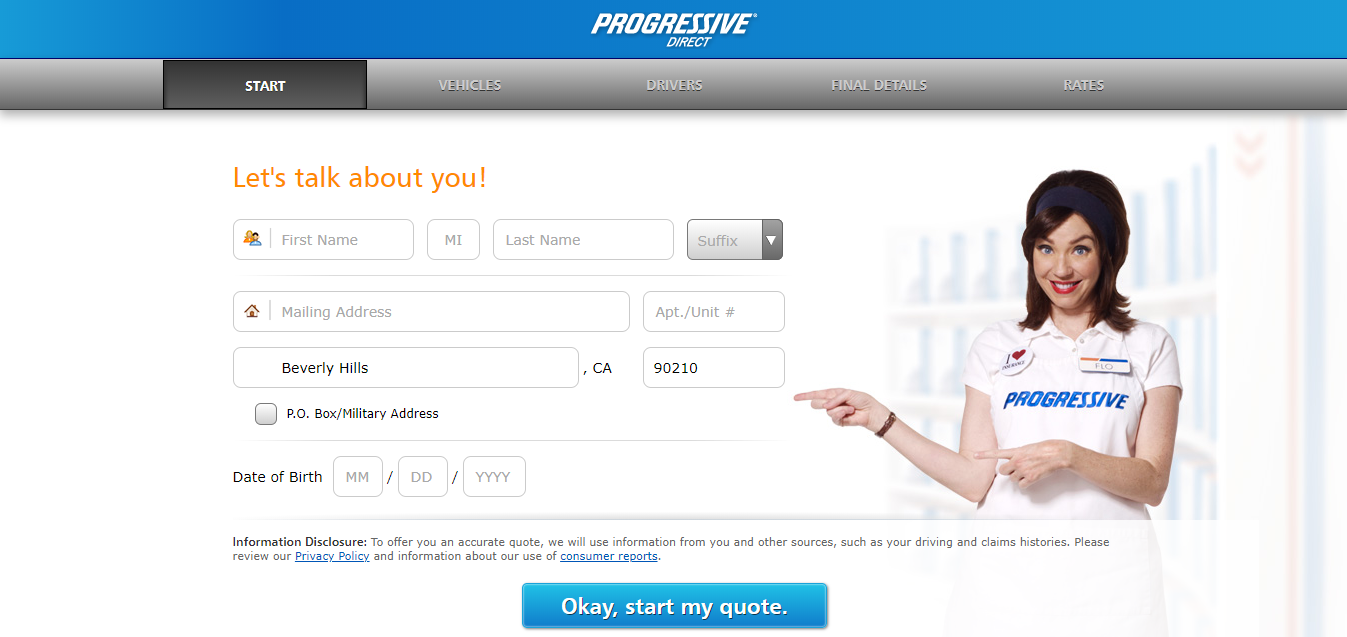

Step 2: Basic Information

Once you select an auto insurance quote and enter your ZIP code, you’ll be asked to enter basic information about yourself.

You’ll be asked for your name, address, and date of birth.

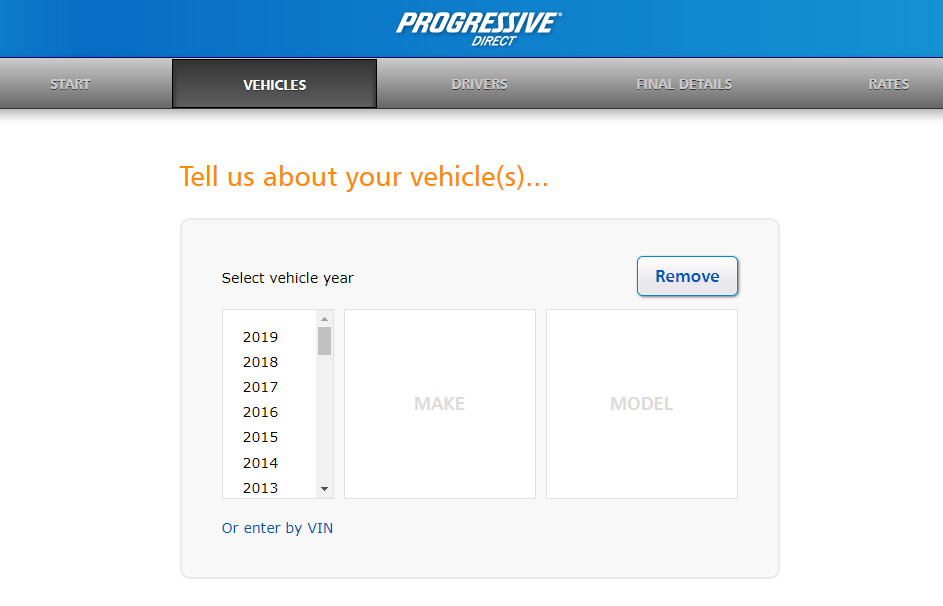

Step Three: Vehicle Information

Next, you’ll have to enter information about your vehicles. If you know your vehicle identification number (VIN), you can enter that.

Otherwise, fill in what you know about your vehicle’s year, make, and model.

You will also be asked about the use of your car, as this can help calculate commute distance rates.

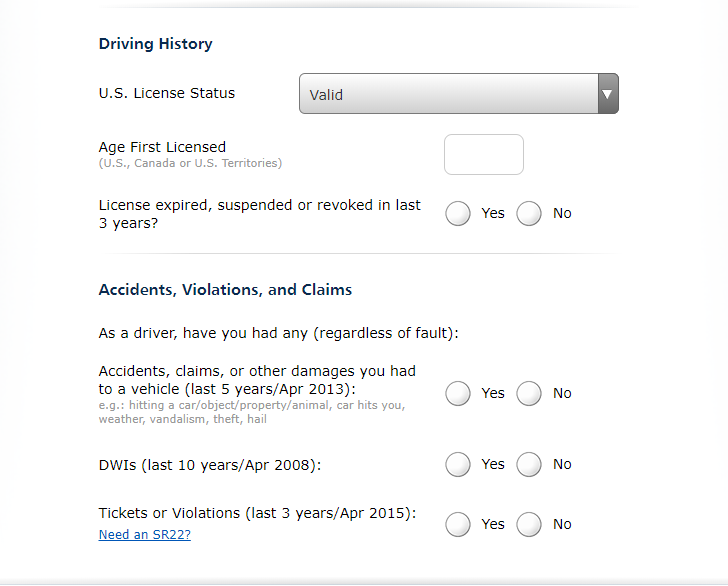

Step Four: Driver Information

One of the last sets of information you’ll need to fill out is driver history.

Progressive will ask you about past accidents, tickets, and violations. If you recall, these violations are an important factor in determining insurers’ rates.

You will also need to fill out basic details, such as your gender, past license revocations, and primary residence.

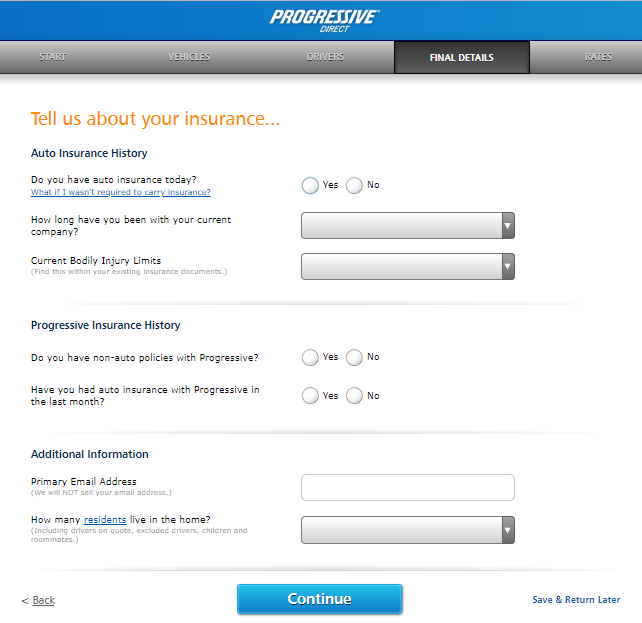

Step Five: Final Details

Finally, Progressive will ask for a few details about your insurance history.

Step Six: Get Your Quote

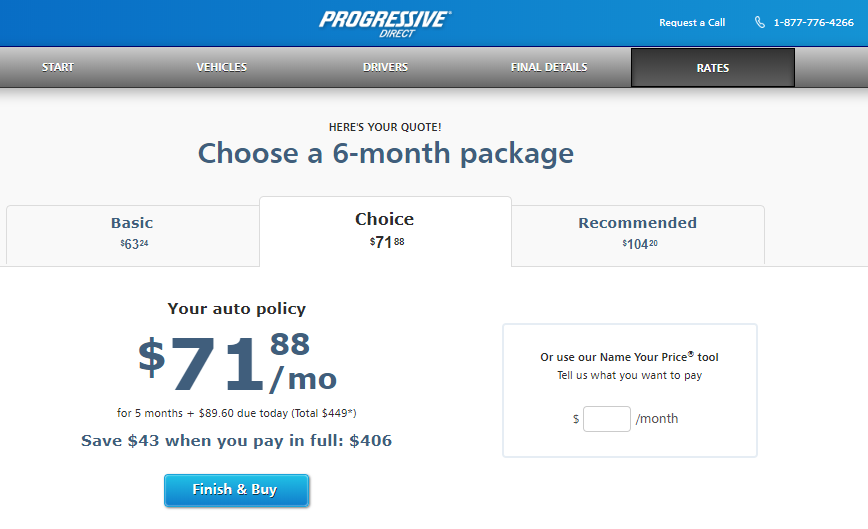

Once you’re done filling out the information, you will immediately be given a quote.

There are options to choose a basic package, a choice package, or a recommended package. While Progressive gives you the option to immediately purchase a plan, you are not obligated to purchase a plan at the end of the quote.

We know we just threw a lot of information at you, so as a reminder, you need the following information for a Progressive quote.

| Information | Required? |

|---|---|

| Social Security Number | Yes (used to check credit scores) |

| Driver's License | No |

| Vehicle Identification Number | No |

| Contact Information (email, address, etc.) | Yes |

| Driver's History | Yes |

| Vehicle Information | Yes |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Design of Website and App

Websites and apps need to be clutter-free these days. Nobody wants to spend time slogging through articles to find information. Nor do people have the patience for apps riddled with bugs.

To see how Progressive has kept up with the times, we are going to go through Progressive’s website and app designs.

Website

Progressive has a simple website design, which is great. There are no annoying pop-ups or banners when you scroll through the site, and answers are easy to find.

On the left side of the screen, there are four drop-down menus: insurance, claims, about, and answers.

On the right side of the screen, there is Progressive’s phone number and a log in option.

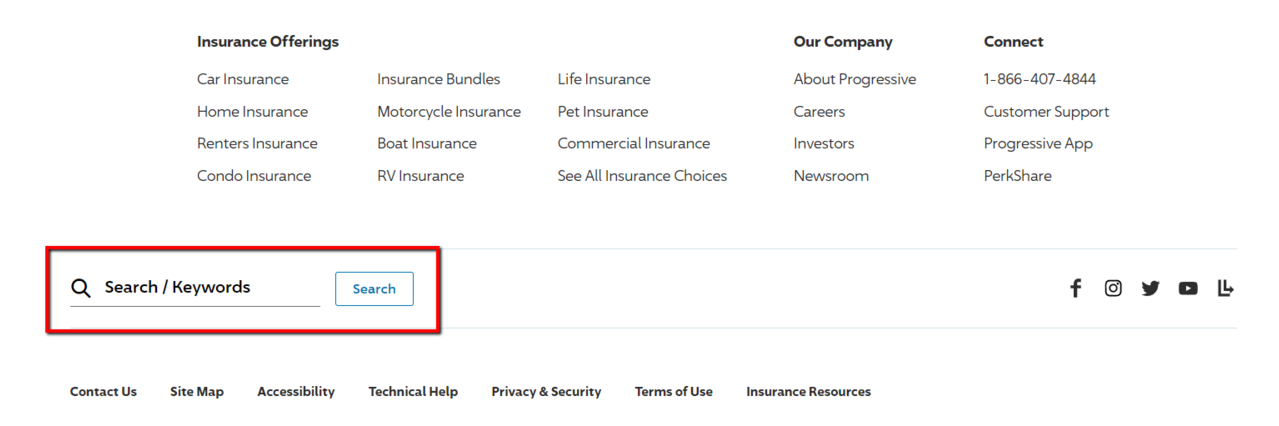

You may have noticed there is no search bar on the top of the screen. This is one flaw with Progressive’s website design. If you want to search manually instead of looking through Progressive’s dropdown menus, you will need to scroll to the bottom of the home page.

If visitors don’t know the search bar is at the bottom, they may become irritated while trying to find information.

In other areas, though, Progressive’s website is well designed and has clear information categories.

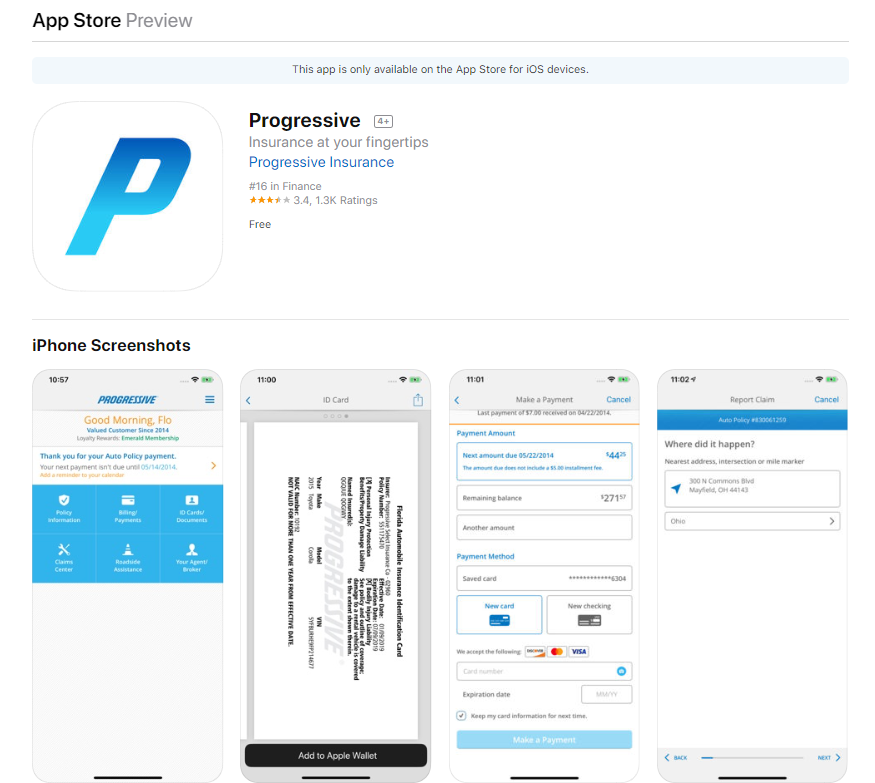

Mobile Apps

Progressive’s main mobile app has good reviews on Apple. The app has 3.4 stars out of five (based on over 1,600 reviews).

Customer’s complaints with the app were normal, as they had to do with bugs. For example, customers complained about trouble signing in and using autopay. For the most part, though, customers seem satisfied with Progressive’s app.

So what can you do on the app?

- View coverages, discounts, ID cards, documents, and policy details

- File claims and add pictures

- Pay bills and view billing history

- See Snapshot data

- Get a quote or make a policy change

- Request roadside assistance

- Contact an agent

The range of services from the app means customers can manage their accounts from their phones.

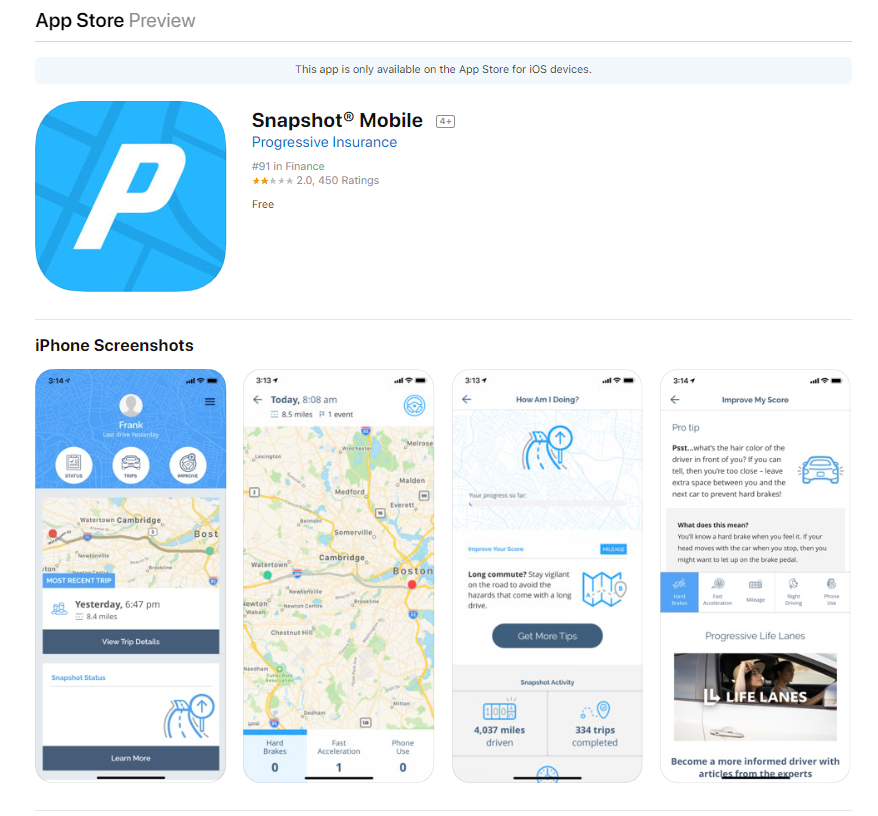

As for Progressive’s Snapshot app, it did less well on Apple reviews.

Snapshot only has two out of five stars (based on over 400 reviews).

This is typical of most driving apps. Unfortunately, insurers haven’t yet created technology that perfectly records driving data. As a result, drivers find themselves overly penalized for hard braking and other things outside their control.

There are also issues with the app draining users’ batteries and users forgetting to mark that they aren’t driving when in a car (resulting in distracted driving points).

Hopefully, Progressive will work on correcting these issues with their app.

Pros and Cons

We are nearly done with our guide. So let’s take a moment to look at Progressive’s pros and cons.

| Pros | Cons |

|---|---|

| Wide range of coverages and add-ons | More expensive than other providers |

| Higher than average number of discounts | Doesn't have a military discount |

| Website easy to use | Search bar isn't easily accessible |

| Stable financial future, pays out good amount of claims | Driving app has poor reviews |

Progressive’s rates are higher than the norm, but Progressive’s amount of discounts should help keep costs down.

The Bottom Line

Progressive has multiple programs and discounts that can help lower costs, which could make Progressive an affordable provider. If you have a clean driving record and good credit history, Progressive’s rates will be even lower.

Customer satisfaction with Progressive isn’t as good as it could be, but Progressive’s stable financial ratings show Progressive is still attracting and keeping customers.

If you are considering Progressive, make sure to get a quote to see if Progressive is within your budget.

FAQ

Before we end our guide, we want to look at what others are asking about Progressive. Keep reading to find answers to commonly asked questions.

What is accident forgiveness at Progressive?

There are two types of accident forgiveness at Progressive. The first type is small accident forgiveness. With this type, your first claim won’t raise your rates as long as the total claim amount is less than $500.

The second type, large accident forgiveness, makes sure your rates won’t increase after an accident (no matter the amount). To qualify for the second type, you need to have been a Progressive customer for at least five years.

You also need to have been accident-free for the last three years.

Can I buy a Progressive policy online?

At the end of Progressive’s free quote form, Progressive gives customers the option to buy a policy online. This means that you don’t need to visit a site in-person or call to buy a Progressive policy.

Will Progressive’s Snapshot App raise my rates?

Unfortunately, Progressive will raise rates if the app shows drivers to be high-risk. While Progressive says only two out every 10 drivers receive a rate increase from the app, if you aren’t a good driver, don’t get the app.

Can I cancel the Snapshot App?

If you find the app is raising your rates, it’s a good idea to discontinue it. However, while you can cancel it at any time, in some states you may be charged a surcharge if you cancel within 45 days of getting the app.

What if I miss a Progressive payment?

Insurance lapses are not good for your record. However, Progressive does have a short grace period if you miss a payment. Depending on what state you live in, you’ll have 10 – 20 days after the missed payment before Progressive cancels your insurance.

Worried about forgetting a payment? Progressive offers autopayment for its customers.

Do I need rental insurance if I already have a Progressive policy?

It depends. If you have comprehensive or collision coverage, you may not have to purchase rental insurance. However, Progressive recommends that drivers buy rental coverage because if you get in a rental car accident, Progressive won’t raise your rates because you won’t be filing with Progressive. Instead, everything will be handled through the rental car insurance.

Congratulations. You’ve completed our intensive review of Progressive insurance. We hope you are now ready to make the critical decision on which provider you trust to insure your vehicle.

Want to start comparison shopping today? Enter your ZIP code in our free online tool below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.