Maryland Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

Maryland’s generated some interesting nicknames over the years. Known as the Old Line State, in reference to George Washington, its residents also refer to it as Little America.

Here, you’ll find bustling cities like Baltimore and a gateway straight into the heart of America’s political scene.

What’s it like to drive through Maryland? And how difficult is it to find car insurance in the state?

Shopping for car insurance is never easy. You need to set time aside to research your local providers and compare their rates and coverage. If you need car insurance right away, this research process could really disrupt your daily life.

That’s where we come in. Thanks to this guide to Maryland’s car insurance requirements and providers, you won’t have to do that research on your own.

Want to get a jump on the game? You can use our free online tool to start researching available rates in your area. Just enter your ZIP code to get started.

| Statewide Stats | Details |

|---|---|

| Road Miles | Total in State: 32,037 Miles Driven: 57,516 millions |

| Vehicles | Registered: 4,008,847 Motor Vehicle Thefts: 13,151 |

| Population | 6,000,561 |

| Most Popular Vehicle | CR-V |

| Uninsured%/Underinsured% | 12.4% |

| Total Driving Related Deaths | Speeding Fatalities: 160 DUI Fatalities: 186 |

| Average Premiums (Annual) | Liability: $609.74 Collision: $353.99 Comprehensive: $152.72 Combined: $1,116.45 |

| Cheapest Provider | USAA |

Maryland Car Insurance Coverage and Rates

Let’s build up a financial foundation before diving into the details of Maryland’s roadway laws. In this section, we’ll touch on Maryland’s minimum required liability insurance and the types of documents you need on your side while you’re on the road.

What is Maryland’s car culture?

Maryland’s history with cars isn’t as storied as some states’, but it does have a fair stake in automotive history.

Maryland was the home of the Broening Highway General Motors Plant, which closed in 2005 but, prior to that close date, manufactured some of the Oldsmobiles, Pontiacs, and Chevrolet Trucks still on the roads today. Maryland is also home to the Classic Motor Museum in St. Michaels, which tourists can visit to learn more about the cars that used to tear up Maryland’s motorways.

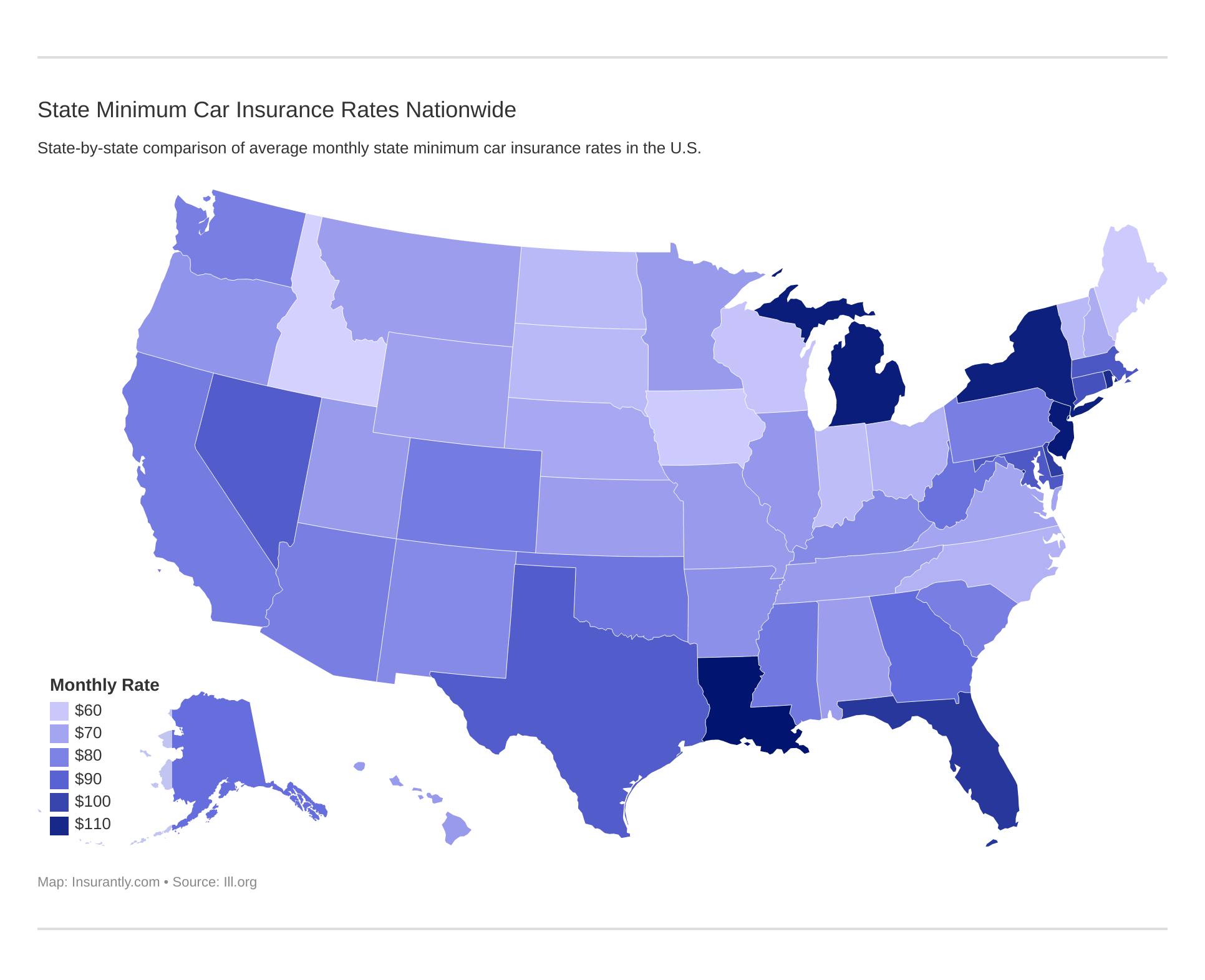

How much coverage is required for Maryland’s minimum coverage?

Minimum liability coverage describes the amount of coverage your state of residence — in this case, Maryland — requires you to have to drive legally on the road. Maryland requires you to drive with proof of your minimum liability coverage, or else you’re at risk for fines or license suspension.

Here are the state’s minimum liability coverage requirements:

| Maryland Insurance Required | Minimum Limits |

|---|---|

| Bodily Injury Liability (of one person) | $30,000 |

| Bodily Injury Liability (two or more people) | $60,000 |

| Property Damage Liability | $15,000 |

Note, too, that Maryland is an at-fault state. This means any accident you get into will be assigned a responsible party. Whoever is determined to be at fault will have to pay for both their own damages and any damages incurred by the other party.

That’s all the more reason to consider purchasing more than just the state’s minimum required liability coverage.

What are forms of financial responsibility in Maryland?

As mentioned, you’ll need to carry a form of financial responsibility, or proof of insurance, on your person while driving in Maryland. If you don’t, you may get in trouble with law enforcement.

The following documents both serve as proof of financial responsibility:

- Your insurance card

- A Maryland Insurance Certificate (FR-19)

How much percentage of income are premiums in Maryland?

We don’t always want to think about how much car insurance will impact our monthly budgets. That said, it’s an important figure to know when you’re determining how much money you have to spend on things like rent, groceries, and utilities each month.

Your Maryland car insurance payments will come out of your personal disposable income. You can see what that figure looks like on average in the table below:

| Details | Full Coverage Average Premiums (Annual) | Disposable Income | Premiums as Percentage of Income |

|---|---|---|---|

| 2012 | $1,056.82 | $46,815 | 2.26% |

| 2013 | $1,071.35 | $45,664 | 2.35% |

| 2014 | $1,096.37 | $46,875 | 2.34% |

As you can see, Maryland drivers typically use 2.34 percent of their disposable income to pay for car insurance annually. That percentage has been increasing year by year.

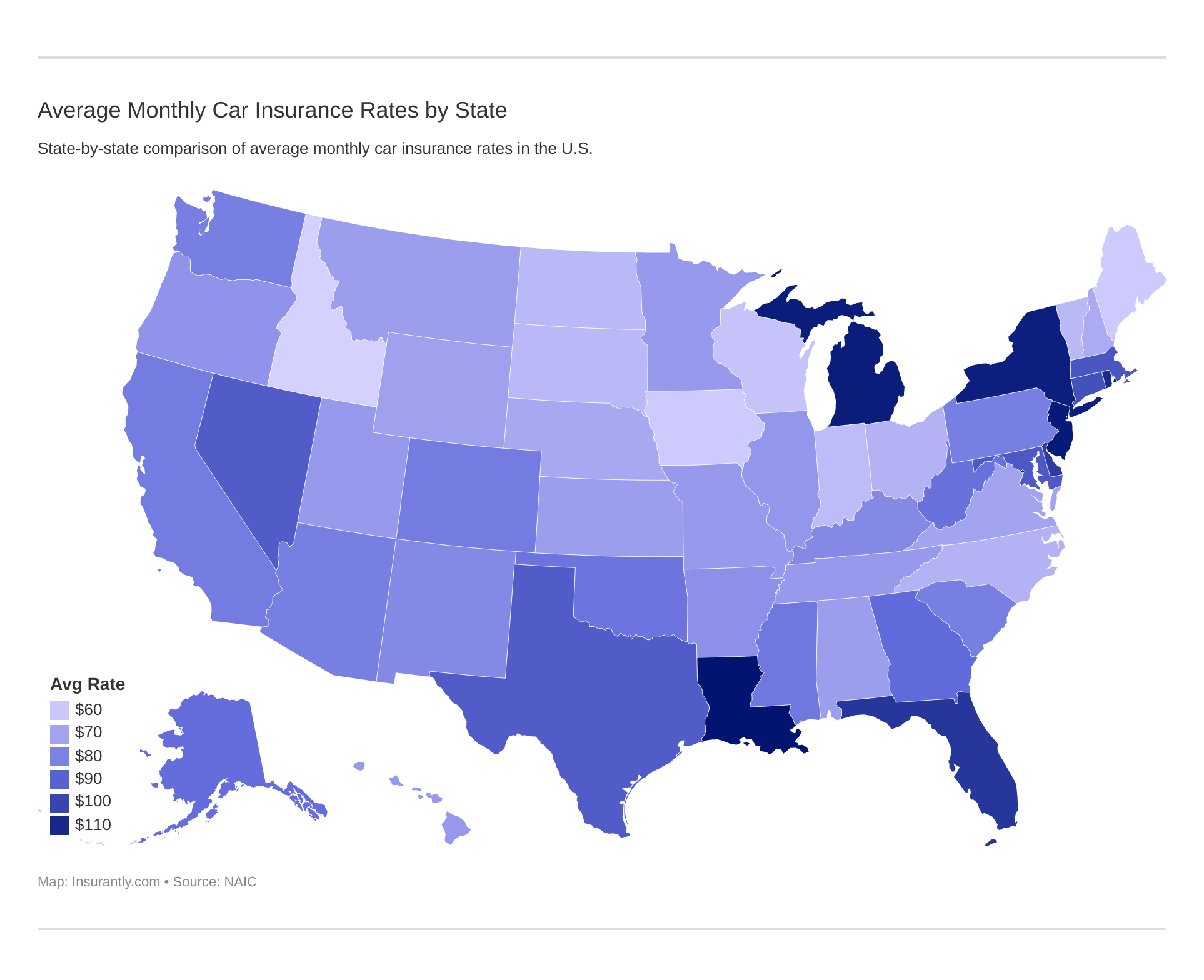

Average Monthly Car Insurance Rates in MD (Liability, Collision, Comprehensive)

As we mentioned before, you’re only required to carry Maryland’s minimum required car insurance to drive legally on the road. You can also choose from other types of coverage, though, including the ones detailed below:

| Type of Coverage | Average Annual Premiums |

|---|---|

| Liability Coverage | $609.74 |

| Collision Coverage | $353.99 |

| Comprehensive Coverage | $152.72 |

| Full Coverage Premiums | $1,116.45 |

Note, of course, that the average annual premiums have likely increased since the National Association of Insurance Commissioners (NAIC) released their report.

What additional liability is available in Maryland?

The aforementioned types of insurance don’t necessarily cover personal injury or property damage when you’re determined to be the at-fault party after an accident. You may also need additional liability coverage if the other party involved in the accident doesn’t have enough money to cover your damages.

Take a look at the table below, and you’ll see the other types of insurance you may be interested in:

| Loss Ratio | 2012 | 2013 | 2014 |

|---|---|---|---|

| Personal Injury Protection (PIP) | 78% | 77% | 77% |

| Medical Payments (MedPay) | 88% | 88% | 78% |

| Uninsured/Underinsured Motorist Coverage (UUM) | 67% | 69% | 69% |

Look at it this way: PIP helps you cover personal injury expenses that arise as a result of your accident, whether or not the accident is your fault. In the same vein, uninsured motorist coverage helps you keep your finances safe if the other driver involved in the accident doesn’t have enough coverage.

What add-ons, endorsements, and riders are available in Maryland?

You can explore additional, optional coverage by considering some of the add-ons below. Click on the available links to learn more:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

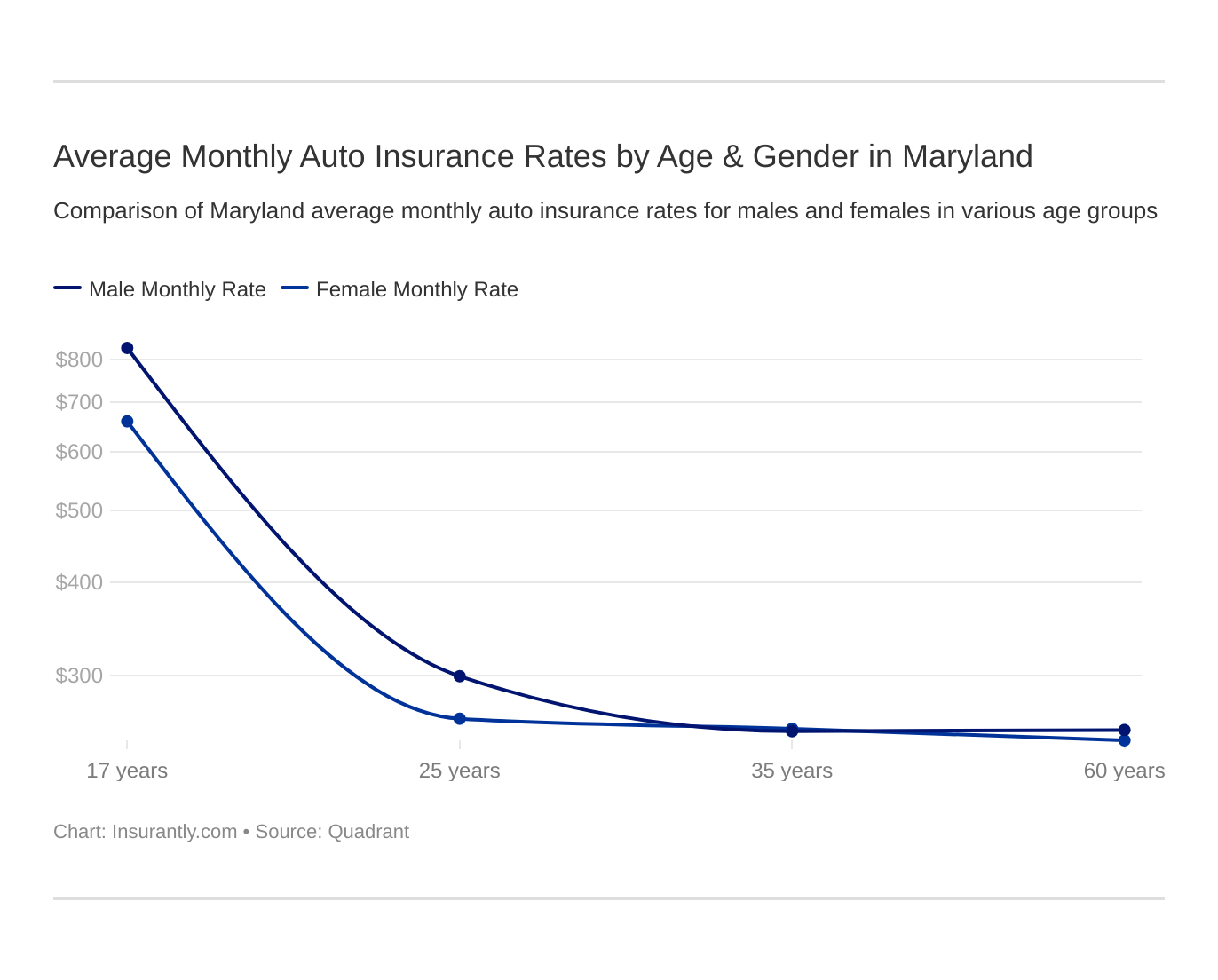

Average Monthly Car Insurance Rates by Age & Gender in MD

Quite often, insurance companies charge men higher rates than women under the assumption that men (especially young men) drive more recklessly than women. Six states have made this practice illegal — California, Hawaii, Massachusetts, Pennsylvania, Montana, and North Carolina — but as you can see, Maryland isn’t one of them.

Read more: Hawaii Car Insurance (The Only Guide You’ll Ever Need)

In the table below, you’ll notice that the differences in rates are most significant for 17-year-old drivers.

| Company | Married 35-Year-Old Female | Married 35-Year-Old Male | Married 60-Year-Old Female | Married 60-Year-Old Male | Single 17-Year-Old Female | Single 17-Year-Old Male | Single 25-Year-Old Female | Single 25-Year-Old Male |

|---|---|---|---|---|---|---|---|---|

| Allstate Indemnity | $3,479.22 | $3,341.48 | $3,315.46 | $3,402.86 | $10,126.25 | $11,877.20 | $3,142.00 | $3,180.86 |

| Geico Cas | $2,409.20 | $2,633.97 | $2,737.58 | $3,154.25 | $7,238.09 | $8,259.04 | $2,057.84 | $2,171.06 |

| Liberty Mutual Fire Ins Co | $6,671.15 | $6,671.15 | $6,594.83 | $6,594.83 | $12,964.69 | $19,221.87 | $6,671.15 | $8,990.68 |

| NAICOA | $2,001.73 | $2,008.48 | $1,810.88 | $1,863.99 | $4,680.47 | $6,150.29 | $2,316.18 | $2,493.50 |

| Progressive Select | $2,445.57 | $2,204.58 | $2,128.62 | $2,174.55 | $8,688.04 | $9,494.13 | $2,844.59 | $2,778.79 |

| State Farm Mutual Auto | $2,384.38 | $2,384.38 | $2,189.99 | $2,189.99 | $7,402.28 | $9,470.28 | $2,661.50 | $3,004.10 |

| USAA | $1,974.24 | $1,939.21 | $1,843.88 | $1,839.49 | $4,378.75 | $5,166.68 | $2,274.19 | $2,536.67 |

Rates get lower and more consistent as a person ages.

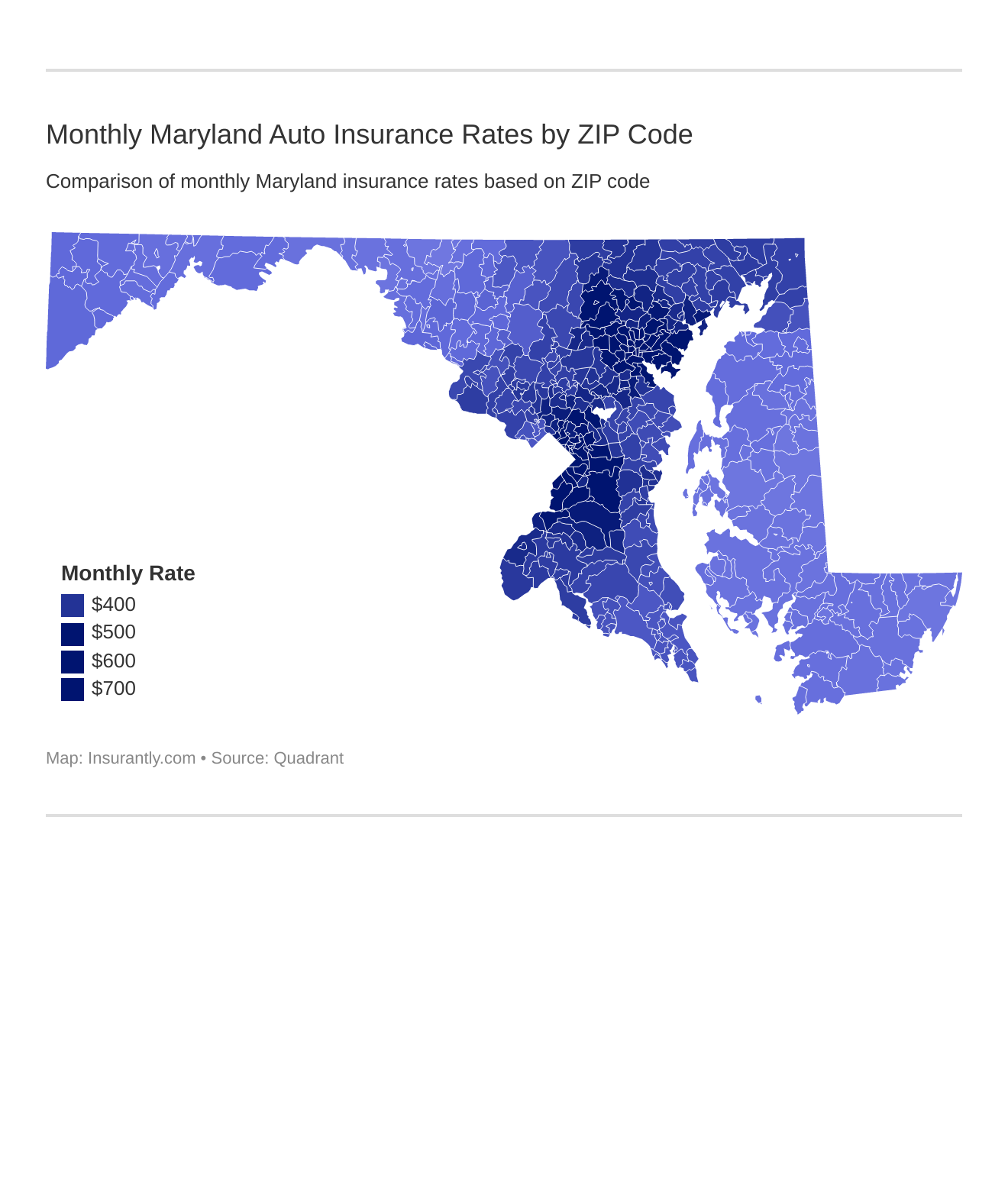

What are the cheapest rates by ZIP code in Maryland?

Your ZIP code is going to directly influence the rates that car insurance providers are able to give you, as you can see on the map below.

The Potomac area code has one of the higher car insurance rates. Many of the area codes that represent Maryland’s more affluent counties will have car insurance rates that reflect their area’s adjusted gross income.

What are the cheapest rates by city in Maryland?

Your car insurance rate will also vary based on the city you live in, as you can see in the tables below. First, take a look at the top 10 most expensive cities in Maryland.

| Maryland Most Expensive Cities | Average Car Insurance Rates |

|---|---|

| Randallstown | $7,288.96 |

| Windsor Mill | $7,164.27 |

| Baltimore | $6,862.78 |

| Capitol Heights | $6,517.08 |

| District Heights | $6,402.12 |

| Cheverly | $6,358.32 |

| Bladensburg | $6,313.13 |

| Forest Heights | $6,203.36 |

| East Riverdale | $6,143.03 |

| Garrison | $6,113.39 |

Next, take a look at the 10 cheapest cities in Maryland for car insurance.

| Maryland Cheapest Cities | Average Car Insurance Rates |

|---|---|

| Smithburg | $3,658.86 |

| Denton | $3,679.84 |

| Maugansville | $3,680.30 |

| Chewsville | $3,682.15 |

| Ridgely | $3,683.98 |

| Hillsboro | $3,688.53 |

| Templeville | $3,688.53 |

| Preston | $3,689.34 |

| Easton | $3,689.44 |

| Cascade | $3,696.13 |

Most of the highest insurance rates in the states are charged to residents of Baltimore and nearby areas.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best Maryland Car Insurance Companies

Now that we’ve laid the groundwork for Maryland’s rates and providers, let’s dive into the details. In this section, we’ll rank and re-rank Maryland’s most influential car insurance providers based on the ways their premiums fluctuate, what customers have to say about them, and their market standing.

Don’t feel intimidated by the barrage of information. Everything here is meant to help you find the provider that will best suit your budget. Whether you’re looking for cheap and easy coverage or something more comprehensive, you’ll find it here.

What are the financial ratings of the largest car insurance companies in Maryland?

A.M. Best outlines individual insurance companies’ financial ratings, as you can see below:

| Leading Insurers in Maryland | A.M. Best Rating |

|---|---|

| Allstate Insurance Group | A+ |

| Erie Insurance Group | A+ |

| Geico | A++ |

| Hartford Fire & Casualty Group | A+ |

| Liberty Mutual Group | A |

| Nationwide Corp Group | A+ |

| Progressive Group | A+ |

| State Farm Group | A++ |

| Travelers Group | A++ |

| USAA Group | A++ |

Fortunately, none of the financial ratings for the major companies in Maryland drop beneath an A ranking. Several of the providers even have A++ rankings, which is even better news.

Which car insurance companies have the best ratings in Maryland?

Customer experience and satisfaction also contribute to a company’s state-wide reputation:

As indicated in the chart above, Geico holds the highest customer satisfaction rating in Maryland and the surrounding areas. It’s only outstripped by Erie Insurance, a regional provider.

Which car insurance companies have the most complaints in Maryland?

On the other side of the coin, we have consumer complaints. Take a look at the complaint ratios for each of Maryland’s largest car insurance providers:

| Leading Insurance Companies in Maryland | Number of Complaints |

|---|---|

| Allstate Insurance Group | 163 |

| Erie Insurance Group | 22 |

| Geico | 333 |

| Hartford Fire & Casualty Group | 9 |

| Liberty Mutual Group | 222 |

| Nationwide Corp Group | 25 |

| Progressive Group | 120 |

| State Farm Group | 1482 |

| Travelers Group | 2 |

| USAA Group | 296 |

As you can see, State Farm Group reports the most complaints on an annual basis. That percentage of reports, however, is not so significant when you consider the company’s size. Larger companies serve more customers, so they’re bound to get more complaints than a smaller company with fewer customer transactions.

Note that complaints don’t tell the whole story of someone’s experience with a company. This data is useful to consider when choosing your car insurance provider, but you shouldn’t base your decision on this factor alone.

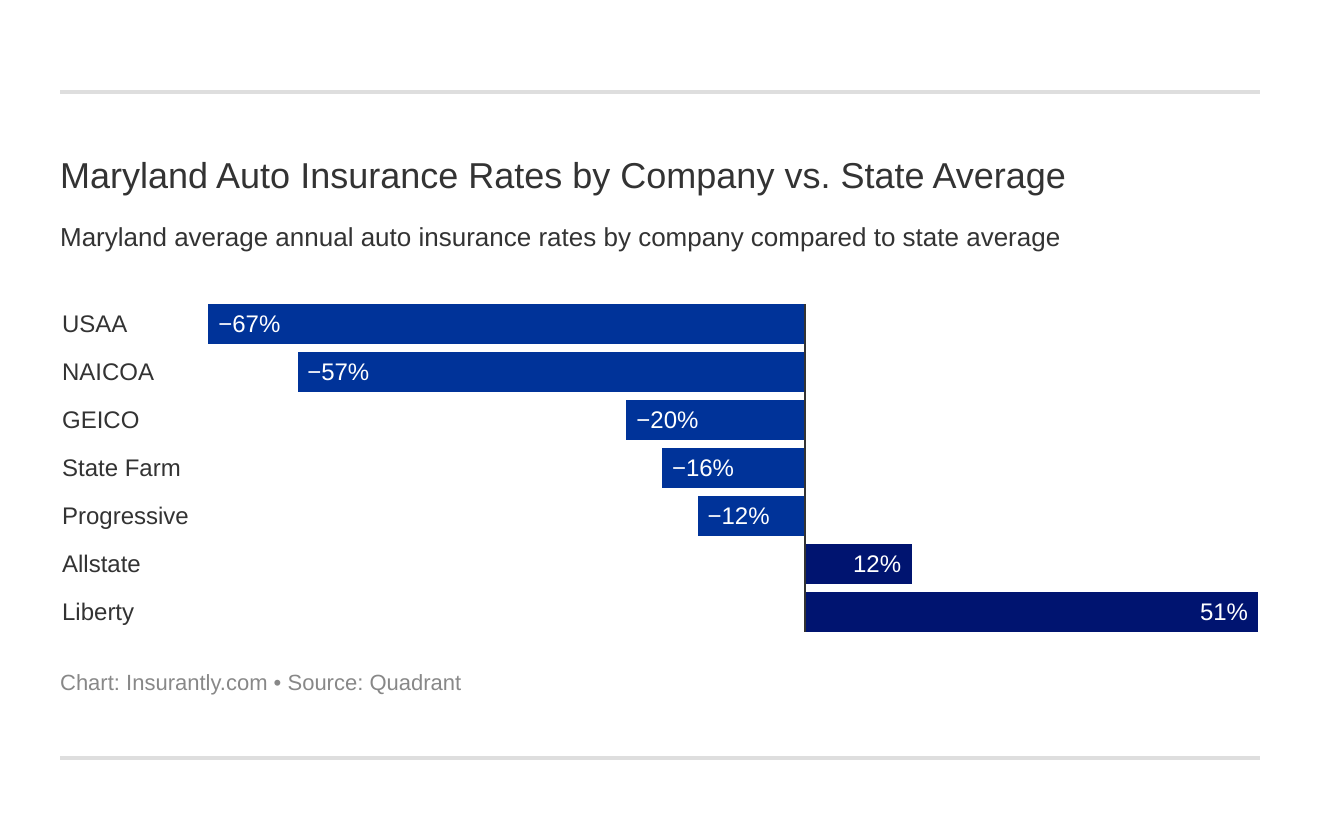

What are the cheapest car insurance companies in Maryland?

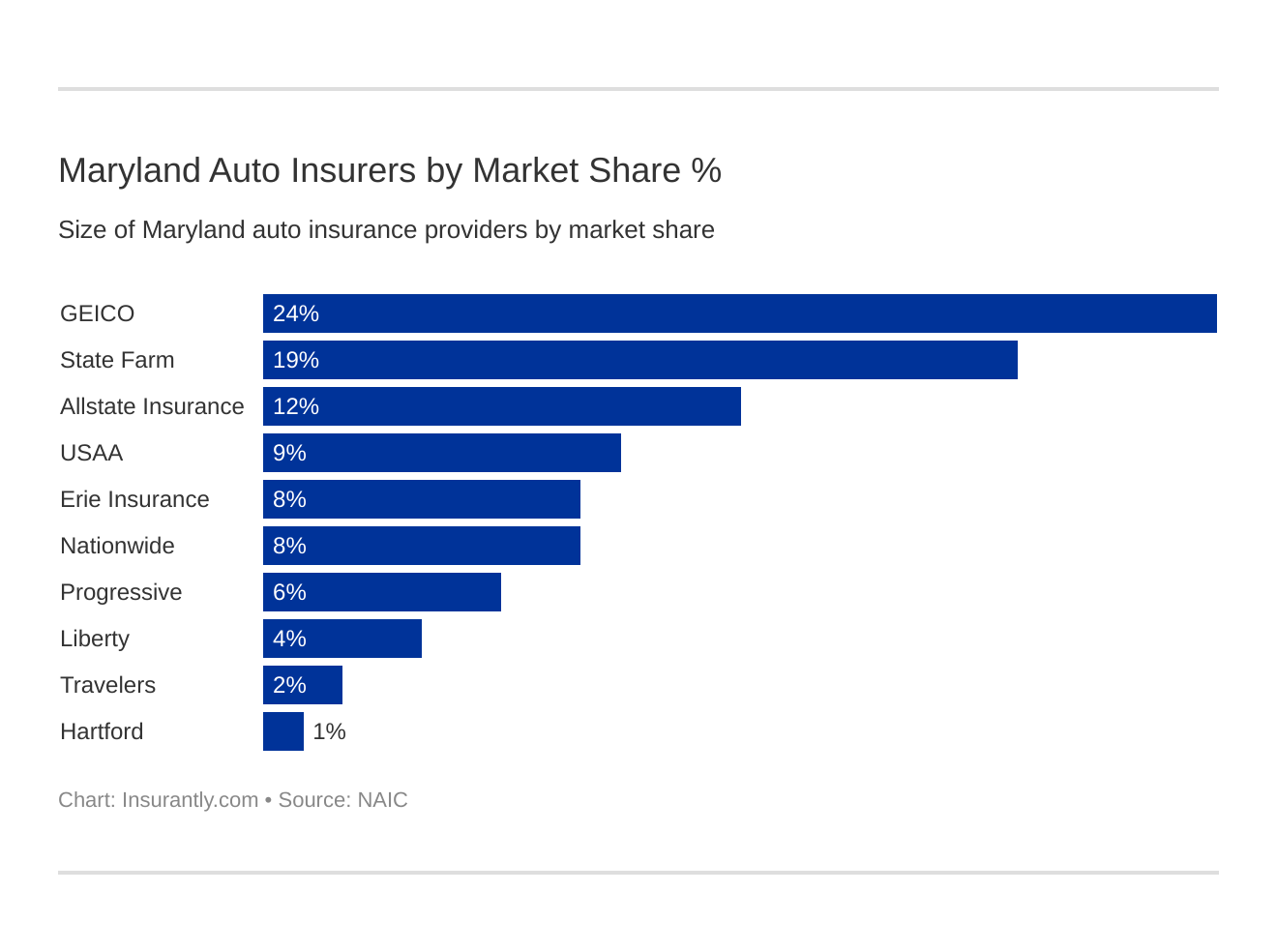

As mentioned, loss ratios and market share play a role in determining whether a car insurance provider is the best one for you. Take a look at Maryland’s breakdown to see where some of the largest providers in the state stand financially:

| Insurance Company | Direct Written Premiums | Market Share |

|---|---|---|

| Geico | $1,173,739 | 23.98% |

| State Farm Group | $940,404 | 19.21% |

| Allstate Insurance Group | $582,872 | 11.91% |

| USAA Group | $422,116 | 8.62% |

| Erie Insurance Group | $376,241 | 7.69% |

| Nationwide Corp Group | $373,032 | 7.62% |

| Progressive Group | $310,170 | 6.34% |

| Liberty Mutual Group | $185,153 | 3.78% |

| Travelers Group | $81,122 | 1.66% |

| Hartford Fire & Casualty Group | $50,075 | 1.02% |

Geico holds the highest market share for car insurance providers in Maryland, meaning it does a lot of business in the state. It also means that, if you’re insured through Geico and you file a claim, you probably won’t have to worry about whether or not they can afford to pay it out. They’re making plenty of money.

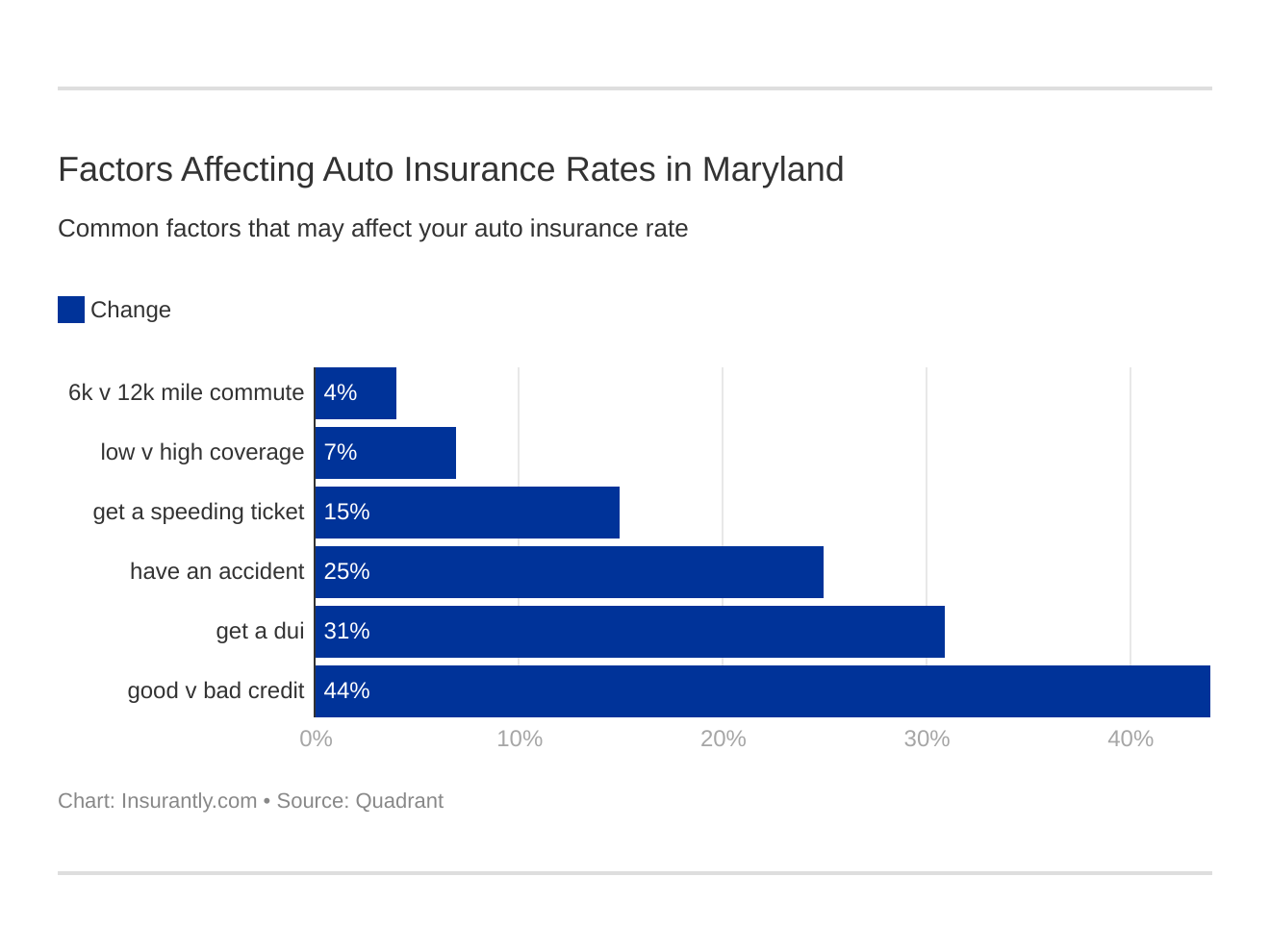

Does my commute affect my car insurance rate in Maryland?

The length of your morning commute may have an impact on your car insurance rate also, as you can see in this data:

| Insurance Company | Commute and Annual Mileage | Annual Average Premiums |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $5,159.18 |

| Allstate | 25 miles commute. 12000 annual mileage. | $5,307.15 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,768.30 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,896.96 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $9,048.56 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $9,546.53 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $2,915.69 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $2,915.69 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,094.86 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,094.86 |

| State Farm | 10 miles commute. 6000 annual mileage. | $3,858.87 |

| State Farm | 25 miles commute. 12000 annual mileage. | $4,062.86 |

| USAA | 10 miles commute. 6000 annual mileage. | $2,658.84 |

| USAA | 25 miles commute. 12000 annual mileage. | $2,829.44 |

USAA’s rates are the lowest. However, Progressive’s rates don’t change based on your commute, and the changes seen in the other providers aren’t too significant. In some states, there are some pretty substantial differences in rates for different commute lengths, so Maryland drivers are lucky in this respect.

Can coverage level change my car insurance rate with companies in Maryland?

Your chosen level of coverage is going to affect your premium price, as well:

| Insurance Company | Coverage Type | Annual Average Premiums |

|---|---|---|

| Allstate | High | $5,397.13 |

| Allstate | Medium | $5,199.95 |

| Allstate | Low | $5,102.42 |

| Geico | High | $3,995.32 |

| Geico | Medium | $3,808.14 |

| Geico | Low | $3,694.42 |

| Liberty Mutual | High | $9,590.04 |

| Liberty Mutual | Medium | $9,275.12 |

| Liberty Mutual | Low | $9,027.48 |

| Nationwide | High | $3,030.44 |

| Nationwide | Medium | $2,924.01 |

| Nationwide | Low | $2,792.62 |

| Progressive | High | $4,281.91 |

| Progressive | Medium | $4,095.34 |

| Progressive | Low | $3,907.33 |

| State Farm | High | $4,156.65 |

| State Farm | Medium | $3,972.14 |

| State Farm | Low | $3,753.81 |

| USAA | High | $2,878.19 |

| USAA | Medium | $2,753.05 |

| USAA | Low | $2,601.17 |

Naturally, the more car insurance coverage you invest in, the more you’re going to pay for your premium. Of all of the providers, USAA charges the least for all levels of car insurance. However, this company only insures active and retired United States military personnel and their families. Assuming you don’t qualify for USAA, Nationwide is probably your best option.

How does my credit history affect my car insurance rate with companies in Maryland?

Your credit history reflects your ability (and/or willingness) to pay your bills. Naturally, car insurance providers are going to take your credit history into account when offering you a rate.

| Insurance Company | Credit History | Annual Average Premiums |

|---|---|---|

| Allstate | Poor | $6,779.90 |

| Allstate | Fair | $4,730.97 |

| Allstate | Good | $4,188.63 |

| Geico | Poor | $4,344.33 |

| Geico | Fair | $3,598.70 |

| Geico | Good | $3,554.85 |

| Liberty Mutual | Poor | $13,288.03 |

| Liberty Mutual | Fair | $8,563.61 |

| Liberty Mutual | Good | $6,040.99 |

| Nationwide | Poor | $3,726.47 |

| Nationwide | Fair | $2,636.53 |

| Nationwide | Good | $2,384.07 |

| Progressive | Poor | $5,161.32 |

| Progressive | Fair | $3,875.85 |

| Progressive | Good | $3,247.40 |

| State Farm | Poor | $5,794.48 |

| State Farm | Fair | $3,437.51 |

| State Farm | Good | $2,650.60 |

| USAA | Poor | $3,659.27 |

| USAA | Fair | $2,509.68 |

| USAA | Good | $2,063.46 |

The lower your credit score is, the more you should expect to pay for your car insurance because businesses see a low credit score as evidence that you’re a financial risk. Each of the providers in Maryland will vary their rates accordingly.

USAA again offers the cheapest rates for members of the military and their immediate family. For all others, if you have poor credit, your next best option is probably going to be Nationwide.

How does my driving record change my rates with car insurance companies in Maryland?

Your driving history reflects both your knowledge of the rules of the road and your ability to work within them. As you might expect, car insurance providers will take your history into account when assigning you a rate.

| Insurance Company | Driving Record | Annual Average Premiums |

|---|---|---|

| Allstate | With 1 DUI | $4,632.04 |

| Allstate | With 1 accident | $6,158.29 |

| Allstate | With 1 speeding violation | $5,510.30 |

| Allstate | Clean record | $4,632.04 |

| Geico | With 1 DUI | $5,144.48 |

| Geico | With 1 accident | $4,234.15 |

| Geico | With 1 speeding violation | $3,232.71 |

| Geico | Clean record | $2,719.17 |

| Liberty Mutual | With 1 DUI | $13,177.49 |

| Liberty Mutual | With 1 accident | $8,825.47 |

| Liberty Mutual | With 1 speeding violation | $8,465.21 |

| Liberty Mutual | Clean record | $6,722.01 |

| Nationwide | With 1 DUI | $2,744.79 |

| Nationwide | With 1 accident | $3,443.50 |

| Nationwide | With 1 speeding violation | $2,908.52 |

| Nationwide | Clean record | $2,565.95 |

| Progressive | With 1 DUI | $4,229.05 |

| Progressive | With 1 accident | $4,633.82 |

| Progressive | With 1 speeding violation | $4,020.51 |

| Progressive | Clean record | $3,496.06 |

| State Farm | With 1 DUI | $3,915.37 |

| State Farm | With 1 accident | $4,461.30 |

| State Farm | With 1 speeding violation | $3,915.37 |

| State Farm | Clean record | $3,551.42 |

| USAA | With 1 DUI | $3,849.72 |

| USAA | With 1 accident | $2,645.44 |

| USAA | With 1 speeding violation | $2,323.31 |

| USAA | Clean record | $2,158.09 |

High-risk drivers are frequently charged more for their coverage than low-risk drivers. Liberty Mutual is the least forgiving of all of the companies operating in Maryland, with the largest cost jumps between incidents that can be reported on a person’s driving record.

Which car insurance companies are the largest in Maryland?

With all that in mind, what car insurance providers have the largest cuts of the industry in Maryland?

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $940,404 | 76.11% | 19.21% |

| Allstate Insurance Group | $582,872 | 56.19% | 11.91% |

| USAA Group | $422,116 | 78.75% | 8.62% |

| Erie Insurance Group | $376,241 | 78.20% | 7.69% |

| Nationwide Corp Group | $373,032 | 63.41% | 7.62% |

| Progressive Group | $310,170 | 59.90% | 6.34% |

| Liberty Mutual Group | $185,153 | 61.25% | 3.78% |

| Travelers Group | $81,122 | 63.94% | 1.66% |

| Hartford Fire & Casualty Group | $50,075 | 61.65% | 1.02% |

| Total for the State | $4,895,088 | 69.61% | 100.00% |

As you can see, Geico corners nearly a quarter of the market, with other providers fighting over the remaining three-fourths.

How many car insurance companies are available in Maryland?

Domestic and foreign insurers are titles that may not mean exactly what you think. Domestic providers are those that are local to a specific state. Foreign insurers, comparatively, are providers who make their policies available just about everywhere in the country.

Below you can see how many of each are operating in Maryland:

| Type of Insurer | Number |

|---|---|

| Domestic | 32 |

| Foreign | 860 |

Foreign providers are not inherently better than domestic providers, nor do things work the other way around. You’ll want to work with the provider who suits your needs best.

Maryland Laws

Unless you’re an extremely talented lawyer, there’s no way you’re going to be able to memorize all of Maryland’s roadway laws. That’s why you have this guide. Here, we break down the rules of the road dictating how drivers are supposed to maneuver on Maryland’s interstates. Once you know the rules, you’ll be able to follow them to secure a lower car insurance rate.

What are the car insurance laws in Maryland?

It is illegal to drive in Maryland if you don’t have the state minimum liability coverage or more. Penalties for driving without insurance include:

- The loss of your license plate and vehicle registration

- Fines of up to $150 dollars, which will go toward uninsured motorist penalty fees

- A registration restoration fee of up to $25

How State Laws for Insurance are Determined

All laws pertaining to car insurance in the state of Maryland must be passed by the state’s General Assembly before becoming law. After their passing, these laws — initially seen as bills — must be signed into law by the governor.

Windshield Coverage Law in Maryland

The state of Maryland currently does not have legislation in place that requires car insurance providers to replace drivers’ broken windshields. If you want to invest in windshield coverage, you’ll need to speak with your provider’s representatives to see if it’s available as an add-on or through comprehensive coverage.

High-Risk Insurance

If you have a spotty driving history, you may have to seek out high-risk insurance. High-risk insurance, or an SR-22, is a type of insurance that high-risk drivers are required to add to their existing coverage after a conviction or similar punishment.

You may be required to get an SR-22 if you’ve received any of the following:

- DUI conviction

- Reprimand for driving without insurance

- Reprimand for driving with a suspended license

- Reprimand for leaving the scene of an accident

Low-Cost Insurance

Maryland does make an independent program available to high-risk and low-income drivers who wouldn’t be able to have car insurance otherwise. This program was known as the Maryland Auto Insurance Fund, or the MAIF. Established in 1973, the agency is now called Maryland Auto Insurance (MAI), and it actively covers drivers who are otherwise unable to find coverage.

You are eligible for MAI if you’ve been denied coverage by more than two insurance companies due to your driving history or ability to pay for said coverage. Note, though, that MAI — despite its name — is not sponsored by the state of Maryland. You’ll have to go through an independent application process to receive the coverage you need.

If you’re still looking for ways to save on your coverage, be sure to ask your provider of choice if you or your family are eligible for any of the following discounts:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e., if you have alarms, tracking systems, etc. on your vehicle)

- Auto-Pay Discounts (if you were to set up automatic payments from checking; some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-Car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

Be sure you shop around to find the best coverage for you that is equally cost-effective.

Automobile Insurance Fraud in Maryland

The insurance industry sees 10 percent of its operating costs go to investigating fraudulent claims or accounts over the course of a year.

There are two different types of car insurance fraud:

- Hard fraud involves a driver deliberately falsifying a claim or faking an accident to receive compensation

- Soft fraud involves a driver padding a claim or misrepresenting accident information to an insurance provider

Soft fraud is the more common of the two.

Even though you may think you’re just telling a white lie, soft fraud is considered a misdemeanor, and lying on your claim is considered a Class 5 felony.

Statute of Limitations

After an accident, you will have a limited amount of time to submit a claim to your insurance provider. That time begins on the same day you have your accident.

In Maryland, the statute of limitations for personal injury and property damage is the same. You will have three years from the day of your accident to submit a claim to your insurance provider.

State-Specific Laws

Most of Maryland’s roadway laws can be found in other states, as well. However, in this state, you cannot make unlawful vehicle modifications to your car under the Equipment of Vehicles, MD. Transportation Code Title 22.

What are the vehicle licensing laws in Maryland?

You need to regularly update your license to stay legal on the road. What are the rules, though, for older drivers, younger drivers, and everyone in between? In this section, we’ll discuss all of the specific regulations relating to licensing in Maryland.

REAL ID

As mentioned by NBC news, REAL ID is coming to the United States in 2020. But what does that mean for you?

Drivers everywhere will need to renew their licenses to travel by plane, be that on a domestic flight or an international one.

Penalties for Driving Without Insurance

You may think that it’d be less expensive to drive without insurance in Maryland. Unfortunately, you’d be incorrect.

As mentioned earlier in this article, the penalties for driving without insurance in Maryland are severe, not to mention expensive. They typically entail a loss of your license plates and vehicle registration. You’ll also be expected to pay uninsured motorist penalty fees for every day your coverage has lapsed. These fees break down as follows:

- $150 for the first 30 days without coverage

- $7 for every day after, applied daily

You’ll also need to pay a license and registration restoration fee of up to $25 to have your documents returned to you.

Teen Driver Laws

Learning how to drive can be equal parts exhilarating and terrifying. Not only do teenagers need to learn how to operate a two-ton machine, but they need to familiarize themselves with the rules of the road to stay legal while driving.

Maryland teenagers are able to get behind the wheel of a car once they turn 15 and nine months. They’ll need to pass a knowledge and vision test first to receive their learner’s permit. This learner’s permit comes with a number of restrictions, as you can see in the table below:

| Requirement | Details |

|---|---|

| Minimum Holding Period | 6 months |

| Supervised Driving Hours | Total driving - 60 hours Nighttime driving -10 hours |

| Driver Education | Classroom - 30 hours Behind the wheel - 6 hours |

| Supervising Adult | Age - 21 or older (should have held license for 3 years) |

Once the minimum holding period has passed, the teenager can swap out their learner’s permit for a provisional license. They can also immediately begin working with a provisional license upon turning 16-and-a-half, as long as they pass a written and behind-the-wheel test.

The restrictions placed on provisional licenses are as follows:

| Requirement | Details |

|---|---|

| Alcohol Consumption | No trace of alcohol is allowed for teenagers |

| Nighttime Restrictions | 12 AM - 5 AM (allowed under specific circumstances) |

| Passenger Restrictions | Not allowed to drive with passengers under 18 (unless accompanied by a qualified driver or driving with family members) |

As soon as a teenager has been on the road for 18 months, they’ll be able to drive with an unrestricted license. However, any teenager behind the wheel of a car needs to be insured.

Older Driver License Renewal Procedures

Drivers older than 40 years old will need to pass a vision test every time they have their license renewed. That said, older drivers will stay on the eight-year cycle, even after they pass 70 years of age.

New Residents

If you’re new to Maryland, you’ll need to make sure your existing car insurance coverage meets the state’s minimum liability requirements. You’ll also have 60 days to replace your existing driver’s license with a Maryland license.

If you drive commercially, you’ll only have 30 days. Make sure to carve out the time to visit your local DMV to take a vision test and to register your vehicle in the state. Note that your vehicle will be required to pass the Maryland Safety Inspection before it is officially registered.

License Renewal Procedures

Maryland residents need to renew their licenses on an eight-year cycle. It’s possible to do this by mail or online, and those options are available even to older drivers.

Negligent Operator Treatment System (NOTS)

Maryland’s Negligent Operator Treatment System is more commonly known as the point system, or the system law enforcement representatives will reference when you’ve violated a traffic law. In Maryland, you’ll only be assessed for point distribution if you’ve been convicted of a traffic violation.

If you’ve been awarded points via the Negligent Operator Treatment System in Maryland, those points will remain visible to insurance providers as public information for three years after your conviction. After only two years, though, the points will no longer be considered “current.”

What are the rules of the road in Maryland?

While we can’t control everything that happens on the road, we can control our own behavior. Keep the rules of the road in Maryland in mind, and the roads will be much safer for everyone.

Seat Belt and Car Seat Safety

According to Maryland state law, everyone in a moving vehicle needs to be wearing a seat, and younger passengers must be in a car seat. If you’re caught driving on the road without a seat belt on, you could be charged up to $50 for your infraction, not including any processing or additional fees.

Children younger than seven and shorter than 57 inches must be kept in an appropriate car seat. What constitutes “appropriate” will entirely depend on your child’s weight and height. If you’re caught driving a child around without the aid of a car seat, you may also face fines of up to $50.

Maryland gets a little more specific when it comes to riding in the cargo area of a pickup truck. Anyone may ride in the back of a cargo truck unsecured if they are:

- 16 years old or older

- 15 or younger AND traveling under 25 miles an hour

- An employee on a farm or traveling to a worksite

Other parties can be charged for doing so.

Keep Right and Move Over

If you’re driving more slowly than the posted speed limit, or if you’re not looking to pass a car in front of you, Maryland law dictates that you must remain in the right-hand lane of the interstate.

You must also move over for vehicles that have their lights flashing, regardless of whether or not they’re clearly marked as emergency vehicles. These vehicles include but are not limited to:

- Police cruisers

- Ambulances

- Firetrucks

- Tow trucks

- Recovery vehicles

Speed Limits

Everyone’s been tempted to speed now and then. However, speeding not only increases the risk of an accident, but it could also possibly get you fined and cause your insurance rates to increase.

Take a look at Maryland’s speed limits in the table below:

| Type of Road | Speed Limit |

|---|---|

| Baltimore County Alleys | 15 mph |

| Business Districts | 30 mph |

| Residential Districts - Undivided Highways | 30 mph |

| Residential Districts - Divided Highways | 35 mph |

| Non Residential Districts - Undivided Highways | 50 mph |

| Non Residential Districts - Divided Highways | 55 mph |

Note that these are the maximum speeds for the applicable roads. If you’re caught going faster, you’re likely to receive a ticket.

Ridesharing

The rise of ridesharing services like Lyft and Uber has changed the way career drivers work while on the road. Nowadays, if you want to use your car for a transportation service, you’re going to need to have insurance that covers your career as well as your person.

At this point in time, six of Maryland’s insurance providers offer ridesharing coverage. These are:

- Allstate

- Erie

- Farmers

- Geico

- Liberty Mutual

- USAA

That said, there is no law in place stating that insurance providers have to cover any injuries or property damage you might receive while working. You’ll need to go out of your way to procure ridesharing coverage if you want to continue working on the road.

Automation on the Road

Self-driving vehicles are still being tested around the United States, but they’ve yet to take to the roads. Right now, “automation” refers primarily to platooning technology, or technologies designed to keep groups of vehicles together while traveling on the road. Trucks and buses typically use these sorts of technologies to stay within a reasonable distance of one another.

At this point in time, Maryland has not drafted any automation-related legislation that drivers need to be concerned with.

What are the safety laws in Maryland?

Sometimes, drivers’ behavior can get them in trouble. Maryland has instituted a few safety laws designed to keep drivers from actively working against themselves while on the road, as you’ll see in this section.

DUI Laws

It is illegal across the United States to drive a vehicle when you have a blood alcohol content (BAC) of 0.08 or higher. If you get caught driving while intoxicated, you’ll face charges for your actions and may end up with a DUI on your record. That record will stick, too, as Maryland’s look-back period lasts five years.

In the table below, you can learn more about the legal consequences of drinking and driving:

| Penalty | First Offense | Second Offense | Third Offense |

|---|---|---|---|

| License Suspension | Six months | One year | 18 months up to lifetime |

| Imprisonment | No minimum up to one year | Five days to one year | No minimum up to three years |

| Fine | No minimum up to $1000 | No minimum up to $2000 | No minimum up to $3000 |

| Other | 12 points on license | 12 points on license If two convictions w/in five years, IID program mandatory | 12 points on license |

Needless to say, getting behind the wheel after you’ve been drinking is a bad decision, both for you and for other drivers on the road. Pass your keys to a friend or call a rideshare. You’ll be safer for the effort.

Marijuana-Impaired Driving Laws

There are no specific laws in Maryland dictating the legal consequences of driving while under the influence of marijuana.

Distracted Driving Laws

In response to a rise in device-related fatalities all across the nation, Maryland instituted a universal handheld phone ban for drivers in the state. This means no texting and no calling while you’re behind the wheel.

Texting or calling while driving is considered a primary offense. This means that a law enforcement officer will need no other reason to pull you over if you’re caught breaking the rule. Consequences include a $40 fine for your first offense, followed by $100 every time you’re caught after that.

Driving in Maryland

The roadways in any state are going to have dangers that drivers can only respond to. There will be situations we can’t control, so it’s good to have a general idea of what kind of trouble may be coming our way. When we have that information beforehand, we can drive more carefully.

That’s why, in this section, we’re going to touch on vehicle theft and fatality rates throughout Maryland. Here, you’ll learn what you need to look out for and the best practices you can institute to stay safe on the road.

How many vehicle thefts occur in Maryland?

There are certain types of vehicles more likely to be stolen in Maryland than others, as you can see in the table below:

| Make and Model | Most Popular Vehicle Year for Theft | Number of Cars Stolen |

|---|---|---|

| Dodge Caravan | 2003 | 727 |

| Honda Accord | 2008 | 675 |

| Toyota Camry | 2014 | 347 |

| Honda Civic | 2012 | 313 |

| Ford Pickup (Full Size) | 2004 | 287 |

| Nissan Altima | 2013 | 230 |

| Toyota Corolla | 2014 | 204 |

| Jeep Cherokee/Grand Cherokee | 2015 | 194 |

| Chevrolet Pickup (Full Size) | 1999 | 192 |

| Hyundai Sonata | 2013 | 169 |

Apparently, vehicle thieves in Maryland like to get their hands on Dodge Caravans and Honda Accords.

How many road fatalities occur in Maryland?

No one, to our knowledge, can control the weather or the sun. What drivers can control is their behavior. In the following section, we’ll detail the fatalities Maryland sees over time that are the result of both the environment and human behavior working in tandem.

Most Fatal Highway in Maryland

According to a study released by ASecureLife, I-95 is Maryland’s most deadly interstate. This study took data collected between 2015-2017 to make this assertion, and it cites weather conditions as well as driver recklessness as contributors to the highway’s fatality count.

Fatal Crashes by Weather Condition and Light Condition

Different weather and light conditions can impact the way that drivers operate on the road. Take a look at how both factors cause fatalities.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 184 | 117 | 104 | 18 | 0 | 423 |

| Rain | 14 | 9 | 9 | 4 | 0 | 36 |

| Snow/Sleet | 2 | 0 | 1 | 0 | 0 | 3 |

| Other | 1 | 5 | 0 | 0 | 0 | 6 |

| Unknown | 16 | 8 | 15 | 2 | 2 | 43 |

| Total | 217 | 139 | 129 | 24 | 2 | 511 |

In Maryland, as you can see, the vast majority of roadway fatalities take place during the daylight hours. That said, a good number also occurs when the road is just getting dark. That’s all the more reason to keep an eye on the road, regardless of what time of day you’re driving.

Fatalities (All Crashes) by County

There are several different types of crashes a driver can get into, as you can see in the table below:

| Crash Type | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 442 | 520 | 522 | 558 | 501 |

| Single Vehicle | 254 | 280 | 288 | 308 | 278 |

| Involving a Large Truck | 49 | 58 | 65 | 55 | 70 |

| Involving Speeding | 134 | 124 | 132 | 163 | 123 |

| Involving a Rollover | 65 | 99 | 60 | 59 | 61 |

| Involving a Roadway Departure | 205 | 249 | 222 | 263 | 215 |

| Involving an Intersection (or Intersection Related) | 127 | 145 | 146 | 170 | 137 |

Maryland sees single-vehicle crashes more often than just about every other type of crash. That said, many of the state’s other fatalities include a roadway departure or speeding.

How do these crashes break down by county? Let’s take a look:

| Rank | County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Prince Georges | 87 | 98 | 96 | 78 | 99 |

| 2 | Baltimore County | 58 | 64 | 69 | 54 | 72 |

| 3 | Anne Arundel County | 34 | 37 | 37 | 44 | 44 |

| 4 | Baltimore City | 31 | 30 | 42 | 53 | 38 |

| 5 | Charles County | 16 | 8 | 15 | 29 | 35 |

| 6 | Montgomery County | 40 | 39 | 47 | 42 | 33 |

| 7 | Cecil County | 17 | 14 | 16 | 21 | 31 |

| 8 | Frederick County | 20 | 18 | 20 | 16 | 27 |

| 9 | Carroll County | 20 | 11 | 16 | 21 | 25 |

| 10 | Harford County | 25 | 17 | 22 | 25 | 21 |

| Sub Total 1 | Top Ten Counties | 354 | 358 | 385 | 390 | 425 |

| Sub Total 2 | All Other Counties | 111 | 84 | 135 | 132 | 125 |

| Total | All Counties | 465 | 442 | 520 | 522 | 550 |

Single vehicles see the most accidents of all vehicles on the road, and numbers have unsteadily increased since 2014. Roadway departures are most often the cause of fatalities, as well, as their numbers well out-pace fatalities involving intersections, rollovers, speeding, and large trucks.

Traffic Fatalities in Maryland

Location and road type also impact the likelihood of a car accident, as you can see in the table below:

| Fatality Type (Urban vs Rural) | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Total | 591 | 549 | 496 | 485 | 511 | 465 | 442 | 520 | 522 | 550 |

| Rural | 222 | 203 | 182 | 170 | 180 | 167 | 149 | 125 | 108 | 126 |

| Urban | 368 | 342 | 313 | 311 | 325 | 295 | 293 | 378 | 408 | 416 |

| Unknown | 1 | 4 | 1 | 4 | 6 | 3 | 0 | 17 | 6 | 8 |

Urban roads in Maryland see more fatalities than rural roads, likely due to the high number of vehicles operating in the area.

Fatalities by Person Type

When we refer to “person type” while discussing fatality data, we mean a person’s relationship to a vehicle as opposed to any other demographic statistics.

| Person Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 181 | 174 | 214 | 192 | 213 |

| Light Truck - Pickup | 39 | 24 | 42 | 33 | 42 |

| Light Truck - Utility | 40 | 48 | 50 | 47 | 51 |

| Light Truck - Van | 19 | 8 | 11 | 19 | 12 |

| Large Truck | 5 | 7 | 10 | 12 | 10 |

| Other/Unknown Occupants | 2 | 2 | 8 | 9 | 6 |

| Total Occupants | 286 | 264 | 335 | 318 | 337 |

| Light Truck - Other | 0 | 1 | 0 | 0 | 3 |

| Bus | 0 | 0 | 0 | 6 | 0 |

| Pedestrian | 108 | 101 | 97 | 108 | 114 |

| Bicyclist and Other Cyclist | 6 | 5 | 11 | 16 | 10 |

| Other/Unknown Nonoccupants | 3 | 3 | 2 | 4 | 3 |

| Total Nonoccupants | 117 | 109 | 110 | 128 | 127 |

| Total Motorcyclists | 62 | 69 | 75 | 76 | 86 |

| Total | 465 | 442 | 520 | 522 | 550 |

Most fatal crashes involved passenger cars or light trucks, which is not surprising since these are the vehicles most prevalent on the road.

Fatalities by Crash Type

We can also look at the different types of crashes and causes for fatalities on the road in Maryland:

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes) | 465 | 442 | 520 | 522 | 550 |

| Single Vehicle | 269 | 254 | 280 | 288 | 304 |

| Involving a Large Truck | 58 | 49 | 58 | 63 | 48 |

| Involving Speeding | 148 | 134 | 124 | 132 | 160 |

| Involving a Rollover | 71 | 65 | 99 | 60 | 59 |

| Involving a Roadway Departure | 226 | 205 | 249 | 222 | 262 |

| Involving an Intersection | 100 | 127 | 145 | 146 | 163 |

As you can see, speeding and roadway departures are common causes of fatal accidents, which means Maryland drivers should ensure they are always following the speed limit and exercising caution when exiting or entering the interstate.

Five-Year Trend for the Top 10 Counties

The table below relays the top 10 counties in Maryland that happen to see the most accidents over a year.

| Ranking | County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| 1 | Prince Georges | 87 | 98 | 96 | 78 | 99 |

| 2 | Baltimore County | 58 | 64 | 69 | 54 | 72 |

| 3 | Anne Arundel County | 34 | 37 | 37 | 44 | 44 |

| 4 | Baltimore City | 31 | 30 | 42 | 53 | 38 |

| 5 | Charles County | 16 | 8 | 15 | 29 | 35 |

| 6 | Montgomery County | 40 | 39 | 47 | 42 | 33 |

| 7 | Cecil County | 17 | 14 | 16 | 21 | 31 |

| 8 | Frederick County | 20 | 18 | 20 | 16 | 27 |

| 9 | Carroll County | 20 | 11 | 16 | 21 | 25 |

| 10 | Harford County | 25 | 17 | 22 | 25 | 21 |

| Sub-Total 1 | Top Ten Counties | 354 | 358 | 385 | 390 | 425 |

| Sub-Total 2 | All Other Counties | 111 | 84 | 135 | 132 | 125 |

| Total | All Counties | 465 | 442 | 520 | 522 | 550 |

The most populated counties in Maryland see the bulk of the state’s fatalities. Prince George’s County has had the most fatalities for several years running, followed by Baltimore County.

Fatalities Involving Speeding by County

We’ve talked about the dangers of speeding in this guide before, but only in the sense that you may face legal consequences if you’re caught going faster than the posted speed limit.

Maryland also sees its fair share of speeding-related fatalities, as you can see in the table below:

| County Name | Speeding Fatalities 2015 | 2016 | 2017 | Speeding Fatalities Per 100K 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Allegany County | 1 | 4 | 1 | 1.38 | 5.54 | 1.40 |

| Anne Arundel County | 13 | 15 | 14 | 2.30 | 2.64 | 2.44 |

| Baltimore City | 12 | 15 | 15 | 1.93 | 2.43 | 2.45 |

| Baltimore County | 10 | 16 | 18 | 1.21 | 1.92 | 2.16 |

| Calvert County | 3 | 2 | 2 | 3.32 | 2.20 | 2.19 |

| Caroline County | 3 | 2 | 2 | 9.20 | 6.08 | 6.03 |

| Carroll County | 3 | 2 | 5 | 1.79 | 1.20 | 2.98 |

| Cecil County | 7 | 8 | 9 | 6.83 | 7.79 | 8.76 |

| Charles County | 5 | 3 | 17 | 3.21 | 1.91 | 10.64 |

| Dorchester County | 0 | 1 | 0 | 0.00 | 3.10 | 0.00 |

| Frederick County | 7 | 3 | 12 | 2.85 | 1.21 | 4.76 |

| Garrett County | 1 | 3 | 1 | 3.40 | 10.22 | 3.42 |

| Harford County | 4 | 7 | 4 | 1.60 | 2.80 | 1.59 |

| Howard County | 7 | 8 | 8 | 2.24 | 2.52 | 2.49 |

| Kent County | 0 | 1 | 0 | 0.00 | 5.09 | 0.00 |

| Montgomery County | 8 | 3 | 5 | 0.77 | 0.29 | 0.47 |

| Prince Georges | 24 | 18 | 30 | 2.64 | 1.98 | 3.29 |

| Queen Anne | 0 | 4 | 2 | 0.00 | 8.13 | 4.02 |

| Somerset County | 1 | 1 | 0 | 3.89 | 3.87 | 0.00 |

| St. Mary | 5 | 1 | 7 | 4.50 | 0.89 | 6.21 |

| Talbot County | 1 | 0 | 3 | 2.67 | 0.00 | 8.09 |

| Washington County | 6 | 6 | 3 | 4.02 | 4.01 | 1.99 |

| Wicomico County | 0 | 3 | 1 | 0.00 | 2.92 | 0.97 |

| Worcester County | 3 | 6 | 1 | 5.83 | 11.65 | 1.93 |

Naturally, Prince George’s County — one of the largest in the state — sees the most fatalities related to speeding over the course of a year. Comparatively, counties like Queen Anne see few to none.

Fatalities Involving an Alcohol-Impaired Driver

Deciding to get behind the wheel after you’ve had a few drinks is one of the worst choices you can ever make. Not only do you put yourself at risk, but you put the lives of your passengers and other drivers on the road in danger, too.

Unfortunately, some drivers don’t think about this, or they believe they can drive just fine while intoxicated. As a result, we see alcohol-impaired fatalities like those that Maryland reports:

| County Name | Alcohol-Impaired Driving Fatalities 2015 | 2016 | 2017 | Alcohol-Impaired Driving Fatalities Per 100K Population 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Allegany County | 3 | 11 | 0 | 4.14 | 15.24 | 0.00 |

| Anne Arundel County | 15 | 10 | 19 | 2.66 | 1.76 | 3.31 |

| Baltimore City | 16 | 9 | 10 | 2.57 | 1.46 | 1.63 |

| Baltimore County | 13 | 18 | 29 | 1.57 | 2.16 | 3.48 |

| Calvert County | 6 | 2 | 3 | 6.63 | 2.20 | 3.28 |

| Caroline County | 4 | 3 | 2 | 12.26 | 9.12 | 6.03 |

| Carroll County | 2 | 5 | 5 | 1.20 | 2.99 | 2.98 |

| Cecil County | 2 | 6 | 12 | 1.95 | 5.84 | 11.68 |

| Charles County | 3 | 10 | 13 | 1.93 | 6.35 | 8.14 |

| Dorchester County | 1 | 1 | 1 | 3.09 | 3.10 | 3.11 |

| Frederick County | 5 | 4 | 4 | 2.04 | 1.61 | 1.59 |

| Garrett County | 1 | 3 | 3 | 3.40 | 10.22 | 10.26 |

| Harford County | 5 | 5 | 4 | 2.00 | 2.00 | 1.59 |

| Howard County | 5 | 5 | 6 | 1.60 | 1.58 | 1.87 |

| Kent County | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 |

| Montgomery County | 12 | 6 | 10 | 1.15 | 0.57 | 0.94 |

| Prince Georges | 35 | 23 | 39 | 3.85 | 2.52 | 4.27 |

| Queen Anne | 4 | 0 | 7 | 8.16 | 0.00 | 14.06 |

| Somerset County | 0 | 1 | 1 | 0.00 | 3.87 | 3.86 |

| St. Mary | 4 | 3 | 11 | 3.60 | 2.68 | 9.76 |

| Talbot County | 2 | 2 | 3 | 5.33 | 5.38 | 8.09 |

| Washington County | 10 | 3 | 3 | 6.70 | 2.00 | 1.99 |

| Wicomico County | 5 | 4 | 1 | 4.90 | 3.90 | 0.97 |

| Worcester County | 6 | 7 | 2 | 11.66 | 13.59 | 3.87 |

Urban counties like Prince Georges see some of the most alcohol-related fatalities over the course of a year in Maryland. That’s all the more reason to appoint a designated driver on Superbowl Sunday or other busy weekends.

Teen Drinking and Driving

Note that the above statistics include teen drivers who got behind the wheel while intoxicated. Once again, it’s larger counties like Prince George’s that see the most alcohol-related fatalities in a year’s time. Those fatality rates are in flux, too, making it difficult to determine a pattern.

EMS Response Time

If you get into an accident, you want to know that emergency medical services, or EMS, will be able to make it to your location quickly. Let’s see how long it takes, on average, for Maryland’s EMS to reach the site of a crash.

| Road Type | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival | Total Fatal Crashes |

|---|---|---|---|---|---|

| Rural | 2.00 | 11.81 | 35.76 | 46.88 | 99 |

| Urban | 3.12 | 10.40 | 29.25 | 39.23 | 379 |

You’ll notice that EMS is able to respond to urban accidents more quickly than rural accidents. The difference here, however, isn’t so significant. Regardless of where your accident takes place, EMS will be able to get you to a hospital within an hour of your accident.

What is transportation like in Maryland?

Those are the dangers you have to look out for while driving through Maryland — but what is an average day like? Let’s break down standard commute times, types, and traffic so you can better predict what your normal commute in Maryland is going to look like.

Car Ownership

As is the case with most states in the nation, Maryland residents tend to own two cars. The number of drivers who own a single car or three cars are about even.

Commute Time

Speaking of that morning drive, be prepared to spend a bit of extra time in your car. The average Maryland commute comes in at 31 minutes. That’s roughly five minutes higher than the national average.

Commuter Transportation

The number of single-driver cars on the road contributes to that longer commute time. As is the case in many other states, Maryland drivers prefer to be on their own when they’re in the car. This doesn’t mean that carpooling is unheard of, but rather that it is significantly less common than jamming out to the radio on your own in the mornings and evenings.

Traffic Congestion in Maryland

We’ve alluded to Maryland traffic a few times now — it’s best to bite the bullet. Baltimore traffic is notoriously terrible. In fact, the city comes in at number five on INRIX’s list of America’s most congested cities.

| City | Hours Spent in Traffic (2017) | Peak (Time in Traffic) | Daytime (Time in Traffic) | Overall (Time in Traffic) |

|---|---|---|---|---|

| Baltimore | 27 | 11% | 6% | 7% |

| Columbia | 31 | 18% | 7% | 10% |

| Annapolis | 24 | 14% | 7% | 8% |

| Frederick | 14 | 8% | 3% | 4% |

| Hagerstown | 9 | 5% | 5% | 5% |

As you can see, though, Baltimore isn’t the only bustling city in Maryland. Maryland’s major urban areas all see a degree of congestion during the busiest hours of the day. Just know that, if you have a meeting to get to in any of these areas, you’re going to need to give yourself some extra time to get from Point A to Point B.

Conclusion

And just like that, we’ve come to the end of our comprehensive guide to Maryland’s roadways and car insurance providers. Feel as though you’re ready to start thinking about your car insurance rate? You can use our FREE online tool to start comparing rates in your area. Just enter your ZIP code to get a free quote comparison.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.