Hawaii Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Mar 19, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| Hawaii Statistics Summary | Hawaii Statistics |

|---|---|

| Road Miles | Total in State: 4,439 Vehicle Miles Driven: 10,174 |

| Vehicles | Registered: 1,350,438 Thefts: 3,879 |

| State Population | Estimated: 1,420,491 |

| Most Popular Vehicle | Tacoma |

| Uninsured Motorists | 10.60% State Rank: 30th |

| Driving Fatalities | Speeding: 50 DUI: 42 |

| Average Annual Premiums | Liability: $458.54 Collision: $313.17 Comprehensive: $101.56 Combined: $873.28 |

| Cheapest Provider | Geico |

Hawaii is a state of wonders. The beautiful beaches enchant nearly everyone’s imagination. When you live in the area, you might get used to them, but there’s still something stunning about walking out and seeing lush mountains and gorgeous waters right in front of you.

There is a little known fact about Hawaii, though, that we need to address. Across the six islands that make up the state, you’ll find over a million registered vehicles. That’s more than you expected, isn’t it?

All of those drivers are in need of insurance — state law requires it. But finding car insurance in Hawaii can be difficult. You don’t always know what kind you need, and when you do figure it out, you have to compare rates between dozens of different providers.

In short, shopping for car insurance is stressful.

That’s why we’re here to help. Instead of making you run around and compare a bunch of rates on your own, we’ve gathered all the information you’ll ever need on Hawaii’s providers, driving laws, and fatalities here in this guide. Now you can much more readily peruse the rates available to you and choose the one that’ll best fit your lifestyle.

Ready to get started? Let’s explore Hawaii together and unravel the mysteries of local car insurance.

Don’t want to wait? You can enter your ZIP code into our FREE online tool to start comparing car insurance rates in your area.

Hawaii Car Insurance Coverage and Rates

There are more car insurance plans in the world than there are shells in the sea — or so it seems. Trying to find the one that’s best for you without help is like trying to swim for the first time. You’re going to struggle until someone gives you the boost you need.

That’s what this section is for. We’re going to guide you through the different kind of car insurance responsibilities you have as a resident of Hawaii. Once you’ve got us keeping your afloat, it’ll be much easier for you to get a feel for the kind of policy you’re looking for.

Hawaii Minimum Coverage

Hawaii is a no-fault car accident state. This means that if you happen to get into an accident, you will be responsible for your own property damage or injury costs. It also means that the other party won’t be able to ask you to pay for their damages.

This is a good thing and a bad thing. Hawaii’s no-fault status directly impacts the kind of insurance you’re supposed to have. Unlike a number of other states, Hawaii requires you to have minimum liability insurance alongside personal injury protection. If you’re lacking either of these types of coverage, you won’t legally be able to drive on Hawaii’s interstates.

Take a look at Hawaii’s breakdown of its required minimum liability insurance below:

| Insurance Type | Insurance Required |

|---|---|

| Bodily Injury Liability Coverage | $20,000 per person $40,000 per accident |

| Property Damage Liability Coverage | $10,000 minimum |

| PIP/"No-Fault" Coverage | $10,000 minimum |

As you can see, you’ll need the following coverage to drive in Hawaii:

- $10,000 in personal injury protection

- $20,000 for bodily injury for a single person

- $40,000 in bodily injury for multiple people

- $10,000 for property damage

Forms of Financial Responsibility

In addition to state minimum liability and personal injury protection, you’ll need to carry forms of financial responsibility — alternatively known as proof of insurance — on your person while on the road. These forms can protect you from being wrongfully fined in case of a traffic stop or collision.

Proof of insurance in Hawaii includes:

- An insurance card

- A temporary insurance binder

- Proof of insurance as shown on a smartphone

Premiums as a Percentage of Income

When you’re budgeting for your preferred car insurance premium, you’re going to have to keep your per capita disposable income in mind. Your per capita disposable income consists of the amount of money you have available to spend after you’ve paid your taxes.

The following table breaks down the average personal incomes that Hawaiians have seen over the past few years. It then compares those incomes to the average cost of full coverage in Hawaii:

| Year | Full Coverage | Disposable Income | Insurance as Percentage of Income |

|---|---|---|---|

| 2012 | $844.12 | $40,339.00 | 2.09% |

| 2013 | $844.16 | $40,094.00 | 2.11% |

| 2014 | $858.16 | $41,801.00 | 2.05% |

As you can see, Hawaiians are expected to pay between 2.05 percent and 2.11 percent of their per capita disposable income towards their car insurance coverage.

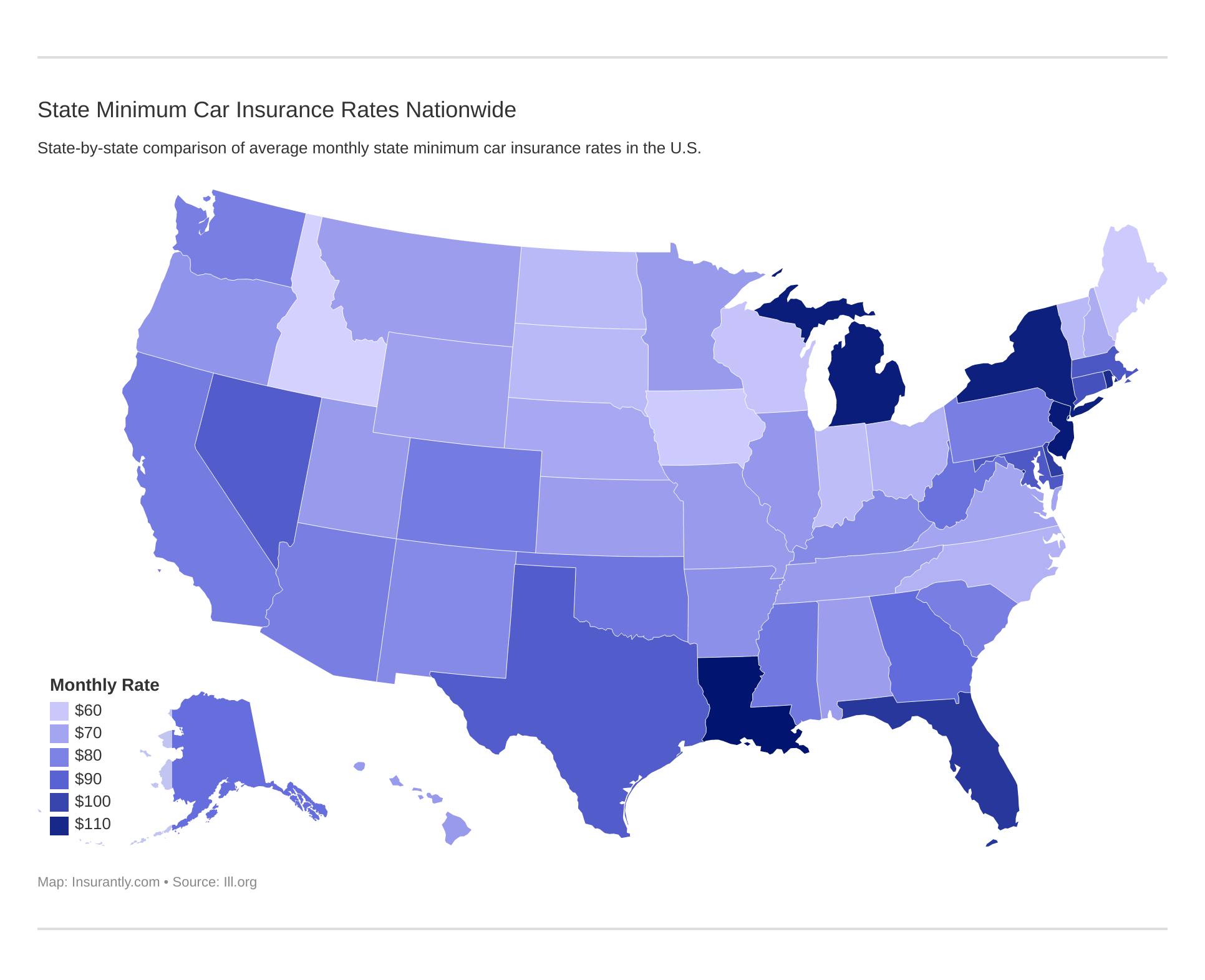

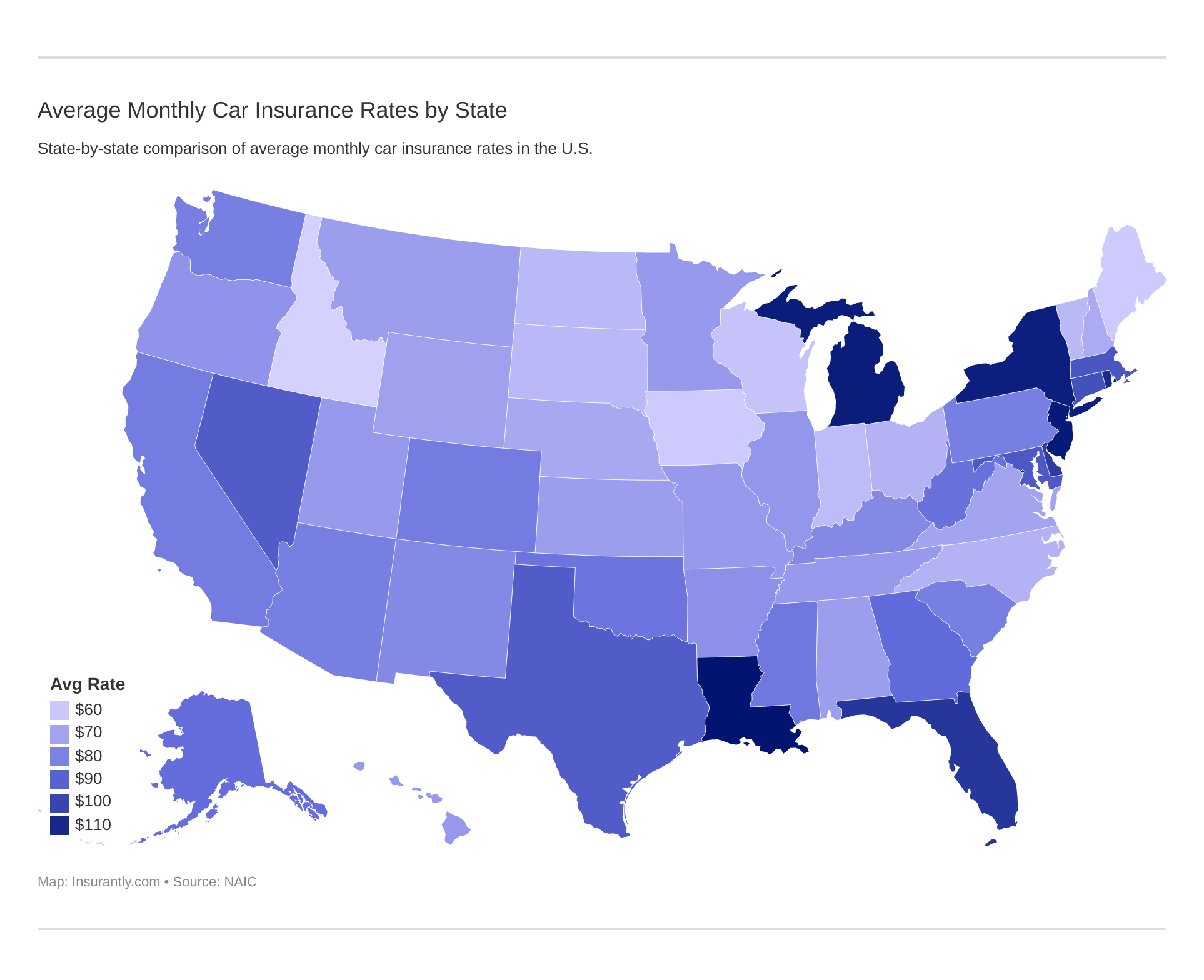

Average Monthly Car Insurance Rates in HI (Liability, Collision, Comprehensive)

According to the National Association of Insurance Commissioners, core coverage in Hawaii ranges as follows:

| Coverage Type | Annual Costs |

|---|---|

| Liability | $458.54 |

| Collision | $313.17 |

| Comprehensive | $101.56 |

| Combined | $873.28 |

| National Average | $1,311 |

That said, you should also note that these rates were originally determined in 2015. As of 2019 and beyond, you should anticipate paying more for all of these coverage types.

Additional Liability

Hawaii’s uninsured driver problem isn’t as significant as other states’. The state ranks at number 30 out of 50 for uninsured drivers, with roughly 10 percent of the population driving without coverage.

While that number may seem low, it’s more than enough reason to consider purchasing additional liability coverage, like MedPay or Uninsured/Underinsured Protection.

| Loss Ratio | 2015 | 2014 | 2013 |

|---|---|---|---|

| PIP (Personal Injury Protection) | 63% | 62% | 61% |

| Medical Payments (Med Pay) | 126% | 232% | 79% |

| Uninsured/Underinsured Motorist | 43% | 43% | 40% |

The above table makes note of the loss ratios that both Med Pay and Uninsured/Underinsured insurance have garnered in the past. These numbers are notable because they reveal how much money car insurance providers, on average, spend on claims versus how much they take in on premiums.

In short, the closer a loss ratio is to 100 percent, the more claims the company in question pays. That said, a company with a 100 percent loss ratio is also losing money. Comparatively, companies with lower loss ratios aren’t paying out on their clients’ claims.

When shopping for car insurance, you’ll want to look for a company with a loss ratio somewhere in the 60 to 70 percent range.

Add-ons, Endorsements, and Riders

You can explore additional, optional coverage by considering some of the add-ons below. Click on the available links to learn more:

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

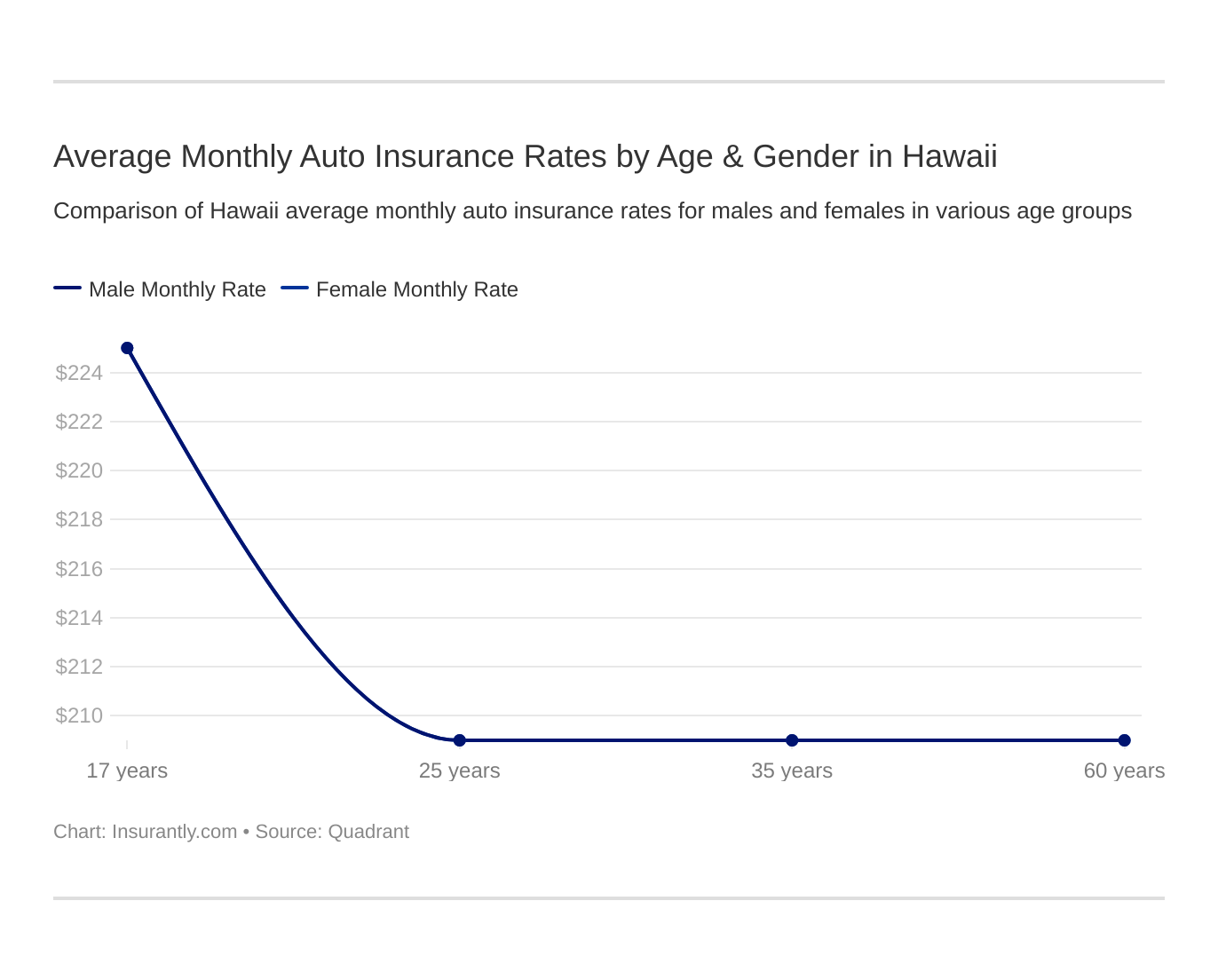

Average Monthly Car Insurance Rates by Age & Gender in HI

Some states have banned discrimination based on gender for car insurance rates, and this is one of those few states. As you can see the rate for males and females is the same, but the rate still varies with age.

| Company | Demographic | Average Annual Rate |

|---|---|---|

| Allstate Insurance | Married 35-year old female | $2,173.49 |

| Allstate Insurance | Married 35-year old male | $2,173.49 |

| Allstate Insurance | Married 60-year old female | $2,173.49 |

| Allstate Insurance | Married 60-year old male | $2,173.49 |

| Allstate Insurance | Single 17-year old female | $2,173.49 |

| Allstate Insurance | Single 17-year old male | $2,173.49 |

| Allstate Insurance | Single 25-year old female | $2,173.49 |

| Allstate Insurance | Single 25-year old male | $2,173.49 |

| Farmers Ins HI Standard | Married 35-year old female | $4,659.38 |

| Farmers Ins HI Standard | Married 35-year old male | $4,659.38 |

| Farmers Ins HI Standard | Married 60-year old female | $4,659.38 |

| Farmers Ins HI Standard | Married 60-year old male | $4,659.38 |

| Farmers Ins HI Standard | Single 17-year old female | $5,077.15 |

| Farmers Ins HI Standard | Single 17-year old male | $5,077.15 |

| Farmers Ins HI Standard | Single 25-year old female | $4,659.38 |

| Farmers Ins HI Standard | Single 25-year old male | $4,659.38 |

| Geico Govt Employees | Married 35-year old female | $3,358.86 |

| Geico Govt Employees | Married 35-year old male | $3,358.86 |

| Geico Govt Employees | Married 60-year old female | $3,358.86 |

| Geico Govt Employees | Married 60-year old male | $3,358.86 |

| Geico Govt Employees | Single 17-year old female | $3,358.86 |

| Geico Govt Employees | Single 17-year old male | $3,358.86 |

| Geico Govt Employees | Single 25-year old female | $3,358.86 |

| Geico Govt Employees | Single 25-year old male | $3,358.86 |

| Liberty Mutual Fire | Married 35-year old female | $3,179.89 |

| Liberty Mutual Fire | Married 35-year old male | $3,179.89 |

| Liberty Mutual Fire | Married 60-year old female | $3,179.89 |

| Liberty Mutual Fire | Married 60-year old male | $3,179.89 |

| Liberty Mutual Fire | Single 17-year old female | $3,218.54 |

| Liberty Mutual Fire | Single 17-year old male | $3,218.54 |

| Liberty Mutual Fire | Single 25-year old female | $3,179.89 |

| Liberty Mutual Fire | Single 25-year old male | $3,179.89 |

| Progressive Direct | Married 35-year old female | $1,976.86 |

| Progressive Direct | Married 35-year old male | $1,976.86 |

| Progressive Direct | Married 60-year old female | $1,976.86 |

| Progressive Direct | Married 60-year old male | $1,976.86 |

| Progressive Direct | Single 17-year old female | $2,781.14 |

| Progressive Direct | Single 17-year old male | $2,781.14 |

| Progressive Direct | Single 25-year old female | $1,976.86 |

| Progressive Direct | Single 25-year old male | $1,976.86 |

| State Farm Mutual Auto | Married 35-year old female | $1,040.28 |

| State Farm Mutual Auto | Married 35-year old male | $1,040.28 |

| State Farm Mutual Auto | Married 60-year old female | $1,040.28 |

| State Farm Mutual Auto | Married 60-year old male | $1,040.28 |

| State Farm Mutual Auto | Single 17-year old female | $1,040.28 |

| State Farm Mutual Auto | Single 17-year old male | $1,040.28 |

| State Farm Mutual Auto | Single 25-year old female | $1,040.28 |

| State Farm Mutual Auto | Single 25-year old male | $1,040.28 |

| USAA | Married 35-year old female | $1,176.35 |

| USAA | Married 35-year old male | $1,176.35 |

| USAA | Married 60-year old female | $1,176.35 |

| USAA | Married 60-year old male | $1,176.35 |

| USAA | Single 17-year old female | $1,228.38 |

| USAA | Single 17-year old male | $1,228.38 |

| USAA | Single 25-year old female | $1,176.35 |

| USAA | Single 25-year old male | $1,176.35 |

It’s not gender that has the most significant impact on your car insurance rates, as you can see — it’s age (except for teenage boys, but they’re an outlier in the data set).

As drivers age, premiums tend to even out. By the time drivers hit middle age, as you can see above, the premiums they’ll see should be balanced. In some cases, women even have to pay more than their male companions.

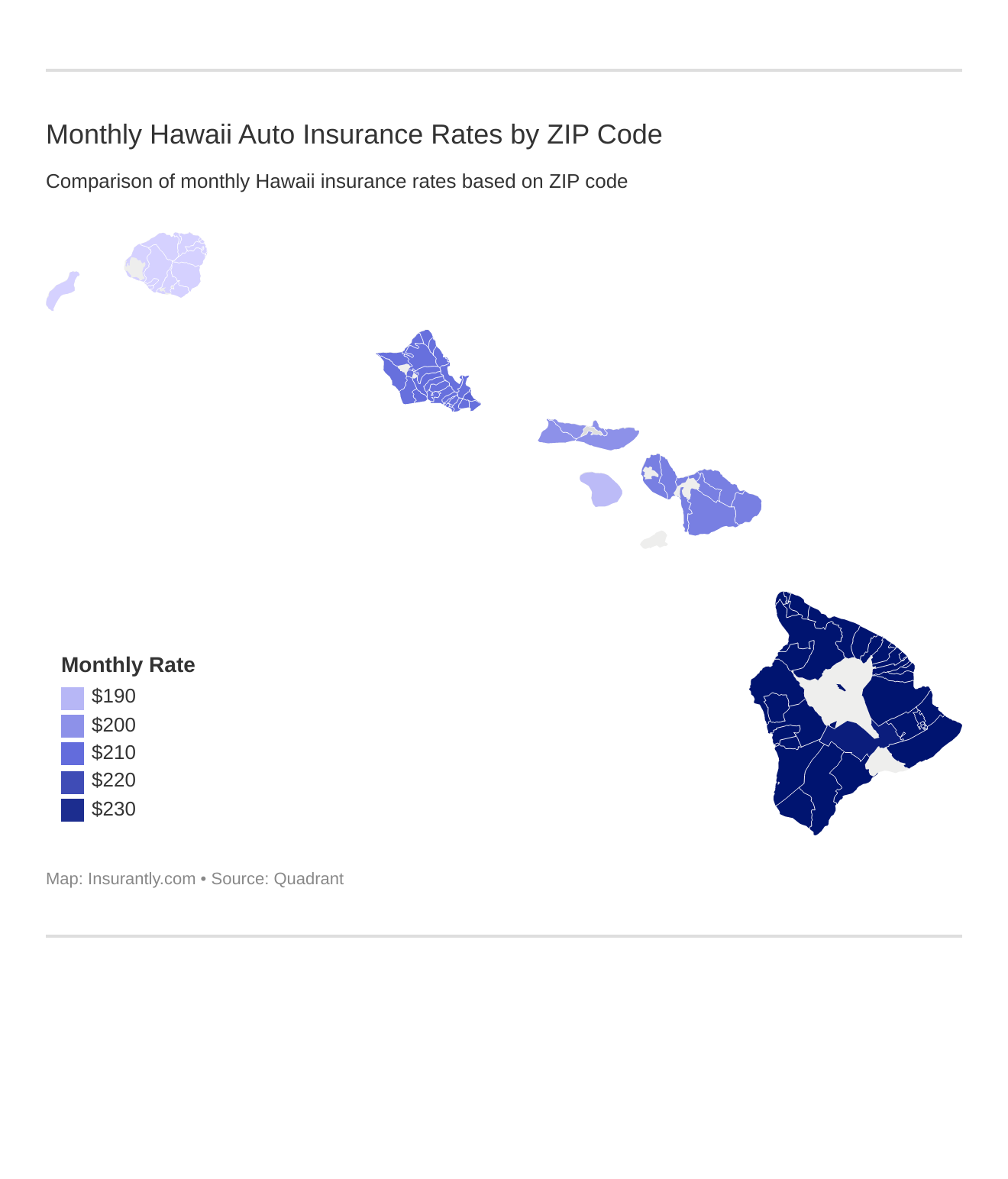

Cheapest Rates by ZIP Code

It’s not just age and gender than can impact the premium you’re offered. Your ZIP code can have a significant impact on your initial rate, as you can see below:

| ZIP Code | Average | Allstate Insurance | Farmers Ins HI Standard | Geico Govt Employees | Liberty Mutual Fire | Progressive Direct | State Farm Mutual Auto | USAA |

|---|---|---|---|---|---|---|---|---|

| 96701 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96703 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96704 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96705 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96706 | $2,520.31 | $2,212.33 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96707 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96708 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96710 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96712 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96713 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96714 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96716 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96717 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96718 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96719 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96720 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96722 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96725 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96726 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96727 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96728 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96729 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96730 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96731 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96732 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96734 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96737 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96738 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96739 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96740 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96741 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96742 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96743 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96744 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96746 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96747 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96748 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96749 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96750 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96751 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96752 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96753 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96754 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96755 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96756 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96759 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96760 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96761 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96762 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96763 | $2,263.39 | $2,116.77 | $3,397.27 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96764 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96766 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96768 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96769 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96770 | $2,397.78 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $1,671.97 | $1,075.14 | $1,095.52 |

| 96771 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96772 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96773 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96774 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96776 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96777 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96778 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96779 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96780 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96781 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96782 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96783 | $2,859.11 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,415.64 | $1,083.14 | $1,222.56 |

| 96784 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96785 | $2,814.68 | $2,451.60 | $5,487.00 | $3,708.67 | $3,645.14 | $2,104.66 | $1,083.14 | $1,222.56 |

| 96786 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96789 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96790 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96791 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96792 | $2,508.57 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96793 | $2,459.60 | $2,116.77 | $4,338.04 | $3,347.67 | $3,139.39 | $2,104.66 | $1,075.14 | $1,095.52 |

| 96795 | $2,544.50 | $2,130.17 | $4,664.22 | $3,200.79 | $3,078.47 | $2,415.64 | $1,049.86 | $1,272.36 |

| 96796 | $2,198.62 | $1,778.53 | $4,071.56 | $3,065.08 | $2,624.75 | $1,960.81 | $894.17 | $995.42 |

| 96797 | $2,520.31 | $2,212.33 | $4,664.22 | $3,200.79 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96813 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96814 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96815 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96816 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96817 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96818 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96819 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96821 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96822 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96825 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96826 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96844 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96850 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96853 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96854 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96857 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96858 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96859 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96860 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96861 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96863 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

| 96898 | $2,511.19 | $2,130.17 | $4,664.22 | $3,219.13 | $3,078.47 | $2,164.12 | $1,049.86 | $1,272.36 |

ZIP codes affect auto insurance because of factors like traffic, crime to name a few. Find out how your ZIP code stacks up in HI.

Cheapest Rates by City

Your offered car insurance rate will also vary based on the city you live in:

| Most Expensive Cities | Average Cost | Least Expensive Cities | Average Cost |

|---|---|---|---|

| HAWI | $2,859.11 | ANAHOLA | $2,198.62 |

| HILO | $2,859.11 | KAPAA | $2,198.62 |

| HOLUALOA | $2,859.11 | KAUMAKANI | $2,198.62 |

| HONAUNAU | $2,859.11 | KEALIA | $2,198.62 |

| HONOKAA | $2,859.11 | KEKAHA | $2,198.62 |

| HONOMU | $2,859.11 | KILAUEA | $2,198.62 |

| KAILUA KONA | $2,859.11 | KOLOA | $2,198.62 |

| KAMUELA | $2,859.11 | LIHUE | $2,198.62 |

| KAPAAU | $2,859.11 | MAKAWELI | $2,198.62 |

| KEAAU | $2,859.11 | PRINCEVILLE | $2,198.62 |

| KEALAKEKUA | $2,859.11 | WAIMEA | $2,198.62 |

| KEAUHOU | $2,859.11 | LANAI CITY | $2,263.39 |

| KURTISTOWN | $2,859.11 | HOOLEHUA | $2,397.78 |

| LAUPAHOEHOE | $2,859.11 | KALAUPAPA | $2,397.78 |

| MOUNTAIN VIEW | $2,859.11 | KAUNAKAKAI | $2,397.78 |

| NAALEHU | $2,859.11 | MAUNALOA | $2,397.78 |

| NINOLE | $2,859.11 | HAIKU | $2,459.60 |

| OCEAN VIEW | $2,859.11 | HANA | $2,459.60 |

| OOKALA | $2,859.11 | KAHULUI | $2,459.60 |

| PAAUILO | $2,859.11 | KIHEI | $2,459.60 |

| PAHALA | $2,859.11 | KULA | $2,459.60 |

| PAHOA | $2,859.11 | LAHAINA | $2,459.60 |

| PAPAALOA | $2,859.11 | MAKAWAO | $2,459.60 |

| PAPAIKOU | $2,859.11 | PAIA | $2,459.60 |

| WAIKOLOA | $2,859.11 | PUUNENE | $2,459.60 |

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Best State Car Insurance Companies

Now that you have a better idea of what factors can start to impact your available insurance rates, let’s take a look at the providers available to you in Hawaii. In this section, we’ll explore consumer experiences, third-party ratings, and the different variables that can alter your premiums with some of Hawaii’s most prominent providers.

The Largest Companies’ Financial Ratings

A.M. Best measures the financial success of a car insurance provider depending on the state that the provider in question operates in. As you’ll see in the table below, A.M. best applies its grades based on a company’s loss ratio and market share:

| Florida Providers (Listed by Size, Largest to Smallest): | A.M. Best Rating: |

|---|---|

| Allstate | A+ |

| AmTrust NGH Group | A- |

| Farmers | A |

| Geico | A++ |

| J. Whited Group (Windhaven) | A- |

| Liberty Mutual | A |

| Progressive | A+ |

| State Farm | A++ |

| Travelers Group | A |

| USAA | A++ |

Read more: Florida Car Insurance (The Only Guide You’ll Ever Need)

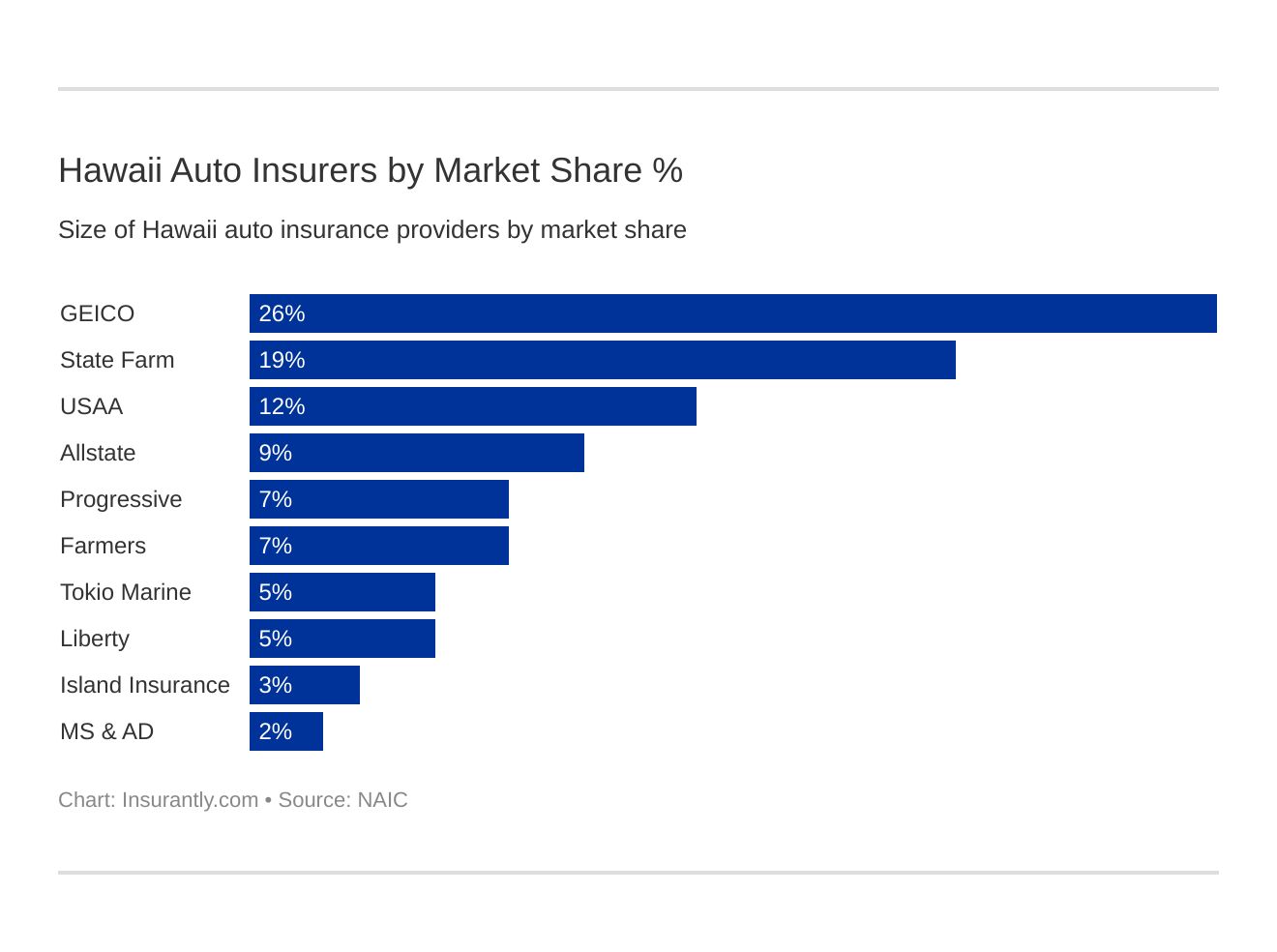

Who are the largest car insurance companies in Hawaii?

Companies with the Most Complaints in Hawaii

On the flip side of customer satisfaction comes customer complaints. While we shouldn’t always take complaints at face value, they’re a useful asset to consider when choosing a company to work with:

| Insurance Company | Number of Insureds | Number of Complaints Received | Ratio of Complaints Per 1,000 Automobiles |

|---|---|---|---|

| 21st Century Centennial/Farmers Insurance Hawaii | 67,600 | 67 | 0.991 |

| Allstate Insurance | 86,537 | 23 | 0.266 |

| DTRIC Insurance | 23,594 | 4 | 0.170 |

| First Insurance Companies | 55,121 | 7 | 0.127 |

| Geico | 242,514 | 61 | 0.252 |

| Hartford Underwriter's Insurance Company | 16,370 | 5 | 0.305 |

| Island Insurance Companies | 28,992 | 3 | 0.103 |

| Liberty Mutual | 36,425 | 2 | 0.055 |

| Progressive | 43,064 | 3 | 0.070 |

| State Farm | 180,947 | 17 | 0.094 |

| USAA | 105,787 | 16 | 0.151 |

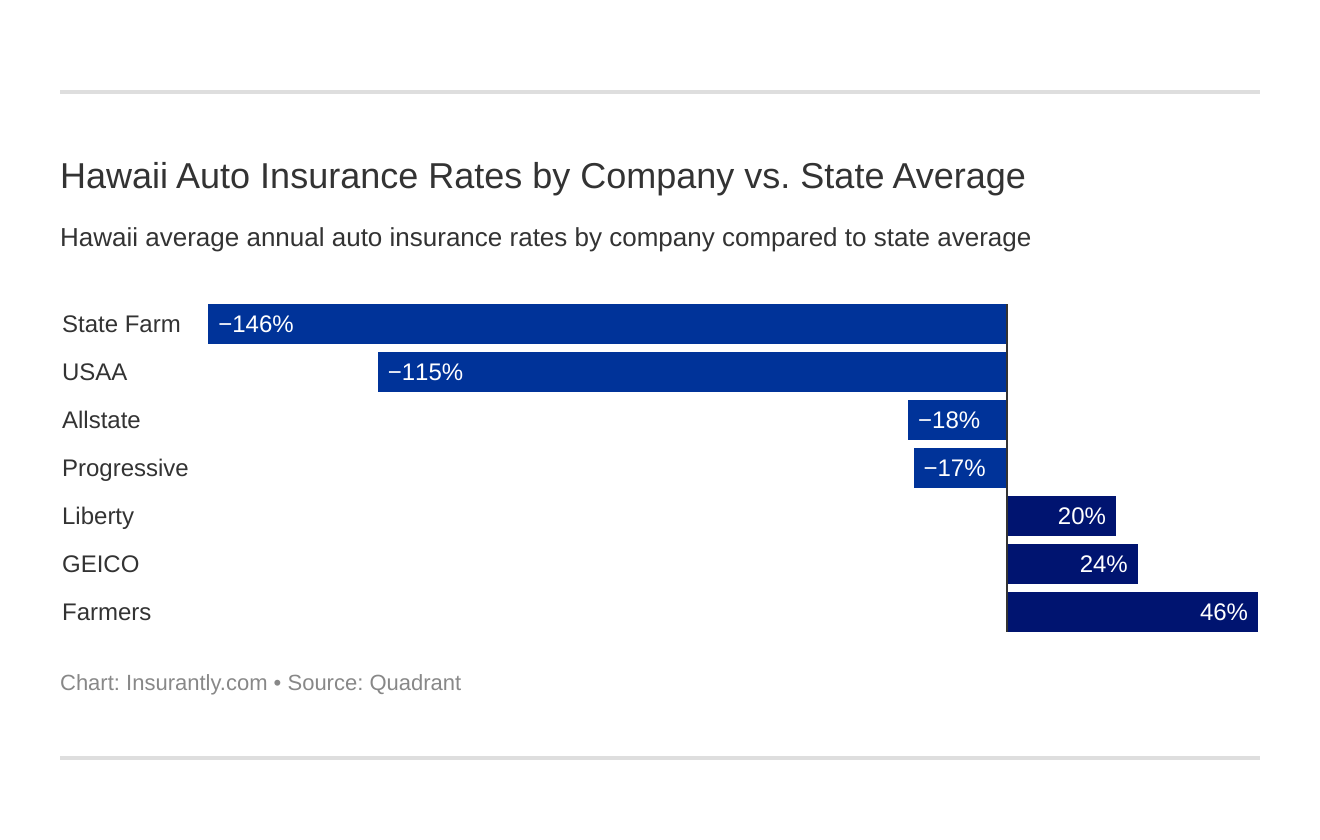

Cheapest Companies in Hawaii

Of course, we know that your budget is one of the biggest factors you have to consider when choosing a car insurance provider.

| Company | Average | Compared to State Average | |

|---|---|---|---|

| Allstate Insurance | $2,173.49 | -$382.70 | -17.61% |

| Farmers Ins HI Standard | $4,763.82 | $2,207.64 | 46.34% |

| Geico Govt Employees | $3,358.86 | $802.68 | 23.90% |

| Liberty Mutual Fire | $3,189.55 | $633.37 | 19.86% |

| Progressive Direct | $2,177.93 | -$378.25 | -17.37% |

| State Farm Mutual Auto | $1,040.28 | -$1,515.90 | -145.72% |

| USAA | $1,189.35 | -$1,366.83 | -114.92% |

Commute Rates by Company

The distance of your morning commute is going to impact your car insurance rate, as you can see below:

| Group | Commute & Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $2,035.52 |

| Allstate | 25 miles commute. 12000 annual mileage. | $2,311.46 |

| Farmers | 10 miles commute. 6000 annual mileage. | $4,763.82 |

| Farmers | 25 miles commute. 12000 annual mileage. | $4,763.82 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,358.86 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,358.86 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $3,189.55 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $3,189.55 |

| Progressive | 10 miles commute. 6000 annual mileage. | $2,177.93 |

| Progressive | 25 miles commute. 12000 annual mileage. | $2,177.93 |

| State Farm | 10 miles commute. 6000 annual mileage. | $1,040.28 |

| State Farm | 25 miles commute. 12000 annual mileage. | $1,040.28 |

| USAA | 10 miles commute. 6000 annual mileage. | $1,189.35 |

| USAA | 25 miles commute. 12000 annual mileage. | $1,189.35 |

Some states have banned discrimination based on your credit score when it comes to auto insurance rates, and this is one of those States.

Coverage Level Rates by Company

Your chosen level of coverage is going to impact the amount you’re expected to pay:

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $2,320.93 |

| Allstate | Medium | $2,178.85 |

| Allstate | Low | $2,020.68 |

| Farmers | High | $4,918.73 |

| Farmers | Medium | $4,799.09 |

| Farmers | Low | $4,573.64 |

| Geico | High | $3,493.66 |

| Geico | Medium | $3,383.08 |

| Geico | Low | $3,199.86 |

| Liberty Mutual | High | $3,365.61 |

| Liberty Mutual | Medium | $3,193.05 |

| Liberty Mutual | Low | $3,009.99 |

| Progressive | High | $2,369.14 |

| Progressive | Medium | $2,176.37 |

| Progressive | Low | $1,988.28 |

| State Farm | High | $1,108.19 |

| State Farm | Medium | $1,042.97 |

| State Farm | Low | $969.68 |

| USAA | High | $1,255.96 |

| USAA | Medium | $1,188.96 |

| USAA | Low | $1,123.14 |

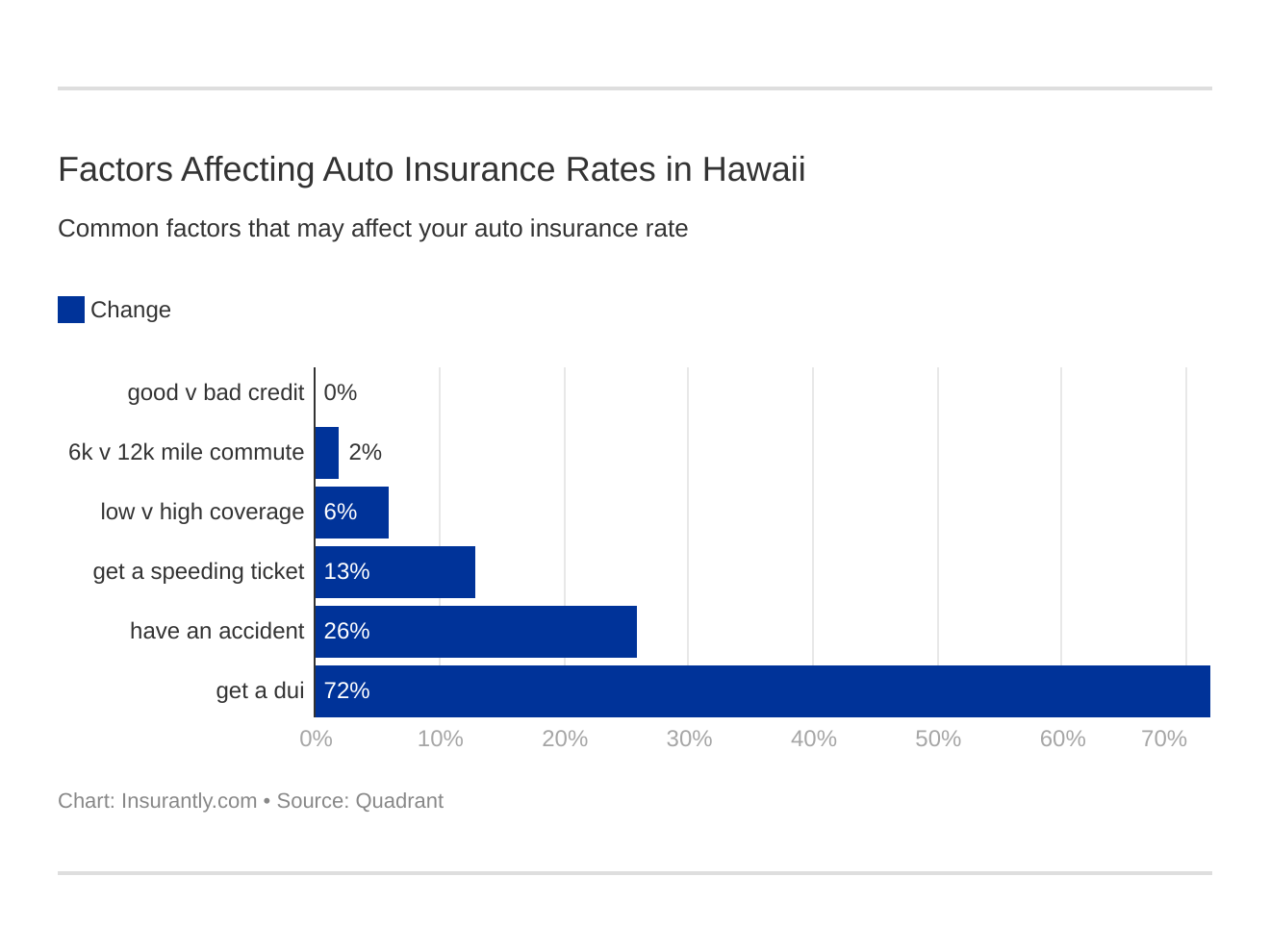

Credit History Rates by Company

Fun fact! In Hawaii, it is illegal for insurance companies to ask you questions about your credit score when taking you on as a client. Even if you have a poor credit history, then, your car insurance rate won’t suffer for it.

Driving Record Rates by Company

Your driving history reflects both your knowledge of the rules of the road and your ability to work within them.

| Company | Clean Record | 1 Speeding Violation | 1 Accident | 1 DUI |

|---|---|---|---|---|

| Allstate | $1,293.11 | $1,774.29 | $1,904.18 | $3,722.37 |

| Farmers | $2,290.51 | $2,290.51 | $3,419.86 | $11,054.40 |

| Geico | $1,414.01 | $1,414.01 | $1,834.57 | $8,772.86 |

| Liberty Mutual | $1,697.57 | $2,124.22 | $2,124.22 | $6,812.19 |

| Progressive | $1,649.25 | $2,137.29 | $2,322.92 | $2,602.26 |

| State Farm | $950.44 | $1,040.29 | $1,130.10 | $1,040.29 |

| USAA | $901.19 | $942.77 | $1,109.67 | $1,803.79 |

As you might guess, high-risk drivers are charged more for their coverage than low-risk drivers.

Largest Car Insurance Companies in Hawaii

There are also some companies operating in Hawaii that have a significantly larger presence than others. We’ve broken down the marketing standing and loss ratios of those 10 largest companies so you can get a better idea of what they have to offer you in terms of protection:

| Florida Providers (Listed by Size, Largest to Smallest): | A.M. Best Rating: |

|---|---|

| Allstate | A+ |

| AmTrust NGH Group | A- |

| Farmers | A |

| Geico | A++ |

| J. Whited Group (Windhaven) | A- |

| Liberty Mutual | A |

| Progressive | A+ |

| State Farm | A++ |

| Travelers Group | A |

| USAA | A++ |

Number of Insurers in Hawaii

Domestic and foreign insurers are titles that don’t use their titular terms in the traditional sense. Domestic providers are providers who are present only in a specific state. Foreign insurers, comparatively, are providers who make their policies available just about everywhere.

You can check out Hawaii’s divide in its domestic to foreign providers in the table below:

| Property & Casualty Insurance | Number |

|---|---|

| Domestic | 17 |

| Foreign | 608 |

| Total | 625 |

Hawaii Driving Laws

Now that you’ve got a better idea of what kind of factors can change your rates, you might be leaning towards one insurer over the others. Don’t make a decision yet, though.

This next section dives into the laws and legalities that allow you to stay safe on Hawaii’s interstates. Here, we’ll talk about teen licensing, older vehicle licensing, and the ways you’re expected to protect yourself and the other people in your car.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Car Insurance Laws

Hawaii has a number of laws in place that apply specifically to the way you can interact with your car insurance provider. Take a look at the section below to get a better idea of how you can work with an agency and what rights you have, as a driver.

Windshield Coverage

Unfortunately, the Hawaiian state government does not require car insurance providers to cover your broken windshield. However, it is illegal for you to drive in Hawaii with a fractured or busted front window.

You’ll need to talk to your provider about their comprehensive insurance plans to see whether or not they’ll allow you to include windshield coverage in your policy.

High-Risk Insurance

If you have a spotty driving history, you may have to seek out high-risk insurance. High-risk insurance, or an SR-22, is a type of insurance that high-risk drivers are required to add to their existing coverage after a conviction or similar punishment.

You may be required to get an SR-22 through the Department of Motor Vehicles if you’ve received any of the following:

- DUI conviction

- Reprimand for driving without insurance

- Reprimand for driving with a suspended license

- Reprimand for leaving the scene of an accident

Low-Cost Insurance

Hawaii does not offer car insurance programs for low-income families that would ease the pressure of paying for car insurance. However, drivers can seek out discounts to make the cost of insurance more bearable.

Be sure to ask your provider of choice if you or your family are eligible for any of the following:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e. if you have alarms, tracking systems, etc on your vehicle)

- Auto-Pay Discounts (if you were to set up automatic payments from checking – some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

Be sure you shop around in order to find the best coverage for you that is equally cost-effective.

Automobile Fraud in Hawaii

It’s difficult to commit insurance fraud by accident.

That said, the insurance industry sees 10 percent of its operating costs go to enduring fraudulent claims or accounts over the course of a year.

There are two different types of automobile fraud.

- Hard fraud sees a driver deliberately falsifying a claim or faking an accident in order to receive compensation

- Soft fraud sees a driver padding a claim or misrepresenting accident information to an insurance provider

Soft fraud is the more common of these two types of fraud.

Even though you may think you’re just telling a white lie, soft fraud is considered a misdemeanor, and lying on your claim is considered a class 5 felony.

Statute of Limitations

A statute of limitations outlines the amount of time you have after an accident to file a claim for damages with your provider of choice. Take a look at Hawaii’s statute of limitations below:

- Personal Injury: two years

- Property Damage: two years

Vehicle Licensing Laws

Hawaii also has specific legislation dictating how a person can obtain and maintain their license. Take a look below to make sure that you’re complying with state law.

Real ID

You’d figure that your driver’s license would qualify as a REAL ID without any modifications, right? Not anymore.

Real ID is arriving in 2020. All Hawaiian drivers — and drivers throughout the United States — will need to have REAL ID to get on a plane, be the flight domestic or international.

Penalties for Driving Without Insurance

You might think that it’s cheaper to forgo car insurance so that you don’t have to pay bi-annual fees. This isn’t the case. It is illegal to drive in Hawaii without car insurance, and you can be heavily fined if you get caught doing so.

Take a look at the consequences in the table below:

| Number of Offense | Fine | License Suspension | Jail Time |

|---|---|---|---|

| 1st Offense | $500 or community service | 3 months or nonrefundable insurance policy in force for six months | No |

| 2nd Offense | $1,500 minimum | One year, or nonrefundable insurance policy in force for six months | No |

Teen Driver Laws

If you’ve got a teenager who’s just learning how to drive, or if you are a teen getting behind the wheel for the first time, congratulations! You should be aware that the Aloha State has a set of roadway rules that applies specifically to these first-time drivers, as you can see in the table below:

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions | Time Restrictions |

|---|---|---|---|

| Learner's Permit: | 15 years, 6 months | Passenger must be licensed driver aged 21 or older supervising in front seat. | Between 11 p.m. and 5 a.m., young driver must be accompanied by a parent or guardian. Teens must have 50 hours of driving practice, including 10 hours at night, with a parent or legal guardian, before obtaining provisional license. |

| Provisional License | Must be 16 years old and have held learner's permit for at least 6 months. | Can drive alone but transport no more than one person under age 18 who is not a household member. | May not drive between 11 p.m. and 5 a.m. unless accompanied by a licensed parent or guardian or driving to/from employment or to/from a school-authorized activity at the driver’s school. Between 11 p.m. and 5 a.m., they may not transport more than one person under 18 unless accompanied by a parent or guardian. |

| Full License | Must be 17 years old and have held provisional license for at least 6 months. | None. | None. |

Older Driver License Renewal Procedures

Older drivers, as you can see in the table below, are required to renew their permits a little differently than most drivers in Hawaii:

| License renewal cycle | General population: 8 years | Older population: 2 years for people 72 and older |

|---|---|---|

| Mail or online renewal permitted | General population: by mail, limited to 2 consecutive renewals, but must appear in person at least every 16 years | Older population: by mail, limited to 2 consecutive renewals, but must appear in person at least every 16 years |

| Proof of adequate vision required at renewal | General population: every renewal | Older population: every renewal |

License Renewal Procedures

The general, Hawaiian population is required to go through the following procedures to renew their licenses:

- Complete your renewal within your eight-year cycle

- Submit proof of adequate vision upon every renewal

- You’re permitted to renew your license by mail for up to two consecutive renewals, after which you must visit the DMV at least once in person.

Rules of the Road

That covers legalities. Now let’s take a look at roadway courtesy and the kind of rules you should be aware of while driving in Hawaii.

Fault vs. No-Fault

As has been mentioned, Hawaii is a no-fault state. This means that both parties involved in an accident will have to attend to their own costs and that one party will not be determined to be responsible for the full cost of the accident.

This is both a good thing and a bad thing for some drivers. On one hand, having the responsible party pay for your damages saves your personal bank account. On the other hand, you’ll want to invest in more insurance in a no-fault state so as to better preserve your accounts.

Seat Belt and Car Seat Laws

Hawaii’s seat belt laws are reasonably straightforward. If your child is over the age of eight, they need to be secured by a seat belt — and so do you!

Comparatively, any child three years old or younger needs to be in a child safety seat. Children who are between the ages of four and seven can utilize booster seats. However, if your kiddos are over four feet and nine inches in height, or if they weigh more than 40 pounds, then they can use an adult safety seat in the back seats of your car.

Hawaii legislation also places limitations on who can ride in the cargo area of a pickup truck. If you meet the following qualifications, you can go right on ahead and fulfill your country music video dreams:

- Anyone who is 13 years old or older may ride in the cargo area when there are no other seats available in the cab, and when the tailgate and side racks are shut.

- Passengers may sit on the floor of a cargo truck so long as they do not disturb the cargo

- Anyone many ride in the cargo area during a life-threatening emergency

- Parade guests

- Employees on duty

Keep Right and Move Over Laws

Keep right laws in Hawaii are about the same as they are in any other state. If you’re going the speed limit or at a pace that’s under the posted speed limit, you’ll need to stay on the right side of the highway. Likewise, you should only merge into the left lane if you’re looking to pass another driver or if indicated to do so by signage or a law enforcement representative.

Likewise, move-over laws in the state require you to move to the side of the road if you happen to see a state emergency vehicle. The vehicles you need to move over for include:

- Law enforcement

- Firefighters

- Ambulances

- Utility workers

- Tow-truck drivers

- Drivers with hazard lights on

Speed Limits

Who hasn’t dreamed about secretly being Speed Racer? Unfortunately, you need to leave those dreams in the realm of sleep. Compliance with Hawaii’s speed limits not only keeps everyone safe, but it prevents you from earning yourself a speeding ticket.

Hawaii’s posted speed limits break down as follows:

- Rural Interstates: 60 MPH

- Urban Interstates: 60 MPH

- Limited Access Roads: 55 MPH

- Other Roads: 45 MPH

Ridesharing

The rise of Uber and Lyft have made it easier than ever for people to get to the places they need to go. These companies have also created a new industry for drivers across the United States. If you currently work with either company or one of their competitors, or if you’ve thought about using your vehicle for a job before, you’ll need to get ridesharing insurance.

At this point in time, there aren’t any providers able to provide drivers with car insurance that specifically addresses ridesharing. Make sure you speak to your employer and to a provider representative before signing on to work for either of the aforementioned ridesharing services.

Safety Laws

Last but not least, let’s touch on the legalities that impact drivers’ behavior while on the road.

DUI Laws

It can be tempting, with the beach so close, to over-drink once and a while. The last thing you want to do, though, is drink and drive. Hawaii has a number of laws in place designed to discourage intoxicated drivers from getting on the road. You can take a look at some of the consequences for drinking and driving in the table below:

| - | |

|---|---|

| BAC Limit | 0.08 |

| HIGH BAC Limit | N/A |

| Criminal Status by Offense | 1st-3rd petty are misdemeanors. 4th+ are considered class C felony. |

| Formal Name for Offense | Driving Under the Influence (DUI) / Operating a Vehicle Under the Influence of an Intoxicant (OVUII). |

| Look Back Period/Washout Period | 5 years |

| 1st Offense-ALS or Revocation | 1 year |

| 1st Offense Imprisonment | 48 hours-5 days. |

| 1st Offense-Fine | $150 - $1000 + $25 to neurotrauma special fund + $25 to trauma system special fund if the court ordered. |

| 1st Offense-Other | 14 hour minimum rehab program. May require 72 hours of community service. IID for 1 year |

| 2nd Offense-DL Revocation | 18 months-2 years if 2nd offense in 5 years. |

| 2nd Offense-Imprisonment | Minimum 240 community service hours OR 5-30 days with 48 consecutive hours. |

| 2nd Offense-Fine | $500 - $1500 + $25 to neurotrauma special fund + $50 to trauma system fund if the court ordered. Additional $500 if there was a child in vehicle. |

| 2nd Offense-Other | Abuse and education program required. IID during the revocation period. |

| 3rd Offense-DL Revocation | 2 year revocation if received two convictions within the past 5 years. |

| 3rd Offense-Imprisonment | 10-30 days. 48 hours must be served consecutively. |

| 3rd Offense-Fine | $500 - $2500 + $25 to neurotrauma special fund + $50 to trauma system fund if the court ordered. Additional $500 if child there was a child in the vehicle. |

| 3rd Offense-Other | 240 minimum hours of community service. Abuse and education program required. IID required during the revocation period |

| Mandatory Interlock | All offenders. |

Do note that the legalities presented in Hawaii’s Revised Statute 291E-61 apply both to alcohol and to other decision-inhibiting products, like marijuana.

Distracted Driving Laws

With the advent of cellphones and the rise of the IoT, it’s tempting to be on your phone all the time. Hawaii’s government has taken steps to limit the amount of time drivers can spend on their phone, thereby promoting the safety of everyone in the state.

You should know that Hawaii has instituted an overarching ban on hand-held devices for drivers. Likewise, no driver is permitted to text while at the wheel of a car. Drivers under the age of 18 are also banned from using their cellphones for calls or texting while on the road.

Driving in Hawaii

Now that you’re more familiar with Hawaii’s roadway laws and expectations, you should feel as though you can drive a little more safely on its roadways.

This following section will touch on some of the obstacles that you might come to face while driving in Hawaii. While these numbers aren’t meant to scare you, they will let you know what kind of roadway behavior to expect from your fellow Hawaiian drivers.

Vehicle Theft in Hawaii

There are certain types of vehicles that are more likely to be stolen in Hawaii than others, as you can see in the table below:

| Make/Model | Year | Number of Thefts |

|---|---|---|

| Honda Civic | 2000 | 250 |

| Honda Accord | 1994 | 180 |

| Ford Pickup (Full Size) | 2006 | 154 |

| Toyota Tacoma | 2003 | 86 |

| Toyota Corolla | 2004 | 64 |

| Toyota Camry | 2000 | 55 |

| Toyota 4Runner | 1997 | 45 |

| Nissan Frontier | 2004 | 44 |

| Nissan Altima | 2004 | 42 |

| Dodge Pickup (Full Size) | 2001 | 37 |

Road Fatalities in Hawaii

There are more things for you to worry about in Hawaii, though, than vehicle theft. Take a look at the section below to learn more about the dangers that you might encounter while driving on any of Hawaii’s accessible islands.

Most Fatal Highway in Hawaii

If you’re driving down Hawaii’s interstates, you’ll want to take particular care on Route 11. This roadway circles around the Big Island and sees a significant amount of traffic on a daily basis. The route has a crash rate of 0.4, according to GeoTab. Keep your eyes peeled, though, and you should find that keeping yourself safe on the highway isn’t too difficult.

Fatal Crashes by Weather Condition and Light Condition

Different weather and light conditions can impact the way that drivers are able to operate on the road. Take a look at how both factors cause fatalities throughout Maine:

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 37 | 26 | 14 | 2 | 0 | 79 |

| Rain | 5 | 6 | 1 | 0 | 0 | 12 |

| Snow/Sleet | 0 | 0 | 0 | 0 | 0 | 0 |

| Other | 0 | 0 | 1 | 0 | 0 | 1 |

| Unknown | 1 | 1 | 0 | 0 | 2 | 4 |

| TOTAL | 43 | 33 | 16 | 2 | 2 | 96 |

Read more: Maine Car Insurance (The Only Guide You’ll Ever Need)

Traffic Fatalities

Location also impacts the likelihood of a car accident, as you can see in the table below:

| County Name | Total Fatalities 2013 | Total Fatalities 2014 | Total Fatalities 2015 | Total Fatalities 2016 | Total Fatalities 2017 | Fatalities Per 100K 2013 | Fatalities Per 100K 2014 | Fatalities Per 100K 2015 | Fatalities Per 100K 2016 | Fatalities Per 100K 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Hawaii County | 26 | 13 | 21 | 32 | 35 | 13.57 | 6.69 | 10.67 | 16.11 | 17.47 |

| Honolulu County | 53 | 53 | 48 | 59 | 49 | 5.38 | 5.36 | 4.83 | 5.94 | 4.96 |

| Kalawao County | 0 | 0 | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Kauai County | 7 | 8 | 3 | 8 | 6 | 10.05 | 11.34 | 4.20 | 11.15 | 8.31 |

| Maui County | 16 | 21 | 21 | 21 | 17 | 9.94 | 12.85 | 12.77 | 12.70 | 10.22 |

Fatalities by Person Type

Person type is also likely to impact fatality statistics. “Person type” here refers to a person’s relationship to a vehicle as opposed to any other demographic statistics.

| Type | Number of Fatalities |

|---|---|

| Traffic Fatalities | 107 |

| Passenger Vehicle Occupant Fatalities (All Seat Positions) | 59 |

| Motorcyclist Fatalities | 25 |

| Drivers Involved in Fatal Crashes | 144 |

| Pedestrian Fatalities | 14 |

| Bicyclist and other Cyclist Fatalities | 6 |

As you can see, passengers are the people most frequently involved in fatalities. Motorists are also high up on the list of potential fatality victims.

Fatalities by Crash Type

There are also specific crash types that most frequently result in fatalities:

| Crash Type | Number |

|---|---|

| Single Vehicle | 59 |

| Involving a Large Truck | 9 |

| Involving Speeding | 50 |

| Involving a Rollover | 26 |

| Involving a Roadway Departure | 60 |

| Involving an Intersection (or Intersection Related) | 30 |

Five-Year Trend for the Top 10 Counties

The table below relays the top 10 counties in Hawaii that happen to see the most accidents over the course of a year.

| County | Total Fatalities 2013 | Total Fatalities 2014 | Total Fatalities 2015 | Total Fatalities 2016 | Total Fatalities 2017 |

|---|---|---|---|---|---|

| Honolulu County | 53 | 53 | 48 | 59 | 49 |

| Hawaii County | 26 | 13 | 21 | 32 | 35 |

| Maui County | 16 | 21 | 21 | 21 | 17 |

| Kauai County | 7 | 8 | 3 | 8 | 6 |

| Kalawao County | 0 | 0 | 0 | 0 | 0 |

Fatalities Involving Speeding by County

Hawaii sees its fair share of speeding-related fatalities over the course of a year, as you can see below:

| County Name | Fatalities - 2013 | 2014 | 2015 | 2016 | 2017 | Fatalities Per 100K - 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Hawaii County | 11 | 4 | 9 | 12 | 19 | 5.74 | 2.06 | 4.57 | 6.04 | 9.48 |

| Honolulu County | 27 | 19 | 21 | 30 | 25 | 2.74 | 1.92 | 2.11 | 3.02 | 2.53 |

| Kalawao County | 0 | 0 | 0 | 0 | 0 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Kauai County | 2 | 3 | 4 | 4 | 1 | 2.87 | 4.25 | 1.40 | 5.57 | 1.39 |

| Maui County | 5 | 10 | 8 | 8 | 5 | 3.11 | 6.12 | 6.08 | 4.84 | 3.01 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver

Drinking and driving is never a good idea, even if the Hawaiian beaches make it seem more acceptable. While Hawaii has several laws in place designed to limit the amount of drinking and driving the state sees, it still sees a fair number of alcohol-related fatalities:

| County Name | Fatalities - 2015 | 2016 | 2017 | Fatalities Per 100K Population - 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|

| Maui County | 12 | 7 | 13 | 7.3 | 4.23 | 7.82 |

| Hawaii County | 7 | 8 | 11 | 3.56 | 4.03 | 5.49 |

| Honolulu County | 17 | 19 | 17 | 1.71 | 1.91 | 1.72 |

| Kauai County | 1 | 3 | 1 | 1.4 | 4.18 | 1.39 |

| Kalawao County | 0 | 0 | 0 | 0 | 0 | 0 |

Teen Drinking and Driving

Note that the above statistics also include teen drivers. Hawaii ranks at number 28 in the nation for the arrests of teenagers who have been drinking and driving.

| Statistics | |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 1.4 |

| Higher/Lower Than National Average (1.2) | Higher |

| DUI Arrest (Under 18 years old) | 23 |

| DUI Arrests (Under 18 years old) Total Per Million People | 74.67 |

The good news is that Hawaii’s arrest rate is lower than the national average and that Hawaii sees fewer alcohol-related, teenage fatalities on average that the whole of the United States. Even so, seeing any statistics related to intoxicated teenagers getting into an accident should be sobering — in more ways than one.

EMS Response Time

Knowing that, after an accident, you can quickly be picked up by EMS makes the stress of those situations a little less overwhelming. The good news is that, in Hawaii, the response time of EMS between rural and urban areas is fairly close:

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural Fatal Crashes | 3 | 14.45 | 34.86 | 48.79 |

| Urban Fatal Crashes | 3.13 | 7.51 | 27.54 | 36.38 |

As you can see, while urban accidents will be responded to with more speed, you’ll likely reach a hospital in under an hour after your accident has occurred, regardless of where it takes place.

Transportation

With all of that out of the way, let’s take a look at what traffic looks like on an average day in Hawaii.

Car Ownership

As is the case in most states across America, the average home in Hawaii sees two cars in its garage.

That said, the number of people who own a single car and the number of people who own three cars are reasonably close at roughly 20 percent of the population each.

Commute Time

Hawaiians spend roughly 25.8 minutes commuting to and from work on a daily basis. This comes in at just slightly about the national average, which is 25.5 minutes.

2.65 percent of employees in Hawaii also have to contend with the super commute, or a commute that lasts longer than 90 minutes at a time. At least the view is pretty, right?

Commuter Transportation

As you might expect, the vast majority of Hawaiians prefer to make their way and from work on their own. However, Hawaii sees more carpoolers than average, which means you may be able to double up with a work buddy to make it into work in the morning.

Traffic Congestion in Hawaii

According to the INRIX’s 2018 Global Traffic Scorecard, Honolulu is one of the more congested cities in the world. This city also ranks within the United State’s top five congested cities.

| City | Hours in Congestion | Commute in Traffic: Peak | Commute in Traffic: Daytime | Commute in Traffic: Overall |

|---|---|---|---|---|

| Honolulu, HI | 37 | 17% | 10% | 11% |

| Kaneohe, HI | 28 | 16% | 10% | 11% |

While the Big Island isn’t all that small, it’s not difficult to imagine that traffic may get difficult to navigate before and after work.

And with that, we’ve come to the end of our guide to Hawaii’s car insurance providers. Hopefully, you’re now informed enough to choose a provider in the state that’ll meet all of your needs.

Want to start comparing rates ASAP? Just enter your ZIP code into our FREE online tool to learn about the rates available in your area.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.