Colorado Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 11, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

| Colorado Statistics Summary | |

|---|---|

| Roadway Miles | 88,740 |

| Vehicle Miles | 48,985 Million |

| Vehicles Registered | 4,632,430 |

| Population | 5,607,154 |

| Most Popular Vehicle | Subaru Outback |

| Uninsured Drivers | 13.3 Percent |

| Total Traffic Fatalities | 648 |

| Speeding Fatalities | 230 |

| DUI Fatalities | 177 |

| Full Coverage Average Annual Premium | $981.64 |

| Liability Average Annual Premium | $520.04 |

| Collision Average Annual Premium | $287 |

| Comprehensive Average Annual Premium | $174.61 |

| Cheapest Provider | USAA |

Colorado residents are a lucky bunch. With rolling mountains, a diversity of climates, and bustling cities, Coloradans have the opportunity to pursue whatever outdoorsy — or indoorsy — hobbies suit their needs.

If your hobby is collecting cars, though, you may have started to notice an uptick in the amount you’re being charged for your car insurance. Car insurance rates in Colorado are on the rise alongside cost of living, according to Forbes. Rates seem set to continue rising, as well, at three times the rate of standard economic inflation.

What are you supposed to do? No one wants to dig deeper into their pockets for car insurance than they have to.

Don’t fret just yet. We’re here to help you better understand the car insurance policies that are available to you in Colorado and the ways you can save a bit of money in the long run.

Want to get a jump on our comprehensive guide? You can use our FREE online tool to start comparing car insurance quotes in your area.

Colorado State Car Insurance Coverage and Rates

Let’s dive into Colorado’s cagey world of car insurance coverage and find the best policy for you.

Colorado Minimum Coverage

Colorado is an “at-fault” state. This means that if you get into an accident with someone else, law enforcement will determine which party is “at-fault.” The person deemed to be responsible for the accident will then not only have to pay all of their own bills, but the bills of the injured party, as well.

In order to protect drivers from unexpected costs of these sorts, Colorado requires its drivers to maintain a minimum liability coverage of 25/50/15. You can see this ratio broken down in the table below:

| Coverage | Minimum |

|---|---|

| Bodily Injury Liability | $25,000 per person $50,000 per accident |

| Property Damage Liability | $15,000 per accident |

| Uninsured/Underinsured Motorist Coverage* | $25,000 per person $50,000 per accident |

| Medical Payments (MedPay)* | $5000 |

*May be waived if rejected. UUM must be rejected in writing. MedPay may be rejected in writing or in the same way you buy insurance.

You’ll notice that the aforementioned table includes Uninsured/Underinsured motorist coverage as well as Medical Payments. These two forms of insurance aren’t mandatory for Colorado’s basic coverage and can be rejected in writing at the time you go to purchase a policy.

Note, too, that the 25/50/15 divide is the minimum amount of insurance you need in order to drive legally throughout Colorado. It’s recommended that you invest in a policy with more coverage, but if you want to at the minimum be legal, this is the ratio for you.

Forms of Financial Responsibility

You’ll need to have proof of insurance — otherwise known as a form of financial responsibility — on your person when driving your car. Law enforcement will ask you to present proof of insurance if you happen to get pulled over, and you’ll need to bring proof of insurance with you when you get your vehicle registered with a local DMV.

Valid forms of financial responsibility in Colorado include:

- Valid Colorado insurance card

- Declaration page

- Binder/letter from an insurance company on company letterhead

- Electronic proof of insurance, including insurer-provided electronic image made available on a cellphone, laptop, or other portable electronic device

Now that Colorado has allowed for proof of insurance to be provided via electronic device, you should never have to worry about being without a form of financial responsibility while driving.

Premiums as a Percentage of Income

Your insurance payments will come out of your Disposable Personal Income, or DPI. Your DPI consists of the money you’re able to retain after paying taxes for the year.

| Annual Full Coverage Average Premiums | Monthly Full Coverage Average Premiums | Annual Per Capita Disposable Personal Income | Monthly Per Capita Disposable Personal Income | Percentage of Income |

|---|---|---|---|---|

| $939.52 | $78.29 | $43,609.00 | $3,634.08 | 2.15 |

As you can see, average full coverage in Colorado costs $939.52 a year. With the standard household in Colorado bringing in $43,609.00 a year, that car insurance costs makes up 2.15 percent of a person’s overall DPI.

That percentage will naturally rise or fall based on the kind of insurance you want to invest in.

Core Coverage

And what kind of coverage do you have available to you?

| Type of Coverage | Average Annual Cost |

|---|---|

| Liability | $520.04 |

| Collision | $287 |

| Comprehensive | $174.61 |

| Full Coverage | $981.64 |

Full coverage consists of liability, collision, and comprehensive insurance all together, and it will keep you the safest while on the road. It is also, of course, the most expensive option on your list.

Additional Liability

You’ll also have the option to include MedPay and UUM in your coverage. Before you do, though, you’ll want to examine the loss ratios of the providers you’re looking to work with.

What’s a loss ratio? This percentage reflects the amount of money that insurance providers are spending on claims over the course of a year. Higher loss ratios mean that a company is more likely to pay out on MedPay or UUM claims, but also that the company may be less financially stable than its peers.

Comparatively, a low loss ratio suggests that a company is more financially stable but that they’re less willing to pay out client claims.

| Type of Coverage | 2012 | 2013 | 2014 |

|---|---|---|---|

| Medical Payments (MedPay) | 85.64% | 82.53% | 77.44% |

| Uninsured/Underinsured Motorist Coverage | 96.63% | 96.81% | 95.82% |

You typically want to work with a company that has an average loss ratio — somewhere between 80 percent and 100 percent.

Add-ons, Endorsements, and Riders

You’ll be able to customize your policy further with car insurance add-ons. You’ll have to check with your provider to see if the following are available to you, but each offers a unique type of coverage that can better protect your car — and your wallet — in the long run.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Rental Reimbursement

- Emergency Roadside Assistance

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-As-You-Drive or Usage-Based Insurance

Colorado Demographic Rates

It’s a long-held driving myth that male drivers have to pay more for their car insurance than their female counterparts. In the vast majority of states, though, this myth has proven untrue. Take a look at the range of gender and age demographics below and see for yourself:

| Company | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male |

|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $3,397.34 | $3,180.33 | $3,056.13 | $3,088.23 | $11,732.84 | $12,322.40 | $3,748.22 | $3,771.84 |

| AMCO Insurance | $2,490.00 | $2,536.58 | $2,226.47 | $2,354.68 | $6,292.06 | $8,057.66 | $2,863.59 | $3,094.73 |

| American Family Mutual | $2,552.17 | $2,552.17 | $2,302.28 | $2,302.28 | $6,182.18 | $8,292.20 | $2,552.17 | $3,128.70 |

| Farmers Ins Exchange 2.0 | $3,095.55 | $3,068.12 | $2,804.12 | $3,023.70 | $11,703.79 | $11,788.62 | $3,401.12 | $3,436.88 |

| Geico Cas | $1,962.23 | $2,140.86 | $2,069.94 | $2,343.70 | $6,116.54 | $6,472.19 | $1,797.35 | $1,830.71 |

| Progressive Direct | $2,593.20 | $2,426.75 | $2,250.01 | $2,245.05 | $8,765.26 | $9,802.10 | $2,926.11 | $2,846.92 |

| Safeco Ins Co of America | $1,859.15 | $1,810.08 | $1,578.98 | $1,736.25 | $5,559.53 | $6,061.99 | $1,877.93 | $1,897.98 |

| State Farm Mutual Auto | $2,048.74 | $2,048.74 | $1,842.60 | $1,842.60 | $5,901.90 | $7,471.21 | $2,293.13 | $2,717.20 |

| USAA CIC | $2,232.85 | $2,232.55 | $2,126.52 | $2,134.62 | $5,582.30 | $6,398.91 | $2,873.09 | $3,130.10 |

From 25 to 55, women are more likely to pay more for their car insurance than their male counterparts. Age, though, does factor into the amount a driver has to pay for their coverage.

Teenage drivers, for example, have to pay significantly more than their older, married counterparts. Much of this is due to their limited driving experience, but it does suggest that age plays more of a role in rate distribution than gender does.

The Most Expensive and Least Expensive Rates by County

The county you live in will also impact your car insurance rate. Colorado’s county rate distributions vary from $1,255.68 to $1,722.02. If you’re just moving to Colorado, you might want to keep these rates in mind when searching for your perfect home.

| Cheapest Counties | Rate | Most Expensive Counties | Rate |

|---|---|---|---|

| Grand Junction | $1,255.68 | Denver | $1,722.02 |

| Boulder | $1,308.61 | Aurora | $1,701.78 |

| Estes Park | $1,309.21 | Pueblo | $1,591.16 |

| Alamosa | $1,323.07 | Limon | $1,540.80 |

| Durango | $1,354.86 | Colorado Springs | $1,538.77 |

| Cortez | $1,363.76 | Lakewood | $1,510.47 |

| Gunnison | $1,369.97 | Arvada | $1,456.29 |

| Steamboat Springs | $1,379.17 | Westminster | $1,452.48 |

| Glenwood Springs | $1,383.08 | La Junta | $1,440.19 |

| Littleton Highlands Ranch | $1,394.35 | Trinidad | $1,439.49 |

| Sterling | $1,395.61 | Fort Morgan | $1,430.75 |

You’ll also notice that high-density urban areas like Denver rack up higher car insurance rates than cities like Grand Junction or even its neighbor, Boulder.

Colorado State Car Insurance Companies

With the basics of Colorado car insurance out of the way, what do the state’s individual providers look like in comparison with one another?

The Largest Companies Financial Rating

One of the best places to start is with AM Best Ratings. These ratings reflect a company’s overall financial health.

| Company | AM Best Rating |

|---|---|

| Allstate | A+ |

| American Family | A |

| Farmers | A |

| Geico | A++ |

| Liberty Mutual | A |

| Nationwide | A+ |

| Progressive | A+ |

| State Farm | A++ |

| Travelers | A++ |

| USAA | A++ |

As you can see, few providers in Colorado, and none of the ones mentioned here, drop beneath an “A” rating. This means that the vast majority of providers you examine while shopping for car insurance are going to be able to support your claims financially.

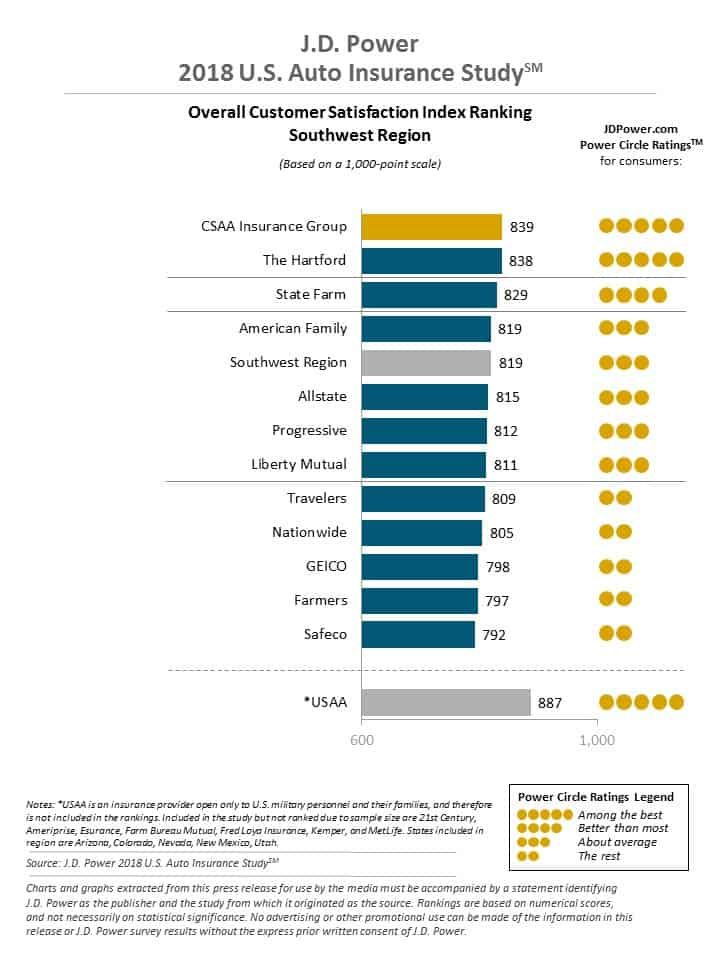

Companies with Best Ratings

From here, we can break up the companies by customer service rating.

Companies with Most Complaints in Colorado

On the flip side of customer satisfaction comes customer complaints. While normally this gossip would be super juicy, Colorado offers us information that simultaneously entertains and disappoints.

| Company Name | Total Complaints | Confirmed Complaints | Complaint Ratio | Company Name | Total Complaints | Confirmed Complaints | Complaint Ratio |

|---|---|---|---|---|---|---|---|

| AIG | 0 | 0 | 0 | MetLife | 4 | 3 | 0.17 |

| Amica Mutual | 4 | 2 | 0.15 | State Farm | 174 | 62 | 0.21 |

| Country Preferred | 2 | 0 | 0.09 | Geico | 6 | 2 | 0.21 |

| Essentia | 0 | 0 | 0 | Nationwide Agribusiness | 6 | 3 | 0.18 |

| Farmers Alliance Mutual | 0 | 0 | 0 | 360 Insurance | 1 | 1 | 0.2 |

| Grange | 0 | 0 | 0 | Farmers | 53 | 18 | 0.2 |

| Great Northern | 1 | 0 | 0.08 | USAA | 32 | 11 | 0.2 |

| SECURA Supreme | 1 | 0 | 0.15 | Horace Mann | 1 | 0 | 0.22 |

| Travelers Home and Marine | 2 | 0 | 0.12 | Liberty Mutual | 43 | 16 | 0.21 |

Read more: Horace Mann Auto Insurance Review: What to Know

That is to say, not many of the providers in the state have seen a significant number of complaints — save, that is, for State Farm.

Colorado Car Insurance Rates by Company

You’ll also want to use a car insurance provider’s available rates to help you choose which company to work with.

| Company | Average | Compared to State Average |

|---|---|---|

| Allstate F&C | $5,537.17 | $1,644.85 |

| AMCO Insurance | $3,739.47 | -$152.85 |

| American Family Mutual | $3,733.02 | -$159.30 |

| Farmers Ins Exchange 2.0 | $5,290.24 | $1,397.92 |

| Geico Cas | $3,091.69 | -$800.63 |

| Progressive Direct | $4,231.92 | $339.60 |

| Safeco Ins Co of America | $2,797.74 | -$1,094.58 |

| State Farm Mutual Auto | $3,270.76 | -$621.56 |

| USAA CIC | $3,338.87 | -$553.45 |

As you can see, there’s definite fluctuation in available average rates. With Allstate F&C coming in at prices of $5,537.17 and Geico at $3,091.69, there’s a range that someone like you can take advantage of.

Colorado Commute Rates by Company

Of course, there are different factors that’ll impact the rates providers are able to offer you. These include the distance you commute to work on a daily basis.

| Group | Commute And Annual Mileage | Annual Average |

|---|---|---|

| Allstate | 10 miles commute. 6000 annual mileage. | $5,537.17 |

| Allstate | 25 miles commute. 12000 annual mileage. | $5,537.17 |

| American Family | 10 miles commute. 6000 annual mileage. | $3,653.11 |

| American Family | 25 miles commute. 12000 annual mileage. | $3,812.93 |

| Farmers | 10 miles commute. 6000 annual mileage. | $5,290.24 |

| Farmers | 25 miles commute. 12000 annual mileage. | $5,290.24 |

| Geico | 10 miles commute. 6000 annual mileage. | $3,025.45 |

| Geico | 25 miles commute. 12000 annual mileage. | $3,157.93 |

| Liberty Mutual | 10 miles commute. 6000 annual mileage. | $2,797.74 |

| Liberty Mutual | 25 miles commute. 12000 annual mileage. | $2,797.74 |

| Nationwide | 10 miles commute. 6000 annual mileage. | $3,739.47 |

| Nationwide | 25 miles commute. 12000 annual mileage. | $3,739.47 |

| Progressive | 10 miles commute. 6000 annual mileage. | $4,231.92 |

| Progressive | 25 miles commute. 12000 annual mileage. | $4,231.92 |

| State Farm | 10 miles commute. 6000 annual mileage. | $3,190.31 |

| State Farm | 25 miles commute. 12000 annual mileage. | $3,351.22 |

| USAA | 10 miles commute. 6000 annual mileage. | $3,244.04 |

| USAA | 25 miles commute. 12000 annual mileage. | $3,433.70 |

Liberty Mutual is fairly generous with its long-term commuters, whereas USAA will charge you a near $200 more if you have to travel further than usual in the morning.

Coverage Level Rates by Company

The amount of coverage you take on will also, naturally, impact the rates you’re expected to pay.

| Group | Coverage Type | Annual Average |

|---|---|---|

| Allstate | High | $5,856.45 |

| Allstate | Medium | $5,518.14 |

| Allstate | Low | $5,236.91 |

| American Family | High | $3,842.92 |

| American Family | Medium | $3,809.91 |

| American Family | Low | $3,546.22 |

| Farmers | High | $6,013.62 |

| Farmers | Medium | $5,215.47 |

| Farmers | Low | $4,641.62 |

| Geico | High | $3,454.92 |

| Geico | Medium | $3,034.95 |

| Geico | Low | $2,785.20 |

| Liberty Mutual | High | $2,969.02 |

| Liberty Mutual | Medium | $2,787.15 |

| Liberty Mutual | Low | $2,637.04 |

| Nationwide | High | $3,729.76 |

| Nationwide | Medium | $3,740.53 |

| Nationwide | Low | $3,748.13 |

| Progressive | High | $4,535.53 |

| Progressive | Medium | $4,244.39 |

| Progressive | Low | $3,915.86 |

| State Farm | High | $3,487.06 |

| State Farm | Medium | $3,272.35 |

| State Farm | Low | $3,052.89 |

| USAA | High | $3,486.28 |

| USAA | Medium | $3,338.66 |

| USAA | Low | $3,191.66 |

Credit History Rates by Company

As your credit history relays your ability to pay back debts that you owe, car insurance providers will absolutely take this data into account when offering you a rate on one of their plans.

| Group | Credit History | Annual Average |

|---|---|---|

| Allstate | Good | $4,105.68 |

| Allstate | Fair | $5,439.82 |

| Allstate | Poor | $7,066.00 |

| American Family | Good | $2,895.90 |

| American Family | Fair | $3,452.49 |

| American Family | Poor | $4,850.67 |

| Farmers | Good | $4,739.93 |

| Farmers | Fair | $4,988.44 |

| Farmers | Poor | $6,142.35 |

| Geico | Good | $2,465.94 |

| Geico | Fair | $3,091.66 |

| Geico | Poor | $3,717.48 |

| Liberty Mutual | Good | $1,947.80 |

| Liberty Mutual | Fair | $2,446.38 |

| Liberty Mutual | Poor | $3,999.04 |

| Nationwide | Good | $3,118.09 |

| Nationwide | Fair | $3,578.13 |

| Nationwide | Poor | $4,522.20 |

| Progressive | Good | $3,768.17 |

| Progressive | Fair | $4,108.11 |

| Progressive | Poor | $4,819.49 |

| State Farm | Good | $2,352.76 |

| State Farm | Fair | $2,918.53 |

| State Farm | Poor | $4,541.00 |

| USAA | Good | $2,256.64 |

| USAA | Fair | $2,816.63 |

| USAA | Poor | $4,943.34 |

The better your credit history, as you can see, the less you’ll have to pay for your car insurance.

Driving Record Rates by Company

We’ve already touched on the consequences of being a high-risk driver, but take a look at the ways different traffic infractions can raise your car insurance rates.

| Group | Driving Record | Annual Average |

|---|---|---|

| Allstate | Clean record | $4,723.09 |

| Allstate | With 1 speeding violation | $5,350.87 |

| Allstate | With 1 accident | $5,431.34 |

| Allstate | With 1 DUI | $6,643.37 |

| American Family | Clean record | $2,762.77 |

| American Family | With 1 speeding violation | $3,131.89 |

| American Family | With 1 accident | $3,915.14 |

| American Family | With 1 DUI | $5,122.27 |

| Farmers | Clean record | $4,468.57 |

| Farmers | With 1 speeding violation | $5,283.78 |

| Farmers | With 1 DUI | $5,665.21 |

| Farmers | With 1 accident | $5,743.39 |

| Geico | Clean record | $2,184.55 |

| Geico | With 1 speeding violation | $2,858.30 |

| Geico | With 1 accident | $3,395.15 |

| Geico | With 1 DUI | $3,928.75 |

| Liberty Mutual | Clean record | $2,450.68 |

| Liberty Mutual | With 1 accident | $2,869.91 |

| Liberty Mutual | With 1 speeding violation | $2,891.61 |

| Liberty Mutual | With 1 DUI | $2,978.75 |

| Nationwide | Clean record | $2,872.86 |

| Nationwide | With 1 speeding violation | $3,163.26 |

| Nationwide | With 1 accident | $3,930.20 |

| Nationwide | With 1 DUI | $4,991.57 |

| Progressive | Clean record | $3,665.41 |

| Progressive | With 1 DUI | $3,869.05 |

| Progressive | With 1 speeding violation | $4,278.14 |

| Progressive | With 1 accident | $5,115.10 |

| State Farm | Clean record | $3,008.73 |

| State Farm | With 1 DUI | $3,270.76 |

| State Farm | With 1 speeding violation | $3,270.76 |

| State Farm | With 1 accident | $3,532.80 |

| USAA | Clean record | $2,439.12 |

| USAA | With 1 speeding violation | $2,750.39 |

| USAA | With 1 accident | $2,973.13 |

| USAA | With 1 DUI | $5,192.84 |

Largest Car Insurance Companies in Colorado

Finally, a provider’s market share will also change the rates that they’re able to offer you.

| Company Name | Direct Premiums Written | Market Share |

|---|---|---|

| State Farm | $906,918 | 19.81 % |

| USAA | $467,079 | 10.20 % |

| Geico | $452,585 | 9.89 % |

| Progressive | $440,274 | 9.62 % |

| Allstate | $388,445 | 8.49 % |

| American Family | $384,892 | 8.41 % |

| Farmers | $330,473 | 7.22 % |

| Liberty Mutual | $319,166 | 6.97 % |

| Travelers | $129,187 | 2.82 % |

| Nationwide | $91,547 | 2.00 % |

Number of Insurers in Colorado

When looking for car insurance coverage in Colorado, you’ll have the option to pick from domestic providers, or providers who are local to the state, and foreign providers, or providers with coverage available nationally. The table below shows the number of licensed insurers in Colorado.

| Domestic | Foreign | Total Number of Licensed Insurers |

|---|---|---|

| 10 | 848 | 858 |

There are more foreign providers available to Colorado residents than domestic, but that doesn’t mean you shouldn’t give the domestic providers a look over while trying to find your ideal coverage.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Colorado Laws and Legalities

Unless you’re a trivia pro, no one’s expecting you to memorize all of Colorado’s state driving laws. We’re here to help you break down the most important laws that you absolutely need to know to be a safe driver on the road.

Car Insurance Laws

Car insurance companies aren’t able to change your rate based on their own whims. They have a little bit of freedom, but for the most part, they have to abide by the laws that Colorado’s state government sets.

High-Risk Insurance

If you’ve ever had your license suspended or revoked, then you’ll have had to file an SR-22. This form allows you to reinstate your license and is available through your insurance company.

What is an SR-22, though? The form effectively assures law enforcement and your provider that you have insurance coverage. If you cancel your policy, your insurer will get in touch with the local DMV, and your license will once again be suspended.

Your license can be suspending for any of the following reasons:

- You were convicted of a DUI

- Driving without insurance

- History of reckless driving or repeat traffic offenses

Low-Cost Insurance

Unfortunately, Colorado does not have a plan in place designed to make paying for insurance easier on low-income households.

If you want to try and lower your insurance rates, try exploring some of the following discounts with your provider of choice:

- Accident-Free Discount

- Affiliation Discount (this would be any discounts through your employer, school, team, etc.)

- Anti-Theft Discounts (i.e. if you have alarms, tracking systems, etc on your vehicle)

- Auto-Pay Discounts (if you were to set up automatic payments from checking – some providers refer to it as a Paper-Saving Discount)

- Good Student Discount

- Homeowner’s Discount

- Multi-car Discount

- Green/Hybrid Car Discount (if you own/lease a hybrid or electric vehicle)

Be sure you shop around in order to find the best coverage for you that is equally cost-effective.

Windshield Coverage

There are no laws in the state of Colorado that require insurers to provide you with coverage that’ll save you money while repairing a fractured or shattered windshield.

Automobile Insurance Fraud in Colorado

It’s extremely difficult to commit automobile insurance fraud by accident. That said, the insurance industry sees 10 percent of its operating costs go to enduring fraudulent claims or accounts over the course of a year.

There are two different types of automobile fraud.

- Hard fraud sees a driver deliberately falsifying a claim or faking an accident in order to receive compensation

- Soft fraud sees a driver padding a claim or misrepresenting accident information to an insurance provider

Soft fraud is the more common of these two types of fraud.

Even though you may think you’re just telling a white lie, soft fraud is considered a misdemeanor, and lying on your claim is considered a class 5 felony.

Statute of Limitations

You have a limited amount of time after an accident has taken place to file a claim with your insurance provider. In Colorado, you have three years to file in the case of property damage or bodily injury.

This time block begins on the day of your accident, so do what you can to move quickly and get the money you deserve.

Vehicle Licensing Laws

If your vehicle isn’t insured or registered with a state DMV, you could face some serious consequences. Familiarize yourself with Colorado’s state licensing laws so you can know what kind of trouble you want to stay out of.

Penalties for Driving Without Insurance

We’ve already noted that you absolutely need car insurance in order to drive legally on the road in Colorado. If you don’t have insurance, not only could you end up paying out of pocket for a car accident, but you’ll face serious legal consequences.

Did you know that 13.30 percent of drivers in Colorado are currently driving without insurance? That means that Colorado ranks at number 19 in the nation for most uninsured drivers on the road.

Take a look at the table below for a better understanding of the consequences of driving without insurance in Colorado:

| Penalty | First Offense | Second Offense |

|---|---|---|

| Fine | $500 minimum | $1,000 minimum |

| Points | Four | Four |

| License Suspension | Until you show proof of insurance to the DMV | Four months |

| Community Service | Possible up to 40 hours | Possible up to 40 hours |

Teen Driver Laws

It’s always an exciting — and slightly terrifying — time when a teen driver takes to the road for the first time. The fantastic news is that since 2002 and the integration of the Graduated Driver Licensing laws in Colorado, teen motor vehicle fatalities have decreased by 67 percent!

This means that teenager drivers are already much safer on the roadways of Colorado. Still, there are restrictions placed on teen licenses that new drivers will have to keep in mind.

| Restrictions | Learner's Permit | Restricted License | Unrestricted License |

|---|---|---|---|

| Age | 15 - if enrolled, attending, and participating in driver's ed 15 1/2 - if completed a four-hour driver-awareness course 16 - if none of above | If under 18, one year after obtaining learner's permit | 17 - if held restricted license 12 months 18 - otherwise |

| Passengers | Must be supervised by a licensed parent/guardian or their licensed adult appointee | First six months - no passengers under 21 Second six months - limit of one passenger under 21 (exceptions: siblings, family emergencies) | No restrictions |

| Hours | No restrictions | First year - no driving between midnight and 5 a.m. (exceptions: presence of a parent/guardian, driving to and from school activities or work, family emergency, being an emancipated teen) | No restrictions |

| Cell phone use | Forbidden | Forbidden | Forbidden if under 18 |

| Pre-requisites | If under 18, parent or guardian must sign an affidavit of liability | Completion of 50 hours supervised driving, 10 of which at night | If under 18, holding a restricted license for one year |

Teenagers also have a different point system applied to their license if they get caught violating traffic laws, as you can see below:

| Time-frame | Points requiring suspension |

|---|---|

| Within 12 months | 6 |

| At any point before turning 18 | 7 |

Older Driver License Renewal Procedures

License renewal requirements for drivers over the age of 66 aren’t so different from those that apply to the general population. All residents, including older ones, must have their licenses renewed on a five-year basis.

The general population, though, can renew their licenses two times online before having to make the trek to the DMV. Alternatively, they can handle every other renewal by mail.

Drivers over 66 will have to either go to the DMV in person or have their licenses renewed every other five years by mail.

New Residents

If you’re just getting settled in Colorado, congratulations and welcome to the Centennial State! You’ll have to register your vehicle with a local DMV within thirty days of declared residency, or within 90 days of moving into a home in Colorado.

You’ll need the following forms to receive a Colorado-based license:

- A valid driver’s license from your previous state of residence

- Social security card

- Two proofs of your current Colorado address

- Proof of lawful presence

- Money to pay for licensing fees

Rules of the Road

Like we’ve already said, Colorado is an at-fault state. You’ll need to be especially careful while on the road, and abide by the rules of the road with care.

Keep Right and Move Over Laws

On Colorado roadways, if you’re driving slower than the posted speed limit or the traffic around you, you’ll need to keep to the right-hand lane of the road.

You’ll also need to move to the right-hand lane if you notice an EMS vehicle or state-sponsored car with its lights on coming in your direction. These vehicles include:

- Firefighters

- Ambulances

- Utility Workers

- Law Enforcement

- Utility Trucks

- Drivers with Hazard Lights on

Speed Limits

You’ll need to abide by Colorado’s posted speed limits if you want to avoid a ticket.

| Type of Roadway | Speed Limit |

|---|---|

| Rural Interstates | 75 mph |

| Urban Interstates | 65 mph |

| Other Limited Access Roads | 65 mph |

| Other Roads | 65 mph |

Note that these are the maximum speeds you can go while on the road in Colorado, and you can face consequences that include fines if you are caught going over them.

Seat Belt and Car Seat Laws

Passengers in your car — and you, of course — are required to wear a seat belt after turning 16 years old. While not wearing a seat belt is only a secondary offense — meaning that you can’t be pulled over for not wearing a seat belt alone — you’ll need to keep one on you for your own protection.

If a passenger under the age of 16 is caught not wearing a seat belt, the offense jumps to a primary and you can be pulled over without any other reason needed.

No one is allowed to ride in the cargo area of a truck, either, unless that area is fully or partially enclosed on all four sides.

There are also specific car seat laws in place designed to keep passengers under the age of eight safe while on the road. Take a look at the table below:

| Type of Car Seat Required | Age | Weight |

|---|---|---|

| Rear-Facing Child Safety Seat | Under one year old | Under 40 pounds if under one year old Under 20 pounds if over one year old |

| Forward Facing or Rear Facing Child Safety Seat | One to four years old | 20 - 40 pounds |

| Forward Facing Safety Seat, Booster Seat, or With Safety Belt-Positioning Device | Four to eight years old | Over 40 pounds |

| Seat Belt or Child Restraint System | Over eight years old | No weight restrictions when over eight years old |

Note that violating a car seat law is considered a primary offense, and you can be pulled over immediately if law enforcement spots a child in your car who is not in their appropriate car seat.

Ridesharing

With the rise of Uber and Lyft, more and more drivers are interested in using their cars as part of their careers. If you want to start ridesharing, you’ll need to make sure that your provider of choice offers ridesharing car insurance.

In Colorado, the following providers make ridesharing insurance available:

- Allstate

- American Family

- Farmers

- Geico

- MetLife

- SafeCo

- State Farm

- USAA

Red Light Cameras

Colorado uses red light cameras to keep an eye on any drivers that might behave inappropriately at red lights. While no points will be applied to your license if you get caught, you can still receive a significant fine.

Puffing Laws

In the colder days of winter, you may like to start your car and let the windshield defrost while you head back into your home, where it’s warm. Unfortunately, this behavior — called “puffing” — is illegal in Colorado, as leaving your car running while unintended can enable vehicle left.

Safety Laws

Making good decisions while on the road does more than keep your insurance rate low. It keeps you and the other drivers around you safe. That’s why Colorado has legislation in place designed to motivate drivers to operate their cars more safely.

DUI Laws

You should never get behind the wheel if you’ve had several drinks over the course of an evening. If you get caught driving while intoxicated, you face misdemeanor charges up until your fourth offense. After the fourth time you’re caught, you’ll be charged with a class 4 felony.

It should be noted that Colorado has two levels of intoxicated driving that it assesses drivers on:

- A DUI see drivers operating a vehicle with a blood alcohol content of .08 percent or higher

- A DWAI, or Driving While Ability Impaired, sees drivers operating motor vehicles with a blood alcohol content between .05 and .07 percent.

| Penalty Type | First Driving While Ability Impaired (DWAI) | First Driving Under the Influence (DUI) | Second DUI or DWAI | Third and Subsequent DUIs and DWAIs |

|---|---|---|---|---|

| Revoked License | Eight points on license | Nine months | One year | Two years |

| Imprisonment | Two days to 180 days | Five days to one year | 10 days to one year | 60 days to one year |

| Fine | $200-$500 | $600-$1000 | $600-$1500 | $600-$1500 |

| Community Service | 24 to 48 hours | 24 to 48 hours | 48 to 120 hours | 48 to 120 hours |

Note that driving while or after using marijuana results in the same charges as driving while intoxicated.

Distracted Driving Laws

Colorado has a number of cellphone-oriented laws in place, as well, designed to keep drivers focused on the road ahead of them:

| Hand-held ban | No |

|---|---|

| Young drivers all cellphone ban | Under 18 years old |

| Texting ban | All drivers |

| Enforcement | Primary |

If you’re caught violating any of the aforementioned restrictions, then you could face the following consequences:

| Class of Driver | First Offense | Second and Subsequent Offenses |

|---|---|---|

| Minor Drivers (all cellphone use) | Class A traffic infraction One point on license $50 fine | One point on license $100 fine |

| Adult Drivers (text messaging) | Class 2 misdemeanor traffic offense Four points on license $300 fine | Bodily injury or proximate cause of death to another, class 1 misdemeanor Four points on license $1000 fine and/or up to one year imprisonment |

Driving in Colorado

Safety is a big issue while driving through Colorado. You need to be aware of what’s going on around you at all times in order to keep yourself safe in your vehicle. There are some things, though, that you can’t look out for.

Let’s explore some of the obstacles to safety in Colorado — not to scare you, but rather to encourage you to keep your eyes open.

Vehicle Theft in Colorado

Not all vehicle thieves are out in the world looking for sports cars. In fact, in Colorado, sports cars don’t even rank on the top ten list of vehicles most commonly stolen.

| Rank | Model | Year | Number of Thefts |

|---|---|---|---|

| 1 | Honda Civic | 1997 | 1,380 |

| 2 | Honda Accord | 1997 | 1,167 |

| 3 | Ford Pickup (Full Size) | 2005 | 595 |

| 4 | Jeep Cherokee/Grand Cherokee | 1999 | 594 |

| 5 | Chevrolet Pickup (Full Size) | 2000 | 450 |

| 6 | Dodge Pickup (Full Size) | 2001 | 308 |

| 7 | Subaru Legacy | 1996 | 215 |

| 8 | Acura Integra | 1994 | 208 |

| 9 | Toyota Camry | 1989 | 203 |

| 10 | Toyota Corolla | 2014 | 170 |

Hondas, as a matter of fact, are among the most commonly stolen vehicles. Why? Practicality, most likely, but also availability.

You can also learn a little bit more about where you’ll need to keep a closer eye on your car by knowing which cities in Colorado see the most theft.

| City | Number of Thefts |

|---|---|

| Denver | 3,487 |

| Colorado Springs | 1,928 |

| Aurora | 1,000 |

| Lakewood | 623 |

| Pueblo | 528 |

| Thornton | 352 |

| Westminster | 322 |

| Arvada | 197 |

| Greeley | 186 |

| Commerce City | 183 |

Urban areas like Denver, of course, see more thefts due to their larger populations.

Risky Behavior While Driving

But what about dangers besides theft? What do those statistics look like?

Fatalities by Road Type

The type of road a person is driving on can impact her likelihood of getting into an accident.

| Type of Roadway | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|

| Rural | 296 | 252 | 247 | 227 | 233 | 244 | 228 | 260 | 266 | 277 |

| Urban | 252 | 213 | 203 | 220 | 241 | 238 | 260 | 285 | 342 | 369 |

Rural roads and urban roads in Colorado see roughly the same number of fatalities, meaning that you should be equally careful on both types of roads within the state.

Fatalities by Weather

One thing we can’t control is the weather. Let’s take a look at how many fatalities in Colorado occur due to the state’s varying environment.

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk |

|---|---|---|---|---|

| Normal | 38 | 11 | 16 | 1 |

| Rain | 8 | 1 | 4 | 0 |

| Snow/Sleet | 10 | 1 | 2 | 0 |

| Other | 3 | 0 | 0 | 1 |

| Unknown | 254 | 104 | 125 | 21 |

| TOTAL | 313 | 117 | 147 | 23 |

Fatalities by Person Type

Person type can also impact the number of accidents Colorado sees over the course of a year. “Person type” here describes a person in relationship to the car that’s in an accident; passengers, pedestrians, and so on.

| Vehicles Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Passenger Car | 141 | 176 | 163 | 187 | 199 |

| Light Truck - Pickup | 77 | 56 | 77 | 66 | 78 |

| Light Truck - Utility | 85 | 70 | 85 | 85 | 104 |

| Light Truck - Van | 14 | 6 | 21 | 24 | 27 |

| Light Truck - Other | 0 | 0 | 1 | 0 | 2 |

| Large Truck | 11 | 10 | 13 | 18 | 26 |

| Bus | 0 | 0 | 0 | 1 | 1 |

| Total Occupants | 331 | 319 | 364 | 383 | 437 |

| Motorcycle | 87 | 94 | 106 | 125 | 103 |

| Pedestrian | 50 | 63 | 59 | 79 | 92 |

| Bicyclist and Other Cyclist | 12 | 10 | 13 | 16 | 16 |

| Other/Unknown Nonoccupants | 2 | 2 | 5 | 5 | 0 |

| Total Nonoccupants | 64 | 75 | 77 | 100 | 108 |

| Total Traffic-Related Fatalities | 482 | 488 | 547 | 608 | 648 |

As you can see, it’s most often passengers who are insured in traffic fatalities.

Fatalities by Crash Type

There are also a number of different types of crashes that take place in Colorado, as you can see:

| Crash Type | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Total Fatalities (All Crashes)* | 482 | 488 | 547 | 608 | 648 |

| - (1) Single Vehicle | 284 | 273 | 305 | 344 | 335 |

| - (2) Involving a Large Truck | 56 | 63 | 64 | 86 | 87 |

| - (3) Involving Speeding | 151 | 168 | 217 | 211 | 230 |

| - (4) Involving a Rollover | 197 | 166 | 195 | 212 | 228 |

| - (5) Involving a Roadway Departure | 287 | 285 | 304 | 295 | 330 |

| - (6) Involving an Intersection (or Intersection Related) | 118 | 127 | 153 | 200 | 190 |

It’s single vehicles that most likely end up in fatal accidents.

Five-Year Trend For The Top 10 Counties

But how have the number of fatalities risen or fallen in Colorado over the past several years?

| County Name | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Adams County | 33 | 32 | 44 | 60 | 64 |

| Arapahoe County | 21 | 30 | 37 | 46 | 45 |

| Boulder County | 12 | 16 | 19 | 24 | 31 |

| Denver County | 40 | 42 | 52 | 54 | 49 |

| El Paso County | 63 | 53 | 48 | 48 | 77 |

| Garfield County | 7 | 8 | 8 | 10 | 21 |

| Jefferson County | 43 | 42 | 55 | 48 | 41 |

| Larimer County | 20 | 24 | 33 | 44 | 36 |

| Pueblo County | 14 | 19 | 12 | 20 | 34 |

| Weld County | 35 | 55 | 55 | 55 | 66 |

As you can see, Colorado’s vehicular fatalities are on the rise. This is all the more reason for you and the drivers around you to take greater care while on the road.

Fatalities Involving Speeding by County

You also don’t have to pretend that you’re Speed Racer while driving through Colorado. Speeding has resulted in a number of fatalities over the past several years, and unlike the weather, it’s an element of these fatalities that we can control.

| County Name | 2015 | 2016 | 2017 | Three-Year Total |

|---|---|---|---|---|

| Adams County | 17 | 19 | 20 | 56 |

| Arapahoe County | 17 | 19 | 17 | 53 |

| Denver County | 28 | 22 | 15 | 65 |

| Douglas County | 4 | 8 | 8 | 20 |

| El Paso County | 15 | 22 | 29 | 66 |

| Garfield County | 5 | 6 | 10 | 21 |

| Jefferson County | 22 | 20 | 18 | 60 |

| Larimer County | 9 | 15 | 16 | 40 |

| Pueblo County | 4 | 4 | 16 | 24 |

| Weld County | 25 | 11 | 20 | 56 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver

Likewise, we can control whether or not we get behind the wheel of a car while intoxicated. We’ve already touched on the consequences of driving while drunk in Colorado, and yet the fatalities involving a person who is intoxicated are on the rise.

| County Name | 2015 | 2016 | 2017 | Three-Year Total |

|---|---|---|---|---|

| Adams County | 11 | 15 | 18 | 44 |

| Arapahoe County | 12 | 13 | 13 | 38 |

| Boulder County | 5 | 3 | 4 | 12 |

| Denver County | 15 | 18 | 20 | 53 |

| Douglas County | 4 | 5 | 3 | 12 |

| El Paso County | 17 | 20 | 24 | 61 |

| Garfield County | 3 | 7 | 5 | 15 |

| Jefferson County | 19 | 9 | 13 | 41 |

| Larimer County | 8 | 12 | 11 | 31 |

| Pueblo County | 3 | 3 | 10 | 16 |

| Weld County | 19 | 13 | 13 | 45 |

Teen Drinking and Driving

You should also note that the above statistics involve teen drivers who’ve been drinking, too. Recently, Colorado has seen a significant number of teenage drivers arrested for drinking and driving, as you can see below:

| Number of Arrests | Arrests per One Million People | Rank Nationally |

|---|---|---|

| 217 | 172.03 | 7 |

EMS Response Time

If you happen to get in a car accident, you’ll want to get in touch with Colorado EMS as quickly as you possibly can. The response time of the EMS will vary based on where your accident has taken place, as you can see:

| Location of Incident | Time of Crash to EMS Notification | Notification to Arrival | Arrival at Scene to Hospital Arrival | Time of Crash to Time of Hospital Arrival |

|---|---|---|---|---|

| Rural | 7.33 | 12.01 | 36.68 | 48.96 |

| Urban | 1.33 | 5.09 | 22.23 | 28.16 |

The good news is that regardless of whether you’re in a rural or urban environment, EMS will be able to get you from the site of your accident to a hospital in less than an hour.

Transportation

With those details out of the way, let’s take a look at your daily commute through Colorado.

Car Ownership

The vast majority of Colorado residents keep two cars in their driveways. It’s interesting to note, though, that just under 5 percent operate without cars on a daily basis. While you’re not going to see that percentage impacting traffic all too much, it does speak to the use of public transportation in Colorado’s more rural areas. More on that in a minute, though.

Commute Time

The commutes in Colorado are not short. The vast majority of commutes tend to range between 5-34 minutes. That said, over 14 percent of Colorado drivers spend between 45-89 minutes in their car during a commute. That’s not quite the terrifying “super-commute,” but it’s darn close.

That said, Colorado’s calculated average commute comes in at around 24 minutes, putting it a smidge under the 25.4 minute national average.

Commuter Transportation

Finally, a significant majority of drivers in Colorado prefer to make their way to and from work on their own. There’s nothing wrong with that — everyone gets to choose their own music this way, even as traffic may get a little bumpy.

Top Cities for Traffic Congestion

And speaking of traffic: there are a number of cities in Colorado with congestion that gets a bit overwhelming. Denver, as you might expect, tops out this list, with Boulder, Greeley, and a few other cities just behind.

| City | Hours Spent in Traffic | Peak (Time in Traffic) | Daytime (Time in Traffic) | Overall (Time in Traffic) |

|---|---|---|---|---|

| Denver | 36 | 13% | 7% | 8% |

| Boulder | 24 | 13% | 10% | 10% |

| Greeley | 12 | 7% | 7% | 6% |

| Colorado Springs | 15 | 8% | 6% | 7% |

| Pueblo | 7 | 5% | 4% | 4% |

If you live in any of these areas, do your best to get out of bed early, or else you risk running late to work.

With that, we come to the end of our comprehensive guide to Colorado car insurance. With this foundation in place, you’ll be able to move forward and find the best car insurance policy for your driving style. We don’t want you to overpay for your car insurance. We just want to make sure that you’re protected while on the road.

Exciting to start comparing rates? Use our FREE online tool to start looking at quotes in your area.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.