Georgia Car Insurance (The Only Guide You’ll Ever Need)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Feb 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.

UPDATED: Feb 10, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We partner with top insurance providers. This doesn’t influence our content. Our opinions are our own.

On This Page

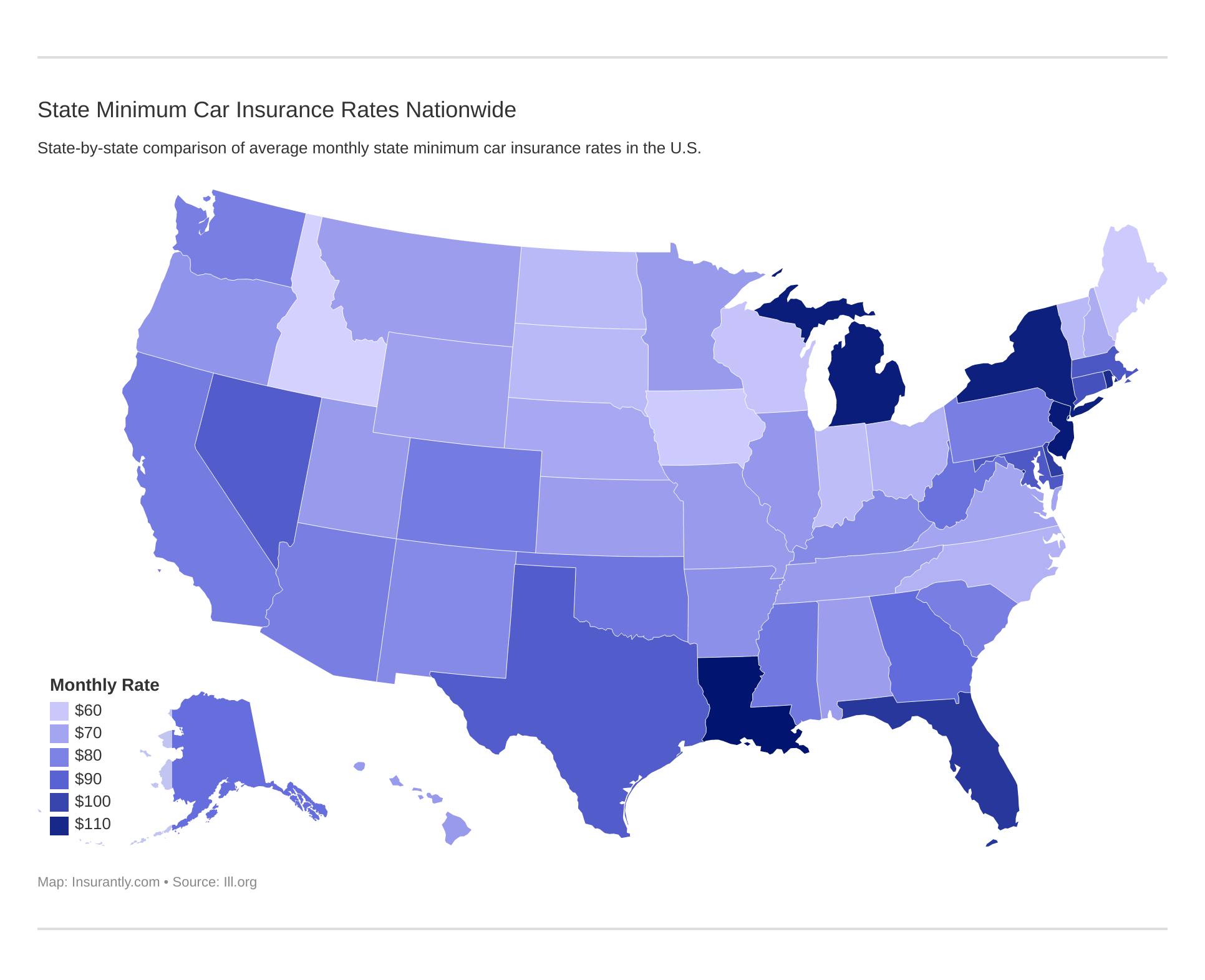

Even though car insurance premiums in Georgia aren’t that much more than the national average, Georgia residents will speak of a different experience because, every year, premiums keep going up.

From 2011 to 2015, rates increased by nearly 15 percent making Georgia rank 4th in the nation as having the largest percent increase out of all states during the same time period.

What non-Georgians don’t know is that the quickly increasing rates are a result of a law passed in 2008 that seriously backfired.

We know how frustrating it can be to live day to day paying high car insurance rates when efforts to elect officials to turn things around result in turn over due to idling and indictments. And what doesn’t help the situation is leading providers in the voluntary market harnessing the power to make the rest of the car insurance companies follow suit.

In our Georgia car insurance guide, we explain the history behind the high rates, the factors that affect premiums, and what to consider about the various companies vying for your business.

Until things get under control in the Commissioner’s office, it’s important for you to shop around for the best deal on car insurance. Use our FREE online tool at the bottom of this page to start comparing car insurance rates in Georgia.

| Georgia Statistics Summary | |

|---|---|

| State Population | 10,519,475 |

| Road Miles | Total in State: 128,134 Vehicle Miles Driven (in millions): 118,107 |

| Driving Deaths | Speeding – 248 Drunk Driving – 366 |

| Vehicles | Registered: 7,937,211 Total Stolen: 26,482 |

| Most Popular Vehicle | F150 |

| Average Premiums (Annual) | Liability – $557.38 Collision – $331.83 Comprehensive – $159.18 Combined Premiums – $1,048.40 |

| Percent of Motorists Uninsured | 12% State Rank: 25th |

| Cheapest Provider | Geico and USAA |

Georgia Car Insurance Coverage and Rates

Knowing a little history behind the rising car insurance premiums will provide some perspective.

A Georgia law passed in 2008 freed auto insurers from a rigorous pre-approval process when they wanted to jack up rates. Soon after, Allstate, the second-largest provider in Georgia at the time, announced their rates would increase by 25 percent.

At the time the law was passed, former Commissioner of Insurance, Ralph Hudgens, was a lawmaker, and his reasoning for backing the bill was that if we let free-market principles take effect, competition would drive rates down.

It appears the law had the opposite effect.

Hudgens has now left office, and hopes towards change are even more doubtful because the newly elected Commissioner, Jim Beck, was recently charged with mail fraud, wire fraud, and money laundering.

For the time being, Georgia residents may not be able to do much about those in office responsible for making decisions. In the meantime, let us help you to make an informed decision.

Georgia Car Culture

Driving in Georgia can’t possibly be pondered without including a reference to the pop-culture TV show of the ’80s The Dukes of Hazzard. The first five episodes were actually filmed in Covington, Georgia in the fictional Hazzard County.

The 1969 Dodge Charger was the vehicle used in the TV series. During the seven years of the show, almost 300 models were damaged while filming General Lee’s daring stunt jumps. The Charger is still a popular vehicle of today.

Another contribution the state of Georgia makes to the history of cars is being home to one of the largest junkyards. With over 4,000 junked vehicles, Old Car City is a favorite destination among classic car aficionados.

Minimum Car Insurance Requirements in Georgia

| Insurance Required | Minimum Limits: 25/50/25 |

|---|---|

| Bodily Injury Liability Coverage | $25,000 per one person $50,000 per accident |

| Property Damage Liability Coverage | $25,000 minimum |

Every state but New Hampshire requires drivers to carry liability insurance which pays those who are owed compensation for property damage and/or injuries resulting from a car accident that you cause.

Georgia is an “at-fault” state. Any injuries or desctruction to property you cause in an accident must be paid by your liability coverage.

Even though Georgia requires a minimum amount of liability coverage, it is wise to purchase much more than the minimum. Georgia requires:

- $25,000 – to cover Injury or death of one person in an accident you caused

- $50,000 – to cover total injuries or death of more than one person in an accident you caused

- $25,000 – to cover property damage in an accident you caused

Liability, however, will not cover injuries or property damage you sustain. That is provided by other optional, but important, types of coverage we will explain shortly.

Required Forms of Financial Responsibility in Georgia

Before you can register your vehicle, you must provide proof of insurance to show that you are financially responsible if you cause an accident.

Even though all insurance companies electronically file your proof of insurance with the Georgia Department of Revenue, you still must carry proof of liability coverage in your vehicle.

When you purchase a new vehicle, the state provides 30 days to transfer your coverage.

Premiums as Percentage of Income in Georgia

Though car insurance rates may vary from person to person and income varies from person to person, data published in 2014 assisted our researchers in calculating how much car insurance rates consume the monthly income of Georgia residents.

Our researchers revealed that from 2012 to 2014 the annual percentage of income used for car insurance hovered between 2.78 and 2.87 percent which is about four-tenths of a percent higher than the nationwide percentage. That’s pretty good considering some states like Michigan and Louisiana have experienced percentages approaching four.

In 2014, the average annual per capita disposable income for a Georgia resident was $34,558 and the car insurance annual premium was $991.25.

Disposable income is the income that is left after Georgia residents pay taxes. Most Americans pay bills on a monthly basis, so the math tells us that around $82.60 per month is assigned to car insurance coverage. The remaining monthly income is assigned to rent/mortgage, food, utility bills, and savings.

Read more: Michigan Car Insurance (The Only Guide You’ll Ever Need)

Average Monthly Car Insurance Rates in GA (Liability, Collision, Comprehensive)

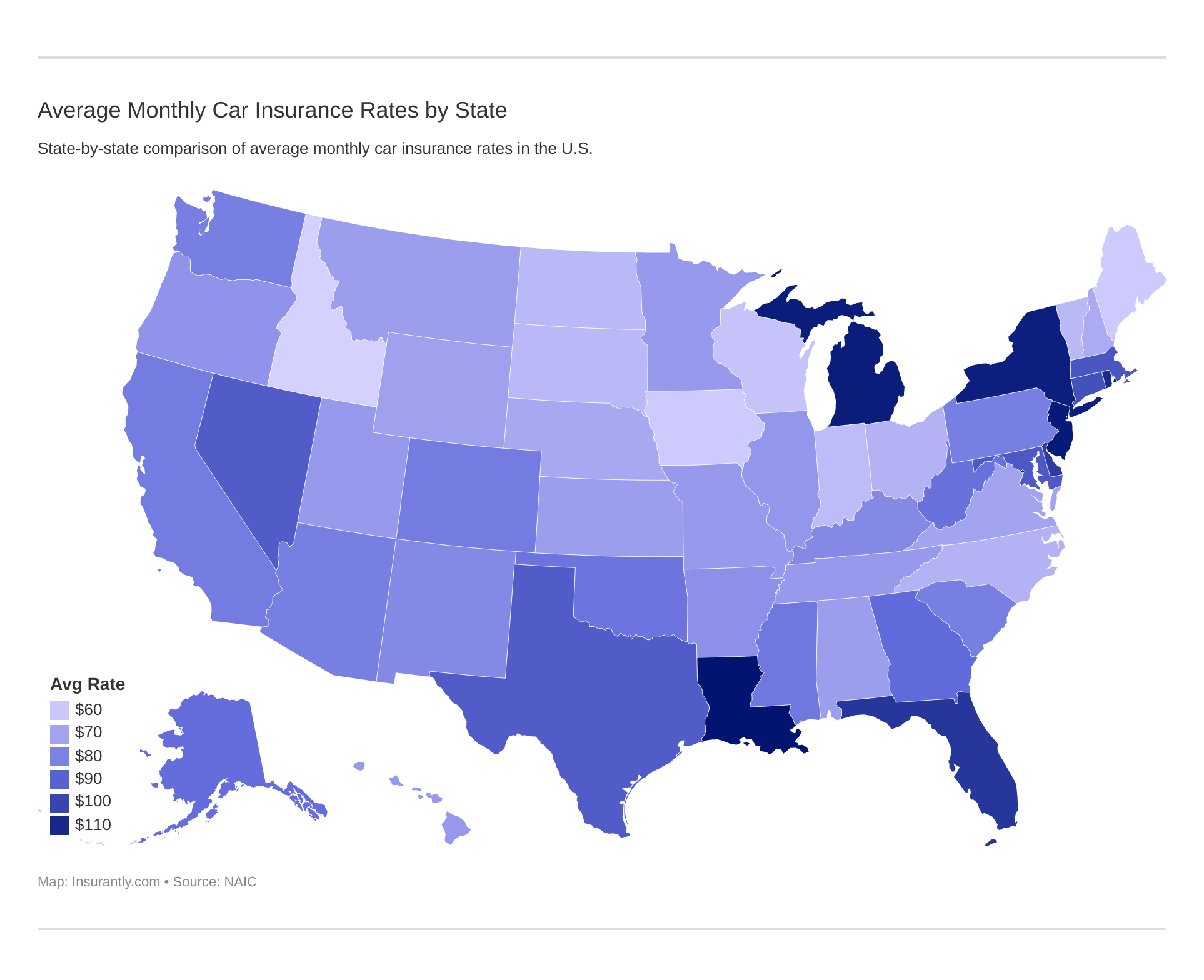

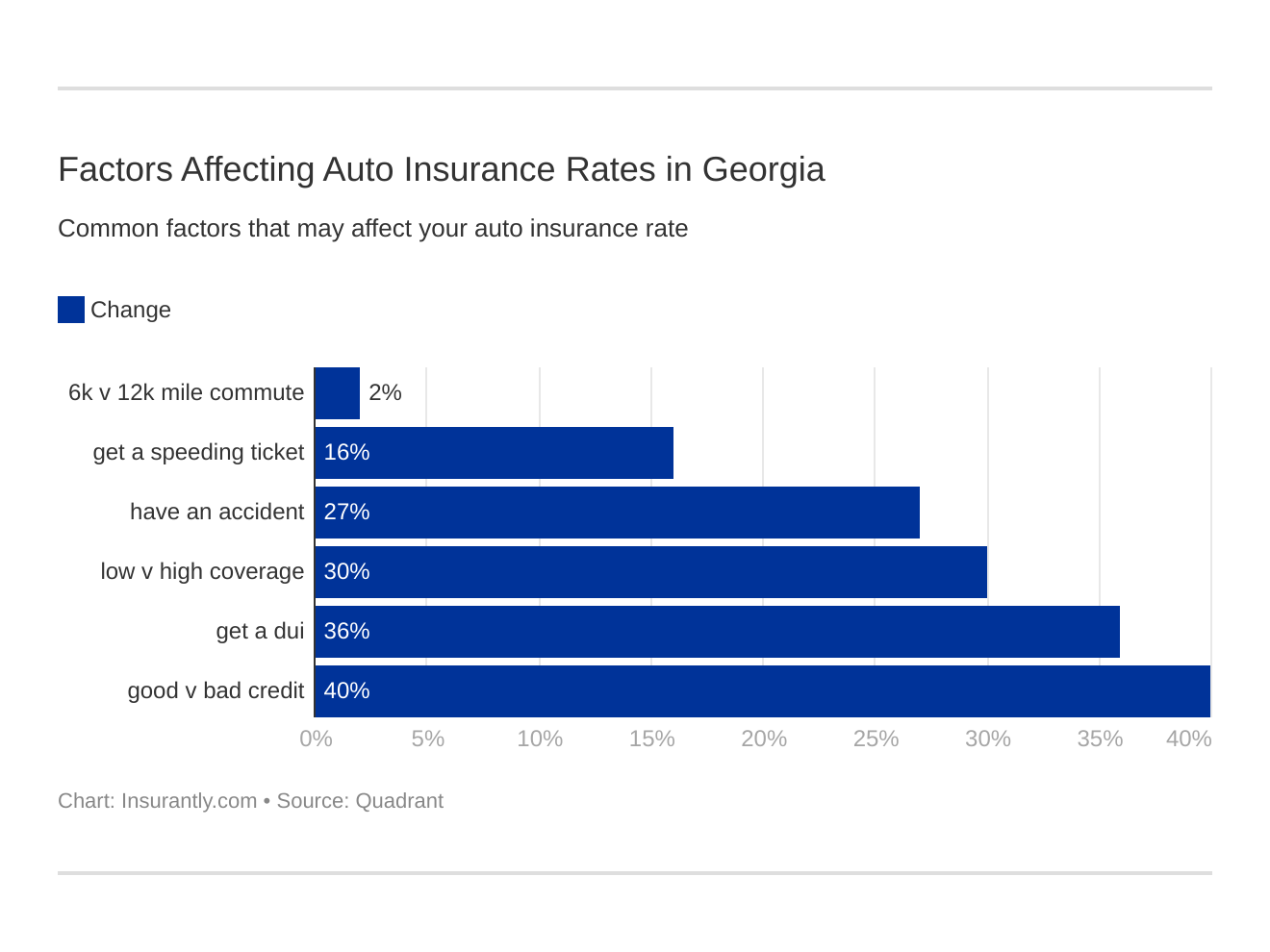

Just like your rates can fluctuate based on factors such as your driving record and credit score, the state average rate can also fluctuate. In most cases, however, rates seem to increase faster than our paychecks.

Luckily, the National Association of Insurance Commissioners tracks the ebb and flow of car insurance rates across the nation. They are the experts and provide us with not only the average liability rates but also comprehensive and collision. Georgia rates are compared to the national averages in the table below.

| Coverage Type: | Annual Costs in 2015 (Countrywide): | Annual Costs in 2015 (GA): |

|---|---|---|

| Liability | $538.73 | $557.38 |

| Collision | $322.61 | $331.83 |

| Comprehensive | $148.04 | $159.18 |

| Combined | $1,009.38 | $1,048.40 |

As mentioned before, it’s best to purchase more than the minimum liability coverage.

Next, we will cover some of the most popular coverage options to enhance your car insurance policy.

Additional Liability Coverage in Georgia

Any insurance provider in the state of Georgia will offer you much more coverage than the minimum liability limits. Listen to them closely because some additional coverages are more important than others to each driver.

Sometimes, we have to work hard (and pay more) to protect ourselves even when others don’t plan ahead to take responsibility when they are at fault. Even though another driver may have the minimum liability coverage required, it may still not be enough to cover the cost of your injuries and damages to your vehicle. This makes the other driver “underinsured.”

An even worse case is when the other driver is at fault and has no insurance at all. In many states, the percent of uninsured drivers can differ based on demographics and laws.

Georgia, however, was ranked 25th in the nation in 2015 with 12 percent of drivers being uninsured.

That’s one percent lower than the national percent. Way to go, Georgia!

In case you are hit by another driver with the minimum liability limits or no liability insurance at all, additional coverages like Med Pay and Uninsured and Underinsured motorist coverage come in handy. Though not required by law, these coverages are highly recommended.

Examining loss ratios are an additional way drivers can consider purchasing more coverage. These ratios tell us how much a company makes on premiums they take in compared to the claims they pay out.

To illustrate, if a loss ratio is 70 percent, the company has covered $60 worth of claims per every $100 they have earned in premiums. The optimal loss ratio is usually between 60 to 70 percent.

Each company has its own loss ratio for each type of coverage, and we will show that data later. For now, the table below outlines the statewide loss ratios for Med Pay and uninsured and underinsured motorists coverages.

| Loss Ratio | 2013 | 2014 | 2015 |

|---|---|---|---|

| Medical Payments (Med Pay) | 86.61% | 83.70% | 84.58% |

| Uninsured/Underinsured Motorist | 81.65% | 87.32% | 93.68% |

For the 17 states that mandate uninsured and underinsured motorist coverage, companies may have less difficulty managing loss ratios.

Companies in Georgia, however, have had trouble keeping their uninsured and underinsured coverage ratios in the safe zone of 60 to 70 percent. It steadily increased between 2013 and 2015, so drivers in Georgia are benefiting greatly from this type of coverage.

Add-ons, Endorsements, and Riders

Other powerful but cheap extras are available to provide extended coverage for you and your family.

Here’s a list of coverage options available to you in Georgia.

- Guaranteed Auto Protection (GAP)

- Personal Umbrella Policy (PUP)

- Emergency Roadside Assistance

- Rental Reimbursement

- Mechanical Breakdown Insurance

- Non-Owner Car Insurance

- Modified Car Insurance Coverage

- Classic Car Insurance

- Pay-as-You-Drive or Usage-Based Insurance

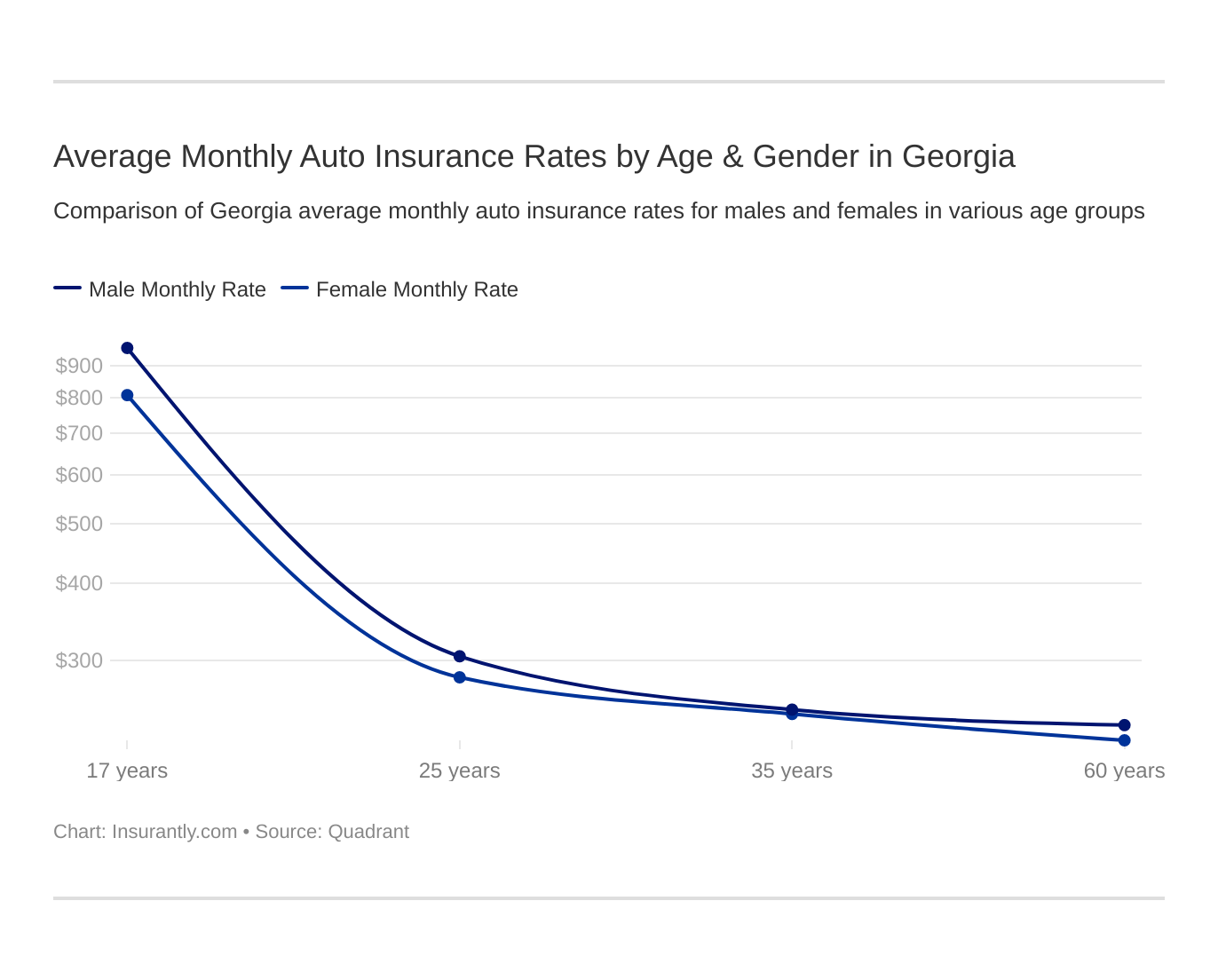

Average Monthly Car Insurance Rates by Age & Gender in GA

Since younger drivers are a higher risk, our rates usually decrease as we get older due to more driving experience.

Some feel, however, that gender should not be a factor in determining car insurance rates. Several states have outlawed gender discrimination, while other states have outlawed other factors as well such as marital status, credit score, and level of education.

Our researchers actually found that age and the actual carrier make the biggest difference in rates.

For Georgia residents, there are differences in rates based on gender. Some companies charge much more for male drivers and some charge slightly more for female drivers. The table below shows rates for different age groups and marital status. It also includes an average for drivers under 18 and over 18 as well as the difference.

| Company | Single 17-year old female | Single 17-year old male | Single 25-year old female | Single 25-year old male | Married 35-year old female | Married 35-year old male | Married 60-year old female | Married 60-year old male | Average Rate over age 18 | Average Rate under age 18 | Difference in Average Rate |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Allstate F&C | $6,787.85 | $8,744.55 | $3,246.86 | $3,545.10 | $2,900.87 | $2,900.87 | $2,779.74 | $2,779.74 | $3,025.53 | $7,766.20 | $4,740.67 |

| Geico General | $5,405.23 | $6,468.98 | $2,312.93 | $2,573.90 | $1,798.00 | $1,774.88 | $1,741.80 | $1,741.80 | $1,990.55 | $5,937.11 | $3,946.55 |

| Nationwide Mutual | $11,720.53 | $15,095.77 | $4,594.13 | $4,986.39 | $3,767.46 | $3,895.53 | $3,724.66 | $4,094.75 | $4,177.15 | $13,408.15 | $9,231.00 |

| Progressive Mountain | $8,918.63 | $9,881.25 | $3,285.16 | $3,438.84 | $2,842.70 | $2,616.94 | $2,442.41 | $2,567.85 | $2,865.65 | $9,399.94 | $6,534.29 |

| Safeco Ins Co of IL | $22,759.67 | $25,413.76 | $5,674.73 | $6,038.00 | $5,354.43 | $5,828.62 | $4,383.03 | $4,975.31 | $5,375.69 | $24,086.72 | $18,711.03 |

| State Farm Mutual Auto | $5,893.47 | $7,744.68 | $2,426.79 | $2,621.78 | $2,211.60 | $2,211.60 | $1,984.58 | $1,984.58 | $2,240.16 | $6,819.08 | $4,578.92 |

| USAA | $6,343.65 | $7,511.58 | $2,192.11 | $2,421.96 | $1,759.52 | $1,757.11 | $1,633.74 | $1,640.04 | $1,900.75 | $6,927.62 | $5,026.87 |

Safeco charges over $18,000 more for drivers under the age of 18 and males under 18 pay nearly $3,000 more than females. Geico seems to be the most lenient for younger drivers, so if you have a teen in your family, this company may be a good option. Otherwise, USAA offers the best rates if you are in the military or are related to someone in the military.

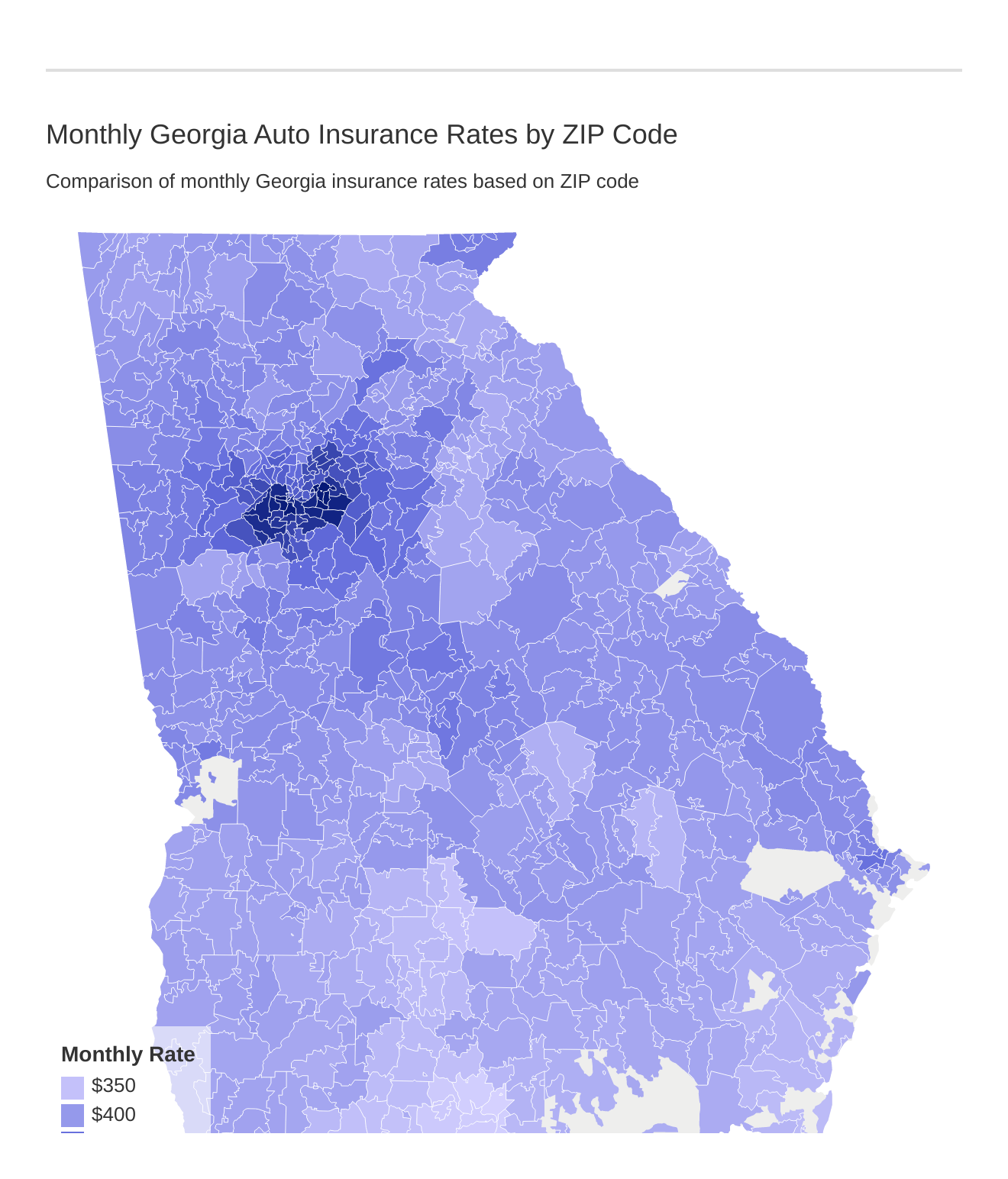

Highest and Lowest Rates by ZIP Code and City

Just like some states have outlawed rates based on gender and marital status, Michigan recently went all the way.

Beginning in July 2020, insurance companies are not permitted to consider any factors other than driving record, and that includes where Michigan residents live. Detroit residents have paid the highest rates in the country for decades. Soon, they will pay the same rate as rural Michigan drivers.

Unfortunately, Georgia is not quite at this point in the game.

In the Peach State, ZIP code and city have a great impact on car insurance rates. After all, the more populated an area is, the more likely you will be in an accident.

Below, you’ll find tables listing the top 10 most and least expensive cities in Georgia. First, the most expensive cities.

| Georgia Most Expensive Cities | Average Car Insurance Rates |

|---|---|

| Clarkston | $6,944.22 |

| Stone Mountain | $6,760.90 |

| Lithonia | $6,732.31 |

| Scottdale | $6,686.79 |

| Pine Lake | $6,580.33 |

| Union City | $6,486.71 |

| Ellenwood | $6,468.98 |

| Decatur | $6,393.82 |

| Conley | $6,350.41 |

| Riverdale | $6,224.25 |

And next, the cheapest cities.

| Georgia Cheapest Cities | Average Car Insurance Rates |

|---|---|

| Moody Air Force Base | $3,976.82 |

| Hahira | $4,022.80 |

| Valdosta | $4,026.35 |

| Barney | $4,079.38 |

| Morven | $4,093.21 |

| Quitman | $4,095.02 |

| Fitzgerald | $4,197.86 |

| Rebecca | $4,202.67 |

| Rochelle | $4,205.41 |

| Dixie | $4,206.31 |

Now that you know the average rate for the ZIP code or city in which you live or perhaps to which you plan to move, let’s take a closer look at the car insurance companies in Georgia.

The Best Georgia Car Insurance Companies

Choosing a company can be difficult with such a large variety of options. Most drivers want the best rate, but there are other factors about companies that may weigh into your decision.

In this section, we provide information about those other factors in considering a company that will best protect you and your family.

Number of Car Insurance Providers in Georgia

| Property & Casualty Insurance | Total |

|---|---|

| Domestic | 23 |

| Foreign | 988 |

| Total | 1011 |

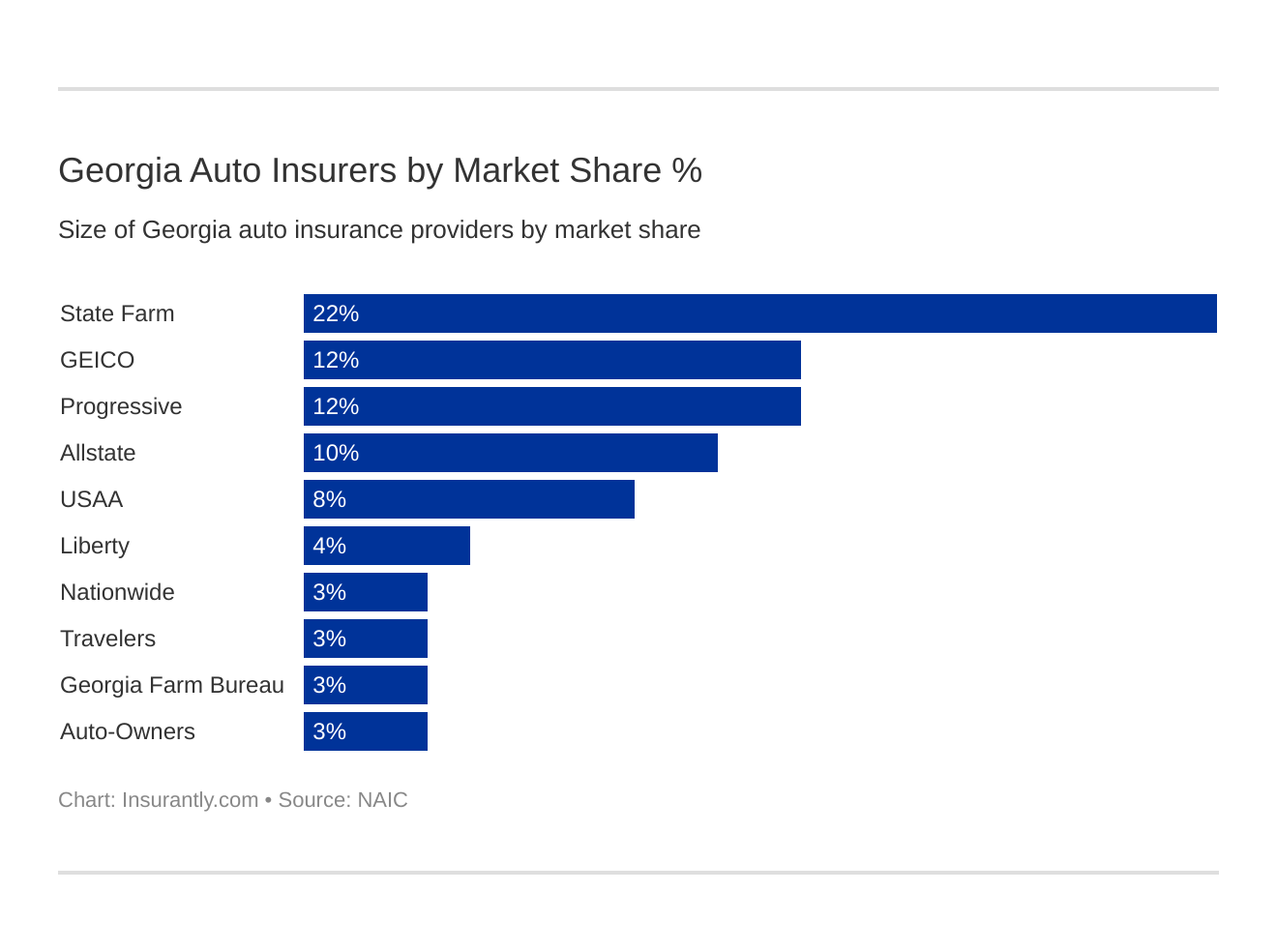

The 10 Largest Car Insurance Companies in Georgia

| Company | Direct Premiums Written | Loss Ratio | Market Share |

|---|---|---|---|

| State Farm Group | $1,937,806 | 68.72% | 22.49% |

| Geico | $1,051,005 | 81.23% | 12.20% |

| Progressive Group | $1,001,828 | 63.09% | 11.63% |

| Allstate Insurance Group | $820,479 | 51.96% | 9.52% |

| USAA Group | $706,276 | 91.01% | 8.20% |

| Liberty Mutual Group | $335,540 | 66.84% | 3.89% |

| Nationwide Corp Group | $267,971 | 77.10% | 3.11% |

| Travelers Group | $266,864 | 71.60% | 3.10% |

| Georgia Farm Bureau Group | $261,432 | 64.70% | 3.03% |

| Auto-Owners Group | $224,705 | 70.36% | 2.61% |

| TOTAL | $8,614,981 | 71.09% | 100.00% |

The same concept of loss ratio explained previously also applies to individual companies. In the table above, you can see that loss ratios are fairly reasonable if they float between 60 and 70 percent.

Unfortunately, Allstate appears to not be paying out for claims as much as some of the other companies.

The 10 Largest Georgia Car Insurance Companies’ Financial Rating

AM Best publishes information about the financial outlook of each car insurance company. If a company receives higher ratings, they are more likely to remain loyal to their customers and pay out claims.

The AM Best ratings for Georgia car insurance companies are listed below.

| Company | Financial Rating |

|---|---|

| Allstate Insurance Group | A+ |

| Auto-Owners Group | A++ |

| Geico | A++ |

| Georgia Farm Bureau Group | B+ |

| Liberty Mutual Group | A |

| Nationwide Corp Group | A+ |

| Progressive Group | A+ |

| State Farm Group | A++ |

| Travelers Group | A++ |

| USAA Group | A++ |

Financial stability doesn’t necessarily reflect customer satisfaction. Let’s take a look at the complaint index for each company.

Now let’s see who is the cheapest car insurance company in Georgia.

Car Insurance Company Complaints

Not every state publishes complaint data, and if they do, it’s minimal. The Georgia Office of Insurance and Safety Fire Commissioner provides data regarding complaints and confirmed complaints filed for each company. This helps consumers weigh in customer satisfaction as a factor in their decision in purchasing a car insurance policy.

The table below can be sorted so that you can see how complaints and confirmed complaints are compared. The Commissioner also calculates a ratio for both total complaints and confirmed complaints. The ratio is calculated based on their share of profits.

| Company | Direct Premiums Written | Number of Complaints | All Complaints Ratio | Number of Confirmed Complaints | Confirmed Complaints Ratio |

|---|---|---|---|---|---|

| Allstate Fire & Cas Ins Co | $235,282,182 | 100 | 1.17 | 15 | 1.17 |

| Allstate Prop & Cas Ins Co | $355,057,416 | 137 | 1.07 | 13 | 0.67 |

| Geico Gen Ins Co | $604,265,081 | 173 | 0.79 | 28 | 0.85 |

| Geico Ind Co | $421,979,188 | 128 | 0.84 | 19 | 0.83 |

| Georgia Farm Bureau Mut Ins Co | $262,558,883 | 59 | 0.62 | 14 | 0.98 |

| Owners Ins Co | $216,427,064 | 27 | 0.34 | 1 | 0.08 |

| Progressive Mountain Ins Co | $694,440,636 | 174 | 0.69 | 30 | 0.79 |

| Progressive Premier Ins Co Of IL | $493,160,157 | 157 | 0.88 | 16 | 0.6 |

| State Farm Mut Auto Ins Co | $1,895,578,081 | 434 | 0.63 | 58 | 0.56 |

| Travelers Prop Cas Ins Co | $250,236,822 | 57 | 0.63 | 9 | 0.66 |

| United Serv Automobile Assn | $258,779,317 | 57 | 0.61 | 7 | 0.5 |

| USAA Cas Ins Co | $241,396,875 | 94 | 1.08 | 11 | 0.84 |

| USAA Gen Ind Co | $202,860,842 | 58 | 0.79 | 11 | 1 |

A complaint ratio below one reveals that the company is better than the average company when it comes to complaints. A ratio above one indicates that the company is worse than the average based on customer complaints.

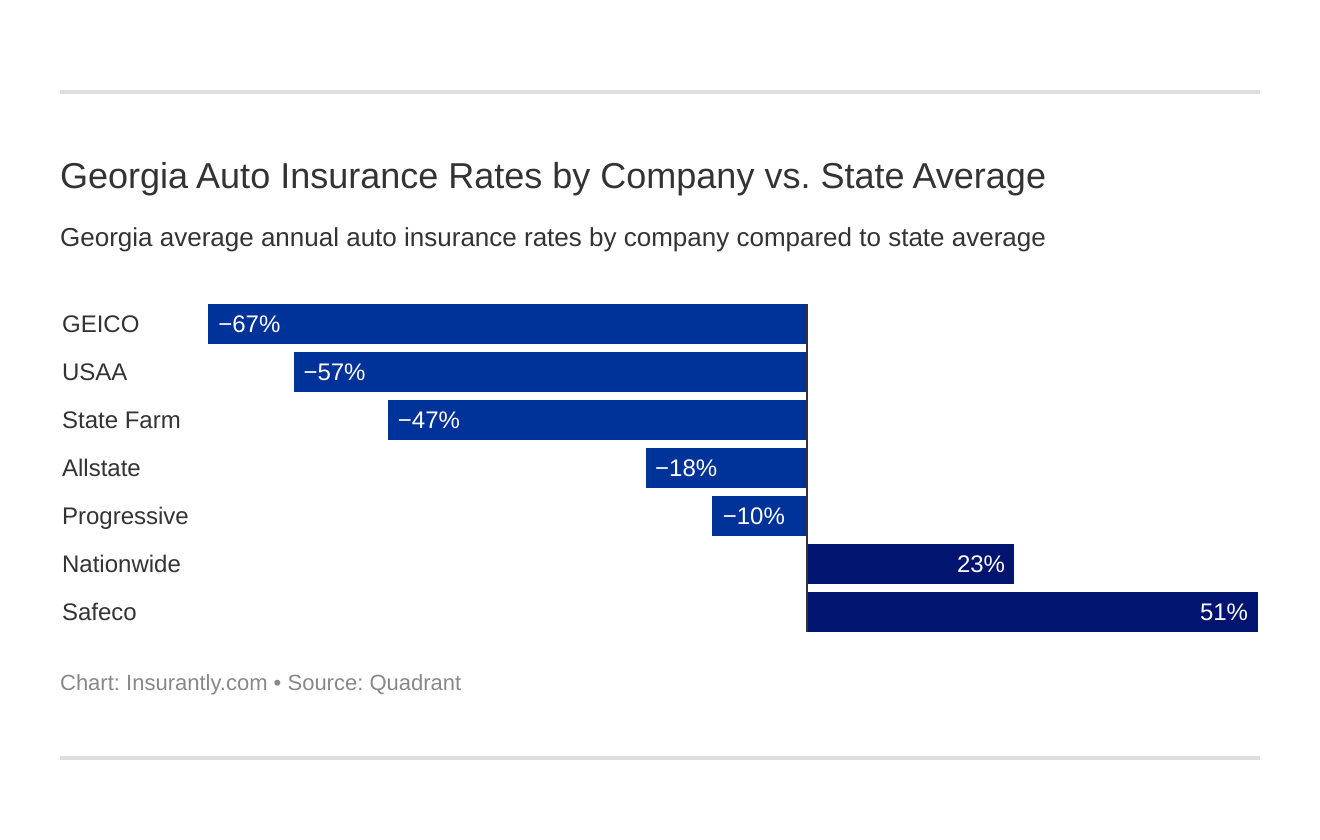

Cheapest Companies in Georgia

You already got a sneak peek at rates for each company when we compared ZIP codes. Now we are going to reveal the cheapest companies overall in Georgia as well as examine rates based on your commute, chosen coverage level, credit history, and driving record.

Let’s take a bird’s eye view first.

The average rate for each company is shown in the table below and compared to the state average with the price difference and percent difference.

| Company | Average | Compared to State Average ($) | Compared to State Average (%) |

|---|---|---|---|

| Allstate | $4,210.70 | -$756.13 | -17.96% |

| Geico | $2,977.19 | -$1,989.64 | -66.83% |

| Safeco | $10,053.44 | $5,086.61 | 50.60% |

| Nationwide | $6,484.90 | $1,518.07 | 23.41% |

| Progressive | $4,499.22 | -$467.61 | -10.39% |

| State Farm | $3,384.88 | -$1,581.95 | -46.74% |

| USAA | $3,157.46 | -$1,809.37 | -57.30% |

The company with the highest average premium is Safeco, and the company with the lowest average premium is Geico. USAA also provides low rates, but you may not qualify for their policy. This company provides services to only military members (retired and active) and their family members.

Commute Rates

The length of your drive to and from work can certainly affect your rates because you are more likely to get into an accident the more miles you drive per day.

| Company | 10 Miles Commute 6,000 Annual Mileage | 25 Miles Commute 12,000 Annual Mileage |

|---|---|---|

| Allstate | $4,115.26 | $4,306.14 |

| Geico | $2,926.71 | $3,027.68 |

| Liberty Mutual | $10,053.44 | $10,053.44 |

| Nationwide | $6,484.90 | $6,484.90 |

| Progressive | $4,499.22 | $4,499.22 |

| State Farm | $3,384.88 | $3,384.88 |

| USAA | $3,013.71 | $3,301.21 |

Three companies don’t charge higher rates for a longer commute: Liberty Mutual, Nationwide and Progressive. If you have a longer than normal commute, consider one of these companies.

Coverage Level Rates

| Company | Low Coverage | Medium Coverage | High Coverage |

|---|---|---|---|

| Allstate | $3,881.04 | $4,254.86 | $4,496.20 |

| Geico | $2,763.97 | $2,991.78 | $3,175.82 |

| Liberty Mutual | $9,636.66 | $9,998.75 | $10,524.93 |

| Nationwide | $6,334.12 | $6,602.52 | $6,518.06 |

| Progressive | $4,121.20 | $4,426.83 | $4,949.64 |

| State Farm | $3,167.98 | $3,387.35 | $3,599.32 |

| USAA | $3,013.26 | $3,141.23 | $3,317.90 |

If you’d like to get more bang for your buck, Nationwide or Liberty Mutual seem to have the best deals for higher coverage levels as compared to lower coverage levels.

Credit History Rates

One factor that insurance companies consider in providing a quote is your credit history because your score can possibly reflect how committed you are to making payments. Again, some states, like Michigan, have now outlawed adjusting rates based on score. But, as for Georgia, this factor still remains.

A credit score takes quite a while to dip unless you have unsafe spending habits in a short period of time or perhaps experienced a life event such as medical complications or a divorce. If you see an increase in your rates at policy renewal, it may be because your credit score dipped.

Always keep an eye on your score and check your credit reports twice per year to look for any questionable items.

As far as Georgia residents are concerned, they fall in the top ten with the lowest vantage scores according to a study from Experian. Scores average around 654 with an average of three credit cards and nearly $7,000 in credit debt.

In the table below are the rates for drivers with good, fair, and poor credit.

| Company | Good Credit | Fair Credit | Poor Credit |

|---|---|---|---|

| Allstate | $3,382.87 | $3,792.84 | $5,456.39 |

| Geico | $2,542.83 | $2,607.81 | $3,780.93 |

| Liberty Mutual | $6,923.06 | $8,834.05 | $14,403.23 |

| Nationwide | $5,476.79 | $6,258.58 | $7,719.34 |

| Progressive | $4,045.92 | $4,376.95 | $5,074.80 |

| State Farm | $2,368.08 | $2,988.35 | $4,798.23 |

| USAA | $2,469.31 | $2,892.23 | $4,110.85 |

Progressive appears to be the most forgiving for having a poor credit score. Liberty Mutual and State Farm, however, will penalize drivers whose credit scores dip into the poor threshold.

Driving Record Rates

If you are female, married, over the age of 25 and have a good credit score with a short commute, you may be doing well to get good rates. But if you have a lead foot or are a distracted or irresponsible driver in any way, your premium will increase if you get a ticket, cause an accident, or get a DUI.

| Company | Clean Record | One Speeding Ticket | One Accident | One DUI |

|---|---|---|---|---|

| Allstate | $3,465.70 | $3,647.83 | $5,365.97 | $4,363.29 |

| Geico | $1,991.22 | $2,244.40 | $2,493.90 | $5,179.25 |

| Liberty Mutual | $7,632.75 | $10,164.83 | $10,428.16 | $11,988.03 |

| Nationwide | $4,993.04 | $6,053.51 | $5,859.64 | $9,033.42 |

| Progressive | $3,524.11 | $4,102.75 | $6,212.74 | $4,157.29 |

| State Farm | $3,084.80 | $3,384.88 | $3,684.98 | $3,384.88 |

| USAA | $2,416.20 | $2,693.63 | $3,058.95 | $4,461.07 |

If one of these terrible incidents happen to you, expect your premium to more than double with Geico and increase by as little as 10 percent with State Farm.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Laws in Georgia

As we have already seen, laws can vary from state to state, change at a moments notice, or stay in effect well beyond the point at which everyone sees a bill was signed with unintended consequences.

Obeying the laws of the road are the best way to prevent your insurance rates from increasing as well as keep you and other drivers safe. Laws in each state can be very different, and they can change frequently.

In the following section, we will review specific details regarding driving laws for Georgia residents.

Car Insurance Laws in Georgia

There are a few specific laws related to car insurance when obtaining coverage, filing a claim, or filing a lawsuit. We cover these important laws in the following sections.

Windshield Coverage

Windshield repairs and replacement are usually covered under the comprehensive portion of your policy. Some state laws require insurance companies to charge a zero deductible; however, for Georgia residents, you are required to pay the comprehensive deductible you set when you began your policy.

The average driver sets their deductibles for comprehensive and collision to either $500 or $1,000, so if this applies to you, you may be better off paying for windshield repair or replacement out of pocket rather than filing a claim.

If you do decide to file a claim, your insurer is permitted to use aftermarket parts as long as they are listed as part of the estimate. If you prefer OEM parts, it is likely you will have to pay the difference.

You can also choose where to have the repair done, but you will have to pay the difference in cost for that as well because your insurer will have a preferred shop.

So you can quickly see that it will likely be more cost effective for you in the short term and long term if you pay out of pocket because if you file a claim, your premium may increase.

High-Risk Insurance

If you have previously been convicted for a DUI or otherwise had your license revoked, going through the voluntary market for car insurance may result in higher than normal premium quotes.

A solution may be to go through the Georgia Automobile Insurance Plan. There are specific eligibility requirements, but insurance companies contribute policies to a lottery to provide affordable coverage to those with a poor driving record.

If you do go through this program, you will not be able to select the company because it is a lottery. But you can apply for the program through any insurance carrier.

Low-Cost Insurance

Those who have income below the poverty level or who receive Medicaid and Medicare benefits are sometimes eligible for low-cost car insurance in some states. Unfortunately, Georgia does not currently have any programs in place.

Some states have programs set up for those who receive benefits from Medicaid or Medicare, or those who have a combined family income that is below the poverty level. Unfortunately, at this time, Georgia has no such plan in place.

You must carry the minimum liability coverage in order to obey the law. Therefore, in Georgia, you can’t afford not to have insurance.

Automobile Insurance Fraud in Georgia

In the Peach State, fraud is considered a crime. Fraud is more than just filing a false claim to get your car fixed. Fraud can be committed by anyone involved with car insurance which includes policyholders, adjusters, repair shops, insurance companies, and even physicians.

You can even be charged with fraud if you commit a “white lie” like saying you are married or have a shorter commute when you get your insurance quote.

If found guilty, you may be sentenced to two to 10 years in prison, fined up to $10,000, or ordered to pay restitution to victims. If you know of anyone suspected of fraud, you can submit a report on the Commissioner’s website.

Statute of Limitations

If you are in an accident and you are not at fault, certain types of coverages may come in handy such as personal injury protection (PIP) and underinsured motorist coverage.

PIP is a type of policy you can purchase to cover immediate costs such as medical expenses and lost wages. Underinsured motorist coverage will help if the driver at fault does not have enough liability coverage to pay for your medical expenses and property damage.

If you don’t have these types of coverages, you can rely on the other driver’s policy to reimburse you for your expenses, but it can take a while. This is why states establish a statute of limitation.

Georgia law allows two years from the date of the accident to file for a lawsuit for personal injury and four years for property damage.

The only exception to the two-year personal injury rule is if someone dies as a result of injuries in a car accident. The two year period can then begin on the date of the person’s death.

Vehicle Licensing Laws in Arkansas

Like all states, Georgia enforces licensing laws. Below we cover some of these laws.

REAL ID

Georgia is compliant with the REAL ID Act.

Penalties for Driving Without Insurance

For the 12 percent of Georgia drivers who choose not to carry insurance, penalties are in place. For the first and subsequent offenses within the same five year period, registration will be suspended and drivers will have to pay a $25 lapse fee and $60 reinstatement fee. Additional fees and taxes will be required as well.

Teen Driver Laws

| Young Driver Licensing Laws | Age Restrictions | Passenger Restrictions (family members excepted) | Time Restrictions |

|---|---|---|---|

| Learning Stage: 40 hours supervised driving, 6 of which must be at night | 15 years | no more than 1 passenger younger than 21 | midnight-5 a.m. secondary enforcement |

| Intermediate Stage: Driving while unsupervised with restrictions; those younger than 17 must have completed driver education; restrictions lifted at age 18 | Must be 16 years old and have held learner's permit for at least 12 months. | first 6 months—no passengers; second 6 months—no more than 1 passenger younger than 21; thereafter, no more than 3 passengers secondary enforcement | midnight-5 a.m. secondary enforcement |

Older Driver and General Population License Renewal Procedure

| License Renewal Procedures | General population | Older Population |

|---|---|---|

| License renewal cycle | 8 years | 8 years |

| Mail or online renewal permitted | by mail, limited to 2 consecutive renewals, but must appear in person at least every 16 years | by mail, limited to 2 consecutive renewals, but must appear in person at least every 16 years |

| Proof of adequate vision required at renewal | every renewal | every renewal |

New Residents

Transferring your current driver’s license to Georgia isn’t difficult at all as long as you do it before 30 days as a new resident. The Georgia Department of Driver Services (DDS) asks that you bring:

- Your current state-issued driver’s license

- Social Security card

- Two documents to show proofs of Georgia residency

- Proof of identity (birth certificate or passport)

You will surrender your other license and pay a fee to be issued a temporary GA license while you wait for your permanent one to arrive in the mail.

You can use your temporary license to then pay the taxes on your vehicle and get it registered. At this point, you will need to have proof of insurance in hand.

Comparative Negligence

Georgia is a modified comparative negligence state which means that, if you file suit against another driver to recover for bodily injury and property damage, your case will be investigated by a claims adjuster or heard by a judge or jury.

If you are found to be a certain percentage at fault in the accident (like turning right without stopping and the other driver ran a stop sign), the amount of money you can recover will be reduced to the percentage at which the other driver was at fault.

Be careful though, because if you are found to be 50 or more percent at fault, as the plaintiff, you will not be able to recover any losses.

Rules of the Road in Georgia

Obeying Georgia state laws as well as driving the speed limit and staying alert will help keep you and your family members safe. Here are a few of the rules of the road for Georgia residents.

Keep Right and Move Over Laws

While driving the roads in Georgia, you must yield and move right if a vehicle is blocking traffic in the left lane. If you are moving more slowly than the other traffic, you must move to the right lane and allow faster traffic to pass on the left.

If you approach a stationary emergency vehicle with flashing lights or a tow truck, utility, or maintenance vehicle with flashing lights, you must move a lane away, if possible. If this is not possible, reduce acceleration to a reasonable speed.

Speed Limits

Maximum posted speed limits are 70 mph on rural interstates, 70 mph on urban interstates, 65 mph on limited access roads and 65 mph on all other roads.

Seatbelt, Carseat, and Cargo Area Laws

Seat belts must be worn by any individual age eight through 17 years in both rear and front seats. Anyone 18 and over seated in the front must wear a seat belt. Failure to wear a seat belt will result in a $15 fine or $25 if it is a child age six to 18.

In Georgia, any child seven years and younger and 57 inches or less must be in a safety seat.

If a child weighs more than 40 pounds, he or she is permitted to use a lap belt in the back seat if there are other children in the back that weigh at least 40 pounds. Any child seven years and younger must be in the rear seat if available.

Any individual 18 and under are restricted from riding in the open cargo area of a truck. People 17 and younger also cannot ride in pickup trucks with a covered cargo area. Both of these cases apply to trucks on the interstate.

Ridesharing

Drivers in Georgia that wish to work for ridesharing services must carry personal car insurance that meets the state’s minimum requirements. If they wish, they can purchase a commercial policy through five insurance providers: Allstate, Farmers, Geico, State Farm, and USAA.

Automation on the Road

According to the Insurance Institute for Highway Safety (IIHS),

“Automation is the use of a machine or technology to perform a task or function that was previously carried out by a human. In driving, automation involves using radar, camera and other sensors to gather information about a vehicle’s surroundings, which is then used by computer programs to perform parts or all of the driving task on a sustained basis.”

Currently, Georgia considers automation technology fully deployed. Anyone operating a fully autonomous vehicle does not need to be licensed or be in the vehicle if the automated driving system is engaged.

Until December 31, 2019, the total liability insurance must be equal to 250 percent of the minimum required amount. After January 1, 2020, the liability insurance need only meet the minimum requirement.

Safety Laws in Georgia

Safety laws are in place to keep everyone safe on the roads; therefore, there are consequences if you drive while distracted or impaired.

DUI Laws

| DUI Sanctions | Limits |

|---|---|

| BAC Limit | 0.08 |

| HIGH BAC Limit | 0.15 |

| Criminal Status by Offense | 1st-2nd misdemeanors, 3rd high and aggravated misdemeanor, 4th+ felony |

| Formal Name for Offense | Driving Under the Influence (DUI) |

| Look Back Period/Washout Period | 10 years |

| 1st Offense-ALS or Revocation | 120 days minimum up to 1 year |

| 1st Offense Imprisonment | 10 days - 12 months, can all be suspended at judge's discretion unless HBAC, then all but 24 hours can be suspended |

| 1st Offense-Fine | $300-$1000 |

| 1st Offense-Other | 20-40 hours community service |

| 2nd Offense-DL Revocation | 3 years |

| 2nd Offense-Imprisonment | 90 days - 12 months; mandatory 72 hours for 2nd in 10 years, otherwise can be probated |

| 2nd Offense-Fine | $600-$1000 |

| 2nd Offense-Other | 30 days community service min, IID 6 months min, evaluation and treatment program mandatory, mandatory DUI school, photo of offender must be published in local newspaper |

| 3rd Offense-DL Revocation | 3rd offense in 5 years - 30 month revocation |

| 3rd Offense-Imprisonment | 120 days - 12 months; sentence can be probated unless 3rd in 10 years, then 15 days mandatory incarceration |

| 3rd Offense-Fine | $1000-$5000 |

| 3rd Offense-Other | min 30 days community service, 6 months IID, DUI school required, photo of offender must be published in local newspaper |

| 4th Offense-DL Revocation | N/A |

| 4th Offense-Imprisonment | 1-5 years, sentence can be probated to 90 days mandatory minimum |

| 4th Offense-Fine | $1000-$5000 |

| 4th Offense-Other | 60 days community service, can be suspended if 3 years jail term served, 6 months IID min |

| Mandatory Interlock | repeat offenders |

Marijuana-Impaired Driving Laws

Georgia is one of only seven states that currently have a zero tolerance for any amount of THC or metabolites in a driver’s system.

Distracted Driving Laws

Georgia has one of the strictest distracted driving laws across the nation. Distracted driving includes:

- Eating or drinking while driving

- Making adjustments to the music or stereo

- Having a conversation with other vehicles in the vehicle

- Any hygiene acts such as applying makeup, brushing hair, checking teeth, etc.

- Using any kind of navigation to include an app, GPS, or a paper map

- Texting

- Talking on a cell phone or headset

- Watching videos

If you are in an accident, be sure to not say anything about what you were doing or not doing, and get a lawyer right away.

Driving in Georgia

Knowing some of the data for your state related to theft, fatalities, and EMS response time will shed some light on the actual safety of Georgia roads.

Vehicle Theft in Georgia

Nearly 12,000 vehicle thefts occurred in Georgia in 2016. Drivers should be extra careful in some of the more populated areas that experience more vehicles as shown in the table below.

| City | Vehicle Thefts |

|---|---|

| Athens-Clarke County | 224 |

| Atlanta | 3,993 |

| College Park | 214 |

| Columbus | 852 |

| East Point | 582 |

| Marietta | 150 |

| Sandy Springs | 214 |

| Savannah-Chatham Metropolitan | 960 |

| Union City | 367 |

| Warner Robins | 218 |

Also important to consider is what make and model of vehicle you decide to purchase because certain models are stolen more often than others. The table below lists the make, model, and model year for the most stolen vehicles in Georgia.

| Rank | Make/Model | Year Model of Vehicle | Number of Thefts |

|---|---|---|---|

| 1 | Honda Accord | 1997 | 1,052 |

| 2 | Ford Pickup (Full Size) | 2006 | 954 |

| 3 | Chevrolet Pickup (Full Size) | 1999 | 948 |

| 4 | Honda Civic | 2000 | 653 |

| 5 | Toyota Camry | 2014 | 568 |

| 6 | Chevrolet Impala | 2008 | 512 |

| 7 | Nissan Altima | 2014 | 484 |

| 8 | Dodge Pickup (Full Size) | 2003 | 452 |

| 9 | Jeep Cherokee/Grand Cherokee | 2001 | 449 |

| 10 | Dodge Caravan | 2002 | 425 |

Road Fatalities in Georgia

In 2017, there were 115 fatalities in Fulton County alone. Let’s examine the data more closely regarding the different types of fatalities.

Fatal Crashes by Weather Condition and Light Condition

| Weather Condition | Daylight | Dark, but Lighted | Dark | Dawn or Dusk | Other / Unknown | Total |

|---|---|---|---|---|---|---|

| Normal | 690 | 140 | 448 | 44 | 1 | 1,323 |

| Rain | 44 | 7 | 39 | 2 | 0 | 92 |

| Snow/Sleet | 3 | 0 | 1 | 0 | 0 | 4 |

| Other | 3 | 1 | 14 | 1 | 0 | 19 |

| Unknown | 1 | 0 | 1 | 0 | 0 | 2 |

| TOTAL | 741 | 148 | 503 | 47 | 1 | 1,440 |

Fatalities (All Crashes) by County

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Appling County | 1 | 8 | 4 | 5 | 7 |

| Atkinson County | 0 | 0 | 4 | 3 | 1 |

| Bacon County | 2 | 1 | 6 | 4 | 4 |

| Baker County | 0 | 4 | 2 | 2 | 2 |

| Baldwin County | 6 | 5 | 5 | 12 | 8 |

| Banks County | 2 | 7 | 7 | 8 | 3 |

| Barrow County | 11 | 9 | 12 | 10 | 12 |

| Bartow County | 17 | 21 | 29 | 26 | 17 |

| Ben Hill County | 1 | 3 | 0 | 2 | 3 |

| Berrien County | 4 | 2 | 2 | 4 | 4 |

| Bibb County | 31 | 23 | 21 | 28 | 34 |

| Bleckley County | 2 | 0 | 5 | 2 | 1 |

| Brantley County | 3 | 2 | 2 | 4 | 4 |

| Brooks County | 8 | 3 | 6 | 4 | 0 |

| Bryan County | 2 | 5 | 8 | 13 | 4 |

| Bulloch County | 15 | 16 | 15 | 18 | 14 |

| Burke County | 12 | 7 | 3 | 8 | 12 |

| Butts County | 3 | 5 | 8 | 3 | 3 |

| Calhoun County | 0 | 0 | 0 | 0 | 2 |

| Camden County | 6 | 9 | 5 | 7 | 10 |

| Candler County | 2 | 2 | 3 | 4 | 4 |

| Carroll County | 16 | 21 | 27 | 20 | 28 |

| Catoosa County | 5 | 8 | 9 | 13 | 3 |

| Charlton County | 4 | 1 | 3 | 2 | 2 |

| Chatham County | 44 | 26 | 54 | 44 | 29 |

| Chattahoochee County | 0 | 0 | 3 | 1 | 4 |

| Chattooga County | 5 | 4 | 4 | 7 | 6 |

| Cherokee County | 16 | 12 | 12 | 7 | 32 |

| Clarke County | 7 | 9 | 15 | 13 | 6 |

| Clay County | 2 | 1 | 0 | 1 | 0 |

| Clayton County | 26 | 21 | 26 | 48 | 32 |

| Clinch County | 2 | 1 | 1 | 3 | 3 |

| Cobb County | 59 | 49 | 49 | 59 | 53 |

| Coffee County | 3 | 6 | 7 | 7 | 8 |

| Colquitt County | 5 | 17 | 13 | 8 | 12 |

| Columbia County | 10 | 7 | 15 | 17 | 21 |

| Cook County | 2 | 5 | 6 | 8 | 5 |

| Coweta County | 10 | 12 | 18 | 22 | 23 |

| Crawford County | 1 | 4 | 4 | 4 | 5 |

| Crisp County | 2 | 4 | 5 | 2 | 2 |

| Dade County | 4 | 6 | 5 | 3 | 2 |

| Dawson County | 7 | 5 | 12 | 5 | 7 |

| Decatur County | 10 | 7 | 6 | 12 | 12 |

| Dekalb County | 70 | 55 | 83 | 80 | 95 |

| Dodge County | 4 | 2 | 5 | 4 | 6 |

| Dooly County | 6 | 4 | 2 | 6 | 1 |

| Dougherty County | 10 | 12 | 13 | 20 | 13 |

| Douglas County | 19 | 12 | 22 | 21 | 17 |

| Early County | 4 | 2 | 8 | 7 | 7 |

| Echols County | 0 | 1 | 2 | 1 | 2 |

| Effingham County | 14 | 16 | 5 | 12 | 6 |

| Elbert County | 2 | 7 | 3 | 7 | 3 |

| Emanuel County | 7 | 12 | 10 | 5 | 8 |

| Evans County | 4 | 6 | 0 | 4 | 4 |

| Fannin County | 6 | 4 | 3 | 1 | 6 |

| Fayette County | 8 | 10 | 7 | 8 | 14 |

| Floyd County | 10 | 16 | 14 | 18 | 12 |

| Forsyth County | 17 | 11 | 13 | 11 | 15 |

| Franklin County | 3 | 4 | 6 | 7 | 8 |

| Fulton County | 85 | 77 | 104 | 130 | 115 |

| Gilmer County | 5 | 7 | 7 | 6 | 10 |

| Glascock County | 0 | 1 | 0 | 2 | 0 |

| Glynn County | 13 | 16 | 9 | 7 | 16 |

| Gordon County | 11 | 5 | 8 | 13 | 5 |

| Grady County | 3 | 4 | 9 | 5 | 7 |

| Greene County | 8 | 4 | 8 | 4 | 5 |

| Gwinnett County | 45 | 55 | 67 | 61 | 66 |

| Habersham County | 7 | 5 | 9 | 12 | 7 |

| Hall County | 17 | 21 | 33 | 31 | 31 |

| Hancock County | 1 | 3 | 7 | 2 | 3 |

| Haralson County | 8 | 3 | 7 | 7 | 5 |

| Harris County | 2 | 4 | 8 | 9 | 9 |

| Hart County | 1 | 6 | 5 | 5 | 7 |

| Heard County | 1 | 1 | 3 | 4 | 2 |

| Henry County | 26 | 26 | 29 | 26 | 27 |

| Houston County | 9 | 8 | 11 | 17 | 12 |

| Irwin County | 5 | 4 | 1 | 3 | 2 |

| Jackson County | 6 | 7 | 19 | 23 | 24 |

| Jasper County | 2 | 2 | 3 | 5 | 7 |

| Jeff Davis County | 6 | 2 | 3 | 4 | 3 |

| Jefferson County | 4 | 4 | 6 | 9 | 4 |

| Jenkins County | 2 | 1 | 4 | 8 | 0 |

| Johnson County | 0 | 1 | 1 | 3 | 2 |

| Jones County | 3 | 4 | 3 | 8 | 8 |

| Lamar County | 3 | 8 | 6 | 3 | 3 |

| Lanier County | 1 | 2 | 0 | 1 | 0 |

| Laurens County | 16 | 8 | 11 | 9 | 13 |

| Lee County | 4 | 3 | 3 | 3 | 2 |

| Liberty County | 6 | 7 | 8 | 8 | 14 |

| Lincoln County | 1 | 0 | 2 | 2 | 0 |

| Long County | 1 | 2 | 2 | 2 | 8 |

| Lowndes County | 7 | 13 | 18 | 17 | 17 |

| Lumpkin County | 4 | 3 | 6 | 5 | 9 |

| Macon County | 6 | 4 | 2 | 2 | 7 |

| Madison County | 11 | 7 | 4 | 4 | 5 |

| Marion County | 1 | 2 | 1 | 3 | 1 |

| Mcduffie County | 3 | 12 | 4 | 6 | 6 |

| Mcintosh County | 4 | 4 | 2 | 5 | 6 |

| Meriwether County | 6 | 3 | 6 | 8 | 4 |

| Miller County | 1 | 0 | 2 | 4 | 0 |

| Mitchell County | 4 | 5 | 3 | 4 | 9 |

| Monroe County | 11 | 7 | 6 | 14 | 12 |

| Montgomery County | 4 | 1 | 2 | 3 | 5 |

| Morgan County | 3 | 5 | 8 | 10 | 9 |

| Murray County | 12 | 18 | 9 | 8 | 6 |

| Muscogee County | 14 | 17 | 14 | 27 | 26 |

| Newton County | 18 | 7 | 18 | 21 | 17 |

| Oconee County | 4 | 3 | 5 | 9 | 6 |

| Oglethorpe County | 2 | 3 | 4 | 2 | 0 |

| Paulding County | 14 | 8 | 24 | 21 | 15 |

| Peach County | 3 | 1 | 10 | 6 | 9 |

| Pickens County | 4 | 5 | 7 | 3 | 8 |

| Pierce County | 3 | 3 | 5 | 4 | 2 |

| Pike County | 3 | 2 | 9 | 2 | 8 |

| Polk County | 7 | 7 | 5 | 13 | 7 |

| Pulaski County | 2 | 2 | 2 | 1 | 1 |

| Putnam County | 2 | 1 | 6 | 8 | 8 |

| Quitman County | 0 | 0 | 0 | 0 | 0 |

| Rabun County | 2 | 4 | 7 | 3 | 6 |

| Randolph County | 2 | 3 | 1 | 0 | 1 |

| Richmond County | 23 | 27 | 27 | 17 | 32 |

| Rockdale County | 8 | 9 | 7 | 13 | 14 |

| Schley County | 2 | 0 | 0 | 2 | 0 |

| Screven County | 3 | 7 | 6 | 4 | 6 |

| Seminole County | 1 | 0 | 2 | 4 | 0 |

| Spalding County | 9 | 9 | 9 | 11 | 10 |

| Stephens County | 5 | 4 | 5 | 3 | 12 |

| Stewart County | 0 | 0 | 1 | 1 | 2 |

| Sumter County | 1 | 7 | 2 | 7 | 6 |

| Talbot County | 6 | 2 | 1 | 0 | 5 |

| Taliaferro County | 4 | 1 | 2 | 1 | 1 |

| Tattnall County | 1 | 6 | 5 | 2 | 5 |

| Taylor County | 2 | 0 | 1 | 3 | 6 |

| Telfair County | 4 | 1 | 4 | 3 | 5 |

| Terrell County | 2 | 1 | 1 | 2 | 4 |

| Thomas County | 5 | 6 | 4 | 10 | 10 |

| Tift County | 6 | 8 | 5 | 12 | 10 |

| Toombs County | 5 | 5 | 5 | 3 | 4 |

| Towns County | 5 | 3 | 3 | 2 | 3 |

| Treutlen County | 3 | 2 | 6 | 2 | 3 |

| Troup County | 19 | 14 | 9 | 16 | 15 |

| Turner County | 1 | 3 | 2 | 4 | 2 |

| Twiggs County | 1 | 2 | 5 | 7 | 6 |

| Union County | 3 | 1 | 4 | 7 | 7 |

| Upson County | 2 | 3 | 5 | 4 | 0 |

| Walker County | 8 | 4 | 11 | 9 | 8 |

| Walton County | 4 | 4 | 10 | 16 | 11 |

| Ware County | 3 | 2 | 5 | 11 | 6 |

| Warren County | 5 | 4 | 6 | 5 | 3 |

| Washington County | 3 | 1 | 9 | 6 | 9 |

| Wayne County | 5 | 5 | 4 | 3 | 9 |

| Webster County | 1 | 1 | 2 | 2 | 0 |

| Wheeler County | 1 | 0 | 3 | 3 | 2 |

| White County | 2 | 4 | 4 | 9 | 7 |

| Whitfield County | 12 | 13 | 17 | 13 | 13 |

| Wilcox County | 0 | 3 | 1 | 1 | 1 |

| Wilkes County | 0 | 2 | 1 | 1 | 1 |

| Wilkinson County | 0 | 6 | 5 | 5 | 4 |

| Worth County | 4 | 11 | 10 | 2 | 10 |

Traffic Fatalities Rural vs Urban

| Crash Location | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Rural | 557 | 462 | 565 | 603 | 573 |

| Urban | 621 | 702 | 867 | 953 | 966 |

Fatalities by Person Type

| Person Type (2017) | Number |

|---|---|

| Occupants (Enclosed Vehicles) | 1,127 |

| Motorcyclists | 139 |

| Nonoccupants | 274 |

Fatalities by Crash Type

| Crash Type (2017) | Number |

|---|---|

| Single Vehicle | 823 |

| Involving a Large Truck | 214 |

| Involving Speeding | 248 |

| Involving a Rollover | 361 |

| Involving a Roadway Departure | 769 |

| Involving an Intersection (or Intersection Related) | 401 |

Five-Year Trend for the Top 10 Counties

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Fulton County | 85 | 77 | 104 | 130 | 115 |

| Dekalb County | 70 | 55 | 83 | 80 | 95 |

| Gwinnett County | 45 | 55 | 67 | 61 | 66 |

| Cobb County | 59 | 49 | 49 | 59 | 53 |

| Bibb County | 31 | 23 | 21 | 28 | 34 |

| Cherokee County | 16 | 12 | 12 | 7 | 32 |

| Clayton County | 26 | 21 | 26 | 48 | 32 |

| Richmond County | 23 | 27 | 27 | 17 | 32 |

| Hall County | 17 | 21 | 33 | 31 | 31 |

| Chatham County | 44 | 26 | 54 | 44 | 29 |

| Top Ten Counties | 428 | 380 | 502 | 534 | 519 |

| All Other Counties | 752 | 784 | 930 | 1,022 | 1,021 |

| All Counties | 1,180 | 1,164 | 1,432 | 1,556 | 1,540 |

Fatalities Involving Speeding by County

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Appling County | 0 | 0 | 4 | 1 | 0 |

| Atkinson County | 0 | 0 | 1 | 0 | 0 |

| Bacon County | 0 | 0 | 2 | 0 | 0 |

| Baker County | 0 | 0 | 2 | 2 | 2 |

| Baldwin County | 0 | 0 | 2 | 3 | 1 |

| Banks County | 0 | 1 | 2 | 0 | 0 |

| Barrow County | 1 | 1 | 4 | 1 | 1 |

| Bartow County | 0 | 1 | 3 | 4 | 0 |

| Ben Hill County | 0 | 1 | 0 | 0 | 0 |

| Berrien County | 0 | 2 | 1 | 0 | 0 |

| Bibb County | 6 | 4 | 3 | 7 | 8 |

| Bleckley County | 0 | 0 | 1 | 0 | 1 |

| Brantley County | 0 | 1 | 0 | 0 | 0 |

| Brooks County | 1 | 2 | 0 | 2 | 0 |

| Bryan County | 0 | 1 | 0 | 4 | 1 |

| Bulloch County | 0 | 1 | 2 | 2 | 2 |

| Burke County | 3 | 0 | 0 | 0 | 1 |

| Butts County | 0 | 1 | 0 | 0 | 0 |

| Calhoun County | 0 | 0 | 0 | 0 | 0 |

| Camden County | 2 | 4 | 1 | 1 | 2 |

| Candler County | 0 | 0 | 1 | 0 | 0 |

| Carroll County | 3 | 3 | 6 | 2 | 6 |

| Catoosa County | 3 | 2 | 4 | 2 | 1 |

| Charlton County | 1 | 1 | 1 | 0 | 0 |

| Chatham County | 13 | 7 | 9 | 9 | 7 |

| Chattahoochee County | 0 | 0 | 0 | 0 | 0 |

| Chattooga County | 2 | 1 | 1 | 2 | 0 |

| Cherokee County | 2 | 5 | 1 | 0 | 8 |

| Clarke County | 1 | 2 | 4 | 4 | 1 |

| Clay County | 0 | 0 | 0 | 0 | 0 |

| Clayton County | 5 | 6 | 3 | 14 | 8 |

| Clinch County | 1 | 0 | 0 | 1 | 1 |

| Cobb County | 16 | 6 | 13 | 19 | 13 |

| Coffee County | 0 | 1 | 3 | 1 | 3 |

| Colquitt County | 1 | 5 | 0 | 0 | 2 |

| Columbia County | 4 | 3 | 3 | 7 | 7 |

| Cook County | 0 | 0 | 2 | 2 | 1 |

| Coweta County | 1 | 3 | 7 | 2 | 4 |

| Crawford County | 0 | 1 | 3 | 2 | 1 |

| Crisp County | 0 | 0 | 0 | 0 | 0 |

| Dade County | 0 | 0 | 0 | 0 | 0 |

| Dawson County | 2 | 0 | 1 | 1 | 2 |

| Decatur County | 0 | 0 | 1 | 2 | 2 |

| Dekalb County | 11 | 11 | 19 | 17 | 15 |

| Dodge County | 0 | 0 | 2 | 1 | 0 |

| Dooly County | 1 | 0 | 0 | 1 | 0 |

| Dougherty County | 0 | 4 | 3 | 2 | 0 |

| Douglas County | 8 | 2 | 6 | 6 | 3 |

| Early County | 0 | 1 | 0 | 1 | 0 |

| Echols County | 0 | 0 | 0 | 0 | 0 |

| Effingham County | 1 | 3 | 1 | 1 | 1 |

| Elbert County | 1 | 1 | 0 | 0 | 0 |

| Emanuel County | 0 | 0 | 2 | 0 | 0 |

| Evans County | 0 | 0 | 0 | 0 | 0 |

| Fannin County | 1 | 0 | 0 | 0 | 0 |

| Fayette County | 0 | 4 | 1 | 1 | 1 |

| Floyd County | 4 | 1 | 5 | 4 | 2 |

| Forsyth County | 3 | 2 | 5 | 2 | 5 |

| Franklin County | 0 | 1 | 1 | 1 | 1 |

| Fulton County | 17 | 22 | 29 | 26 | 21 |

| Gilmer County | 1 | 0 | 0 | 1 | 0 |

| Glascock County | 0 | 0 | 0 | 2 | 0 |

| Glynn County | 4 | 3 | 0 | 1 | 3 |

| Gordon County | 4 | 2 | 0 | 2 | 1 |

| Grady County | 0 | 0 | 1 | 1 | 1 |

| Greene County | 1 | 0 | 3 | 0 | 2 |

| Gwinnett County | 8 | 18 | 9 | 15 | 16 |

| Habersham County | 1 | 0 | 1 | 2 | 1 |

| Hall County | 1 | 2 | 6 | 3 | 3 |

| Hancock County | 0 | 0 | 1 | 0 | 0 |

| Haralson County | 2 | 1 | 4 | 0 | 1 |

| Harris County | 0 | 2 | 1 | 3 | 1 |

| Hart County | 0 | 0 | 0 | 1 | 1 |

| Heard County | 0 | 0 | 0 | 0 | 0 |

| Henry County | 2 | 9 | 3 | 3 | 4 |

| Houston County | 2 | 1 | 2 | 4 | 1 |

| Irwin County | 1 | 1 | 0 | 0 | 0 |

| Jackson County | 0 | 0 | 0 | 3 | 4 |

| Jasper County | 1 | 0 | 0 | 0 | 0 |

| Jeff Davis County | 1 | 1 | 0 | 0 | 0 |

| Jefferson County | 0 | 0 | 0 | 1 | 0 |

| Jenkins County | 0 | 0 | 0 | 0 | 0 |

| Johnson County | 0 | 0 | 0 | 0 | 0 |

| Jones County | 0 | 0 | 0 | 0 | 2 |

| Lamar County | 0 | 5 | 0 | 0 | 1 |

| Lanier County | 1 | 0 | 0 | 0 | 0 |

| Laurens County | 3 | 2 | 2 | 0 | 2 |

| Lee County | 1 | 0 | 0 | 0 | 0 |

| Liberty County | 1 | 1 | 1 | 3 | 1 |

| Lincoln County | 0 | 0 | 0 | 0 | 0 |

| Long County | 0 | 0 | 0 | 1 | 2 |

| Lowndes County | 0 | 3 | 0 | 1 | 2 |

| Lumpkin County | 1 | 0 | 4 | 1 | 0 |

| Macon County | 1 | 0 | 0 | 0 | 1 |

| Madison County | 1 | 0 | 1 | 0 | 1 |

| Marion County | 0 | 1 | 0 | 1 | 0 |

| Mcduffie County | 0 | 4 | 0 | 1 | 1 |

| Mcintosh County | 0 | 0 | 0 | 0 | 1 |

| Meriwether County | 0 | 2 | 2 | 3 | 0 |

| Miller County | 0 | 0 | 0 | 3 | 0 |

| Mitchell County | 0 | 0 | 0 | 0 | 2 |

| Monroe County | 2 | 4 | 1 | 1 | 2 |

| Montgomery County | 0 | 0 | 0 | 0 | 0 |

| Morgan County | 2 | 0 | 3 | 2 | 1 |

| Murray County | 6 | 6 | 2 | 1 | 3 |

| Muscogee County | 2 | 3 | 4 | 4 | 7 |

| Newton County | 4 | 1 | 3 | 2 | 2 |

| Oconee County | 1 | 0 | 0 | 0 | 1 |

| Oglethorpe County | 1 | 0 | 0 | 0 | 0 |

| Paulding County | 0 | 1 | 3 | 2 | 3 |

| Peach County | 0 | 0 | 4 | 1 | 2 |

| Pickens County | 0 | 0 | 2 | 0 | 1 |

| Pierce County | 0 | 1 | 1 | 1 | 0 |

| Pike County | 1 | 0 | 3 | 1 | 2 |

| Polk County | 0 | 2 | 0 | 0 | 0 |

| Pulaski County | 0 | 0 | 0 | 0 | 0 |

| Putnam County | 1 | 0 | 1 | 1 | 2 |

| Quitman County | 0 | 0 | 0 | 0 | 0 |

| Rabun County | 0 | 0 | 0 | 0 | 0 |

| Randolph County | 1 | 0 | 0 | 0 | 0 |

| Richmond County | 3 | 4 | 5 | 9 | 8 |

| Rockdale County | 0 | 0 | 0 | 2 | 1 |

| Schley County | 0 | 0 | 0 | 0 | 0 |

| Screven County | 1 | 3 | 0 | 2 | 0 |

| Seminole County | 0 | 0 | 0 | 1 | 0 |

| Spalding County | 0 | 0 | 2 | 2 | 0 |

| Stephens County | 0 | 1 | 0 | 0 | 4 |

| Stewart County | 0 | 0 | 0 | 1 | 2 |

| Sumter County | 0 | 1 | 0 | 0 | 1 |

| Talbot County | 1 | 0 | 0 | 0 | 0 |

| Taliaferro County | 0 | 0 | 0 | 0 | 0 |

| Tattnall County | 0 | 0 | 0 | 0 | 1 |

| Taylor County | 0 | 0 | 0 | 0 | 2 |

| Telfair County | 0 | 0 | 0 | 1 | 0 |

| Terrell County | 0 | 0 | 0 | 0 | 1 |

| Thomas County | 1 | 0 | 0 | 2 | 2 |

| Tift County | 2 | 1 | 0 | 1 | 4 |

| Toombs County | 0 | 0 | 1 | 1 | 0 |

| Towns County | 0 | 1 | 0 | 0 | 0 |

| Treutlen County | 0 | 0 | 0 | 0 | 0 |

| Troup County | 2 | 3 | 0 | 3 | 1 |

| Turner County | 0 | 0 | 0 | 0 | 0 |

| Twiggs County | 0 | 0 | 0 | 0 | 0 |

| Union County | 0 | 0 | 1 | 0 | 1 |

| Upson County | 0 | 0 | 3 | 0 | 0 |

| Walker County | 0 | 0 | 3 | 1 | 0 |

| Walton County | 0 | 1 | 2 | 3 | 1 |

| Ware County | 1 | 0 | 1 | 0 | 0 |

| Warren County | 2 | 0 | 3 | 0 | 1 |

| Washington County | 1 | 0 | 1 | 1 | 0 |

| Wayne County | 2 | 1 | 0 | 0 | 0 |

| Webster County | 0 | 0 | 0 | 0 | 0 |

| Wheeler County | 1 | 0 | 1 | 0 | 0 |

| White County | 2 | 0 | 0 | 2 | 0 |

| Whitfield County | 3 | 0 | 9 | 2 | 2 |

| Wilcox County | 0 | 0 | 1 | 0 | 0 |

| Wilkes County | 0 | 1 | 0 | 0 | 0 |

| Wilkinson County | 0 | 0 | 0 | 0 | 0 |

| Worth County | 1 | 2 | 2 | 0 | 0 |

Fatalities in Crashes Involving an Alcohol-Impaired Driver by County

| County | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|

| Appling County | 0 | 1 | 0 | 1 | 2 |

| Atkinson County | 0 | 0 | 2 | 0 | 0 |

| Bacon County | 0 | 1 | 1 | 2 | 0 |

| Baker County | 0 | 1 | 1 | 2 | 2 |

| Baldwin County | 1 | 2 | 2 | 1 | 2 |

| Banks County | 1 | 0 | 0 | 1 | 0 |

| Barrow County | 5 | 1 | 4 | 3 | 2 |

| Bartow County | 4 | 8 | 6 | 5 | 2 |

| Ben Hill County | 1 | 0 | 0 | 1 | 1 |

| Berrien County | 3 | 1 | 1 | 0 | 0 |

| Bibb County | 6 | 6 | 6 | 4 | 8 |

| Bleckley County | 0 | 0 | 0 | 0 | 0 |

| Brantley County | 0 | 1 | 0 | 0 | 2 |

| Brooks County | 1 | 2 | 2 | 2 | 0 |

| Bryan County | 0 | 0 | 1 | 7 | 2 |

| Bulloch County | 5 | 6 | 4 | 2 | 5 |

| Burke County | 4 | 3 | 0 | 4 | 5 |

| Butts County | 0 | 2 | 2 | 0 | 1 |

| Calhoun County | 0 | 0 | 0 | 0 | 0 |

| Camden County | 2 | 3 | 2 | 2 | 6 |

| Candler County | 2 | 0 | 1 | 0 | 0 |

| Carroll County | 4 | 3 | 7 | 3 | 7 |

| Catoosa County | 1 | 2 | 3 | 4 | 2 |

| Charlton County | 0 | 0 | 2 | 1 | 1 |

| Chatham County | 13 | 9 | 14 | 14 | 6 |

| Chattahoochee County | 0 | 0 | 0 | 0 | 3 |

| Chattooga County | 1 | 1 | 0 | 2 | 2 |

| Cherokee County | 3 | 2 | 3 | 0 | 3 |

| Clarke County | 2 | 1 | 6 | 1 | 3 |

| Clay County | 0 | 0 | 0 | 0 | 0 |

| Clayton County | 8 | 5 | 6 | 11 | 9 |

| Clinch County | 1 | 0 | 0 | 1 | 0 |

| Cobb County | 19 | 11 | 12 | 20 | 15 |

| Coffee County | 0 | 2 | 2 | 1 | 3 |

| Colquitt County | 0 | 5 | 3 | 3 | 4 |

| Columbia County | 3 | 1 | 0 | 5 | 5 |

| Cook County | 0 | 1 | 0 | 2 | 0 |

| Coweta County | 1 | 2 | 5 | 7 | 4 |

| Crawford County | 0 | 1 | 2 | 0 | 0 |

| Crisp County | 0 | 0 | 1 | 0 | 0 |

| Dade County | 2 | 2 | 1 | 0 | 1 |

| Dawson County | 0 | 0 | 2 | 1 | 3 |

| Decatur County | 3 | 1 | 0 | 4 | 3 |

| Dekalb County | 21 | 13 | 25 | 21 | 26 |

| Dodge County | 1 | 1 | 0 | 1 | 1 |

| Dooly County | 2 | 0 | 0 | 1 | 1 |

| Dougherty County | 1 | 2 | 2 | 5 | 2 |

| Douglas County | 5 | 3 | 4 | 5 | 4 |

| Early County | 1 | 0 | 1 | 2 | 1 |

| Echols County | 0 | 0 | 1 | 1 | 1 |

| Effingham County | 1 | 4 | 2 | 1 | 2 |

| Elbert County | 1 | 1 | 1 | 3 | 1 |

| Emanuel County | 2 | 2 | 3 | 2 | 3 |

| Evans County | 0 | 2 | 0 | 0 | 1 |

| Fannin County | 2 | 1 | 1 | 0 | 0 |

| Fayette County | 2 | 2 | 2 | 2 | 2 |

| Floyd County | 2 | 2 | 2 | 2 | 2 |

| Forsyth County | 2 | 2 | 4 | 1 | 3 |

| Franklin County | 0 | 0 | 2 | 0 | 3 |

| Fulton County | 21 | 19 | 31 | 36 | 27 |

| Gilmer County | 0 | 2 | 1 | 1 | 1 |

| Glascock County | 0 | 1 | 0 | 1 | 0 |

| Glynn County | 1 | 3 | 1 | 1 | 5 |

| Gordon County | 3 | 0 | 2 | 3 | 1 |

| Grady County | 2 | 1 | 2 | 2 | 2 |

| Greene County | 0 | 2 | 3 | 1 | 1 |

| Gwinnett County | 11 | 14 | 20 | 24 | 24 |

| Habersham County | 1 | 3 | 4 | 4 | 1 |

| Hall County | 8 | 4 | 9 | 9 | 8 |

| Hancock County | 0 | 1 | 4 | 0 | 0 |

| Haralson County | 0 | 0 | 4 | 1 | 1 |

| Harris County | 1 | 1 | 1 | 3 | 2 |

| Hart County | 0 | 4 | 2 | 1 | 3 |

| Heard County | 0 | 0 | 0 | 1 | 0 |

| Henry County | 6 | 8 | 5 | 7 | 6 |

| Houston County | 2 | 1 | 3 | 5 | 3 |

| Irwin County | 1 | 2 | 1 | 0 | 0 |

| Jackson County | 1 | 0 | 2 | 3 | 4 |

| Jasper County | 1 | 0 | 1 | 2 | 3 |

| Jeff Davis County | 2 | 2 | 0 | 1 | 0 |

| Jefferson County | 1 | 0 | 3 | 4 | 0 |

| Jenkins County | 0 | 0 | 1 | 1 | 0 |

| Johnson County | 0 | 0 | 0 | 0 | 0 |

| Jones County | 2 | 1 | 0 | 1 | 1 |

| Lamar County | 0 | 4 | 2 | 1 | 0 |

| Lanier County | 0 | 0 | 0 | 0 | 0 |

| Laurens County | 2 | 1 | 3 | 3 | 2 |

| Lee County | 1 | 1 | 2 | 0 | 0 |

| Liberty County | 1 | 2 | 2 | 1 | 1 |

| Lincoln County | 0 | 0 | 0 | 0 | 0 |

| Long County | 0 | 0 | 1 | 1 | 2 |

| Lowndes County | 0 | 2 | 3 | 4 | 3 |

| Lumpkin County | 1 | 1 | 1 | 1 | 2 |

| Macon County | 2 | 1 | 1 | 0 | 1 |

| Madison County | 3 | 1 | 2 | 1 | 2 |

| Marion County | 0 | 2 | 0 | 2 | 1 |

| Mcduffie County | 1 | 3 | 0 | 2 | 2 |

| Mcintosh County | 1 | 0 | 0 | 3 | 2 |

| Meriwether County | 1 | 2 | 2 | 3 | 1 |

| Miller County | 1 | 0 | 1 | 0 | 0 |

| Mitchell County | 2 | 2 | 1 | 1 | 2 |

| Monroe County | 5 | 1 | 2 | 6 | 3 |

| Montgomery County | 0 | 1 | 0 | 0 | 0 |

| Morgan County | 0 | 0 | 1 | 2 | 2 |

| Murray County | 4 | 2 | 1 | 1 | 2 |

| Muscogee County | 5 | 4 | 5 | 7 | 11 |

| Newton County | 4 | 2 | 7 | 2 | 7 |

| Oconee County | 0 | 0 | 1 | 1 | 1 |

| Oglethorpe County | 1 | 0 | 1 | 1 | 0 |

| Paulding County | 3 | 1 | 6 | 6 | 3 |

| Peach County | 3 | 1 | 6 | 2 | 3 |

| Pickens County | 0 | 1 | 0 | 1 | 2 |

| Pierce County | 1 | 0 | 0 | 1 | 2 |

| Pike County | 0 | 0 | 3 | 0 | 1 |

| Polk County | 1 | 1 | 0 | 2 | 1 |

| Pulaski County | 0 | 0 | 0 | 1 | 1 |

| Putnam County | 2 | 0 | 1 | 3 | 3 |

| Quitman County | 0 | 0 | 0 | 0 | 0 |

| Rabun County | 0 | 2 | 1 | 1 | 0 |

| Randolph County | 2 | 0 | 0 | 0 | 1 |

| Richmond County | 8 | 6 | 6 | 4 | 8 |

| Rockdale County | 3 | 4 | 2 | 1 | 6 |

| Schley County | 1 | 0 | 0 | 0 | 0 |

| Screven County | 0 | 3 | 0 | 2 | 2 |

| Seminole County | 0 | 0 | 0 | 0 | 0 |

| Spalding County | 2 | 2 | 4 | 3 | 0 |

| Stephens County | 0 | 1 | 0 | 0 | 3 |

| Stewart County | 0 | 0 | 0 | 0 | 1 |

| Sumter County | 1 | 2 | 1 | 2 | 0 |

| Talbot County | 4 | 0 | 0 | 0 | 3 |

| Taliaferro County | 0 | 0 | 0 | 0 | 0 |

| Tattnall County | 0 | 4 | 2 | 0 | 1 |

| Taylor County | 0 | 0 | 0 | 0 | 3 |

| Telfair County | 1 | 0 | 1 | 0 | 1 |

| Terrell County | 0 | 0 | 0 | 0 | 1 |

| Thomas County | 1 | 3 | 0 | 2 | 1 |

| Tift County | 1 | 1 | 0 | 2 | 0 |

| Toombs County | 0 | 0 | 0 | 1 | 0 |

| Towns County | 0 | 1 | 0 | 0 | 1 |

| Treutlen County | 0 | 0 | 0 | 0 | 0 |

| Troup County | 10 | 6 | 2 | 4 | 2 |

| Turner County | 0 | 1 | 0 | 0 | 0 |

| Twiggs County | 0 | 0 | 2 | 0 | 0 |

| Union County | 0 | 0 | 1 | 1 | 1 |

| Upson County | 0 | 1 | 1 | 2 | 0 |

| Walker County | 1 | 0 | 2 | 3 | 1 |

| Walton County | 1 | 1 | 0 | 3 | 1 |

| Ware County | 0 | 0 | 2 | 4 | 2 |

| Warren County | 1 | 0 | 0 | 1 | 0 |

| Washington County | 1 | 0 | 3 | 1 | 3 |

| Wayne County | 2 | 1 | 1 | 1 | 1 |

| Webster County | 1 | 1 | 0 | 0 | 0 |

| Wheeler County | 0 | 0 | 1 | 1 | 0 |

| White County | 0 | 1 | 0 | 4 | 1 |

| Whitfield County | 3 | 2 | 6 | 3 | 2 |

| Wilcox County | 0 | 0 | 0 | 0 | 0 |

| Wilkes County | 0 | 1 | 0 | 0 | 0 |

| Wilkinson County | 0 | 0 | 1 | 1 | 0 |

| Worth County | 0 | 4 | 1 | 0 | 0 |

Teen Drinking and Driving

| Details | Numbers |

|---|---|

| Alcohol-Impaired Driving Fatalities Per 100K Population | 1.0 |

| Higher/Lower Than National Average (1.2) | lower |

| DUI Arrest (Under 18 years old) | 89 |

| DUI Arrests (Under 18 years old) Total Per Million People | 35.44 |

EMS Response Time

| Type of Crash | Time of Crash to EMS Notification | EMS Notification to EMS Arrival | EMS Arrival at Scene to Hospital Arrival | Time of Crash to Hospital Arrival |

|---|---|---|---|---|

| Rural Fatal Crashes (534 total) | 3.82 | 11.46 | 47.55 | 59.82 |

| Urban Fatal Crashes (905 total) | 3.32 | 9.13 | 33.42 | 43.33 |

Transportation

Most Georgia households have two or more cars and commute 10-34 minutes alone to work.

Residents have an average commute time of 27.1 minutes which puts Georgia above the national average of 25.5 minutes. Not too surprising is that almost 79 percent of the population drive to work alone. Even over three percent of residents spend more than 90 minutes commuting per day.

Car Ownership

Over 60 percent of Georgia households have two or more cars and about 20 percent are single-car households. Fewer than five percent of Georgia households do not own a car.

Commute Time

Georgia residents have an average commute time of 27.1 minutes which puts Georgia above the national average of 25.5 minutes. Over three percent of residents spend more than 90 minutes commuting per day.

Commuter Transportation

Almost 79 percent of the population drive to work alone and about 12 percent carpool or take public transportation.

Traffic Congestion in Georgia

Even with a beltline, Atlanta is still ranked 11th in the US for having the most traffic congestion. In 2018, drivers spent an average of 108 hours in traffic and the cost per driver was $1,505.

Start comparing car insurance rates in Georgia today. Just enter your ZIP code below.

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance. Our goal is to be an objective, third-party resource for everything auto insurance related. We update our site regularly, and all content is reviewed by auto insurance experts.